Cosmetic Contact Lenses Market Size

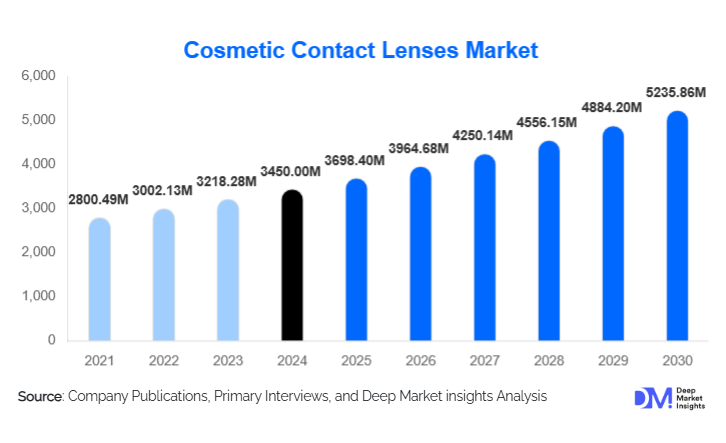

According to Deep Market Insights, the global cosmetic contact lenses market size was valued at USD 3,450 million in 2024 and is projected to grow from USD 3,698.40 million in 2025 to reach USD 5,235.86 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for aesthetic enhancement, increasing social media influence, growing adoption among young adults, and technological advancements in lens comfort and safety.

Key Market Insights

- Plano cosmetic lenses dominate the market, catering to consumers seeking aesthetic enhancement without vision correction, reflecting the rising trend of eye color experimentation and fashion-focused purchases.

- Silicone hydrogel lenses are gaining traction globally, due to enhanced oxygen permeability, comfort, and suitability for extended wear, driving repeat purchases and premium pricing.

- Asia-Pacific leads the market, driven by high population density, rising disposable incomes, and strong e-commerce penetration in countries such as China, India, and South Korea.

- North America remains a key market, supported by mature retail networks, high consumer awareness, and strong demand for prescription cosmetic lenses in urban regions.

- E-commerce and online distribution channels are rapidly expanding, making cosmetic lenses accessible to younger demographics, increasing convenience, and reducing dependence on physical retail outlets.

- Technological innovations, including AR-enabled try-on apps, advanced lens materials, and enhanced safety certifications, are shaping consumer purchasing decisions.

What are the latest trends in the cosmetic contact lenses market?

Fashion and Social Media Influence Driving Adoption

Cosmetic contact lenses are increasingly being used as a fashion accessory, influenced heavily by social media platforms, celebrity endorsements, and visual content trends. Younger demographics are driving demand for colored and special-effect lenses for events, photoshoots, cosplay, and social media content. Retailers and manufacturers are leveraging Instagram, TikTok, and YouTube campaigns to showcase trending lens colors and designs, stimulating impulse purchases and repeat sales. Seasonal launches of limited-edition lenses, collaborations with fashion brands, and influencer marketing campaigns are becoming common strategies for market players.

Technological Advancements in Lens Comfort and Safety

Innovations such as silicone hydrogel lenses, moisture-lock technology, and lenses with enhanced oxygen permeability have improved consumer comfort, extended wear duration, and reduced eye health risks. Augmented reality (AR) apps allow customers to virtually try different eye colors before purchase, improving confidence and reducing product returns. Moreover, regulatory compliance and safety certifications are becoming a differentiator, as consumers prioritize medically safe and comfortable cosmetic lenses.

What are the key drivers in the cosmetic contact lenses market?

Rising Aesthetic and Fashion Consciousness

Consumers increasingly view cosmetic lenses as a fashion statement rather than solely for vision correction. Millennials and Gen Z, driven by social media trends, are experimenting with bold colors, themed lenses, and special-effect designs. Approximately 55% of cosmetic lens purchases in 2024 were influenced by aesthetic appeal. The desire for unique eye appearances at parties, cosplay events, and social gatherings has fueled continuous market growth.

Growth of E-commerce and Direct-to-Consumer Channels

Online platforms allow easy access to cosmetic lenses, enabling comparisons of colors, prices, and reviews. E-commerce now contributes around 30% of global cosmetic lens sales, with online subscription models and brand D2C websites gaining popularity. Convenience, discreet delivery, and wide product variety are driving adoption, particularly among urban youth.

