Custom Apparel Market Size

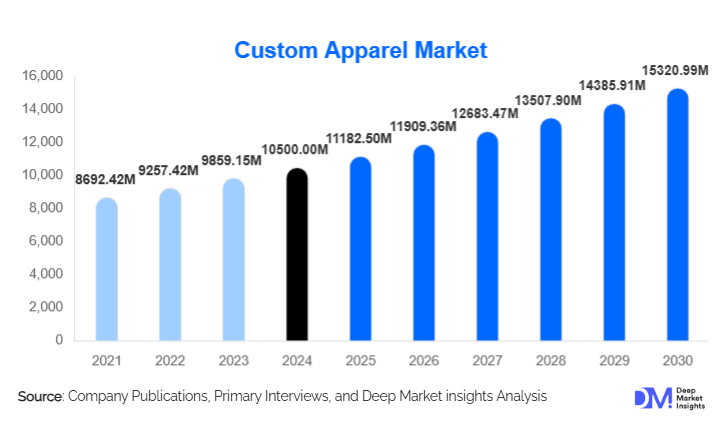

According to Deep Market Insights, the global custom apparel market size was valued at USD 10,500 million in 2024 and is projected to grow from USD 11,182.50 million in 2025 to reach USD 15,320.99 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for personalised fashion, growing adoption of digital printing technologies, expansion of e-commerce platforms, and rising corporate and promotional apparel needs globally.

Key Market Insights

- Digital customisation technologies are transforming apparel production, enabling faster turnaround times, on-demand printing, and interactive design platforms for end consumers.

- Corporate branding and promotional merchandise continue to expand, with companies leveraging custom apparel for employee engagement, marketing campaigns, and events.

- North America dominates the market in terms of revenue, driven by high disposable incomes, fashion-conscious consumers, and strong e-commerce penetration.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class populations, urbanisation, and increased interest in personalised apparel in countries such as India, China, and Japan.

- Technological adoption, including AI-based design tools, augmented reality try-ons, and advanced embroidery machines, is improving the accessibility and appeal of custom apparel.

What are the latest trends in the custom apparel market?

On-Demand and Digital Printing Solutions

Companies are increasingly adopting digital printing, sublimation, and on-demand manufacturing techniques to meet consumer preferences for personalized clothing. These technologies reduce inventory costs, enable rapid production cycles, and allow customers to visualize designs virtually before purchase. Print-on-demand services are particularly popular in the e-commerce sector, empowering small businesses, startups, and influencers to enter the market with minimal capital investment.

Sustainable and Eco-Friendly Custom Apparel

Eco-conscious consumers are driving demand for apparel made from organic cotton, recycled fabrics, and low-impact dyes. Manufacturers are responding by adopting sustainable sourcing practices, water-saving production methods, and eco-friendly packaging. Custom apparel brands integrating sustainability into their value proposition are witnessing stronger customer loyalty and premium pricing opportunities.

What are the key drivers in the custom apparel market?

Rising Consumer Demand for Personalized Fashion

Consumers increasingly seek apparel that reflects personal identity, hobbies, affiliations, and lifestyle. Social media and influencer culture amplify the appeal of unique, customizable clothing. This trend encourages manufacturers to offer interactive design platforms and niche collections, driving growth across both online and offline channels.

Expansion of E-Commerce and Direct-to-Consumer Platforms

E-commerce growth and direct-to-consumer sales models have made it easier for consumers to access custom apparel. Platforms offering user-friendly design tools, AR-based virtual try-ons, and fast shipping options are accelerating adoption. This trend enables smaller brands to compete globally, fueling overall market growth.

Corporate and Promotional Apparel Demand

Organizations increasingly use custom apparel for branding, events, and marketing purposes. Uniforms, giveaways, and limited-edition merchandise boost revenue streams for manufacturers and contribute significantly to the global market. B2B bulk orders remain a consistent growth segment.

What are the restraints for the global market?

High Production Costs for Small-Batch Orders

Producing personalized apparel in small quantities often incurs higher costs due to labor, advanced machinery, and quality control. These costs can limit adoption for price-sensitive consumers and small businesses.

Complex Supply Chain and Material Availability

Dependence on specific fabrics, dyes, and skilled labor can create supply bottlenecks. Fluctuations in raw material prices, limited availability of sustainable fabrics, and logistical challenges in global distribution may constrain market growth.

What are the key opportunities in the custom apparel industry?

Integration of AI and AR Design Platforms

Advanced design tools using AI and AR allow consumers to create custom apparel virtually, improving engagement and reducing errors. Retailers leveraging these technologies can offer real-time previews, predictive sizing, and interactive design recommendations, driving higher conversion rates.

Emerging Market Expansion

Regions such as Asia-Pacific, Latin America, and the Middle East are witnessing rising disposable incomes and growing interest in personalized fashion. Localized production, partnerships with e-commerce platforms, and targeted marketing strategies can help companies tap these high-growth markets.

Corporate & Promotional Apparel Growth

The demand for branded uniforms, giveaways, and event-specific merchandise continues to rise. Companies offering sustainable and quality custom apparel can benefit from long-term B2B contracts, enhancing revenue stability.

