Cosmetic Serum Market Size

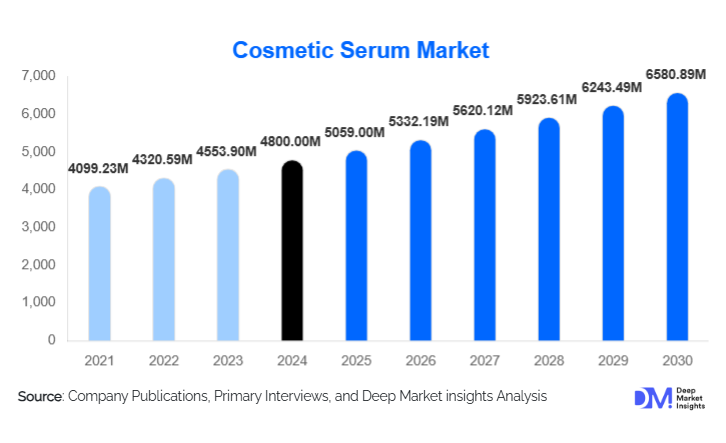

According to Deep Market Insights, the global cosmetic serum market was valued at USD 4,800 million in 2024 and is projected to reach approximately USD 5,059.20 million in 2025 and further grow to USD 6,580.89 million by 2030, expanding at a CAGR of around 5.4% during the forecast period (2025–2030). This growth is driven by rising consumer demand for high-performance skincare, ingredient-led innovation, and the rapid expansion of digital beauty channels.

Key Market Insights

- Anti-aging serums remain the largest product segment, as global consumers increasingly prioritize wrinkle reduction, skin firming, and preventive skincare.

- Hyaluronic acid–based serums are among the most popular ingredients, due to their hydrating power, wide skin-type compatibility, and broad appeal across age groups.

- Water-based serums dominate in form factor, as they offer lightweight textures and efficient delivery of active ingredients.

- Mid-tier / prestige price positioning is the sweet spot, balancing strong performance and value, and capturing a significant share of the market.

- Online / direct-to-consumer (D2C) channels are growing rapidly, enabling both legacy and indie brands to scale efficiently.

- Asia-Pacific is emerging as a critical growth region, driven by rising beauty awareness, innovation (e.g., K-beauty), and deepening e-commerce adoption.

What are the latest trends in the cosmetic serum market?

Sustainable & Clean Beauty Formulations

Beauty brands are aggressively shifting toward sustainable and clean-serum formulations. Consumers are increasingly demanding plant-based actives, bioengineered ingredients, and eco-friendly packaging. In response, companies are reformulating traditional serum lines to use recyclable or airless pumps, biodegradable materials, and ethically sourced ingredients. This move not only resonates with environmentally conscious consumers but also aligns with ESG goals and regulatory pressures. As sustainability becomes part of brand identity, “green” serums that deliver high performance without compromising eco-credentials are rapidly rising in popularity.

Personalization & Custom Serums

Personalized skincare is transforming the cosmetic serum market. Using AI-powered diagnostics, skin-analysis apps, and subscription business models, brands are now offering custom serums tailored to individual skin needs, such as hydration, pigmentation, or sensitivity. These bespoke formulations foster brand loyalty and recurring purchase behavior, as consumers sign up for tailored delivery plans. The shift toward customization is also helping niche players differentiate from mass-market brands.

Cross-Border E-commerce & Emerging Market Penetration

E-commerce continues to be a major engine of growth for cosmetic serums, particularly in emerging markets. Brands based in innovation hubs like South Korea and Europe are exporting directly to consumers in regions such as India, Brazil, and the Middle East. Cross-border platforms and social commerce enable rapid scaling, while local consumers gain access to premium and indie acts unavailable in domestic retail. This globalization of beauty is unlocking vast untapped demand in previously underpenetrated markets.

What are the key drivers in the cosmetic serum market?

Rising Awareness of Preventive Skincare

There is a growing consumer mindset that skincare is not simply about cosmetics but about prevention. People are increasingly using serums to forestall skin aging, combat pigmentation, and protect against environmental damage. This preventive approach is fueling consistent demand for targeted treatment serums, especially anti-aging and antioxidant-rich variants.

Ingredient-Led Innovation & Advanced Delivery Systems

Breakthroughs in active ingredients, such as peptides, retinoids, and bioengineered molecules, are driving product innovation. At the same time, advances in delivery technology (liposomes, microencapsulation) are improving ingredient stability and skin absorption. These innovations make serums more compelling, encouraging consumers to pay a premium for science-backed performance.

Digital Commerce & Consumer Education

The rise of social media, skin-diagnostic apps, and influencer marketing is educating consumers about the efficacy of serums. E-commerce platforms give brands a direct line to customers, enabling rapid feedback, sampling, and tailored content. This digital ecosystem accelerates trial, adoption, and repeat purchase, making serums more accessible and desirable globally.

What are the restraints for the global market?

Cost and Price Sensitivity

Many high-efficacy serums are positioned at a premium due to expensive active ingredients, research efforts, and specialized packaging. This high cost can be a barrier in price-sensitive markets, limiting mass adoption. Brands targeting emerging economies often struggle to reconcile performance with affordability.

Formulation & Stability Challenges

Potent actives such as vitamin C, retinol, and peptides are chemically unstable and can degrade, reducing their effectiveness. Ensuring ingredient stability requires advanced formulation science, high-quality packaging, and rigorous testing. These constraints increase production complexity and cost, making innovation riskier.

