Cycle Tourism Market Size

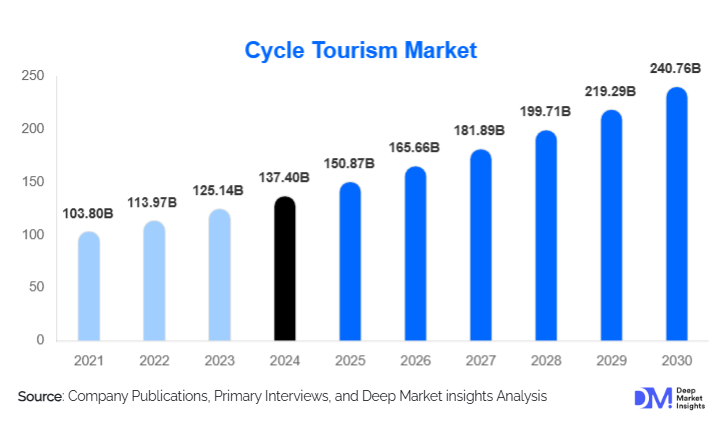

According to Deep Market Insights, the global cycle tourism market size was valued at USD 137.4 billion in 2024 and is projected to grow from USD 150.87 billion in 2025 to reach USD 240.76 billion by 2030, expanding at a CAGR of 9.8% during the forecast period (2025–2030). The market’s expansion is primarily driven by the global shift toward sustainable travel, increasing adoption of e-bikes, and the rising preference for active and wellness-oriented tourism experiences across Europe, North America, and the Asia-Pacific.

Key Market Insights

- Cycle tourism is rapidly evolving as a pillar of sustainable and experiential travel, merging fitness, adventure, and eco-consciousness into one segment.

- Europe dominates the market with its extensive cycling infrastructure, cross-border cycling routes, and long-standing cultural affinity for cycling holidays.

- Asia-Pacific is the fastest-growing region, supported by government-led investments in cycling infrastructure and the surge of wellness tourism in China and India.

- Technology integration, including e-bikes, GPS mapping, and mobile booking platforms, is expanding accessibility and enhancing traveler convenience.

- Group and friends-based travel remains the largest segment, accounting for nearly 44% of total cycling tourists globally in 2024.

- Multi-day tours are leading in revenue share, contributing more than two-thirds of total market value due to higher per-trip spending and guided service offerings.

Latest Market Trends

Rise of E-Bike and Tech-Enhanced Cycling Experiences

The integration of e-bikes and digital tools is revolutionizing the cycling tourism industry. E-bikes are extending the reach of cycle tourism to older and less-experienced cyclists by reducing physical effort while maintaining the thrill of exploration. Mobile route-planning applications, GPS tracking, and online booking systems are improving convenience and personalizing travel experiences. Operators are leveraging analytics to offer customized itineraries, while social media platforms enable cyclists to share experiences in real time, fueling peer-driven demand growth. The tech ecosystem, including AI-assisted itinerary design and smart wearables, is enhancing safety and engagement on the trail.

Wellness and Sustainable Travel Convergence

Cycle tourism is increasingly merging with wellness and sustainability trends. Travelers are seeking eco-friendly holidays that promote health, mindfulness, and connection with nature. Cycling routes through scenic regions, wellness retreats with cycling activities, and eco-lodges powered by renewable energy are gaining popularity. Many destinations now promote “carbon-light” cycling holidays that combine physical activity with cultural exploration and local gastronomy. The market’s sustainable positioning has made it a preferred alternative to motor-based tours, particularly among millennials and Generation Z travelers.

Cycle Tourism Market Drivers

Growing Demand for Active and Sustainable Travel

The shift toward active lifestyles and eco-friendly tourism experiences is driving market growth. Consumers are increasingly drawn to cycling holidays that combine fitness, recreation, and minimal environmental impact. Governments and tour operators are aligning with global sustainability goals by promoting bicycle-based tourism corridors and eco-certified cycling accommodations.

Expansion of Cycling Infrastructure and Destination Networks

Public investment in cycling infrastructure has surged worldwide. Europe continues to lead with transnational cycling routes like EuroVelo, while Asia-Pacific nations such as Japan, South Korea, and India are expanding dedicated bike paths to attract eco-conscious travelers. These developments are transforming entire regions into cycle-friendly destinations and unlocking new market potential.

Technological Innovation and E-Bike Adoption

Rapid advancements in electric bicycles, route-navigation systems, and online booking platforms have widened the market’s appeal. E-bikes enable longer rides with less effort, attracting a broader demographic base, including older travelers. Combined with mobile route apps and digital safety tracking, technology is enhancing the accessibility and overall satisfaction of cycle tourism experiences.

