Cosmeceuticals & Dermatologists Market Size

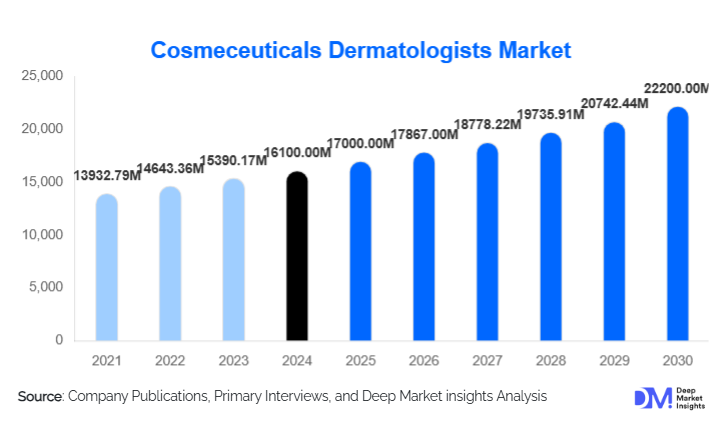

The global cosmeceuticals & dermatologists market was valued at approximately USD 16,100 million in 2024 and is projected to increase to around USD 17,000 million in 2025, before reaching USD 22,200 million by 2030, expanding at a CAGR of 5.1% over the forecast period (2025–2030). This market segment, focusing on dermatologist-endorsed, clinically active cosmetic skincare products, injectable adjuncts, and other advanced skin therapies distributed through professional dermatology channels, is witnessing strong growth driven by the increasing consumer preference for science-based, results-oriented skincare solutions.

Key Market Insights

- Skin care topicals remain the cornerstone of the market, forming the largest share thanks to broad application across anti-aging, pigmentation, acne, and barrier repair needs.

- Dermatology clinic / physician-dispensed channels dominate premium product adoption, due to consumer trust in professional endorsement and the ability to command higher margins.

- Anti-aging / wrinkle reduction is the highest revenue application, fueled by aging populations and consumers seeking visible, scientifically validated results.

- North America currently leads in share, supported by mature healthcare infrastructure, high per capita spend, and early adoption of medical skincare.

- Asia Pacific is emerging as the fastest-growing region, driven by rising incomes, digital penetration, and increasing access to dermatology care.

- Innovation and digital integration, such as AI skin diagnostics, advanced delivery systems, teledermatology, and hybrid product formatsare reshaping how the market competes and scales.

Latest Market Trends

Blending Cosmetic Appeal with Clinical Efficacy

One of the dominant trends is the merging of cosmetic sensorial attributes (e.g., texture, fragrance, aesthetics) with clinically effective actives (peptides, retinoids, growth factors, botanicals). Consumers increasingly demand that skincare not only “feel nice” but also deliver visible therapeutic benefits. This convergence drives R&D into smarter formulations, stable delivery systems, and ingredient transparency. Dermatologists, too, are more willing to prescribe or recommend certain cosmeceuticals when backed by clinical evidence, blurring lines between prescription and high-performance skincare.

Rise of Digital Dermatology & Personalization

Teledermatology platforms, AI-based skin analysis, and personalized regimen engines are accelerating the path from consumer interest to product adoption. Brands are embedding digital diagnostics (skin scanning, condition mapping), remote consultation, and subscription refill models into their offerings. This trend shortens the feedback loop between user results and product iteration, deepens engagement, and helps smaller brands scale quickly with lower overhead.

Market Drivers

Growing Awareness of Skin Health and Preventive Care

Consumers today are more educated about environmental stressors (UV, pollution, blue light) and are shifting from treating damage to preventing it. This has raised demand for cosmeceuticals that support barrier function, antioxidant defense, and long-term skin wellness. Dermatologists are increasingly prescribing skincare regimens as adjuncts to clinical care rather than purely reactionary treatments.

