Cricket Guards Market Size

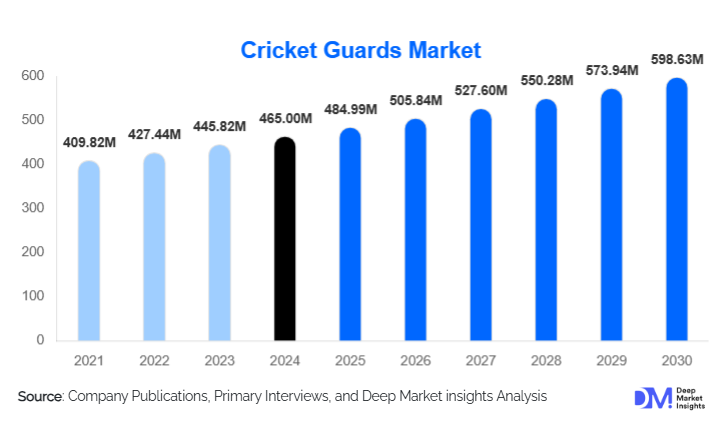

According to Deep Market Insights, the global cricket guards market size was valued at USD 465 million in 2024 and is projected to grow from USD 484.99 million in 2025 to reach USD 598.63 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). Market growth is driven by rising participation in cricket across professional, amateur, and youth levels, increasing safety awareness, and the adoption of advanced lightweight and composite material technologies in guard manufacturing.

Key Market Insights

- Batting and wicket-keeping guards remain essential equipment across all levels of cricket, ensuring consistent and recurring demand.

- Asia-Pacific dominates global consumption, with India, Pakistan, Australia, and Bangladesh driving over half of the market’s value.

- North America is the fastest-growing region, supported by expanding grassroots leagues and rising popularity among immigrant communities.

- Material innovation, carbon fiber, hybrid foams, and ergonomic fits are pushing premiumization in the cricket guards category.

- Youth and academy cricket is the fastest-growing end-user segment, driven by structured training programs and safety mandates.

- Online distribution is rapidly gaining traction, with direct-to-consumer (D2C) brands increasing their share globally.

Latest Market Trends

Shift Toward Advanced Composite and Custom-Fit Guards

Manufacturers are increasingly incorporating advanced materials such as carbon fiber, high-density foam, reinforced PVC, and hybrid composites. These innovations enhance shock absorption while reducing weight, significantly improving player comfort and mobility. Custom-fit and ergonomically contoured guards, often achieved through 3D scanning or modular padding, are gaining popularity among professional and amateur players alike. The trend is elevating guard performance standards and enabling manufacturers to capture premium pricing tiers.

Digital Sales Channels and Global Online Penetration

Online platforms and D2C ecommerce stores are reshaping the cricket guard purchase journey. Players can now compare materials, certifications, fit styles, and pricing through digital catalogs and virtual fitting tools. Online sales are especially strong in non-traditional markets such as North America, Europe, and the Middle East, where physical cricket stores are limited. This shift is enabling global brands to reach a wider audience while reducing dependency on retail distributors.

Cricket Guards Market Drivers

Increasing Cricket Participation Across All Levels

The proliferation of domestic and franchise T20 leagues worldwide is driving massive growth in player participation. Youth programs, school cricket initiatives, and academy-driven training models are expanding rapidly in Asia, North America, and the Middle East. This surge in participation increases the consumption of protective gear across all segments, amateur, professional, and youth, making it a core market driver.

Rising Safety Awareness and Performance Expectations

As the pace and intensity of cricket increase, so does the need for robust safety gear. Improved awareness around injury prevention, combined with stricter safety norms in academies and professional leagues, is fueling demand for high-quality guards. Modern players seek guards that offer superior protection, enhanced ventilation, sweat resistance, and ergonomic mobility, driving manufacturers to innovate and upgrade product portfolios.

Market Restraints

High Cost of Premium and Composite Guards

Advanced guards using composite materials such as carbon fiber are expensive, limiting accessibility among youth and budget-conscious amateur players. Price sensitivity is particularly high in developing cricket markets, where consumers often opt for basic foam-based guards. This price gap restricts the mass adoption of high-end protective gear and challenges premium manufacturers in capturing broader market share.

Presence of Low-Cost Counterfeit or Generic Guards

The availability of non-certified, low-cost, and generic protective guards in local markets, especially in South Asia, acts as a restraint on revenue growth for premium manufacturers. These low-cost alternatives hinder market penetration for branded and technologically advanced guard products, particularly among amateur players who prioritize affordability.

