Cosmeceuticals Market Size

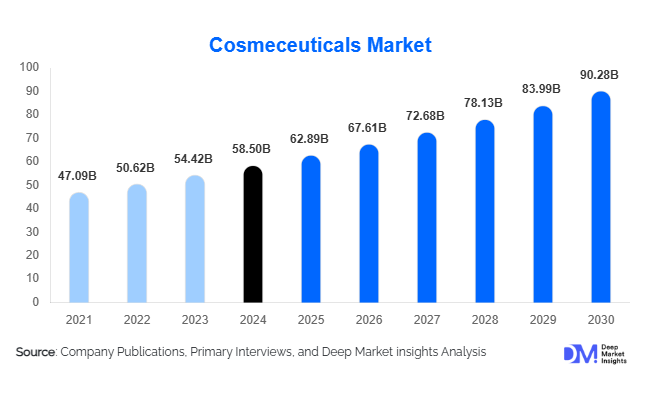

According to Deep Market Insights, the global cosmeceuticals market size was valued at USD 58.5 billion in 2024 and is projected to grow from USD 62.89 billion in 2025 to reach USD 90.28 billion by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by the increasing consumer demand for preventive skincare, rising adoption of multifunctional cosmetic products, and innovations in bioactive and clinically proven ingredients.

Key Market Insights

- Skincare products dominate the cosmeceuticals market, with anti-aging creams and serums capturing the largest share due to rising aging populations and increased awareness of skin health.

- Technological advancements in bioactive ingredients such as peptides, vitamins, and plant-derived actives are enhancing product efficacy and attracting premium consumers.

- North America remains the largest market, led by the USA, due to high consumer spending, advanced dermatology infrastructure, and established e-commerce channels.

- Asia-Pacific is the fastest-growing region, driven by China, India, and South Korea, where rising disposable incomes and social media influence are boosting premium product demand.

- E-commerce and direct-to-consumer channels are expanding, allowing niche cosmeceutical brands to reach consumers globally with personalized offerings.

- Integration with dermatology and wellness sectors is creating new applications for therapeutic cosmeceuticals, driving growth beyond traditional beauty markets.

Latest Market Trends

Rise of Anti-Aging and Multi-Functional Products

Consumers increasingly seek products that deliver both cosmetic and therapeutic benefits, such as anti-aging serums, moisturizers with active ingredients, and hair growth solutions. Multi-functional formulations are gaining traction as they provide convenience and high efficacy. Innovations in peptides, hyaluronic acid, and botanical extracts are driving product differentiation, with clinical validation becoming a key factor in consumer purchase decisions. This trend is particularly strong in skincare and haircare segments, where targeted solutions are preferred by both millennials and aging populations.

Digital and E-Commerce Driven Adoption

E-commerce platforms and online retail channels are reshaping market dynamics. Digital marketing, social media campaigns, and virtual skin consultations are improving consumer engagement and broadening the market reach for emerging brands. Online channels now represent over 25% of global cosmeceutical sales, particularly in APAC, where internet penetration and smartphone adoption are high. Brands are increasingly offering AI-driven personalized recommendations and subscription models, enhancing customer retention and sales conversion rates.

Cosmeceuticals Market Drivers

Growing Anti-Aging Awareness

The global rise in aging populations, particularly in North America and Europe, is driving demand for anti-aging cosmeceuticals. Skincare products targeting wrinkles, fine lines, and pigmentation dominate the market, accounting for roughly 40% of the global product segment. Consumers increasingly prefer clinically validated formulations, boosting the growth of premium products in developed markets.

Technological Advancements in Bioactive Ingredients

Innovations in peptides, vitamins, plant-derived actives, and hyaluronic acid are enhancing the therapeutic benefits of cosmeceuticals. Companies investing in R&D to develop novel, clinically tested formulations are achieving higher market penetration, especially in skincare and haircare applications. The adoption of personalized and functional formulations is expanding consumer preference for high-efficacy products.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online retail growth is facilitating easier access to niche and premium cosmeceutical products. Digital-first strategies, including AI-driven personalization, virtual consultations, and influencer marketing, are reshaping purchase behavior and supporting the rapid adoption of new product lines. Emerging markets in the Asia-Pacific region are witnessing the highest online penetration, increasing regional growth rates.

Market Restraints

High Product Costs

Premium cosmeceuticals are often priced higher due to bioactive ingredients and clinical testing. This limits affordability in emerging markets and restricts broader adoption, potentially slowing overall market growth.

Regulatory Challenges

Variations in regulatory approvals across regions, especially for products containing pharmaceutical-grade ingredients, pose challenges to global product launches. Compliance with different country-specific standards increases time-to-market and operational costs for manufacturers.

