Death Care Services Market Size

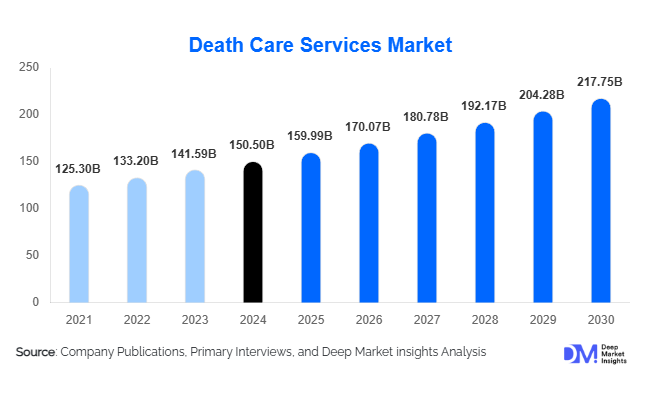

According to Deep Market Insights, the global death care services market size was valued at USD 150.5 billion in 2024 and is projected to grow from USD 159.99 billion in 2025 to reach USD 217.75 billion by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The death care services market growth is primarily driven by the global aging population, increasing adoption of cremation and eco-friendly alternatives, and rising integration of digital funeral planning and memorial services.

Key Market Insights

- Cremation services account for over 40 % of the global market in 2024, fueled by affordability, urbanization, and evolving cultural acceptance.

- Pre-need funeral planning is the fastest-growing segment, supported by consumers’ desire to reduce family burden and manage future costs.

- Asia-Pacific dominates global share ( 38.5 %) and remains the fastest-growing regional market, driven by demographic expansion and modernization of funeral infrastructure.

- Digital transformation reshapes the industry, with online funeral bookings, livestreamed ceremonies, and e-commerce of memorial products.

- Green burials and eco-cremation technologies are becoming mainstream as sustainability influences consumer decisions.

- Market consolidation continues, with major players expanding through acquisitions and investment in advanced crematoria and digital services.

Latest Market Trends

Digitalization and Virtual Memorialization

Technology is redefining how families plan and commemorate lives. Funeral homes are adopting online planning portals, virtual ceremonies, and digital memorials where friends can join services remotely. Livestreaming, online obituary management, and memorial websites are now integral offerings, appealing to globalized families separated by distance. This digital shift also enhances transparency in pricing and service customization, allowing customers to select caskets, urns, or memorial packages online. The integration of AI chat support and digital documentation streamlines the at-need arrangement process, making services more efficient and accessible worldwide.

Rising Demand for Eco-Friendly Death Care

Green burial services, alkaline hydrolysis (water cremation), biodegradable urns, and tree-planting memorials are gaining rapid traction. Consumers increasingly seek environmentally sustainable alternatives to traditional burials due to land scarcity and carbon footprint concerns. Funeral providers are investing in energy-efficient cremation chambers, natural burial preserves, and low-emission transport options. Governments and municipalities are encouraging eco-cemetery development, while younger generations view sustainability as an essential value even in end-of-life planning, pushing the market toward long-term ecological alignment.

Death Care Services Market Drivers

Global Aging Population and Rising Mortality Rates

Accelerating demographic aging across developed and emerging markets remains the single largest driver of the death care industry. Longer life expectancy and the baby boomer generation reaching advanced ages are increasing annual mortality numbers, directly boosting demand for funeral, cremation, and memorial services. Nations such as Japan, Italy, Germany, and the U.S. face unprecedented elderly populations, ensuring stable, recurring market demand well into the 2030s.

Personalization and Premiumization of Services

Families increasingly demand customized funeral experiences reflecting the individuality of the deceased. Personalized themes, music, bespoke urns, and multimedia tributes are becoming standard features. Providers that integrate emotional storytelling, virtual attendance options, or hybrid services combining traditional rituals with modern aesthetics capture higher margins. This shift from standardized to experiential funerals is expanding average revenue per service and redefining brand positioning across the sector.

Adoption of Digital Platforms and Pre-Need Planning

Online funeral planning and pre-need contracts are witnessing strong adoption. Consumers are securing future arrangements through prepaid packages that guarantee costs and protect loved ones from financial stress. Providers offering transparent, digital booking journeys and integrated payment plans achieve long-term customer retention. The rise of funeral-tech startups is also introducing mobile apps for service selection, documentation, and memorial creation, increasing convenience and accessibility.

Market Restraints

Land Scarcity and Rising Burial Costs

Urban cemetery land shortages and rising real estate prices have significantly increased the cost of burial plots. In metropolitan areas, limited space pushes families toward cremation or alternative methods. These constraints not only reshape consumer choices but also pressure service providers to innovate in land-efficient burial solutions such as vertical mausoleums or shared memorial parks.

Cultural and Regulatory Limitations

Strict cultural norms and fragmented regulatory frameworks often hinder innovation. In regions where traditional burial rituals are deeply rooted, acceptance of eco-burials or digital memorials remains low. Licensing requirements for crematoria and land-use permits for cemeteries can delay expansion, while environmental emission standards add to operational costs.

