Corner Inserter Seamer Market Size

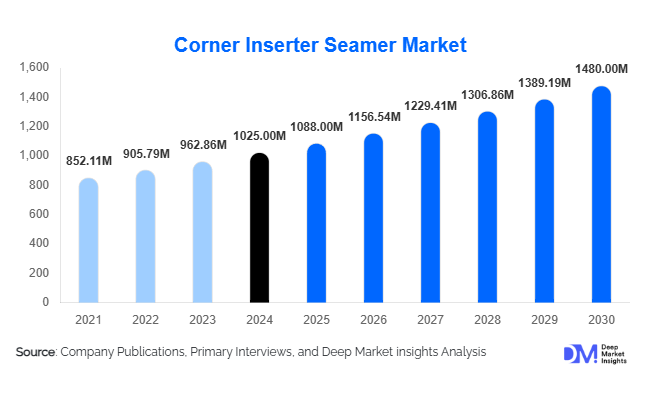

According to Deep Market Insights, the global corner inserter seamer market size was valued at USD 1,025 million in 2024 and is projected to grow from USD 1,088 million in 2025 to reach USD 1,480 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market growth is primarily driven by the increasing adoption of automated packaging solutions, rising demand for premium and specialty packaging, and technological innovations in high-speed and AI-integrated corner inserter seamers.

Key Market Insights

- Automation and AI are transforming packaging operations, enabling manufacturers to achieve higher efficiency, reduce labor dependency, and maintain consistent quality standards.

- Rigid and specialty packaging dominate demand, particularly in food & beverages, pharmaceuticals, cosmetics, and electronics, driving high-value seamer adoption.

- North America remains a leading market, with strong industrial production, high consumer packaging standards, and rapid adoption of automated machinery.

- Asia-Pacific is the fastest-growing region, fueled by rising industrialization, e-commerce expansion, and growing packaging requirements in emerging economies such as China and India.

- Technological integration, including machine vision, AI-based defect detection, and high-speed operations, is reshaping manufacturing capabilities.

- Sustainable packaging trends are creating demand for seamers compatible with recyclable and eco-friendly materials, providing growth opportunities for equipment manufacturers.

Latest Market Trends

Automation and Smart Manufacturing

Corner inserter seamers are increasingly integrated with automated production lines and AI-enabled quality control systems. High-speed seamers equipped with sensors and machine vision detect alignment issues in real time, reducing wastage and operational errors. Smart manufacturing adoption is particularly prevalent in pharmaceutical and electronics packaging, where precision and regulatory compliance are critical. Companies offering predictive maintenance and IoT-enabled performance analytics are gaining a competitive edge.

Sustainability-Driven Packaging Solutions

Manufacturers are focusing on eco-friendly packaging, driving demand for corner inserter seamers capable of handling recycled and biodegradable materials. Governments are encouraging sustainable production practices through subsidies and regulatory incentives, particularly in Europe and North America. Demand for sustainable packaging is increasing in the FMCG, cosmetics, and food industries, creating opportunities for manufacturers that can combine efficiency with environmental compliance. Machines optimized for minimal material waste and energy-efficient operations are highly preferred.

Corner Inserter Seamer Market Drivers

Increasing Demand for Automated Packaging

Automation reduces labor costs, improves production speed, and ensures consistency in packaging quality. Industries with high-volume packaging needs, such as pharmaceuticals, food & beverages, and electronics, are increasingly investing in fully and semi-automatic seamers. The growing trend of e-commerce and ready-to-eat packaged goods is further boosting the adoption of automated systems, as companies require faster and reliable packaging processes.

Expansion of End-Use Industries

Rapid growth in sectors such as food & beverages, cosmetics, and consumer electronics is increasing demand for corner inserter seamers. Rising consumer preference for premium, aesthetically appealing, and sturdy packaging drives the adoption of machines capable of high-quality seam formation. This trend is particularly strong in APAC and LATAM markets, where urbanization and disposable income growth are supporting packaged product consumption.

Technological Advancements in Seamers

Integration of high-speed operations, AI-based alignment control, and predictive maintenance features has enhanced the efficiency and reliability of corner inserter seamers. Companies investing in research and development to create adaptable machines capable of handling multiple packaging materials are gaining significant market share. Smart machinery also reduces downtime, improves sustainability, and meets stricter regulatory standards.

Market Restraints

High Initial Investment

The cost of automated corner inserter seamers, particularly high-speed and AI-enabled models, remains substantial. Small and medium enterprises often face challenges in adopting these machines due to high capital expenditure and long ROI periods. This limits market penetration in low-volume and cost-sensitive segments.

Raw Material and Maintenance Challenges

Fluctuating costs of packaging materials and the need for specialized maintenance expertise may restrict growth. Machines handling specialty and sustainable materials require regular calibration and skilled operators, which can increase operational complexity and limit adoption among smaller manufacturers.

