Dash Cam Market Size

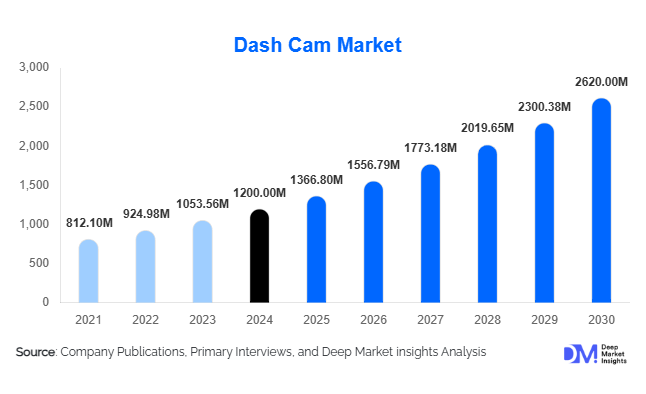

According to Deep Market Insights, the global dash cam market size was valued at USD 1,200.00 million in 2024 and is projected to grow from USD 1,366.80 million in 2025 to reach USD 2,620.13 million by 2030, expanding at a CAGR of 13.9% during the forecast period (2025–2030). The dash cam market growth is primarily driven by rising concerns over road safety, growing demand for vehicle security and monitoring, increasing adoption of fleet management systems, and technological advancements such as AI-powered dash cams, 4K recording, and cloud-based storage solutions.

Key Market Insights

- Integration of AI and advanced driver assistance features is driving demand for intelligent dash cams capable of fatigue detection, collision warnings, and real-time monitoring.

- Emerging markets in Asia-Pacific and Latin America offer significant growth potential due to increasing vehicle sales, urbanization, and road safety awareness.

- Insurance incentives and regulatory support are encouraging adoption, with many insurers offering discounts for vehicles equipped with dash cams.

- North America dominates the market, with the U.S. and Canada accounting for the largest share due to strong consumer awareness and technology adoption.

- Europe is among the fastest-growing regions as countries like Germany, the U.K., and France see rising demand for dash cams in personal and commercial vehicles.

- Technological adoption, including AI-powered analytics, Wi-Fi-enabled systems, and cloud storage capabilities, is reshaping consumer expectations and market offerings.

What are the current trends shaping the dash cam market globally?

AI-Powered Dash Cams and Advanced Features

Dash cams with AI integration are emerging as a key trend, enabling functions such as lane departure warnings, collision detection, driver fatigue monitoring, and automatic incident recording. These smart dash cams offer higher security, improve fleet management efficiency, and provide insurers with reliable data for claim settlements. The integration of cloud storage and smartphone connectivity is increasing consumer convenience, allowing real-time monitoring and video sharing, which strengthens the market appeal.

Wi-Fi and Cloud-Enabled Systems

Modern dash cams with Wi-Fi and cloud storage are gaining traction, enabling seamless video upload, remote monitoring, and live streaming. Consumers increasingly prefer devices that integrate with smartphones and vehicle infotainment systems. Cloud-based solutions allow easier retrieval of footage for insurance or legal purposes and enhance data security. This trend is particularly strong in regions with high smartphone penetration and digital infrastructure.

Which factors are driving growth in the dash cam market?

Rising Road Safety Concerns

Global traffic accidents, increasing insurance fraud, and heightened awareness of driver safety are driving demand for dash cams. Vehicles equipped with dash cams provide verifiable evidence in disputes and support safer driving behaviors, particularly in high-traffic urban environments.

Insurance and Fraud Prevention

Insurance companies are offering incentives for installing dash cams, as video evidence reduces fraudulent claims and improves settlement accuracy. This not only encourages adoption among consumers but also strengthens the position of dash cams in commercial and fleet applications.

Technological Advancements and Feature Enhancements

High-resolution recording (4K), night vision, GPS integration, AI analytics, and cloud connectivity are transforming dash cams from basic recording devices into sophisticated monitoring systems. These innovations make dash cams more appealing to both personal vehicle owners and commercial operators, driving widespread adoption.

What challenges and restraints are affecting the global dash cam market?

High Initial Costs

Premium dash cams with advanced features remain relatively expensive, creating a barrier for budget-conscious consumers. While prices have been decreasing for basic models, high-end devices still require significant investment, limiting adoption in price-sensitive markets.

