Crepe Makers Market Size

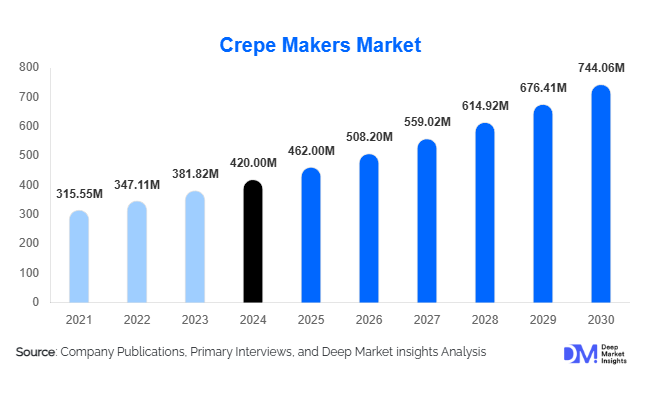

According to Deep Market Insights, the global crepe makers market size was valued at USD 420 million in 2024 and is projected to grow from USD 462.0 million in 2025 to reach USD 744.06 million by 2030, expanding at a CAGR of 10.0% during the forecast period (2025–2030). Market growth is driven by the rising global café culture, increasing consumer interest in gourmet home cooking, and expanding demand for commercial kitchen equipment tailored for specialty food formats such as crepes, pancakes, and similar quick-serve dishes.

Key Market Insights

- Electric crepe makers dominate the market, accounting for over 62% of global sales in 2024, driven by high energy efficiency and suitability for both commercial and home kitchens.

- Commercial food-service applications lead, representing 56% of total market value, as restaurants, snack bars, and catering services upgrade cooking equipment to diversify menus.

- North America holds the largest share at 39%, while Asia-Pacific is the fastest-growing region with a CAGR above 7.5% due to the rising café and food-truck culture.

- Technological innovation, including smart heating, IoT-enabled appliances, and improved non-stick surfaces, is reshaping product differentiation in both premium and commercial segments.

- Online retail channels are emerging as high-growth distribution networks, complementing the still-dominant offline retail segment.

- Manufacturers are increasingly localizing production in Asia and Latin America to optimize costs and expand market accessibility.

What are the latest trends in the crepe makers market?

Rise of Compact and Smart Kitchen Appliances

Growing urbanization and shrinking kitchen spaces are propelling demand for compact, multifunctional cooking appliances. Smart electric crepe makers with digital temperature control, mobile app connectivity, and dual-function features (e.g., crepe + pancake + flatbread) are gaining traction. This aligns with the broader “connected kitchen” trend, where consumers seek precision and convenience. Integration of IoT technology allows users to customize cooking presets and monitor performance remotely, improving energy efficiency and user experience.

Commercial Food-Truck and Café Expansion

The surge in mobile food services, pop-up cafés, and cloud kitchens is creating a robust commercial demand for portable, high-output crepe makers. Operators prefer lightweight, fast-heating electric units with durable plates and energy-saving systems. As urban centers embrace mobile catering and outdoor festivals, manufacturers are introducing heavy-duty models optimized for mobility. This segment is expected to grow fastest over the next five years, especially in the Asia-Pacific and Latin America.

Premiumization and Aesthetic Appliance Design

Consumer preferences are shifting toward visually appealing, ergonomically designed kitchen appliances. Premium home brands are introducing stainless-steel and matte-finish crepe makers that complement modern kitchen décor. Coupled with influencer marketing and social media recipes, aesthetic innovation has become a selling point, encouraging higher household adoption rates in developed economies.

What are the key drivers in the crepe makers market?

Expanding Global Café and Breakfast Culture

The proliferation of café chains, brunch restaurants, and breakfast-focused food formats has significantly increased commercial demand for crepe makers. Global franchises are introducing crepe-based menu innovations, driving equipment sales for both single-unit restaurants and large kitchen operators. This trend is particularly strong in North America and Western Europe, where the café industry continues double-digit annual expansion.

Growing Home Gourmet and DIY Cooking Trend

Consumers are embracing at-home gourmet cooking as a form of recreation and self-expression. Social-media platforms have popularized crepe recipes and presentation styles, encouraging households to purchase electric crepe makers for experiential cooking. Compact electric models and affordable pricing have made these appliances accessible to a broader consumer base, boosting retail demand globally.

Product Innovation and Technological Efficiency

Continuous product upgrades, such as improved heating elements, energy-saving technologies, and superior non-stick coatings, enhance equipment performance and longevity. Leading manufacturers are investing in R&D for faster preheat times, smart sensors, and durable designs. This technological progress has improved reliability, enabling commercial users to maintain consistency during high-volume operations.

What are the restraints for the global market?