What are the key opportunities in the cosmetic serum industry?

Eco-Luxury & Clean-Ingredient Serums

The clean beauty movement opens a compelling opportunity to offer “eco-luxury” serums, high-performance formulas made with sustainable actives and eco-conscious packaging. Brands that successfully integrate luxury quality with ethical production can command premium prices and appeal to environmentally minded consumers, particularly in mature and emerging markets.

Scale-up of Personalized Skincare Platforms

Personalization offers major growth potential. By scaling AI-driven skin analysis, subscription-based models, and made-to-order serums, brands can foster deeper consumer engagement and recurring revenue. New entrants, especially digital-first players, can disrupt traditional beauty by offering tailored skincare without enormous inventory risk.

Expansion in Emerging Geographies via Digital Channels

Emerging markets like India, Brazil, and the Middle East present high growth potential, especially via cross-border e-commerce. Companies can capitalize on increasing skin-health awareness, rising discretionary spend, and digital adoption by launching localized online offerings of premium and active-rich serums. This is a scalable way to tap latent demand in underpenetrated regions.

Product Type Insights

Anti-aging serums dominate the product-type segment due to strong demand for wrinkle reduction, firmness, and age-related skin care. Hydrating serums, particularly those based on hyaluronic acid, also hold a large share, offering a universal appeal across age groups and skin types. Brightening and acne-fighting serums are growing rapidly, driven by concerns of hyperpigmentation and skin texture, especially in younger and more diverse consumer markets. Multi-functional serums that combine benefits, such as anti-aging plus hydration, are gaining traction, as consumers prefer streamlined skincare routines.

Application Insights

The primary end-use for cosmetic serums remains daily personal skincare, with women constituting the largest consumer base. However, demand for men’s skincare is rising swiftly, particularly in anti-aging and hydrating categories. Professional applications, such as in dermatology clinics and aesthetic practices, are also expanding, especially for clinical-grade or treatment-focused serums. Serums are being used increasingly in post-procedure care (e.g., after microneedling or chemical peels) to accelerate recovery and enhance results. Meanwhile, wellness-beauty crossovers are emerging, with consumers seeking “beauty-from-within” bundles combining topical serums and ingestible supplements.

Distribution Channel Insights

Online channels, including D2C brand sites, e-commerce marketplaces, and social commerce, are the fastest-growing route for serum sales. These platforms provide wide access, transparent pricing, and direct engagement. Specialty beauty retailers and department stores remain important for prestige and luxury serums, offering in-person sampling and expert advice. Pharmacies and drug-store chains also play a significant role, especially for clinically formulated or dermatologist-endorsed serums. In addition, dermatology clinics and aesthetic salons serve as strategic distribution points for treatment serums personalized to skin concerns.

| By Product Type | By Ingredient Base | By Gender | By Skin Concern | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America (led by the U.S. and Canada) is a mature, high-value market with strong demand for premium, clinically backed serums. In 2024, it accounted for approximately 30–32% of global serum revenues. High consumer spending power, advanced retail infrastructure, and digital adoption underpin the region’s dominance. Innovation-driven brands and dermatologist-recommended formulations continue to drive growth.

Europe

Europe contributes a significant share (estimated at around 28–30%) of the global serum market. Key markets include Germany, the UK, France, and Italy. European consumers value safety, sustainability, and high-quality ingredients, fueling demand for clean and premium serums. Strict regulatory standards also push brands to innovate responsibly.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing 25–27% of global market share in 2024. Major markets such as China, South Korea, India, and Japan are driving demand through rising beauty consciousness, the popularity of K-beauty, and strong e-commerce growth. South Korea remains a global innovation hub, while China and India contribute large consumer bases with expanding digital reach.

Latin America

In Latin America, countries such as Brazil and Mexico are showing increasing interest in active serums, especially for pigmentation, hydration, and aging. Though their share is smaller compared to mature markets, the region is gradually scaling up via both domestic consumption and imported prestige brands. Growth is enabled by rising middle-class income and e-commerce penetration.

Middle East & Africa

Africa is home to emerging demand in countries such as South Africa and Nigeria, while the Middle East (notably the UAE, Saudi Arabia, and Qatar) is cultivating a luxury skin-care culture. The region benefits from high-income consumers, an appetite for premium beauty, and improved access to international brands. Export-led e-commerce is an important driver here, and intra-regional premium spending is also on the rise.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic Serum Market

- L’Oréal

- The Estée Lauder Companies

- Unilever

- Procter & Gamble

- Shiseido

- Amorepacific

- Beiersdorf

- Kao Corporation

- Coty

- Johnson & Johnson

- Chanel

- Clarins

- Revlon

- DECIEM (The Ordinary)

- Paula’s Choice

Recent Developments

- In early 2025, L’Oréal launched a sustainably packaged, bio-peptide serum line formulated with upcycled botanical residues.

- Mid-2025 saw The Estée Lauder Companies acquire a D2C personalized serum startup, enabling expansion into made-to-order skincare via AI skin diagnostics.

- In late 2024, Amorepacific unveiled a new clean-beauty hyaluronic acid serum brand targeting environmentally conscious consumers in Asia-Pacific and Europe.

- In mid-2025, Beiersdorf announced a significant investment in eco-production facilities to produce zero-waste serum packaging using biodegradable materials.