Corner Inserter Seamer Market Opportunities

Expansion into Emerging Markets

Rising demand for packaged consumer goods in the Asia-Pacific and LATAM is creating substantial growth opportunities. Countries such as China, India, and Brazil are experiencing urbanization-driven increases in FMCG consumption, e-commerce expansion, and rising demand for quality packaging. Manufacturers entering these markets with cost-effective and semi-automatic seamers can capture significant market share.

Sustainability Integration

Growing environmental awareness is pushing manufacturers toward recyclable, biodegradable, and lightweight packaging. There is an opportunity for corner inserter seamer producers to develop machines optimized for eco-friendly materials, offering energy efficiency, reduced waste, and compliance with environmental regulations.

Technology-Driven Differentiation

AI-enabled seamers with machine vision, predictive maintenance, and multi-material handling capabilities provide manufacturers with a competitive advantage. New entrants or existing participants focusing on innovative technology integration can differentiate themselves, expand into high-value industries, and offer premium service solutions such as remote diagnostics and smart production monitoring.

Product Type Insights

Automatic corner inserter seamers dominate the market, accounting for approximately 48% of the global market share in 2024. Their popularity is driven by the need for high-speed, low-error, and fully automated packaging lines in food & beverages, pharmaceuticals, and electronics. Semi-automatic machines hold around 30% market share, appealing to SMEs seeking flexibility with moderate production volume. Manual seamers represent the remaining 22%, primarily used for low-volume, niche, or specialty applications, often in luxury packaging or industrial kits.

Application Insights

Rigid box packaging leads the market, representing 55% of demand in 2024, due to its use in high-value consumer products like cosmetics, electronics, and premium food items. Flexible packaging is growing rapidly, particularly in the pharmaceutical and snack industries, supported by rising e-commerce demand. Specialty packaging, including luxury and industrial kits, is expanding, fueled by the need for differentiated product presentation and precision assembly.

End-Use Industry Insights

The food & beverages sector remains the largest end-use segment, accounting for 38% of global demand in 2024. Pharmaceuticals & healthcare follow closely at 25%, driven by stringent quality and regulatory requirements. Cosmetics & personal care (18%) and electronics & consumer durables (12%) are rapidly growing segments due to premium packaging trends. Industrial and other applications account for the remaining 7%. Export-driven demand from developed countries for high-quality packaging is further supporting growth in the Asia-Pacific and Europe.

| By Product Type | By Application / Packaging Type | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market in 2024, led by the U.S. due to advanced industrial infrastructure, high packaging standards, and widespread adoption of automated machines. Canada contributes moderately, focusing on pharmaceuticals and food & beverage packaging. Growth is steady, supported by investments in smart manufacturing and sustainability initiatives.

Europe

Europe holds around 28% of the market, with Germany, France, and the UK leading adoption. Growth is driven by regulatory requirements for sustainable packaging and the need for precision in high-value industries such as pharmaceuticals and cosmetics. The region is increasingly integrating AI-enabled seamers and IoT-based maintenance systems. Europe is also witnessing moderate expansion in specialty and luxury packaging applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India, supported by rapid industrialization, e-commerce expansion, and increasing consumer demand for packaged goods. Japan and South Korea are mature markets with steady demand for high-precision and high-speed machines. Southeast Asian countries are emerging markets, increasingly adopting semi-automatic and mid-range seamers for SMEs. APAC is expected to grow at a CAGR higher than the global average during 2025–2030.

Latin America

Brazil and Argentina are leading markets in LATAM, with growing packaged food and cosmetics demand. Market growth is moderate but increasing due to rising disposable incomes and emerging e-commerce trends. Semi-automatic seamers are preferred due to cost considerations.

Middle East & Africa

The region contributes moderately, with South Africa and the UAE as leading markets. Demand is driven by industrial expansion, luxury product packaging, and investment in high-end manufacturing. Growth opportunities exist in pharmaceuticals and electronics packaging for export-oriented production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Corner Inserter Seamer

- Bobst Group

- MarquipWardUnited

- Langston Equipment

- Valco Melton

- Baumer hhs

- Illinois Tool Works (ITW)

- Klockner & Co

- Fosber

- Thiele Technologies

- Kolbus

- Halm Industries

- Komori Corporation

- Sun Automation Group

- Highcon

- Bischof + Klein

Recent Developments

- In March 2025, Bobst Group launched a next-generation AI-enabled automatic corner inserter seamer with integrated predictive maintenance, targeting high-speed pharmaceutical and electronics packaging.

- In January 2025, MarquipWardUnited expanded its semi-automatic seamer portfolio for SMEs in APAC, focusing on cost-efficient and modular designs.

- In November 2024, Langston Equipment introduced eco-friendly seamers compatible with recyclable and biodegradable boards, catering to sustainability-conscious FMCG and cosmetic companies.