Cosmetic Dyes Market Size

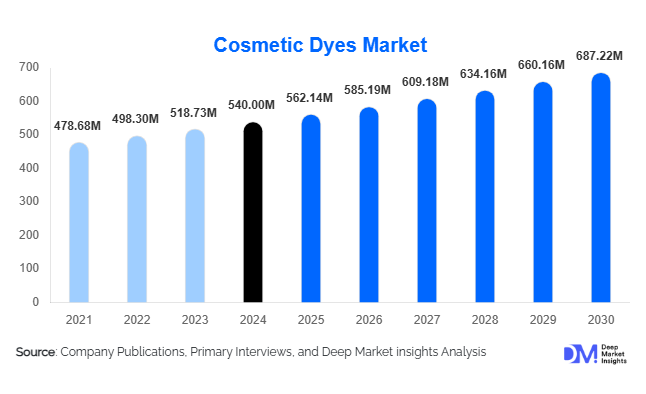

According to Deep Market Insights, the global cosmetic dyes market size was valued at USD 540 million in 2024 and is projected to grow from USD 562.14 million in 2025 to reach USD 687.22 million by 2030, expanding at a CAGR of 4.1% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer focus on personal grooming, increasing adoption of natural and sustainable dyes, and technological advancements in dye formulations for hair, skin, and nail products.

Key Market Insights

- Natural and organic cosmetic dyes are gaining traction, reflecting consumer demand for plant-based and eco-friendly pigments in personal care and beauty products.

- Hair color applications dominate the market, driven by growing adoption of at-home kits and professional salon services globally.

- North America and Europe lead the global market, with high disposable income and mature cosmetic industries driving consistent demand.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class income, e-commerce expansion, and growing beauty awareness in China, India, and Japan.

- E-commerce and online retail channels are expanding rapidly, offering convenience, wider product variety, and personalized color solutions.

- Technological innovations, including long-lasting, multifunctional, and water-based formulations, are reshaping product offerings and consumer preferences.

What are the latest trends in the cosmetic dyes market?

Shift Toward Natural and Sustainable Dyes

Manufacturers are increasingly introducing plant-based and mineral pigments such as henna, indigo, turmeric, iron oxides, and titanium dioxide to cater to consumer preferences for safer and eco-friendly alternatives. Regulatory restrictions on synthetic dyes in regions like the EU are accelerating the adoption of natural options. Additionally, companies are investing in R&D for multifunctional natural dyes that provide vibrant color, conditioning properties, and reduced skin irritation, appealing to a broad consumer base and promoting long-term sustainability in product offerings.

Technological Advancements in Dye Formulations

Emerging technologies are enhancing the quality and application of cosmetic dyes. Long-lasting pigments, ammonia-free hair dyes, and water-based foundations are becoming standard to improve consumer safety and comfort. Digital tools, including AI-based shade matching and virtual try-on solutions, enable consumers to select personalized colors. Innovations like nano-dyes and multifunctional gels are increasing product versatility for hair, skin, and nails, strengthening market appeal among tech-savvy and quality-conscious consumers.

What are the key drivers in the cosmetic dyes market?

Rising Personal Grooming and Cosmetic Awareness

The increasing demand for personal care and beauty products, particularly hair color, lipsticks, and foundations, is a primary growth driver. Millennials and Gen Z populations are highly appearance-conscious, fueling demand for diverse shades, premium products, and at-home hair coloring kits. Professional salons also contribute to robust demand for synthetic and natural dyes, with services expanding across urban and semi-urban regions.

Expansion of E-Commerce Channels

Online retail platforms are transforming the cosmetic dyes market by providing consumers with direct access to a wide range of products. Growth in e-commerce has enabled brands to reach underserved regions, offer customized color solutions, and integrate subscription-based sales models. Sales through online channels are growing at approximately 12–14% annually, making digital presence a critical growth lever for manufacturers.

Innovations in Product Formulation

Advanced dye technologies, including multifunctional pigments and water-based formulations, are enhancing product longevity, vibrancy, and consumer safety. These innovations allow companies to introduce personalized products and appeal to eco-conscious consumers, further strengthening adoption across hair, skin, and nail applications.

What are the restraints for the global market?

Stringent Regulatory Environment

Compliance with global standards, such as FDA regulations, REACH, and ISO 22716, poses challenges for manufacturers. Restrictions on certain synthetic dyes increase production costs and limit product formulations, potentially slowing market growth.

Raw Material Price Volatility

Fluctuating prices of key ingredients, including plant extracts, iron oxides, and titanium dioxide, affect profit margins. Supply chain disruptions due to agricultural or geopolitical factors may further increase costs, challenging manufacturers to maintain competitive pricing.