Privacy Concerns

Continuous recording capabilities raise privacy and data protection issues. Legal restrictions in some regions, particularly regarding audio recording, may hinder adoption, and concerns over unauthorized footage sharing may deter consumers from installing dash cams.

What are the major opportunities in the dash cam industry for new and existing players?

Fleet Management and Commercial Vehicle Monitoring

There is increasing adoption of dash cams in commercial vehicles to track driver behavior, monitor routes, and improve operational efficiency. Fleet operators are leveraging AI-powered dash cams to reduce accidents, manage risk, and lower insurance premiums, presenting a significant growth opportunity for manufacturers and new entrants.

Emerging Market Expansion

Countries in Asia-Pacific and Latin America, including India, China, and Brazil, are seeing rising demand due to urbanization, growing vehicle ownership, and road safety awareness. Tailoring products for affordability and regional compliance can unlock untapped potential in these markets.

Government Incentives and Regulations

Regulatory frameworks encouraging dash cam adoption in commercial vehicles, along with insurance discounts for consumers using dash cams, create opportunities for market growth. Collaboration with government programs to improve road safety can further expand market penetration.

Product Type Insights

Single-channel dash cams dominate the market, accounting for roughly 45% of the 2024 market share, due to their affordability and simplicity. Dual-channel dash cams are growing rapidly (35%) as consumers and fleet operators seek enhanced coverage with front and rear monitoring. Multi-channel systems (20%) are primarily used by commercial fleets for comprehensive surveillance and 360-degree recording, reflecting an increasing focus on operational safety.

Application Insights

Personal vehicles remain the largest application segment, driven by safety and insurance benefits. Commercial vehicles, including ride-hailing and logistics fleets, are adopting dash cams for driver monitoring and operational efficiency, making it the fastest-growing segment. Law enforcement usage is also increasing, providing accountability and evidence in traffic incidents.

Distribution Channel Insights

Online channels, including e-commerce platforms and manufacturer websites, dominate dash cam sales due to convenience, competitive pricing, and detailed product information. Traditional retail outlets remain important for customers who prefer in-store purchases. Fleet operators often procure dash cams through B2B contracts with manufacturers or specialized distributors, representing a growing channel segment.

End-Use Insights

Personal vehicles account for the largest market share, while commercial fleets are driving rapid growth. Ride-hailing services, logistics companies, and taxi operators are adopting dash cams for monitoring, compliance, and safety. Emerging industries such as delivery services and autonomous vehicle testing also present new applications. Export-driven demand is significant, with major manufacturing hubs in China, South Korea, and Japan supplying North America and Europe.

| Channel Configuration | Feature Set | Mount & Power |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share (~35%) of the global dash cam market, with strong adoption in the U.S. and Canada. High road safety awareness, insurance incentives, and advanced technology integration drive demand. Fleet operators and individual consumers alike are adopting AI-enabled and cloud-connected dash cams at a growing rate.

Europe

Europe accounts for approximately 25% of the market, with Germany, the U.K., and France as key contributors. Increasing insurance discounts and rising fleet adoption support market growth. Europe is also witnessing early adoption of AI-based dash cams and cloud-connected systems, positioning it as a fast-growing region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Rapid vehicle ownership growth, urbanization, and rising disposable incomes fuel demand. Fleet operators in logistics, ride-hailing, and delivery services are adopting dash cams to reduce operational risks.

Latin America

Brazil, Argentina, and Mexico are emerging as growth markets. Adoption is primarily driven by road safety awareness and insurance incentives for private vehicles and commercial fleets.

Middle East & Africa

While currently smaller in market share, adoption is increasing in the UAE, Saudi Arabia, and South Africa due to safety concerns, rising vehicle ownership, and infrastructure development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dash Cam Market

- Garmin

- BlackVue

- Thinkware

- Vantrue

- Nextbase

- Rexing

- Yi Technology

- Street Guardian

- Vantrue

- Apeman

- PAPAGO

- VIOFO

- Rollei

- Cobra Electronics

- DDPai

Recent Developments

- In March 2025, BlackVue launched a cloud-enabled AI dash cam in North America with real-time driver alerts and cloud storage integration.

- In January 2025, Garmin introduced a dual-channel dash cam with 4K front and rear recording, targeting fleet operators in Europe.

- In December 2024, Thinkware expanded its product portfolio in Asia-Pacific with a Wi-Fi-enabled dash cam optimized for urban commuting and ride-hailing fleets.