Cycling Tourism Market Size

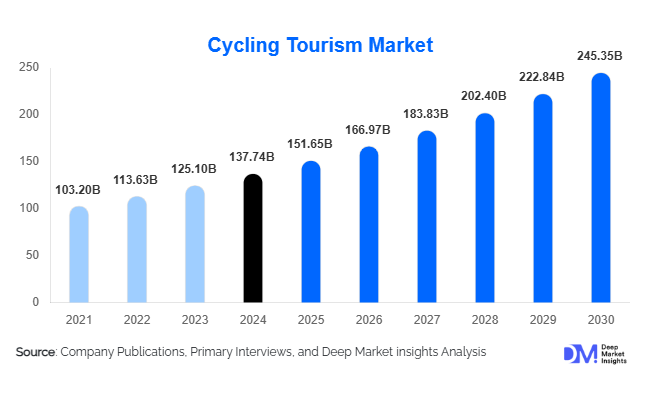

According to Deep Market Insights, the global cycling tourism market size was valued at USD 137.74 billion in 2024 and is projected to grow from USD 151.65 billion in 2025 to reach USD 245.35 billion by 2030, expanding at a CAGR of 10.10% during the forecast period (2025–2030). Growth is being propelled by rising outdoor recreation participation, expanding government investments in cycling infrastructure, and increasing demand for wellness-oriented and eco-friendly travel experiences. The surge in e-bike adoption, digital navigation tools, and sustainable mobility programs has further accelerated the integration of cycling into mainstream tourism across key markets globally.

Key Market Insights

- Recreational cycling is the dominant segment worldwide, driven by growing interest in wellness tourism, scenic travel, and low-impact outdoor activities.

- Self-guided cycling tours are gaining strong traction due to travelers' preference for flexible, customizable itineraries and digital navigation tools.

- Europe remains the largest regional market, supported by extensive cycling networks, government backing, and a deeply rooted cycling culture.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class tourism, e-bike penetration, and large-scale mobility investments in China, Japan, South Korea, and Southeast Asia.

- E-bike tourism is transforming accessibility, enabling older travelers and beginners to participate in long-distance and terrain-heavy cycling holidays.

- Technology integration, including GPS navigation, AI itinerary planning, and IoT-enabled bikes, is redefining traveler experiences and enhancing safety, personalization, and convenience.

What are the latest trends in the cycling tourism market?

Shift Toward Sustainable & Low-Carbon Travel Experiences

As global travelers increasingly seek eco-conscious tourism, cycling has emerged as one of the most sustainable travel modes. Governments are integrating cycling tourism into national carbon-neutral mobility plans, developing greenways, dedicated cycling lanes, and long-distance scenic trails. Travelers are opting for environmentally aligned itineraries that reduce carbon footprints while enhancing destination immersion. Many operators now incorporate carbon-offset programs, eco-certified accommodations, and renewable-energy-powered e-bike fleets. This shift is reshaping cycling tourism into a central pillar of sustainable global travel ecosystems.

Digital Integration & Smart Cycling Infrastructure

Technology is significantly elevating cycling tour experiences. Advanced GPS apps, IoT-enabled bikes, real-time navigation, and AI-based route planners allow travelers to explore independently with enhanced confidence and safety. VR-based previews of cycling routes help travelers evaluate destinations before booking, while connected cycling gear provides performance analytics and emergency alerts. Online platforms integrating accommodation, bike rentals, route planning, and local attractions into a single interface are accelerating adoption among digitally savvy travelers. These tech upgrades cater especially to millennials and younger cyclists seeking personalized, data-driven adventure experiences.

What are the key drivers in the cycling tourism market?

Growing Global Focus on Health, Wellness & Outdoor Lifestyles

A surge in health-conscious behavior, coupled with the global rise of wellness tourism, has positioned cycling holidays as an appealing choice for active travelers. Participation in recreational cycling has increased by more than 12% in the past three years, driven by public awareness campaigns, fitness trends, and post-pandemic demand for open-air activities. Travelers now seek immersive, physically engaging tourism, making cycling one of the preferred options for short domestic trips and long-distance adventures alike. This driver continues to strengthen long-term market potential across all age groups.