Aging Populations & Demand for Anti-Aging Solutions

As median ages rise globally, demand for products that reduce visible aging signs (wrinkles, laxity, pigmentation) is rising steeply. Middle-aged and older consumers often opt for dermatologist-endorsed or clinically validated products, driving higher value per unit. The preventive skincare habits of younger generations also expand future growth potential.

Ingredient Innovation & Delivery Technologies

Breakthroughs in nanocarriers, encapsulation, time-release systems, molecular stabilization (for peptides, growth factors, vitamins), and hybrid actives are enabling more efficacious, lower-irritation formulations. These advances also allow brands to differentiate and charge premium pricing. Companies investing in R&D often gain first-mover advantage in niche therapeutic skincare areas (e.g., pigmentation reversal, barrier repair, sensitive skin).

Market Restraints

Regulatory and Safety Barriers

Because cosmeceuticals straddle the boundary between cosmetics and pharmaceuticals, regulatory regimes differ greatly across countries. Proving safety and efficacy through clinical trials adds cost and time, especially in regions with stricter oversight. Inconsistent definitions of what constitutes a “therapeutic claim” complicate labeling, marketing, and cross-border trade.

Price Sensitivity & Access Constraints

Premium dermatologist-endorsed cosmeceuticals often carry price points beyond reach in many emerging markets. Moreover, in less urbanized or rural areas, access to dermatology clinics is limited, which impedes adoption. Consumers may choose mass OTC cosmetics over higher-cost clinically backed alternatives, particularly where results are gradual.

Market Opportunities

Penetration of Tier 2 / Tier 3 Cities in Emerging Markets

Many existing players have saturated metro / Tier 1 cities in markets like India, China, Brazil, and Southeast Asia. The next frontier lies in Tier 2 / Tier 3 cities, where rising incomes, aspirational consumers, and improving healthcare access open new demand for dermatologist-endorsed cosmeceuticals. Partnerships with local clinic chains, mobile dermatology drives, and digital marketing can catalyze growth.

Teledermatology & Digital Prescription Models

Telehealth expansion enables consumers to receive dermatology advice, prescriptions, and product recommendations remotely. Integrating cosmeceutical sales into these workflows (e.g., clinic-approved e-commerce links) reduces friction and increases conversion. Especially in underserved or remote areas, digital prescription models can dramatically extend reach without requiring physical infrastructure.

Premium Niche & Targeted Therapeutic Extensions

Opportunities exist to develop narrow-focus cosmeceuticals for conditions like post-laser recovery, pigmentation (melasma), post-procedural skin repair, scar strengtheners, and microbiome-centric skincare. Similarly, combining injectables or in-office treatments with complementary post-treatment skincare regimes presents a “bundle” opportunity. Brands that specialize in these niche therapeutic segments can carve premium and defensible positions.

Product Segment Insights

Within the product spectrum, skin care topicals dominate the market owing to their broad addressable needs (anti-aging, acne, barrier repair, pigmentation). Topicals enjoy a lower regulatory burden relative to injectables, easier consumer adoption, recurring usage, and scale via retail and clinician channels. In 2024, skin care likely accounted for 60–65% of total market revenue. The growth in advanced serums, multifunctional “all-in-one” formulations, and clinically backed texture evolution (lighter sensorial profiles) is reinforcing this dominance.

Application Insights

The anti-aging / wrinkle reduction segment is the largest revenue contributor among applications. As demographics skew older, demand for wrinkle-smoothing, elasticity-restoring, collagen-boosting, and pigmentation-control products remains strong. This segment may hold a 25–30% share of the total 2024 market value. Innovations in peptides, growth factors, and hyaluronic acid boosters push margins upward, while overlapping benefits (e.g., antioxidant + brightening) help crossover into adjacent applications.