What are the key opportunities in the cosmetic dyes market?

Rising Demand for Natural and Organic Dyes

Eco-conscious consumers are driving demand for plant-based and mineral-derived dyes. Companies can capitalize on this trend by developing natural, multifunctional products that provide vibrant colors, conditioning effects, and safety benefits, appealing to both home and professional users.

Expansion in Emerging Markets

Markets in India, China, Brazil, and Southeast Asia are witnessing growing disposable income and beauty awareness. Establishing local production facilities and robust distribution channels in these regions can help companies capture market share while minimizing import costs and addressing regional preferences.

Technological Innovations and Personalized Products

Adopting advanced dye technologies and AI-driven solutions enables brands to offer personalized hair, skin, and nail colors. Digital tools for virtual try-ons, shade matching, and subscription-based custom products present new growth avenues and enhance customer engagement.

Product Type Insights

Synthetic dyes dominate the market, accounting for approximately 65% of global revenue in 2024 due to their cost-effectiveness, stability, and wide color variety. Natural dyes are gaining momentum, driven by consumer demand for eco-friendly alternatives and regulatory restrictions on certain synthetic pigments. Liquid dyes are preferred for hair and foundation applications, capturing 55% of the market, while powders and gels are increasingly used in specialty products such as nail colors and blushes.

Application Insights

Hair color applications are leading globally, contributing around 40% of market revenue in 2024. Lipsticks, foundations, and nail products follow, benefiting from growing consumer focus on personalized makeup and at-home beauty routines. Innovations in multifunctional and long-lasting pigments are expanding adoption across all applications, particularly in professional salons.

Distribution Channel Insights

Online retail channels account for 30% of global market share in 2024, reflecting the convenience of digital platforms and growing e-commerce penetration in emerging markets. Specialty stores, supermarkets, and pharmacies remain important for brand visibility, premium positioning, and consumer trust. Subscription-based models and social media-driven campaigns are emerging as effective methods to engage consumers directly.

End-Use Insights

Personal care and cosmetics companies are the largest end-users, representing approximately 70% of the market, supplying both retail and salon channels. Salons and spas are driving professional adoption, while DIY home-use kits are growing rapidly due to increasing awareness and convenience. Emerging applications in cosmetic tattooing, hair extensions, and eco-friendly nail products are creating new demand streams. Export-driven demand from India, China, and Germany is also strengthening the global market.

| By Type | By Application | By Form | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of the global market in 2024, led by the U.S., with strong demand for both synthetic and natural dyes. High disposable income, mature beauty standards, and robust salon networks support growth. Canada contributes modestly, with increasing interest in eco-friendly products and at-home coloring solutions.

Europe

Europe holds 25% of the market, with Germany, France, and the U.K. as major consumers. Regulatory compliance, high cosmetic awareness, and premium product adoption drive demand. Eco-conscious formulations and multifunctional dyes are particularly favored in this region.

Asia-Pacific

APAC is the fastest-growing region, with China, India, Japan, and South Korea driving expansion. Rising middle-class income, online retail growth, and beauty awareness contribute to 9% CAGR. India is emerging as a key market for natural dyes, while China leads in synthetic dye consumption and export capacity.

Latin America

Brazil and Mexico are primary markets, with increasing adoption of hair and skin cosmetic dyes. Expanding middle-class income and online retail penetration support moderate growth (7% CAGR).

Middle East & Africa

Africa, as a natural source of raw materials, supports local production, while the Middle East, led by the UAE and Saudi Arabia, demonstrates growing demand for luxury cosmetic products. Intra-African trade in cosmetic dyes is also increasing, driven by regional salon networks and export opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic Dyes Market

- Clariant AG

- BASF SE

- DIC Corporation

- Sensient Technologies

- Huntsman Corporation

- L’Oréal Group

- Roha Dyechem

- Chr. Hansen Holding A/S

- Eternal Materials

- Sun Chemical

- Kiri Industries

- Venkat International

- Neville Chemicals

- Wacker Chemie AG

- AkzoNobel

Recent Developments

- In March 2025, Clariant AG expanded its natural dye portfolio, introducing plant-based pigments with multifunctional cosmetic benefits for hair and skin applications.

- In January 2025, BASF SE launched long-lasting, ammonia-free hair dyes, targeting eco-conscious and health-focused consumers in Europe and APAC.

- In February 2025, Sensient Technologies introduced AI-driven color-matching solutions for cosmetic manufacturers, enhancing product customization and consumer engagement.