Corporate Entertainment Market Size

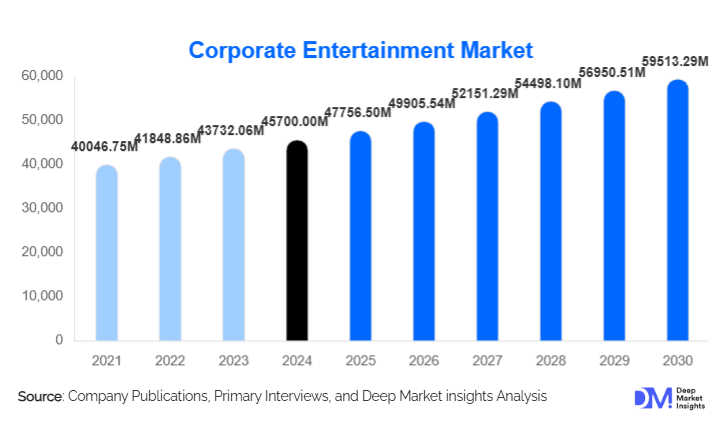

According to Deep Market Insights, the global corporate entertainment market size was valued at USD 45,700.00 million in 2024 and is projected to grow from USD 47,756.50 million in 2025 to reach USD 59,513.29 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The growth of the corporate entertainment market is primarily driven by rising corporate budgets for employee engagement, the increasing adoption of hybrid and digital event solutions, and the demand for experiential marketing that enhances brand visibility and employee productivity.

Key Market Insights

- Corporate entertainment is evolving toward hybrid and virtual event formats, combining live performances with digital engagement to reach global audiences effectively.

- Live entertainment services dominate, including concerts, motivational speakers, and team-building experiences that drive employee satisfaction and brand loyalty.

- North America leads the market, with the U.S. and Canada accounting for 38% of the global corporate entertainment spend due to higher per-capita corporate budgets.

- Asia-Pacific is the fastest-growing region, with China and India driving demand through emerging corporate offices and increasing adoption of premium event services.

- Europe maintains steady growth, led by the UK and Germany, with a strong focus on corporate conferences, seminars, and brand activations.

- Technological integration, including AR/VR, AI-driven engagement tools, and digital conferencing platforms, is reshaping the corporate entertainment experience globally.

What are the latest trends in the corporate entertainment market?

Hybrid and Virtual Event Solutions

Organizations are increasingly incorporating hybrid and fully virtual corporate events to complement live experiences. Virtual platforms, AR/VR technologies, and gamified digital interactions enable companies to host conferences, product launches, and team-building exercises across geographies. This approach enhances inclusivity, reduces logistical costs, and allows corporates to track engagement metrics more efficiently. As remote and hybrid work models persist, virtual corporate entertainment solutions continue to gain prominence, making digital events a core segment of the overall market.

Experiential and Team-Building Entertainment

There is a marked shift toward experiential corporate entertainment, including adventure activities, creative workshops, and interactive team-building programs. Companies prioritize experiences that boost employee collaboration, morale, and creativity. Immersive experiences, such as escape rooms, themed corporate retreats, and gamified engagement modules, are increasingly preferred. These programs are often linked to broader corporate objectives such as leadership development, cultural integration, and talent retention, driving steady demand in this segment.

What are the key drivers in the corporate entertainment market?

Increasing Corporate Budgets for Employee Engagement

Global corporates are allocating larger budgets to improve employee satisfaction, loyalty, and retention. Investment in high-quality entertainment, award ceremonies, and experiential events helps companies strengthen workplace culture and brand reputation. This trend is particularly strong in IT, financial services, and healthcare sectors, which account for over 50% of total spending on corporate entertainment globally.

Technological Advancements in Event Management

Integration of AI, AR, VR, and interactive virtual platforms is transforming corporate entertainment, enabling seamless hybrid events and data-driven engagement tracking. These technologies provide real-time feedback, gamification, and immersive experiences that appeal to digitally savvy employees and clients. Companies investing in these tools gain a competitive edge by delivering scalable, impactful events with measurable ROI.

Focus on Experiential Marketing

Corporate events are increasingly used as marketing tools to engage clients, launch products, and enhance brand visibility. Experiential marketing campaigns embedded in corporate entertainment, such as interactive product showcases, live performances, and themed corporate retreats, are boosting the adoption of premium event services. This integration helps organizations achieve both employee engagement and brand promotion objectives.

What are the restraints for the corporate entertainment market?

High Costs of Premium Services

Small and medium-sized enterprises often face challenges in adopting high-end entertainment services due to budget constraints. Premium live performances, virtual platform subscriptions, and full-scale event management solutions require significant investment, which limits broader adoption among mid-market companies.

