Crystal Products Market Size

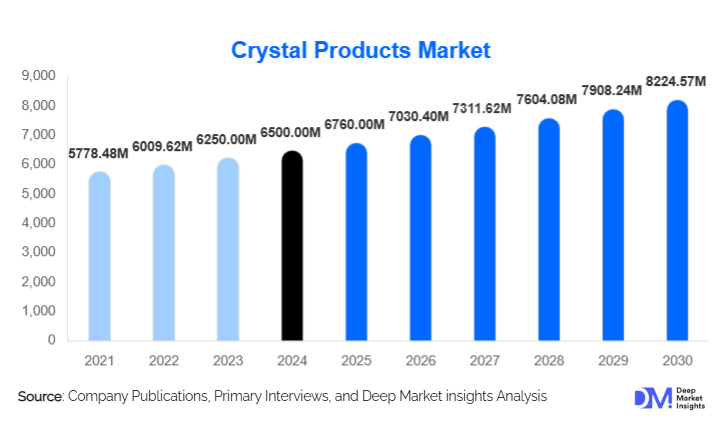

According to Deep Market Insights, the global crystal products market size was valued at USD 6,500 million in 2024 and is projected to grow to USD 6,760.00 million in 2025 and further reach USD 8,224.57 million by 2030, expanding at a CAGR of 4.0% during the forecast period (2025–2030). The market growth is primarily driven by rising global demand for luxury home décor, increasing residential interior investments, and strong adoption of premium barware, lighting, and collectible crystal items among affluent consumers.

Key Market Insights

- Luxury crystal décor and barware continue to dominate global demand, supported by rising lifestyle spending and a strong gifting culture.

- Lead-free and eco-crystal products are rapidly gaining traction as consumers shift toward health-conscious and sustainable premium goods.

- Online retail is emerging as a major growth catalyst, driven by virtual showrooms, customization tools, and direct-to-consumer brand strategies.

- Asia-Pacific represents the fastest-growing region, fueled by rising disposable income and a surge in luxury consumption across China and India.

- North America and Europe maintain the largest market share, supported by established luxury retail ecosystems and long-standing heritage brands.

- Technological advancements in laser-cutting, CNC engraving, and digital customization are transforming product design and premiumization strategies.

What are the latest trends in the crystal products market?

Sustainable and Lead-Free Crystal Gaining Momentum

Manufacturers are increasingly shifting toward lead-free, eco-friendly crystal compositions to appeal to health-conscious and environmentally aware consumers. These products offer the same optical clarity and brilliance as traditional lead crystal while using non-toxic materials. The trend is supported by tightening global regulations and growing demand for “green luxury” offerings. Brands are launching collections made with recyclable materials, energy-efficient production processes, and eco-crystal formulas designed to reduce environmental impact. Sustainability labeling and supply-chain transparency are emerging as key differentiators for premium crystal brands.

Technology-Enhanced Customization and Design

New technologies such as laser engraving, 3D modeling, CNC cutting, and AI-based design tools are revolutionizing crystal craftsmanship. Consumers increasingly prefer personalized crystal items, including monogrammed barware, bespoke lighting pieces, and limited-edition sculptures. Online product configurators allow customers to visualize custom engravings, shapes, and finishes in real time. Virtual showrooms, AR previews for lighting installations, and digitally enabled artisan collaborations are making premium crystal more experiential and accessible. This trend is particularly appealing to younger luxury buyers seeking individuality and exclusivity.

What are the key drivers in the crystal products market?

Rising Global Affluence and Luxury Spending

Growth in high-income households and rising aspirational spending are major contributors to the crystal products market. Affluent consumers increasingly purchase luxury barware, decorative items, and handcrafted lighting to elevate residential interiors. The premiumization of lifestyles, especially in emerging economies, has driven demand for fine crystal pieces as symbols of sophistication and cultural refinement. The expansion of designer collaborations, heritage craftsmanship marketing, and limited-edition collections further boosts the luxury segment’s appeal.

Growing Focus on Home Décor and Interior Aesthetics

The global surge in home renovation, interior design investments, and lifestyle-oriented consumption is a significant driver of crystal product demand. High-end lighting, decorative vases, sculptures, and barware are widely used to enhance modern and classic interior styles. The rising popularity of home bars, luxury dining settings, and curated display décor has substantially increased the adoption of premium crystal items. Interior designers and architects increasingly incorporate custom crystal pieces into luxury homes, boutique hotels, and upscale commercial spaces, driving sustained growth in both residential and commercial segments.

What are the restraints for the global market?

High Production and Material Costs

Crystal manufacturing is resource-intensive, requiring high-purity silica, metal oxides, skilled artisans, and energy-heavy furnaces. Fluctuations in energy prices, raw materials, and labor costs significantly impact production economics. These high input costs limit mass-market scalability and keep final product prices high, restricting access primarily to premium and luxury buyers. Smaller manufacturers often struggle to compete with established brands that benefit from economies of scale and advanced manufacturing capabilities.

Competition from Alternative Materials

High-quality glass, acrylic, and engineered crystal alternatives increasingly compete with traditional crystal products at lower price points. These alternatives mimic the appearance of crystal while offering improved durability and affordability, appealing to cost-sensitive consumers. As a result, the traditional crystal market faces pressures to differentiate through craftsmanship, brand heritage, and premium positioning. This challenge restricts market penetration across broader consumer demographics.