High Price Sensitivity and Substitute Products

In many developing regions, consumers perceive crepe makers as specialty appliances. Multifunctional griddles, induction cooktops, and flat-bread makers serve as cheaper substitutes, limiting the market’s addressable base. For commercial buyers, high-end crepe makers involve significant upfront costs, discouraging smaller operators from upgrading equipment frequently.

Limited Awareness and Regional Culinary Preferences

Outside Europe and North America, crepe consumption is not a traditional practice, reducing equipment penetration. Many regional cuisines rely on different cooking formats, creating cultural and behavioral barriers. Manufacturers face the challenge of educating consumers and promoting versatile usage (for pancakes, dosas, tortillas, etc.) to widen adoption in emerging markets.

What are the key opportunities in the crepe makers industry?

Growth in Emerging Economies

Rising disposable incomes and urban café culture in Asia-Pacific, the Middle East, and Latin America present immense opportunities. Local assembly and affordable product lines can attract new customers. Governments encouraging local manufacturing, such as India’s “Make in India” initiative, are further supporting market entry for international brands.

Integration of Smart Technologies

The convergence of cooking appliances and connected-home technology opens a premium opportunity. IoT-enabled crepe makers that allow remote control, temperature calibration, and app-based recipe support will cater to tech-savvy consumers. Manufacturers investing in smart kitchen ecosystems will likely capture a competitive edge in developed economies.

Product Diversification into Food Trucks and Catering Equipment

Commercial food-service operators are diversifying menus and equipment portfolios. Portable crepe stations with modular designs are ideal for event catering, pop-up markets, and outdoor festivals. By focusing on industrial-grade durability, manufacturers can enter new B2B niches that value high output and mobility features.

Product Type Insights

Electric crepe makers dominate the global market, accounting for an estimated 62% share in 2024. Their strong position stems from growing consumer demand for safe, easy-to-use, and energy-efficient appliances suitable for both households and commercial kitchens. The preference for precise temperature control, easy cleaning, and consistent performance continues to drive adoption, particularly across North America and Europe, where e-commerce and retail bundling strategies, such as the inclusion of recipe kits and accessories, boost sales. Electric models also align with rising global energy-efficiency regulations and smart appliance integration trends, further reinforcing their dominance through 2030.

Gas-powered crepe makers hold roughly 28% of the global market, driven by their strong appeal in commercial environments, especially among food trucks, outdoor vendors, and street-food operators who value portability, faster heat recovery, and open-flame control. The segment’s resilience is linked to the expanding street-food culture in Asia-Pacific and Latin America, where portability and rapid heating are key operational advantages. Meanwhile, induction and hybrid models, though currently a niche category, are projected to witness accelerated growth over the forecast period as restaurants and hospitality chains seek energy-efficient, safety-compliant alternatives that reduce long-term operating costs.

Automation and Format Insights

Manual countertop crepe makers continue to lead the market with around 61% of global revenue in 2024. Their simplicity, affordability, and compatibility with a wide range of recipes make them the preferred option for small cafés, independent vendors, and home chefs. Manual crepe pans and tawas also sustain strong demand in regions such as Europe and Asia, where culinary tradition and artisan cooking techniques remain highly valued. These products cater to both professional chefs and home enthusiasts who prefer hands-on preparation and authentic texture control.

In contrast, semi-automatic and fully automated crepe-making systems are gaining traction, especially in large-scale foodservice environments such as hotel chains, catering services, and industrial food manufacturers. These systems are favored for their ability to deliver consistency, speed, and labor savings. The high-capacity/automated commercial segment is expected to grow at a CAGR above 8% between 2025 and 2030, supported by the rising adoption of automation technologies that reduce waste, enhance throughput, and maintain uniform product quality in high-volume production environments.

End-Use Insights

The commercial food-service segment dominates global demand, accounting for 56% of total revenue in 2024. Restaurants, cafés, hotels, and food trucks continue to invest in efficient crepe-making equipment as part of menu diversification strategies. Within this category, food trucks and street kiosks are registering the fastest growth, expanding at double-digit annual rates due to their low setup costs and the global surge in mobile dining concepts. Chain cafés and catering operations are also upgrading to automated units for higher throughput and consistent output.

The household segment, contributing around 44% of demand, is expanding rapidly across emerging markets as middle-class consumers seek specialty appliances to replicate restaurant-quality experiences at home. The popularity of DIY gourmet cooking and social media-driven food trends has boosted sales of mini and portable crepe makers, especially through online platforms. Increasing gifting trends, combined with product innovation such as non-stick coatings and compact designs, are expected to accelerate household adoption through 2030.