Channel / Distribution Insights

The dermatology clinic / physician-dispensed / specialty store channel commands a premium position in the market. Because consumers perceive these channels as more trustworthy and clinically validated, many elect higher-priced products here even though e-commerce and mass retail are gaining ground. In 2024, this channel likely accounted for 40–45% of total revenues. That said, online / direct-to-consumer channels are the fastest expanding, due to lower overhead, broader reach, and ability to incorporate teledermatology or digital prescription links. In many markets, brands now balance clinic presence with subscription e-commerce funnels.

End-Use (Consumer & Clinical Insight)

Dermatology clinics and medical aesthetic centers remain the foundational end-use segment, serving consumers with moderate-to-severe skin concerns (acne, melasma, rosacea, post-procedure recovery, aging). These end-users prefer high-efficacy, clinically validated products, and generate higher margin volume. The beauty / aesthetic clinic segment is rising, especially in markets integrating injectables, laser treatments, and skincare packagesdemand for post-procedural cosmeceutical lines is increasing. Meanwhile, online / D2C consumers seeking premium skincare, preventive regimens, and teleconsultation access form a rapidly growing base. New end-use arenas include post-procedure skin recovery kits, male grooming/scalp health, and microbiome / personalized cosmeceuticals. Export demand is strong from mature markets supplying premium dermatology-grade lines to developing This supports the growth of clinically validated brands in export markets.

| By Product Type | By Active Ingredient | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America captures 30–35% of the 2024 market. The U.S. is the primary driver, with high per-capita spending, advanced dermatology infrastructure, and consumer willingness to pay a premium for clinically validated skin care. Canada contributes as well, though on a smaller scale. The presence of many leading global brands and a mature patent/regulatory environment further strengthens this region’s leadership. Growth tends toward 4–5% CAGR given maturity.

Europe

Europe holds a 25–30% share in 2024. Major countries include Germany, the UK, France, Italy, and Spain. Regulatory environments are more stringent in the EU, which raises barriers, but consumers in Europe value ingredient quality, transparency, and dermatological validation. Growth will be steady (4–6%) as brands expand “clean”, “dermatologist-approved,” and sustainable lines.

Asia Pacific (APAC)

APAC currently accounts for 20–25% of market revenue, but is the fastest-growing regionprojected CAGR in many sources of 7–9%. Key markets are China, South Korea, Japan, India, and Southeast Asia. China and South Korea lead in demand and innovation; India and Southeast Asia are notable for scale potential. Consumer beauty trends, digital access, rising incomes, and expanding dermatology networks support strong growth.

Latin America (LATAM)

LATAM holds a 5–8% share in 2024; Brazil, Argentina, and Mexico are key contributors. Middle-class growth, expanding dermatology services, and increasing aesthetic interest drive demand, though price sensitivity and economic instability temper faster expansion.

Middle East & Africa (MEA)

MEA holds a 3–6% share. Within this, GCC countries (UAE, Saudi Arabia) and South Africa are the largest markets. Luxury skincare and medical aesthetic demand in urban centers, combined with import-driven supply, underpin growth. However, regulatory, licensing, and distribution challenges persist. Intra-African cross-border demand is also emerging in certain corridors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmeceuticals & Dermatologists Market

- L’Oréal

- Johnson & Johnson

- Unilever

- Beiersdorf

- Shiseido

- Allergan (AbbVie)

- Galderma

- Estée Lauder

- Croda

- Kao Corporation

- Skinceuticals / La Roche-Posay (within parent grouping)

- Drunk Elephant (as an innovative niche brand)

- SkinMedica / NeoStrata (clinical skin care brands)

- Revision Skincare

- Uriage / Vichy (dermocosmetic lines)

Recent Developments

- 2025: A leading global beauty group launched AI-based skin diagnostic kiosks tied into dermatologist channels to cross-sell high-performance cosmeceuticals.

- Mid-2024: One major cosmeceutical company acquired a peptide specialty biotech firm to vertically integrate active development and reduce dependency on third-party suppliers.

- Early 2025: A niche clinical skincare brand entered a partnership with a teledermatology platform to bundle consultation + regimen subscription in Southeast Asia.