Regulatory and Logistical Constraints

Restrictions on large gatherings, safety regulations, and regional event permits can slow the execution of live corporate events. Pandemic-related uncertainties and local compliance issues further complicate event planning, limiting market expansion in certain geographies.

What are the key opportunities in the corporate entertainment market?

Digital Transformation and Virtual Platforms

The growing adoption of hybrid and digital events creates opportunities for service providers to expand offerings through AR, VR, and interactive digital solutions. Companies can reach a global audience, optimize event budgets, and track engagement effectively, making this segment highly lucrative.

Expansion into Emerging Markets

Emerging economies in India, Southeast Asia, and Latin America present significant growth potential. Increasing corporate presence, rising disposable incomes, and adoption of global workplace practices drive demand for live, digital, and experiential corporate entertainment services.

ESG-Compliant and Sustainable Event Offerings

Companies are increasingly aligning corporate entertainment with ESG goals, promoting eco-friendly events, local cultural experiences, and socially responsible team-building programs. Providers that integrate sustainability practices into their offerings are likely to differentiate themselves and capture premium market share.

Product Type Insights

Live entertainment services lead globally, accounting for 35% of the 2024 market, due to high demand for concerts, speakers, and team-building performances. Digital/virtual event solutions are gaining momentum, driven by remote work and hybrid event adoption. Event management and catering services continue to grow steadily, providing integrated solutions for large-scale corporate functions. Experiential team-building services are expanding rapidly, particularly in IT and financial sectors, reflecting a trend toward engagement-driven corporate culture.

Application Insights

Corporate conferences and seminars remain the most significant application, contributing 28% of the total market. Product launches, award ceremonies, and corporate retreats are also key revenue drivers. Experiential marketing and client engagement programs are emerging applications, integrating entertainment with strategic corporate objectives. Hybrid and virtual applications are increasingly adopted to scale events and reach remote audiences efficiently.

Distribution Channel Insights

Direct event bookings and corporate partnerships dominate distribution, with online platforms enabling virtual and hybrid event management. Event management agencies specializing in premium services are highly active, particularly for the IT, healthcare, and financial sectors. Social media and influencer-led marketing are shaping corporate engagement strategies, driving awareness and adoption of immersive corporate entertainment offerings.

End-User Insights

IT and software companies account for 25% of the market due to extensive investment in employee engagement programs. Financial services, healthcare, and manufacturing sectors also demonstrate strong demand. Emerging industries, including renewable energy and startups, are adopting corporate entertainment solutions, reflecting growth opportunities for service providers. Export-driven demand is significant, with the U.S., Germany, and India being major exporters of event services and platforms.

| By Service Type | By Event Type | By End-User Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the corporate entertainment market with 38% of the global share. The U.S. dominates, driven by large corporate budgets, high per-capita spending, and well-developed infrastructure. Canada contributes 5%, focusing on conferences and award ceremonies. Demand is shaped by hybrid events, live entertainment, and experiential team-building activities.

Europe

Europe accounts for 28% of the global market, led by the UK (16%) and Germany (12%). Corporate conferences, seminars, and brand activation events drive demand, with sustainability and experiential engagement shaping regional preferences. Europe remains a key adopter of hybrid and digital event solutions.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of ~9%. China and India lead demand, fueled by increasing corporate infrastructure, rising event budgets, and the adoption of global workplace standards. Japan and Australia demonstrate steady demand, focusing on digital, experiential, and team-building events.

Middle East & Africa

UAE and Saudi Arabia account for 6% of global demand, with high-income populations driving premium corporate events. Africa, home to key destinations, focuses on large-scale conferences and luxury corporate retreats, with governments supporting tourism and event infrastructure development.

Latin America

Brazil leads at 4% of the market, with Argentina and Mexico contributing modestly. Demand is primarily for experiential and adventure-focused corporate events, with growth in outbound corporate travel driving service adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Corporate Entertainment Market

- Cvent

- Freeman

- Informa

- Live Nation Entertainment

- AEG Live

- MCI Group

- GES

- Oakwood Worldwide

- HelmsBriscoe

- WRG

- George P. Johnson

- DXB Entertainments

- Jack Morton Worldwide

- Eventbrite

- AlliedPRA

Recent Developments

- In May 2025, Freeman launched a global hybrid event platform integrating AR/VR capabilities to enhance corporate conference experiences.

- In April 2025, Cvent expanded its virtual event management services in APAC, targeting the IT and financial services sectors for large-scale corporate programs.

- In February 2025, Live Nation Entertainment introduced a series of exclusive corporate concerts and motivational speaker series across North America and Europe, catering to high-end corporate clients.