What are the key opportunities in the crystal products industry?

Innovation in Eco-Crystal Production

The global shift toward sustainable luxury creates major opportunities for eco-crystal development. Manufacturers investing in lead-free formulas, recyclable crystal, and energy-efficient processes can appeal to environmentally conscious consumers and comply with global regulatory changes. Brands can capture premium margins by marketing eco-crystal as safe, ethical, and high-end. This innovation pathway is expected to reshape product portfolios and drive long-term market competitiveness.

Expansion in Emerging Markets and the Hospitality Sector

Rapid urbanization, rising disposable incomes, and the expansion of luxury hospitality in Asia-Pacific, the Middle East, and parts of Latin America provide substantial growth opportunities. High-end hotels, restaurants, and event venues increasingly incorporate crystal lighting, tableware, and décor to create a premium ambiance. Crystal manufacturers that partner with interior designers, architecture firms, and hospitality groups can secure large-scale, repeat B2B contracts. Emerging markets’ demand for imported luxury crystal presents additional opportunities for global brand expansion.

Product Type Insights

Barware represents the largest product segment, accounting for roughly 35–38% of global market value. Demand is driven by premium dining trends, luxury home bars, and a strong gifting culture. Home décor items, such as vases, figurines, and sculptures, form another significant segment, supported by interior design trends. Crystal lighting remains a high-value category, propelled by luxury hotels, upscale residences, and commercial design projects. Gifts and collectibles maintain steady demand due to corporate gifting and commemorative items, while jewelry and accessories cater to niche high-fashion consumers.

Application Insights

Residential applications dominate the market, representing over half of global demand, driven by rising household purchasing power and interior enhancement trends. Commercial applications, including hotels, restaurants, corporate spaces, and event venues, are expanding rapidly through bespoke lighting installations and premium tableware. Corporate gifting remains a reliable revenue stream, with crystal trophies, awards, and ceremonial pieces widely used across sectors. Architectural and interior design applications are emerging as high-potential niches, particularly for large crystal installations and custom lighting structures in luxury real estate.

Distribution Channel Insights

Online distribution channels are gaining dominance due to digital showrooms, brand-owned e-commerce platforms, and virtual customization tools. Direct-to-consumer online strategies enable luxury brands to reach global buyers without relying on traditional retail networks. Specialty crystal boutiques and luxury department stores remain strong for premium in-store experiences. B2B distribution, including partnerships with interior designers, hospitality firms, and corporate buyers, continues to expand as crystal products increasingly enter commercial and architectural environments. Social media and influencer-driven marketing further support online discovery and brand engagement.

End-User Insights

Residential consumers represent the largest end-user group, purchasing crystal items for home décor, dining enhancement, and lifestyle-driven consumption. The commercial segment is experiencing robust growth due to luxury hotel expansions, fine dining establishments, and upscale event venues, all of which require high-quality crystal tableware and lighting. Corporate users contribute significantly through awards, gifts, and branded crystal merchandise. Collectors and connoisseurs form a niche but high-value segment, frequently driving demand for limited editions, artisanal craftsmanship, and heritage brand offerings.

| By Product Type | By Material / Composition | By Price Tier | By End-Use / Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for a substantial share of global demand, driven by strong luxury retail ecosystems, high purchasing power, and a robust culture of home décor investment. The United States is the single largest regional market, with consumers showing strong preferences for premium barware, decorative crystal, and personalized gifting items. The region’s mature e-commerce infrastructure further accelerates the adoption of online luxury purchases.

Europe

Europe remains a historic hub for crystal craftsmanship, home to heritage brands and artisanal production clusters. Countries like France, Ireland, the Czech Republic, and Italy lead both production and consumption of premium crystal products. European consumers value craftsmanship, tradition, and sustainable luxury, contributing to steady demand for handcrafted and eco-conscious crystal collections. Tourism-driven retail sales also support market growth in cities known for luxury shopping.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, fueled by rising middle-class affluence, luxury lifestyle adoption, and increasing interest in imported crystalware. China dominates regional demand, especially for luxury décor, lighting, and premium barware. India, Japan, South Korea, and Southeast Asia also contribute significantly, driven by home décor trends, hospitality development, and gifting traditions. Expanding online luxury retail across Asia further accelerates market penetration.

Latin America

Latin America is an emerging market with growing interest in imported luxury crystal items. Brazil, Mexico, and Argentina lead regional demand, supported by rising urban wealth and the adoption of premium décor products. Although price sensitivity remains a challenge, niche luxury consumers and hospitality developers are driving increased uptake of crystal lighting and décor.

Middle East & Africa

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, represents a lucrative market for high-end crystal décor and custom lighting. Luxury real estate development and strong hospitality investments fuel demand for premium crystal installations. Africa contributes primarily as a growing consumer and hospitality market, with South Africa and Nigeria emerging as key demand centers. Architectural crystal installations are particularly prominent in luxury residences and hotels across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Crystal Products Market

Recent Developments

- In March 2025, Swarovski launched a new lead-free eco-crystal collection, emphasizing sustainability and recyclable materials in premium décor.

- In January 2025, Baccarat announced an expansion of its custom lighting division, focusing on large-scale installations for luxury hotels and commercial spaces.

- In April 2025, Waterford Crystal introduced a digital customization platform allowing customers to personalize barware and décor items with AI-driven design previews.