Technological Innovations in Lens Materials

Advanced lens materials such as silicone hydrogel provide higher oxygen permeability, longer comfort, and extended wear, attracting both first-time and repeat users. Innovations like lenses with moisture retention or blue light filtering features enhance consumer appeal, positioning products as both fashion and functional tools.

What are the restraints for the global market?

Regulatory and Compliance Challenges

Different safety standards and regulations across countries create challenges for manufacturers seeking global distribution. Non-compliance can lead to product recalls, limiting market penetration and increasing operational costs for international players.

Health Risks and Consumer Awareness

Improper use of cosmetic lenses may result in eye infections, irritation, or long-term vision issues. Consumer education and awareness campaigns are essential, and failure to implement them can slow adoption rates. This creates a barrier for new entrants in the market.

What are the key opportunities in the cosmetic contact lenses industry?

Expansion into Emerging Markets

Emerging regions such as India, Southeast Asia, and Latin America present high growth potential due to rising disposable incomes, urbanization, and increasing fashion consciousness. Tailored marketing strategies, affordable pricing models, and strategic partnerships with local distributors can help companies capture untapped demand in these markets.

Product Innovation and Technological Integration

Development of lenses with enhanced comfort, longer wear, AR-enabled virtual try-on, and specialty colors presents opportunities to differentiate offerings. Collaborations with technology platforms for immersive shopping experiences and personalization tools can enhance brand loyalty and attract younger demographics.

Collaborations with the Entertainment and Fashion Industries

Cosmetic lenses for cosplay, movies, fashion shows, and themed events are a growing niche. Partnerships with influencers, fashion brands, and event organizers can help companies launch limited-edition designs, boosting both visibility and premium pricing opportunities.

Product Type Insights

Plano cosmetic lenses continue to lead the global market, capturing approximately 60% of total revenue in 2024. This dominance is primarily driven by the rising trend of aesthetic-only adoption without vision correction, particularly among fashion-conscious millennials and Gen Z consumers. Social media influence, celebrity endorsements, and influencer-driven campaigns have amplified consumer interest in experimenting with eye color and style, making plano lenses a preferred choice for everyday wear and special events. Prescription cosmetic lenses, accounting for around 35% of the market, appeal to consumers who require vision correction while enhancing eye aesthetics. The increasing adoption of corrective lenses combined with fashion-forward designs supports stable growth in this segment. Meanwhile, special-effect and themed lenses are emerging rapidly, growing at a CAGR of 8–9% due to cosplay, entertainment, seasonal events, and the rising trend of content creation for social media. Their popularity is further fueled by niche demand for unique and dramatic eye appearances in movies, theatrical performances, and influencer campaigns, highlighting the segment’s strong potential for expansion.

Application Insights

The primary application of cosmetic contact lenses remains fashion and aesthetic enhancement, particularly among young adults and teenagers seeking to modify their appearance for social events, parties, and everyday styling. Secondary drivers include usage for special events, cosplay, and digital content creation, where influencers, photographers, and social media enthusiasts use lenses to enhance visual appeal. Niche applications are expanding in professional contexts such as photography, movies, theater, and influencer campaigns, where eye appearance significantly contributes to aesthetics, character portrayal, and visual storytelling. These trends reinforce the market’s alignment with lifestyle, entertainment, and digital media-driven consumption patterns.

Distribution Channel Insights

Optical retail stores remain the dominant distribution channel, accounting for roughly 50% of global sales. Their market share is supported by consumer trust in professional fitting, prescription verification, and access to high-quality lenses. E-commerce platforms are increasingly influential, with a 30% market share, driven by convenience, broad product variety, and virtual try-on technology that enhances customer confidence and reduces barriers to purchase. Pharmacies and drugstores contribute the remaining 20%, primarily serving over-the-counter cosmetic lens buyers. Among these channels, online sales are growing at the fastest rate due to increased digital penetration, targeted social media marketing, and the rising preference for home delivery among younger consumers. The surge in e-commerce is also enabling manufacturers to launch limited-edition designs and personalized subscription services, further accelerating adoption.