Death Care Services Market Opportunities

Expansion of Pre-Need and Digital Planning Platforms

Pre-need funeral arrangements represent one of the most lucrative growth opportunities. Digital pre-planning portals that allow consumers to customize services, lock in prices, and manage documents online are revolutionizing the industry. Funeral chains investing in mobile platforms and digital engagement tools can secure recurring revenues while enhancing customer experience and brand loyalty.

Green and Sustainable Death Care Innovations

Eco-friendly funerary methods, including water cremation, natural burials, and biodegradable urns, offer providers strong differentiation. As governments enforce stricter environmental regulations, sustainability-aligned operators can access incentives and green certifications, appealing to environmentally conscious consumers. This shift will also open new product categories such as eco-urns, living memorials, and carbon-neutral cremation services.

Emerging Market Expansion and Repatriation Services

Asia-Pacific, the Middle East, and Latin America remain underserved yet high-potential regions. Growing middle-class wealth, rapid urbanization, and shifting cultural attitudes are boosting formal funeral service adoption. Additionally, repatriation services for migrant workers and expatriates present new revenue streams. Companies entering these markets through partnerships and franchising can leverage local trust and global standards to capture early-stage growth.

Product Type Insights

Cremation services dominate the market, accounting for roughly 40 % of total 2024 revenues ( USD 54 billion). Cost efficiency, urban density, and minimal land use drive their popularity. Burial services remain traditional but face slow growth due to cost pressures and space constraints. Memorial and grief support services are emerging as profitable niches, integrating counselling and digital remembrance platforms that enhance post-funeral engagement. Pre-need contracts are rapidly expanding, enabling stable cash flow for operators and cost predictability for consumers.

Distribution Channel Insights

Offline and onsite funeral homes remain dominant, representing about 65 % of the total market value in 2024 (~USD 87 billion). However, online channels are the fastest-growing, driven by tech-enabled transparency and contactless service planning. Hybrid models combining digital pre-planning with physical execution are becoming standard, especially among large chains and urban service providers.

End-User Insights

Individual consumers and families constitute approximately 53 % of total market demand (USD 72 billion in 2024). Institutional customers such as governments, the military, and religious organizations remain steady contributors through contracted cemetery maintenance and public funerals. Corporate clients are emerging for repatriation and employee death-benefit services, adding a new commercial layer to the sector’s customer base.

| By Product Type | By Service Type | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 27 % of the global death care services market ( USD 36 billion in 2024). The U.S. leads due to its well-established funeral infrastructure, rising cremation rates, and expanding pre-need contract adoption. Canada mirrors similar trends, emphasizing eco-burials and digital memorial solutions. Growth remains steady, supported by large franchise chains and digital innovators.

Europe

Europe holds a 22 % share ( USD 30 billion in 2024) with mature markets in the U.K., Germany, France, and Italy. High service costs and limited land availability accelerate cremation adoption. Green burials and biodegradable materials are widely accepted, while government oversight ensures transparency and quality across funeral operations.

Asia-Pacific

Asia-Pacific dominates global share at 38.5 % ( USD 52 billion in 2024) and records the fastest CAGR through 2030. China, India, Japan, and South Korea drive growth due to rapid urbanization, population scale, and modernization of traditional death care. India and Southeast Asia exhibit particularly high growth potential as formal funeral service chains emerge in previously informal markets.

Latin America

Latin America represents about 7 % of the global market ( USD 9.5 billion in 2024). Brazil and Mexico dominate demand, supported by expanding middle-class purchasing power and growing preference for organized funeral arrangements. Cultural openness to hybrid ceremonies and online memorialization is gradually increasing.

Middle East & Africa

MEA holds a 6 % share ( USD 8 billion in 2024) but offers high growth potential. The Gulf Cooperation Council countries, especially the UAE and Saudi Arabia, are witnessing growing repatriation and expatriate-focused services. In Africa, South Africa and Nigeria are leading markets where rising urban populations and infrastructure investments drive the modernization of funeral practices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Death Care Services Market

- Service Corporation International (SCI)

- Dignity PLC

- InvoCare Limited

- Arbor Memorial Inc.

- Matthews International Corporation

- Carriage Services Inc.

- Fu Shou Yuan International Group

- San Holdings Inc.

- Funeral Partners PLC

- Nirvana Asia Ltd.

- StoneMor Partners LP

- Wilbert Funeral Services Inc.

- Park Lawn Corporation

- Victoriaville & Co.

- Thacker Caskets Inc.

Recent Developments

- In May 2025, Service Corporation International announced the expansion of digital pre-planning platforms across North America, integrating AI-based cost estimators and online document management.

- In April 2025, InvoCare Limited launched a series of eco-cremation facilities in Australia, reducing carbon emissions by over 30 % per operation.

- In February 2025, Dignity PLC introduced a national green burial program in the U.K., featuring natural woodland cemeteries and biodegradable caskets sourced from sustainable suppliers.