Cover Glass Market Size

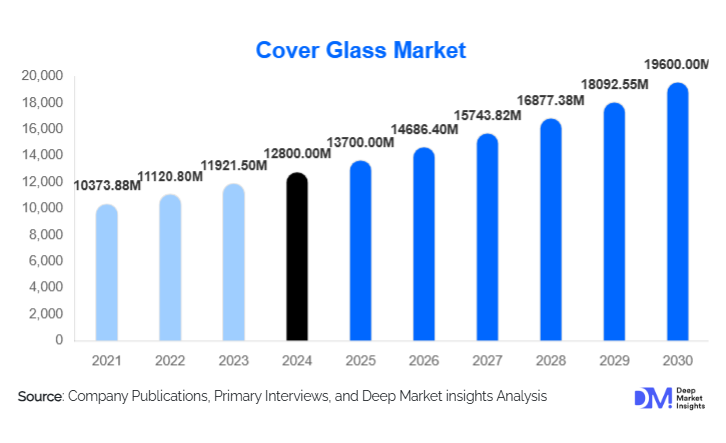

According to Deep Market Insights, the global cover glass market size was valued at USD 12,800 million in 2024 and is projected to grow from USD 13,700 million in 2025 to reach USD 19,600 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of smartphones, tablets, wearable devices, and automotive displays, along with rising demand for scratch-resistant, high-performance glass solutions in consumer electronics, healthcare, and industrial applications.

Key Market Insights

- Consumer electronics continue to dominate demand, with smartphones and tablets accounting for the largest share of cover glass consumption globally.

- Automotive applications are emerging as a high-growth segment, driven by digital dashboards, infotainment systems, and the shift toward electric vehicles (EVs) that require advanced glass solutions.

- Asia-Pacific leads production and consumption, particularly in China, India, and South Korea, due to large-scale electronics manufacturing and rising domestic demand for premium devices.

- North America and Europe maintain strong premium demand, driven by consumer preference for durable and scratch-resistant cover glass in high-end devices.

- Technological integration, including chemically strengthened, ultra-thin, and anti-reflective cover glass, is reshaping product offerings and enabling growth in emerging device categories like wearables and AR/VR applications.

- Market expansion in emerging economies, supported by government initiatives such as “Make in India” and industrial modernization programs, is creating new growth avenues for manufacturers and investors.

What are the latest trends in the cover glass market?

Flexible and Chemically Strengthened Glass Solutions

Manufacturers are increasingly focusing on flexible, foldable, and ultra-thin chemically strengthened glass to cater to next-generation devices. Foldable smartphones, AR/VR headsets, and wearable electronics demand cover glass that is highly durable yet lightweight. Innovations such as anti-fingerprint coatings, oleophobic layers, and enhanced scratch resistance are becoming standard to meet consumer expectations. These technological advancements allow manufacturers to differentiate products and capture high-value segments, especially in premium device categories.

Integration with Automotive and Industrial Displays

Modern vehicles increasingly rely on digital dashboards, infotainment systems, and touch-sensitive panels. High-strength cover glass is now a critical component in automotive electronics, particularly in electric and autonomous vehicles. Industrial applications, including machinery control panels and medical diagnostic equipment, are also driving demand. Glass solutions with high durability, anti-glare coatings, and precise dimensional accuracy are becoming standard in these sectors, supporting long-term adoption and revenue growth.

What are the key drivers in the cover glass market?

Rising Demand in Consumer Electronics

Smartphones, tablets, and wearable devices remain the primary growth drivers for cover glass. Increasing consumer preference for premium, scratch-resistant, and durable devices is pushing manufacturers to adopt chemically strengthened and ultra-thin cover glass. The growing penetration of high-end devices in emerging markets further fuels demand. Additionally, the expansion of AR/VR devices and foldable screens is creating niche opportunities for advanced glass solutions.

Automotive Electrification and Digitalization

The automotive industry is increasingly adopting digital dashboards, infotainment systems, and touch-sensitive control panels. Electric and autonomous vehicles require robust, high-performance cover glass capable of withstanding temperature variations, vibrations, and long-term wear. Government incentives supporting EV adoption, particularly in North America, Europe, and China, further strengthen demand.

Technological Advancements in Glass Manufacturing

Continuous innovation in glass manufacturing, including chemical strengthening, ultra-thin designs, anti-reflective coatings, and flexible solutions, is enabling new applications in consumer electronics, automotive, and industrial devices. These advancements allow manufacturers to offer differentiated products, cater to premium device segments, and maintain competitive positioning in a growing market.

What are the restraints for the global market?

High Production Costs

The cost of manufacturing high-strength and chemically treated cover glass remains high due to raw material expenses and specialized production processes. This can limit adoption in low-cost devices and constrain margins for manufacturers targeting mid-range or budget segments. Variations in raw material prices, including silica and alumina, further add to production volatility.