End-User Insights

Adults aged 18–40 dominate demand, representing approximately 65% of the market in 2024. This segment is driven by disposable income, fashion trends, and social media influence, making them the most frequent users of plano and prescription cosmetic lenses. Teenagers (13–17 years) contribute around 20% of the market share, fueled by cosplay, social media trends, and the desire for temporary aesthetic transformation. The older consumer segment (>40 years) accounts for roughly 15% of demand, primarily purchasing lenses for costumes, themed events, or occasional fashion experimentation. Across all age groups, awareness of lens safety and comfort, combined with the convenience of purchase via retail and online channels, remains a critical factor influencing adoption.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 25% of the global cosmetic contact lenses market in 2024, with strong demand concentrated in the U.S. and Canada. The market is driven by high disposable incomes, a well-established optical retail network, and a growing preference for prescription cosmetic lenses. Key drivers include fashion-conscious urban populations, the influence of social media trends, and widespread awareness of eye health and safety. The rise of e-commerce channels, particularly for AR-enabled virtual try-on tools, has further expanded consumer reach, enabling rapid adoption among millennials and Gen Z. Regulatory support and stringent quality standards also enhance consumer confidence, sustaining steady growth.

Europe

Europe holds roughly 22% market share, with Germany, the UK, and France leading demand. Growth is driven by high disposable incomes, strong urban fashion culture, and stringent regulatory standards that ensure lens safety and comfort. Consumers in Europe show increasing adoption of premium and prescription cosmetic lenses, while online platforms are gaining traction among younger demographics. Social media campaigns, influencer collaborations, and fashion-driven marketing are additional growth enablers, particularly in metropolitan areas. The convergence of health consciousness and aesthetic awareness is supporting steady market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at around 9% CAGR, with China, India, Japan, and South Korea as key contributors. Drivers include a high population density, rising disposable incomes, rapid urbanisation, and strong social media influence on fashion trends. E-commerce platforms are a major growth catalyst, providing access to diverse lens types, virtual try-on tools, and subscription-based services. The younger demographic’s engagement with online content, influencer marketing, and cosplay culture fuels the adoption of plano, prescription, and special-effect lenses. Additionally, increased brand awareness, promotional campaigns, and the growing affordability of cosmetic lenses support rapid market penetration across both urban and semi-urban regions.

Latin America

Latin America, led by Brazil and Argentina, accounted for a smaller share of the global market but shows promising growth potential. Market expansion is driven by urban fashion-conscious consumers, increasing online retail penetration, and influencer-led marketing campaigns. The adoption of cosmetic lenses is rising among teenagers and young adults for social events, entertainment, and aesthetic purposes. Growth is supported by increasing disposable income in urban centres, gradual awareness of lens safety, and partnerships with local optical retailers and e-commerce platforms to provide wider accessibility.

Middle East & Africa

The Middle East (8% share) and Africa (5% share) are emerging markets for cosmetic contact lenses. Growth is primarily driven by high-income urban consumers in the UAE, Saudi Arabia, and South Africa, who show a strong interest in premium and fashion-driven lenses. Drivers include rising awareness of eye aesthetics, fashion trends influenced by social media, increasing disposable incomes, and the expanding presence of retail and e-commerce platforms. Luxury cosmetic lenses and special-effect designs are increasingly popular for events, parties, and social media content creation, further boosting regional adoption. Governments in some regions are also promoting healthcare awareness, which indirectly increases trust and adoption of safe, certified cosmetic lenses.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic Contact Lenses Market

- Johnson & Johnson Vision Care

- Alcon (Novartis)

- Bausch + Lomb

- CooperVision

- Menicon Co., Ltd.

- SEED Co., Ltd.

- Maxvue Vision

- Clalen Co., Ltd.

- Hydron Group

- SynergEyes, Inc.

- Oculus Innovative Sciences

- Acuvue (J&J)

- EO (Eyeconic Lenses)

- iLens

- Gelflex Optical

Recent Developments

- In March 2025, Johnson & Johnson Vision Care launched a new line of silicone hydrogel cosmetic lenses with AR-based virtual try-on technology, enhancing consumer convenience and adoption.

- In January 2025, SEED Co., Ltd. introduced limited-edition cosmetic lenses designed for cosplay and entertainment events, tapping into niche fashion markets.

- In December 2024, Bausch + Lomb expanded its e-commerce presence in Asia-Pacific, offering subscription-based cosmetic lens delivery, targeting millennials and Gen Z consumers.