Rapid Expansion of E-Bike Tourism

E-bike adoption has fueled significant growth, enhancing accessibility for older adults, families, and novices. With annual e-bike tourism growth exceeding 14%, destinations are expanding charging networks and e-bike rental fleets. Travelers can now tackle challenging terrains and longer routes with reduced physical strain, making cycling tourism more inclusive. This trend has expanded the addressable market by an estimated 18–20% since 2020, positioning e-bike tourism as one of the strongest catalysts for future industry expansion.

Government Investments in Cycling Infrastructure

Over USD 30 billion has been invested globally in cycling trails, mobility corridors, and safety infrastructure in the past five years. Europe continues to lead with national cycling route expansions, while North America and APAC are accelerating development of cycling highways, green mobility hubs, and integrated tourism corridors. These infrastructure upgrades enhance route safety, improve rider experience, and attract both domestic and international cycling tourists, reinforcing long-term growth.

What are the restraints for the global market?

Insufficient Infrastructure in Emerging Markets

While cycling tourism is expanding globally, many emerging regions lack dedicated cycling lanes, maintenance services, and safety systems needed to accommodate international travelers. Inconsistent infrastructure, poor road safety, and limited emergency support reduce adoption potential. This gap prevents rapid market penetration into developing regions with otherwise strong tourism appeal. Addressing infrastructure disparities remains essential for the global expansion of cycling tourism.

Seasonal Weather Dependence

Cycling tourism experiences strong seasonal variations influenced by climate patterns. Extreme heat, rain, storms, and climate-related disruptions discourage travel, lead to cancellations, or shorten operating windows for tour operators. Changing weather unpredictability, driven by climate change, impacts route availability and reduces the predictability of demand, particularly for operators dependent on specific peak seasons.

What are the key opportunities in the cycling tourism industry?

Smart Mobility & Digital Experience Integration

There is a growing opportunity to integrate smart mobility technologies, IoT-enabled bikes, app-based safety monitoring, AI route customization, and VR-based destination previews. These enhancements appeal to tech-driven consumers and redefine cycling tourism as a data-rich, personalized, and safer activity. Companies investing in digital platforms, subscription-based travel models, and connected cycling ecosystems stand to capture strong future demand.

Expansion into High-Growth APAC, LATAM & Middle East Markets

Emerging markets present substantial untapped growth potential. Countries such as China, Japan, the UAE, Saudi Arabia, and Chile are investing heavily in cycling tourism corridors and scenic trails. Rising middle-class wealth, adventure travel trends, and health-oriented lifestyles are driving adoption. Early movers into these markets will benefit from low competitive intensity, supportive government initiatives, and strong domestic tourism demand.

Growth of Wellness-Centric & Eco-Friendly Cycling Retreats

Wellness travel is becoming a major global trend, enabling opportunities to merge cycling with holistic wellness programs, nature retreats, and cultural experiences. Cycling retreats combining mindfulness, yoga, spa therapies, and slow tourism are gaining traction. These hybrid experiences attract travelers seeking mental rejuvenation, fitness experiences, and nature immersion, expanding market reach beyond traditional adventure cyclists.

Product Type Insights

Recreational cycling tourism dominates the global market, accounting for approximately 42% of total 2024 revenue. This category attracts all demographics due to its accessibility and suitability for urban, countryside, and scenic routes. Road cycling tourism continues to expand among sports enthusiasts, while mountain biking attracts adventure-driven travelers to rugged terrains. E-bike tourism is rising as one of the fastest-growing segments due to enhanced accessibility and reduced physical strain, making long-distance cycling more inclusive for older adults and beginners.

Application Insights

Leisure and wellness-focused cycling applications lead global demand, supported by rising consumer prioritization of physical activity and outdoor experiences. Adventure cycling applications, including mountain biking, bikepacking, and endurance challenges, are rapidly increasing in popularity among young travelers. Cultural and heritage cycling tours attract tourists interested in historical routes, regional cuisine, and community engagement. Sports-oriented cycling experiences, including training camps and event-linked travel, are also expanding as international cycling competitions attract global participants.