Cricket Guards Market Opportunities

Rapid Expansion in Emerging Cricket Nations

Cricket is growing rapidly in North America, the Middle East, and Latin America. Leagues, community tournaments, and school cricket initiatives are expanding, creating a substantial untapped market for protective guards. Brands that establish early distribution partnerships, local warehouses, or region-specific product lines can capture significant new revenue streams.

Custom Guard Manufacturing and Premiumization

There is a strong opportunity for brands to offer custom-fitted, player-personalized guards built using 3D scanning, modular padding, and ergonomic shaping. As professional and academy-level players increasingly prefer specialized equipment, custom guards can become a high-margin niche. Innovations in breathable materials, moisture-wicking liners, and lighter composites also support premiumization.

Product Type Insights

Batting leg guards (adult) dominate the market, accounting for the largest share due to universal usage by batters at all levels. Their essential nature, frequent replacement cycle, and growing preference for lightweight composite-based pads contribute to their leadership. Wicket-keeping guards, thigh guards, arm guards, and chest/abdomen guards also continue to grow, particularly in elite and academy environments. Entry-level guards made from standard foam and PVC remain popular among youth due to affordability, while hybrid and carbon-reinforced variants command premium segments.

Application Insights

Amateur and recreational cricket applications represent the largest share of global consumption, driven by clubs, schools, and community leagues. Youth academies and school sports programs are fueling rapid growth in demand for standardized protective kits. Professional-level applications, while smaller in volume, drive the premium segment due to advanced material requirements and frequent upgrades. Training academies increasingly require mandatory guard usage, supporting recurring demand in both basic and premium categories.

Distribution Channel Insights

Offline sports retailers remain the primary channel in Asia and Europe, but online channels are expanding rapidly. E-commerce platforms and D2C brand websites allow players to compare features, fit, and performance certifications easily. Specialist cricket equipment stores dominate premium sales in countries like India, Australia, and the UK. Institutional purchase channels (academies, schools, clubs) represent a growing share, particularly for bulk procurement of youth guard kits.

End-User Insights

Amateur and recreational players represent the largest end-user segment, contributing over half of the total market value. Youth players are the fastest-growing category as cricket academies and school-level tournaments expand globally. Professional players remain influential in shaping product trends due to sponsorships, endorsements, and high-performance guard adoption. Institutional users such as academies drive significant recurring demand through standardized protective gear programs.

| By Product Type | By Application | By Distribution Channel | By Traveler Type Equivalent (Mapped to User Type) | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the cricket guards market with nearly 60% share, led by India, Australia, Pakistan, and Bangladesh. Rapid cricket infrastructure expansion, high player participation, and strong domestic leagues drive consistent demand. India alone accounts for over 30–35% of global consumption. Premium guard adoption is rising as players increasingly favor lightweight, ergonomic, and breathable gear.

North America

North America is the fastest-growing region due to expanding cricket leagues, rising youth participation, and growing multicultural communities. The U.S. and Canada together account for an estimated USD 70–80 million in market size. Online distribution is especially strong due to the limited physical cricket stores. This region is expected to grow at a double-digit CAGR during 2025–2030.

Europe

Europe holds a moderate share, driven primarily by the U.K., Ireland, and the Netherlands. Growth is steady, supported by amateur clubs, professional county cricket, and grassroots expansion. European consumers show increasing interest in mid-range and premium guard products with certifications and advanced materials.

Latin America

Latin America represents a small but emerging market. Countries such as Brazil, Argentina, and Chile are developing organized cricket programs. Growth is driven by community clubs, expat players, and rising youth interest. The region offers strong long-term potential as cricket gains exposure through international events and social media.

Middle East & Africa

The Middle East shows strong growth, driven by expatriate communities, new cricket academies, and government-led sports development programs in the UAE, Saudi Arabia, and Qatar. In Africa, South Africa remains the key market with a well-established cricket infrastructure, while Kenya and Nigeria show rising grassroots participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Cricket Guards Market

- Adidas AG

- Puma SE

- Kookaburra Sport Pty Ltd

- Sanspareils Greenlands (SG)

- Grey-Nicolls Sports Ltd

- Gunn & Moore Limited

- Masuri Ltd

- Shrey Sports

- CA Sports

- DSC (Delux Sports Co.)

Recent Developments

- In March 2025, Masuri launched a new carbon-composite thigh and chest guard series designed for elite-level players requiring lightweight yet ultra-protective gear.

- In January 2025, SG introduced an academy-focused guard kit bundle targeting youth cricket programs across India and Southeast Asia.

- In November 2024, Kookaburra announced advancements in ventilated foam technology for batting pads and thigh guards, improving breathability during long innings.