Cosmeceuticals Market Opportunities

Integration with Dermatology and Wellness Sectors

Collaboration with dermatology clinics, hospitals, and wellness centers offers significant opportunities to expand the therapeutic applications of cosmeceuticals. Medical-grade formulations for skin repair, pigmentation, and hair restoration are being increasingly prescribed by professionals, driving adoption in clinical and wellness settings.

Emerging Regional Markets

Asia-Pacific is poised for significant growth due to increasing disposable incomes, rising awareness of preventive skincare, and expanding e-commerce penetration. China, India, and South Korea offer substantial opportunities for both premium and mass-market products. Local production initiatives and government support further enhance market potential.

Technological and Product Innovation

Advancements in biotechnology and ingredient research are enabling brands to launch high-efficacy, clinically proven formulations. Personalized skincare and AI-driven product recommendations provide differentiated consumer experiences, creating premium growth opportunities and fostering brand loyalty.

Product Type Insights

Skincare products dominate the cosmeceuticals market, capturing roughly 40% of the 2024 market (USD 23,400 million). Anti-aging creams and serums are particularly favored due to their efficacy in addressing wrinkles, pigmentation, and skin hydration. Haircare products, including growth serums and scalp treatments, represent a growing segment, driven by lifestyle changes and rising consumer interest in hair health. Body care and makeup with functional ingredients are also expanding, supported by multi-functional formulations.

Formulation Insights

Serums and oils are the leading formulation types, accounting for 30% of the segment, due to high absorption rates and targeted benefits. Creams and lotions remain popular for mass-market applications, while gels and masks are favored for professional and at-home spa treatments. Consumers increasingly prefer lightweight, high-potency formulations that combine convenience with efficacy.

Distribution Channel Insights

Online retail channels hold approximately 25% of market share and continue to grow fastest, especially in the Asia-Pacific. Supermarkets and specialty stores maintain relevance in Europe and North America, while beauty salons and spas are becoming key channels for therapeutic products. Direct-to-consumer strategies, including subscription models and virtual consultations, are enabling brands to bypass traditional retail limitations and strengthen consumer relationships.

End-Use Insights

Personal care and beauty dominate end-use applications, representing 50% of market share, while dermatology clinics and wellness centers account for 15%. The growing preference for medical-grade skin and hair treatments, combined with the rise of wellness tourism, is expanding demand. Export-driven growth is significant, with the USA and Europe importing high-value cosmeceutical products, creating opportunities for global brands to expand into emerging regions.

| By Product Type | By Formulation Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest cosmeceuticals market, with a 35% share (USD 20,475 million) in 2024. The USA leads demand due to high disposable income, strong e-commerce penetration, and established dermatology infrastructure. Consumers increasingly prioritize anti-aging and multifunctional skincare products. Canada also shows steady growth driven by premium skincare adoption and rising wellness trends.

Europe

Europe accounts for 30% of the global market share (USD 17,550 million). Germany, France, and the UK are key contributors, with consumers showing a strong preference for clinically proven and sustainable products. Regulatory support for product safety and efficacy reinforces market growth, while younger demographics are driving demand for natural and organic cosmeceuticals.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 9%, driven by China, India, and South Korea. Rising disposable income, growing awareness, and increasing online penetration are boosting demand for premium and multifunctional products. Expansion of local manufacturing and government incentives is further accelerating growth.

Latin America

Brazil and Argentina lead the Latin American market (8% share). Growing urbanization and rising awareness of preventive skincare are driving premium and anti-aging product adoption. Affluent consumers are increasingly exploring imported high-efficacy cosmeceuticals.

Middle East & Africa

UAE and Saudi Arabia are the largest markets (7% share), driven by premiumization and luxury consumer demand. Africa’s growing wellness and spa industry is gradually adopting therapeutic skincare products, creating niche opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmeceuticals Market

- L’Oréal

- Estée Lauder

- Shiseido

- Procter & Gamble

- Unilever

- Beiersdorf

- Johnson & Johnson

- Amorepacific

- Kao Corporation

- GlaxoSmithKline

- Avon Products

- Coty Inc.

- Revlon

- DSM Nutritional Products

- Naturex

Recent Developments

- In May 2025, L’Oréal launched a line of anti-aging serums with plant-derived peptides, targeting the growing APAC market.

- In March 2025, Estée Lauder expanded its e-commerce capabilities, introducing AI-driven skin diagnostics to boost personalized product sales globally.

- In February 2025, Shiseido invested in R&D for bioactive ingredient innovation, aiming to launch clinically proven multifunctional skincare products in North America and Europe.