Intense Competition and Technological Barriers

The cover glass market is highly competitive, with major players investing heavily in R&D to maintain technological leadership. Smaller companies may face barriers to entry due to high capital requirements, patent protections, and the need for advanced manufacturing infrastructure. Rapid technological changes also necessitate continuous innovation, posing challenges for participants to stay competitive.

What are the key opportunities in the cover glass market?

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer high growth potential due to increasing smartphone penetration, industrial automation, and healthcare modernization. Government initiatives like India’s “Make in India” and China’s “Made in China 2025” encourage local manufacturing and attract investment in cover glass production facilities.

New Applications in Wearables and AR/VR Devices

The rapid adoption of wearable devices, AR/VR headsets, and foldable smartphones is creating new demand for ultra-thin, flexible, and chemically strengthened glass. Companies that invest in R&D to develop specialized solutions for these applications can capture premium pricing and establish leadership in emerging device segments.

Automotive and Industrial Electronics Integration

With increasing digitalization of vehicles and industrial systems, high-performance cover glass is now essential for dashboards, touch panels, and control interfaces. Strategic partnerships with automotive OEMs and industrial equipment manufacturers present lucrative growth opportunities for existing and new market entrants.

Product Type Insights

Aluminosilicate and chemically strengthened glasses dominate the market due to their superior durability, scratch resistance, and lightweight properties, accounting for nearly 40% of global market share in 2024. Soda-lime glass remains popular in cost-sensitive applications, while premium Gorilla Glass variants are preferred in high-end smartphones, tablets, and foldable devices. Trends indicate increasing adoption of flexible, ultra-thin, and anti-reflective glass across consumer electronics and automotive applications.

Application Insights

Smartphones and tablets represent the largest application segment, holding over 50% of market share in 2024. Automotive displays, including infotainment systems and digital dashboards, are rapidly growing, expected to expand at a CAGR of 8.5% during 2025–2030. Wearables, AR/VR devices, medical instruments, and industrial touch panels are emerging applications driving incremental demand, offering opportunities for premium, high-performance glass adoption.

Distribution Channel Insights

Original equipment manufacturers (OEMs) dominate the distribution of cover glass, integrating glass solutions directly into consumer electronics, automotive, and industrial devices. Direct B2B supply contracts, strategic alliances, and partnerships with electronics manufacturers are key channels. Online platforms for replacement and aftermarket glass solutions are growing moderately, while distributors and specialty resellers serve regional and smaller-scale demand, particularly in emerging markets.

| By Product Type | By Application / Device Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 20% of the global cover glass market in 2024, led by the U.S. The region is dominated by premium device consumption and automotive innovations. Rising EV adoption, wearable device penetration, and high disposable income support consistent growth, with a forecast CAGR of 6.8% through 2030.

Europe

Europe held about 18% of the global market in 2024, driven by Germany, the U.K., and France. The region shows strong adoption of premium smartphones and automotive displays. Increasing investment in EVs, industrial automation, and advanced medical devices is supporting steady market expansion, with a projected CAGR of 6.5% during 2025–2030.

Asia-Pacific

Asia-Pacific dominates the market, accounting for roughly 45% of global demand in 2024. China, India, South Korea, and Japan are major contributors due to large-scale electronics manufacturing, smartphone penetration, and growing automotive electronics adoption. This region is also the fastest-growing, projected to expand at a CAGR of 8.0% through 2030.

Latin America

Latin America shows moderate growth, with Brazil and Mexico leading demand for smartphones and automotive applications. The region benefits from increasing industrialization and the gradual adoption of premium electronics. Growth is expected at a CAGR of 5.5% during 2025–2030.

Middle East & Africa

MEA represents a smaller share of global demand, primarily driven by automotive and consumer electronics adoption in the UAE, Saudi Arabia, and South Africa. Government-backed industrial modernization programs and rising urbanization are supporting market expansion, with a forecast CAGR of 6.0% through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cover Glass Market

- Corning Inc.

- Schott AG

- Asahi Glass Co., Ltd.

- Nippon Electric Glass Co., Ltd.

- NEG Group

- Guardian Glass

- AGC Inc.

- Fuyao Glass Industry Group

- Saint-Gobain

- Cardinal Glass Industries

- Ohara Inc.

- Samsung Corning Advanced Glass

- Central Glass Co., Ltd.

- Xinyi Glass Holdings Limited

- NSG Group

Recent Developments

- In June 2025, Corning Inc. expanded production of Gorilla Glass with enhanced scratch and drop resistance for next-generation smartphones and foldable devices.

- In May 2025, Schott AG announced the launch of chemically strengthened ultra-thin glass for automotive and industrial touch panels, targeting EVs and industrial automation equipment.

- In March 2025, Asahi Glass Co., Ltd. introduced anti-reflective and flexible glass solutions for wearable devices and AR/VR applications, supporting premium electronics manufacturers in APAC and Europe.