Cosmetic Ingredients Market Size

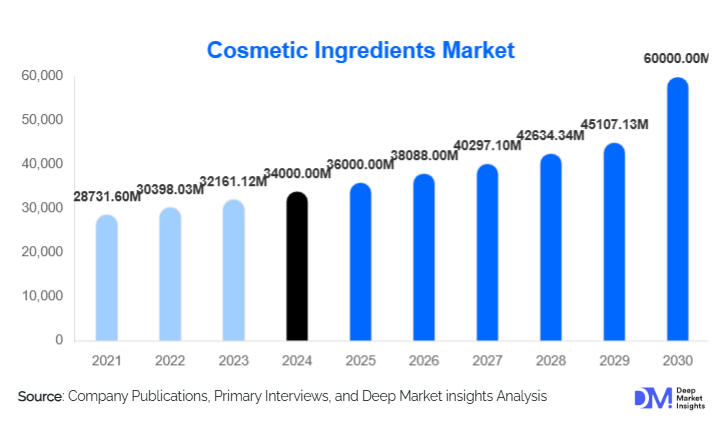

According to Deep Market Insights, the global cosmetic ingredients market size was valued at approximately USD 34,000 million in 2024 and is projected to expand from about USD 35,972 million in 2025 to reach roughly USD 47,686.22 million by 2030, growing at a CAGR of around 5.8% over the forecast period (2025–2030). The market expansion is underpinned by increasing consumer demand for premium, sustainable, and multifunctional cosmetic actives, as well as rising consumption in fast-growing geographies.

Key Market Insights

- Demand is shifting toward cleaner, sustainable, and biotech-derived ingredients, as consumers become more ingredient-aware and regulatory scrutiny intensifies.

- Premium and multifunctional actives are commanding higher margins, driving innovation in R&D pipelines for novel peptides, probiotics, and botanical extracts.

- Asia-Pacific leads in volume consumption, supported by rapid growth in China, India, South Korea, and Southeast Asia for skincare and personal care products.

- North America and Europe emphasize regulatory compliance and safety transparency, pushing ingredient suppliers to invest in certifications, testing, and supply chain traceability.

- Emerging markets in Latin America and the Middle East are drawing focus owing to rising middle-class incomes, beauty awareness, and expanding local cosmetics manufacturing.

- Technological integration, AI-led formulation, blockchain for traceability, and in vitro safety screening are transforming R&D and supply chain transparency.

Latest Market Trends

Biotechnology & Fermentation-Derived Actives Gaining Traction

Ingredient firms are increasingly investing in bio-fermentation, microbial synthesis, and cell culture platforms to generate high-purity actives (e.g., peptides, enzymes, microbial metabolites) as alternatives to traditional plant extracts. These methods provide more consistent quality, lower reliance on agricultural variability, and often a smaller environmental footprint. As those biotech-derived actives mature in cost and scale, they are expected to penetrate deeper into both premium and mass formulations.

Traceability, Transparency & “Clean Label” Push

Consumers and regulators alike are demanding disclosure of ingredient origin, supply chain practices, and sustainability credentials. Ingredient suppliers are adopting blockchain or digital tracking systems to prove provenance, carbon footprint, and ethical sourcing. Labels such as “COSMOS”, “Ecocert”, “USDA Organic”, “Cruelty-Free / Leaping Bunny” are increasingly standard in premium formulations, and ingredient suppliers must comply to supply into those markets.

Market Drivers

Rising Consumer Awareness and Premiumization

Consumers are growing more ingredient-savvy. They increasingly scrutinize labels, favoring botanical actives, “clean” formulations, and multifunctional ingredients. This trend is driving cosmetic brands to demand higher-performing and differentiated ingredients, which pulls up demand in the ingredient sector.

Technological & R&D Innovation

Advances in biotechnology, genomics, AI, and high-throughput screening allow faster innovation of novel actives, more efficient extraction or synthesis, and predictive safety assessments. This reduces time to market for new ingredients and encourages entry of specialty actives beyond commodity chemistries.

Regulation & Safety Demands Encouraging Premium Quality Ingredients

Stringent safety and regulatory standards in Europe (REACH, Cosmetics Regulation), the U.S. (FDA), Japan, and increasingly China require more rigorous testing, registration, and limitation of controversial compounds. Brands want trustworthy ingredient suppliers who can deliver compliant, traceable, and safe ingredients, raising barriers and pushing demand toward high-quality suppliers.

Market Restraints

Raw Material Supply & Price Volatility

Many natural ingredients are agricultural commodities subject to seasonal, climatic, and geopolitical fluctuations. Sudden supply constraints or rising input prices (oils, botanicals, exotic extracts) can squeeze margins or force reformulations.