Market Restraints

Infrastructure and Safety Limitations

Despite growth in infrastructure, many emerging destinations still lack adequate cycling routes, signage, and safety regulations. Poorly maintained trails and inadequate emergency services can deter travelers, particularly families and less-experienced cyclists. These gaps limit participation and constrain the expansion of the global market in developing regions.

Seasonal and Weather Dependency

Cycle tourism is highly seasonal, with demand peaking during favorable weather months. Harsh climates or off-season conditions can reduce activity levels and impact revenue consistency. Operators must rely on diversified geographic portfolios or indoor cycling alternatives to mitigate these seasonal fluctuations.

Cycle Tourism Market Opportunities

Infrastructure and Destination Development

Governments are actively investing in cycling corridors and sustainable transport infrastructure, creating opportunities for destination branding and route-based tourism products. New entrants can capitalize on underdeveloped routes in Latin America, Africa, and Southeast Asia by partnering with local authorities and community organizations to establish cycle-friendly ecosystems.

E-Bike and Digital Integration

The proliferation of e-bikes and connected technologies presents major opportunities for operators to attract broader audiences. Smart rentals, app-based navigation, and integrated wellness tracking are creating premium experiences. Companies that integrate e-bike options with AI-powered trip personalization are expected to command higher margins.

Niche Cycling Segments and Experiential Offerings

The growth of cultural, culinary, and heritage-themed cycling tours presents niche expansion opportunities. Wellness cycling retreats and corporate team-building programs are emerging as lucrative verticals. These niche formats diversify revenue streams and help operators differentiate themselves in a crowded travel market.

Product Type Insights

Road cycling tours dominate the global cycle tourism market, leveraging their accessibility, mature infrastructure, and ability to cater to both casual and serious riders. This segment represents the largest share of market revenue, accounting for roughly 38% of total 2024 sales, due to its scalability across diverse geographies and consistent participation throughout the year. The demand is further supported by performance-oriented events and long-distance touring networks in Europe and North America, driven by the growing popularity of endurance cycling and sportive participation. Mountain biking and gravel tours are experiencing robust double-digit growth, especially in adventure destinations such as New Zealand, Canada, and the Alps, supported by new trail investments and the global popularity of gravel racing. Hybrid and mixed-terrain tours are increasingly attracting younger and family travelers, blending scenic exploration with accessibility and moderate physical challenge. The surge in e-bike adoption has transformed hybrid tours into a key bridge between leisure and adventure cycling, enabling older demographics and less-experienced cyclists to participate comfortably, positioning e-bikes as the largest incremental driver of new tour demand.

Trip Duration Insights

Multi-day cycling tours lead the global market, contributing over 70% of total revenue in 2024. These extended itineraries cater to high-value travelers seeking immersive cultural, scenic, and wellness experiences, supported by premium guided services, accommodation, and luggage transfers. Growth in this category is primarily driven by retired travelers and experiential tourists seeking long-distance, slow-paced exploration. Shorter 2–3 day tours are rapidly expanding, particularly in Europe and North America, where micro-vacations and wellness-focused weekend getaways have surged post-pandemic. Day tours remain essential in urban destinations and serve as accessible entry points for beginners and local travelers. This subsegment’s growth is propelled by rising urbanization and the demand for quick outdoor escapes among city dwellers seeking active lifestyle options. Extended tours continue to benefit from an aging but affluent traveler base, with strong participation in cross-border routes such as EuroVelo and U.S. Rails-to-Trails networks.

Traveler Type Insights

Group and friends-based travelers dominate the market, representing about 44% of total participants in 2024. These travelers are drawn to the safety, structure, and social aspects of guided group cycling tours, often opting for packaged itineraries that minimize logistical complexity. Solo travelers form the fastest-growing segment, supported by digital booking platforms, route-sharing apps, and the global rise of adventure-oriented millennials and digital nomads. Couples and family travelers are increasingly embracing cycling vacations that integrate cultural visits, gastronomy, and wellness activities. Multi-generational participation has grown significantly, thanks to e-bike availability, enhanced trail safety, and diversified accommodation offerings that cater to varied fitness levels within families.