Product Type Insights

T-shirts & Polos dominate the global custom apparel market, accounting for approximately 35% of total revenue in 2024. Their popularity is driven by low production costs, versatility, ease of customisation, and high demand for both casual wear and promotional purposes. Companies offering print-on-demand T-shirts can target individual consumers as well as corporate clients, making this the most lucrative product segment. Hoodies & Sweatshirts are experiencing steady growth, fueled by streetwear trends, influencer-led fashion, and the increasing popularity of athleisure wear among millennials and Gen Z. Sportswear & Activewear represents a significant segment, catering to professional and amateur team uniforms, fitness apparel, and branded merchandise. The rise of health-conscious lifestyles and participation in recreational sports is a key driver for this segment’s global expansion.

Customisation Type Insights

Printing remains the leading customisation type, capturing around 40% of the global market in 2024. Screen printing, digital printing, and sublimation offer flexibility, affordability, and scalability for both small-scale and bulk orders. Printing’s popularity is reinforced by advancements in on-demand and digital printing technologies, enabling rapid turnaround times and intricate designs at lower costs. Embroidery is gaining traction, particularly for premium apparel, corporate branding, and luxury merchandise. Its durability, professional finish, and ability to convey brand identity effectively are driving adoption across corporate, fashion, and promotional segments.

Distribution Channel Insights

Online retail is the largest distribution channel, accounting for over 45% of global revenue in 2024. E-commerce platforms, D2C brand websites, and print-on-demand services provide scalability, extensive market reach, and consumer convenience. The increasing integration of AI-based design tools and augmented reality (AR) try-ons is further enhancing the appeal of online customisation. Offline retail continues to hold significance, particularly in premium and corporate segments, offering hands-on experience, immediate product access, and personalised service. B2B bulk orders remain a critical revenue driver, supported by corporate contracts, promotional campaigns, and sports or event uniforms, where quality, timely delivery, and brand consistency are prioritised.

End-Use Insights

Fashion & Lifestyle is the largest end-use segment, primarily driven by millennials and Gen Z consumers seeking self-expression, trend-based designs, and limited-edition collections. Social media and influencer-led marketing amplify the demand for unique, customised apparel. Corporate & Promotional applications are expanding rapidly, with organisations increasingly adopting branded merchandise, employee uniforms, and event-specific clothing to enhance brand visibility and engagement. Emerging applications in entertainment, sports events, and tourism are unlocking new revenue streams. Export-driven demand is rising from countries with strong manufacturing bases, including China, India, Bangladesh, and Vietnam, enabling international expansion and cross-border B2B contracts.

| By Product Type | By Customization Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 30% of the global custom apparel market in 2024, with the U.S. and Canada leading demand. High disposable incomes, brand-conscious consumers, and advanced e-commerce infrastructure are key growth drivers. The corporate sector’s reliance on promotional merchandise and custom uniforms further strengthens market demand. Additionally, the prevalence of digital printing technology and on-demand platforms encourages small businesses and individual consumers to adopt personalized apparel, reinforcing growth in both the fashion & lifestyle and corporate segments.

Europe

Europe contributes approximately 25% of the global market, with Germany, the U.K., and France as leading countries. Growth is supported by rising fashion awareness, sustainability trends, and strong retail infrastructure. Consumers increasingly demand eco-friendly, ethically produced, and customizable apparel, pushing brands to adopt sustainable fabrics and low-impact dyes. Online retail penetration combined with robust logistics networks allows faster delivery of personalized products, while corporate branding and event merchandise continue to fuel B2B sales across Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the global custom apparel market. Key countries include India, China, Japan, and Australia. Drivers include rapid urbanization, rising middle-class incomes, increasing e-commerce penetration, and growing interest in fashion personalization. Youth-driven demand for affordable, trendy, and unique apparel, coupled with the influence of social media, supports expansion in the T-shirts, hoodies, and sportswear segments. The presence of strong manufacturing hubs allows international export opportunities, making the Asia-Pacific a high-potential region for both domestic and global players.

Latin America

Latin America, particularly Brazil, Argentina, and Mexico, is emerging as a growth market for custom apparel. Increasing consumer interest in event merchandise, promotional items, and sportswear drives adoption. E-commerce platforms and mobile-based retail solutions are facilitating access to customized products for mid-to-high-income consumers. Additionally, corporate demand for uniforms and branded apparel is strengthening B2B sales, while social media trends among younger demographics are boosting lifestyle-related personalization, supporting long-term regional growth.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is witnessing growth driven by high-income populations, luxury fashion adoption, and a rising culture of corporate branding. In Africa, although the market is smaller, local production capabilities, event-driven apparel sales, and urbanization are contributing to increased demand. Government support for industrial growth and investment in textile manufacturing in regions such as Morocco, Egypt, and South Africa is strengthening infrastructure for custom apparel production. Additionally, international fashion brands targeting premium consumers in the Middle East are accelerating market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Custom Apparel Market

- Vistaprint

- Spreadshirt

- Printful

- TeeSpring (Spring)

- Zazzle

- Custom Ink

- Gildan

- Hanesbrands

- Fruit of the Loom

- Stahls'

- Brother International

- VistaPrint (Apparel Division)

- UberPrints

- Tees2UrDoor

- Next Level Apparel

Recent Developments

- In January 2025, Printful expanded its European fulfillment centers to reduce lead times and improve delivery for custom apparel orders.

- In March 2025, Vistaprint introduced AI-based design tools for real-time visualization of personalized T-shirts and corporate merchandise.

- In July 2024, Custom Ink launched eco-friendly apparel lines using organic cotton and water-based inks to cater to sustainability-focused consumers.