Regulatory Barriers & Compliance Costs

Ingredient suppliers must navigate divergent regulations across regions, permitted concentration limits, banned substances, testing burdens, and labeling requirements. The cost and complexity of meeting multiple regulatory regimes can inhibit small players or slow product launches in new markets.

Segmental Analysis

Below is an elaboration on one leading segment from each major dimension with its approximate 2024 share and underlying trend:

By Product / Ingredient Function (Chemical Type) – Surfactants: Surfactants hold about 25–28% of the global ingredient market in 2024. Because nearly every cleansing, foaming, shampoo, and wash formulation requires surfactants, and with the trend toward milder, sulfate-free, biodegradable surfactants, demand remains robust. Surfactants command high volumes and stable consumption across product types.

By Functionality / Benefit – Moisturizing / Hydration Agents: This functionality accounts for approximately 22–26% of ingredient usage. Nearly all skincare, body care, and even some hair care formulations include moisturizers. Innovations like ceramides, hyaluronic acid derivatives, squalane, and lipid barrier enhancers are driving premium growth in this category.

By End-Use Application – Skin Care: Skin care is the dominant end-use, taking around 40–45% of ingredient consumption in 2024. Because skin care formulations often include multiple actives (antioxidants, brighteners, moisturizers, peptides), the ingredient content per product is high, driving value share.

By Ingredient Source / Type – Natural / Botanical / Biotech-derived: This segment commands roughly a 30–40% share in 2024. The growth in consumer preference for “natural” and “clean” formulations is fueling higher adoption of such ingredients. Biotech/fermentation alternatives are also helping expand the share away from purely synthetic types.

End-Use Analysis

Demand for cosmetic ingredients is fundamentally driven by the growth of their end-use segments. Skin care remains the largest consumer of ingredients, as product routines expand (serums, day/night creams, masks, essences) and as brands layer more actives per formula. Hair care is another fast-growing consumer, particularly formulations combining cleansing, scalp health, repair, and aesthetic functions (smoothness, shine). Sun care / UV protection is increasing rapidly, especially in regions with growing awareness of photoprotection ingredients for UV filters and boosters, drawing premium demand. Emerging end uses such as men’s grooming, baby & sensitive skin care, and personalized / customized skincare are opening new niches. Export demand from ingredient-producing nations supports growth, as many ingredient firms supply botanical extracts, oils, and actives globally. As end-use markets (cosmetics, personal care) expand, the ingredient sector scales with it both in volume and value terms.

| By Product Type | By Functionality | By Source Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific likely holds the largest regional share in 2024 (35–45%) due to scale manufacturing, strong demand in China, India, South Korea, and Southeast Asia. China is probably the largest single-country market, with India gaining fast. South Korea and Japan are innovation leaders in advanced cosmetics. Rapid urbanization, rising disposable incomes, expanding skincare routines, and digital retail growth fuel ingredient demand.

North America

North America is a major share region, especially for premium, specialty, and regulated ingredients. The U.S. is a major market. Share perhaps 20–25%. Growth is steady and driven by innovation, brand demand for new actives, regulatory scrutiny, and consumer willingness to pay for advanced formulations. It often shows one of the faster CAGRs among developed regions.

Europe

Europe is mature, with high regulatory barriers and strong consumer insistence on safety and sustainability. It likely holds a 20–25% share. Countries like Germany, France, UK are major markets. Growth is more modest, but premium natural / biotech ingredients find strong acceptance.

Latin America

Latin America, including Brazil and Mexico, has a growing demand for both mass and premium cosmetics. Its ingredient share is smaller (5–10%) but growing. Local botanical sourcing (e.g., Amazonian extracts) offers export opportunities for ingredient firms.

Middle East & Africa

MEA is smaller (5–10%) but with pockets of high growth in GCC (UAE, Saudi Arabia) for luxury & cosmetic consumption. Africa has potential in botanical raw material sourcing (shea butter, marula, etc.). Some intra-regional movement is growing, but infrastructure, regulation, and cost challenges remain.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic Ingredients Market

- BASF SE

- Clariant AG

- Evonik Industries AG

- Croda International Plc

- Dow Inc.

- Solvay SA

- Ashland Global Holdings Inc.

- Lonza Group Ltd.

- Givaudan SA

- Symrise AG

- Seppic SA

- Wacker Chemie AG

- DSM (Royal DSM)

- Innospec Inc.

- Lubrizol Corporation

Recent Developments

- In 2025, several ingredient firms announced expansion of biotech/fermentation facilities to scale up new actives, seeking to reduce dependence on agricultural raw materials.

- Many major players have launched sustainability and traceability programs (e.g., chain-of-custody, carbon footprint labeling) to meet brand and consumer demands.

- M&A and collaborations between legacy chemical firms and biotech or natural ingredient startups have accelerated, allowing established players to access new actives or green technologies.