Age Group Insights

The 31–50-year age group leads the market with approximately 48% share in 2024. This cohort combines strong purchasing power with a lifestyle preference for fitness-oriented and sustainable travel. They typically engage in mid-range and premium tours emphasizing adventure and wellness. Travelers aged above 50 are emerging as a powerful segment due to improved health awareness and widespread e-bike adoption, which makes longer or more challenging routes accessible. Meanwhile, the 18–30-year segment continues to drive demand for budget-friendly, adventure-centric experiences, often emphasizing independence, digital planning, and shared social content. Their influence is shaping community-based cycling networks and self-guided tour growth across Europe and the Asia-Pacific.

| By Product Type | By Trip Duration | By Traveler Type | By Bike Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe remains the global leader in cycle tourism, capturing nearly 40% of total market revenue in 2024. Countries such as Germany, the Netherlands, France, and Spain form the backbone of this dominance, supported by extensive cross-border cycling infrastructure, well-established tour operators, and a mature cycling culture. Spain is emerging as one of the fastest-growing European markets due to its favorable climate, scenic coastal routes, and strong government tourism initiatives promoting active travel. Regional growth drivers include expansive green-transport funding, development of EuroVelo routes, and a deeply ingrained cycling lifestyle that supports both leisure and professional touring. Europe’s premium guided tours and luxury cycling retreats further strengthen its global leadership, while sustainability certifications and eco-labeling initiatives enhance its appeal to environmentally conscious travelers.

North America

North America accounts for about 27% of global market share, with the United States and Canada leading the region’s growth trajectory. The region’s rise is fueled by investments in long-distance multi-use trails such as the Great American Rail-Trail and the Trans-Canada Trail, which have catalyzed cycling-based tourism in rural and scenic areas. The rapid adoption of e-bikes has expanded participation among older and casual riders, while the popularity of road trips and micro-tourism post-pandemic has made cycling a preferred way to explore national parks and coastal regions. Key regional drivers include strong public investment in trail infrastructure, wellness-focused travel trends, and the integration of cycling routes with broader outdoor recreation networks, such as hiking and camping circuits. Canada’s national focus on sustainable tourism and the U.S. emphasis on local adventure travel continue to boost regional market potential.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, projected to expand at a double-digit CAGR through 2030. Countries like China, Japan, India, and Australia are driving growth through urban cycling investments, expanding domestic tourism, and the emergence of hybrid travel formats combining cultural and adventure cycling. India’s market, valued at approximately USD 3.5 billion in 2024, is witnessing rapid expansion fueled by cycling festivals, wellness retreats, and state-backed tourism programs promoting sustainable travel. Regional drivers include a growing middle class, government-led infrastructure programs, and high potential for short-break circuits blending urban and rural experiences. Japan and South Korea are fostering cycling tourism as part of national fitness and eco-tourism policies, while Australia continues to lead in adventure cycling and endurance racing, supported by diverse landscapes and strong domestic participation.

Latin America

Latin America represents an emerging but high-potential region within the cycle tourism landscape, driven by scenic diversity and rising adventure travel demand. Countries such as Brazil, Argentina, and Mexico are positioning themselves as eco- and adventure-tourism destinations, with new cycling circuits being developed across the Andes, Patagonia, and coastal areas. Regional drivers include a growing middle class, scenic rural route availability, and limited competition among tour operators, offering opportunities for differentiated, high-margin products. The region’s alignment with global wellness and sustainability trends, coupled with government interest in diversifying tourism portfolios, positions Latin America as a strategic frontier for future growth.

Middle East & Africa

The Middle East and Africa collectively represent a smaller but rapidly emerging segment of the cycle tourism industry. Africa’s scenic and diverse terrains, from South Africa’s Garden Route to Morocco’s Atlas Mountains, are gaining traction among adventure and endurance cyclists. Meanwhile, Middle Eastern nations like the UAE and Saudi Arabia are investing heavily in sports infrastructure and tourism diversification as part of national transformation plans. Regional drivers include growing interest from luxury adventure operators, national investments in long-distance signature cycling routes, and event-based tourism strategies. However, infrastructural challenges and climatic constraints still limit scalability in certain subregions. Nonetheless, Africa’s eco-tourism potential and the Middle East’s push toward active, sustainable leisure experiences are setting the stage for steady long-term expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cycle Tourism Market

- TUI Group

- Intrepid Travel

- G Adventures

- Backroads

- Exodus Travels

- SpiceRoads Cycling

- World Expeditions

- Travel + Leisure Co.

- Sarracini Travel

- Arbutus Routes

- Butterfield & Robinson

- MT Sobek

- Cyclomundo

- DuVine Cycling & Adventure Co.

- Grasshopper Adventures

Recent Developments

- In April 2025, Intrepid Travel acquired Sawadee to expand its small-group cycling tours across Europe, enhancing its carbon-offset and community-based travel programs.

- In March 2025, TUI Group launched a digital cycling holiday platform integrating AI route suggestions and e-bike rentals across 15 European destinations.

- In January 2025, Backroads introduced hybrid e-bike expeditions in the Asia-Pacific region, offering long-distance guided adventures combining cultural exploration with fitness tourism.