Distribution Channel Insights

Online direct bookings represent the largest distribution channel, driven by traveler preference for dynamic pricing, real-time route information, and customizable itineraries. OTAs specializing in adventure travel are growing rapidly, particularly for guided cycling tours. Offline travel agencies retain relevance for luxury and group packages requiring personalized planning. Cycling clubs, sports associations, and community networks serve as niche channels promoting group tours, charity rides, and amateur events, especially in Europe and North America.

Traveler Type Insights

Couples and families account for the largest share of global cycling tourism (36%), driven by demand for wellness vacations, flexible itineraries, and scenic rural travel. Solo travelers continue to rise, especially among millennials seeking independent exploration and self-guided tours. Sports cyclists represent a high-value niche market drawn to performance-oriented routes and iconic cycling destinations. Corporate groups are adopting cycling tourism for team-building retreats and wellness programs, expanding institutional demand.

Age Group Insights

The 31–50 age group holds the largest market share (45%), combining strong spending power with a high interest in fitness-focused travel. The 18–30 demographic drives growth in adventure and budget cycling experiences, while the 51+ segment increasingly adopts e-bike tourism for scenic and cultural exploration. Age groups above 65 represent a smaller but rapidly expanding niche, with demand centered on wellness cycling retreats and accessibility-enhanced tours.

| By Tour Type | By Traveler Type | By Booking Channel | By Tour Duration |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents approximately 28% of global cycling tourism demand, driven by expanding greenways, wellness tourism adoption, and strong participation in outdoor recreational activities. The U.S. leads regional demand, with high interest in self-guided scenic trail tours and e-bike rentals. Canada’s national parks and cross-country cycling routes are attracting premium adventure tourists.

Europe

Europe is the largest and most mature cycling tourism market, holding 42% of the global share. Germany, France, the Netherlands, Spain, and Italy dominate due to advanced cycling infrastructure, safety standards, and rich cultural trails. EuroVelo routes remain a major attraction for multi-day international cyclists. European travelers also show a strong preference for eco-friendly and cultural cycling holidays.

Asia-Pacific

APAC is the fastest-growing region with a projected CAGR of 9.1%. China, Japan, South Korea, and Australia are leading demand, driven by rising adventure travel and rapid e-bike adoption. Southeast Asian nations such as Vietnam and Thailand are promoting cycling tourism for rural development and sustainable travel initiatives. Improving air connectivity and growing middle-class spending support regional expansion.

Latin America

Chile, Colombia, Argentina, and Mexico are emerging cycling destinations, benefiting from scenic mountain and coastline routes. Colombia’s strong cycling culture and international racing heritage position it as a notable global demand contributor. Growth is supported by adventure tourism trends and government promotion of eco-cycling corridors.

Middle East & Africa

MEA is witnessing increased traction in both domestic and inbound cycling tourism. The UAE and Saudi Arabia are building premium cycling circuits and hosting global cycling events. Africa's demand is centered on South Africa, Kenya, and Morocco, where scenic landscapes and adventure tourism ecosystems attract international cyclists.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cycling Tourism Market

- Backroads

- Trek Travel

- Butterfield & Robinson

- Exodus Travels

- G Adventures

- TDA Global Cycling

- REI Adventures

- DuVine Cycling + Adventure Co.

- VBT Bicycling Vacations

- BikeTours.com

- Macs Adventure

- Radweg-Reisen

- Discover France Adventures

- Pure Adventures

- Intrepid Travel

Recent Developments

- In March 2025, Backroads announced the expansion of its European e-bike fleet, integrating AI-powered navigation systems across major routes.

- In January 2025, Trek Travel launched new long-distance cycling expeditions across Japan and Chile, focusing on cultural immersion and sustainable travel.

- In April 2025, DuVine Cycling introduced premium wellness-cycling retreats combining spa, yoga, and Mediterranean coastal cycling routes.