Distribution Channel Insights

Offline retail remains the leading distribution channel with approximately 55% share in 2024, supported by consumer preference for physical inspection of appliances and the presence of established retail chains offering after-sales services. Specialty appliance stores and supermarkets continue to be key sales points for premium and professional-grade units. However, online sales channels are expanding rapidly and are projected to surpass 50% of total revenue by 2030. The rise of e-commerce platforms, influencer-driven marketing, and direct-to-consumer (D2C) brand strategies is transforming purchase behavior. Digital marketing, bundled promotions, and availability of product demonstrations and reviews are enabling faster adoption, especially among younger, urban consumers in Asia-Pacific and North America.

| By Product Type | By Automation & Format | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global crepe makers market with an estimated 39% share in 2024. Growth in this region is underpinned by the specialty breakfast and food truck trend, where portable and commercial-grade electric and gas crepe makers are increasingly featured in brunch cafés, pop-up events, and seasonal festivals. The U.S. represents the largest national market, fueled by its well-developed café culture, high purchasing power, and rapid adoption of premium appliances through both large retail chains and e-commerce platforms. Canada also contributes steadily, driven by a growing culture of artisanal and gourmet cooking at home. Ongoing innovations in smart appliances, such as digital temperature controls and energy-saving features, further reinforce regional dominance.

Europe

Europe accounts for roughly 30–32% of the global market in 2024 and remains a key hub for premium and professional-grade crepe equipment. The region’s growth is deeply rooted in culinary tradition and artisanal craftsmanship, particularly in France, the birthplace of crepes, where demand for high-quality cast iron and nonstick pans remains strong. Consumers across Germany, the U.K., and Italy exhibit a willingness to invest in durable, high-end appliances designed for both professional and home use. European cafés and patisseries are adopting energy-efficient and aesthetically designed equipment to match the growing emphasis on sustainable gastronomy and authentic dining experiences. Additionally, expanding tourism and the rise of boutique breakfast chains are further fueling equipment replacement and modernization cycles.

Asia-Pacific

The Asia-Pacific (APAC) region holds about 22–25% of the global market and represents the fastest-growing regional segment, with an expected CAGR of 7.9% during 2025–2030. The key regional driver is the rapid expansion of foodservice outlets, coupled with the region’s strong manufacturing base and affordability. China leads both in production and domestic consumption, benefiting from low-cost manufacturing capabilities and a growing café culture in urban areas. India follows closely, with rising middle-class incomes and Western dining trends fueling demand for small electric crepe makers. Southeast Asian nations, particularly Thailand and Indonesia, are witnessing a boom in street-food vendors adopting gas-based portable units due to affordability and convenience. The increasing popularity of dessert cafés and influencer-driven food trends on social media is expected to further accelerate growth.

Latin America

Latin America contributes approximately 5–7% of global revenue, driven by informal foodservice expansion and small-format entrepreneurship. Markets such as Brazil, Argentina, and Mexico are witnessing strong uptake of both gas and electric crepe makers by food trucks, local cafés, and street vendors. The region’s growth is supported by affordability-oriented consumers who prioritize durable and cost-effective models. The emergence of small-scale café chains, combined with increasing participation in weekend markets and festivals, is creating opportunities for local distributors and manufacturers to expand product availability. However, economic volatility and import dependency remain potential constraints, emphasizing the importance of locally assembled low-cost units for sustained market growth.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for 3–5% of global market share in 2024, led by GCC countries such as the UAE, Saudi Arabia, and Qatar. The key regional driver is the growth of the hospitality and event catering sectors, where high-capacity commercial units are increasingly purchased for hotels, banqueting services, and catering firms. Rising investments in luxury café concepts and tourism infrastructure further bolster demand. Africa’s market, while still emerging, shows promise through expanding tourism, catering, and hospitality investments, particularly in Kenya and South Africa. Price sensitivity and limited distribution remain challenges, but ongoing import partnerships and regional manufacturing initiatives are helping bridge the supply gap, enabling greater market accessibility in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Crepe Makers Market

- Krampouz

- Waring Commercial

- Breville Group

- Cuisinart

- Salton Inc.

- Paderno World Cuisine

- Eurodib

- Tibos

- Nemco Food Equipment

- Star Manufacturing

- Chefman

- Domu Brands Ltd.

- NutriChef Kitchen LLC

- Beper S.r.l.

- Conair Corporation

Recent Developments

- In March 2025, Krampouz introduced an IoT-enabled professional crepe maker line with smart temperature monitoring and energy-usage analytics for commercial kitchens.

- In January 2025, Breville Group launched its “Smart Heat Pro” home crepe maker featuring AI-based heat calibration for consistent batter spread and cooking.

- In October 2024, Cuisinart expanded its product portfolio in India through a partnership with a major e-commerce platform to strengthen regional distribution.