Cordless Garden Equipment Market Size

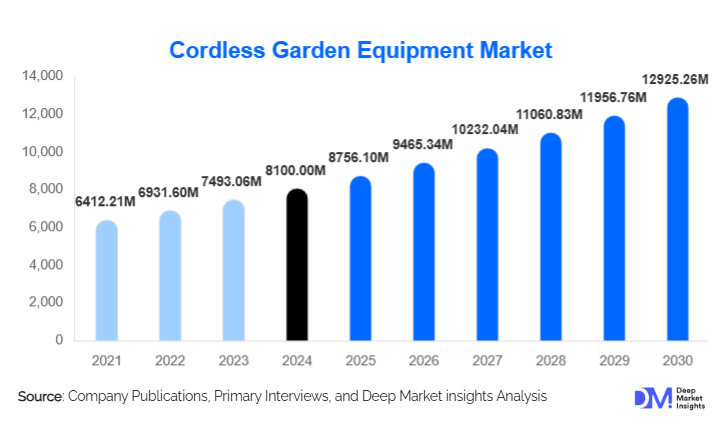

According to Deep Market Insights, the global cordless garden equipment market size was valued at USD 8,100 million in 2024 and is projected to grow from USD 8,756.1 million in 2025 to reach USD 12,925.26 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption of battery-powered gardening tools, technological advancements in lithium-ion batteries, increasing DIY landscaping trends, and growing regulatory pressure to reduce emissions and noise from petrol-powered equipment.

Key Market Insights

- Homeowners are increasingly adopting cordless garden tools due to convenience, lower noise, and maintenance-free operation compared to petrol or corded alternatives.

- Professional landscaping and municipal maintenance segments are shifting to high-voltage cordless platforms for improved runtime and efficiency, particularly in urban areas with stricter environmental regulations.

- North America dominates the market with strong homeowner penetration, regulatory support, and widespread adoption of cordless lawn and garden tools.

- Europe holds a significant market share, driven by consumer preference for sustainable tools, eco-lodges, and landscaping projects requiring quiet, low-emission equipment.

- Asia-Pacific is the fastest-growing region, led by China and India, where suburban expansion, rising disposable income, and government initiatives in green infrastructure are boosting demand.

- Technological integration, including modular battery platforms, smart IoT-enabled tools, and app-based monitoring, is reshaping product offerings and improving user engagement.

What are the latest trends in the cordless garden equipment market?

Battery-Driven Technological Advancements

Lithium-ion battery technology is at the forefront of cordless garden equipment evolution. High-energy-density batteries, longer runtimes, and fast-charging capabilities are enabling cordless tools to match or exceed the performance of traditional petrol-powered equivalents. Smart batteries with app monitoring, predictive maintenance, and multi-tool compatibility are becoming standard, enhancing usability for both residential and commercial users. Manufacturers are increasingly offering modular battery ecosystems, allowing one battery to power multiple tools, which reduces cost and improves user convenience.

Smart and Connected Garden Tools

Connectivity features, including Bluetooth-enabled lawn mowers, app-based runtime monitoring, and automated scheduling, are rapidly gaining traction. IoT-enabled cordless tools provide real-time diagnostics, usage tracking, and maintenance alerts, offering professional landscapers and homeowners better efficiency and precision. Integration with smart home systems is also emerging, allowing seamless control over multiple gardening devices. The trend toward connected and automated solutions caters to tech-savvy users and adds a layer of convenience previously unavailable in garden tools.

What are the key drivers in the cordless garden equipment market?

Advancements in Battery Technology

Improvements in lithium-ion batteries are a major driver, allowing cordless tools to deliver longer runtimes, higher torque, and reduced charging times. This has expanded the usability of battery-powered equipment to include more demanding applications such as ride-on lawn mowers and professional-grade hedge trimmers. Li-ion batteries now dominate the market, representing approximately 45–50% of the total 2024 market value, as manufacturers phase out older battery types like Ni-Cd and Ni-MH.

Growing DIY and Outdoor Living Trends

The surge in home gardening, suburban landscaping, and urban green spaces is fueling demand for cordless garden equipment. Consumers prefer lightweight, low-noise, and easy-to-use tools that enhance their DIY experience. Residential homeowners, representing 66–67% of the market in 2024, are the largest adopters of cordless tools, with an increasing shift towards premium battery platforms for efficiency and convenience.

Regulatory and Sustainability Initiatives

Government regulations in Europe, North America, and parts of Asia are restricting emissions and noise from petrol-powered equipment. Incentives for adopting eco-friendly, battery-powered tools are driving both consumer and professional adoption. Municipalities and landscaping services are switching to cordless fleets to meet sustainability targets, while rental and subscription models further increase penetration.

What are the restraints for the global market?

High Upfront Costs and Battery Replacement Concerns

Premium cordless garden tools typically have higher initial costs compared to petrol or corded options. Battery degradation and replacement costs add to ownership concerns, limiting adoption among price-sensitive customers and small-scale users.

Performance Limitations in Heavy-Duty Applications

While battery technology has improved, high-power applications for large estates or commercial landscapes may still favor petrol-powered tools due to longer continuous runtime and higher torque. This limits penetration in certain professional landscaping segments.

What are the key opportunities in the cordless garden equipment market?

Emerging Markets in Asia-Pacific and Latin America

Rapid urbanisation, rising disposable incomes, and expanding suburban housing in China, India, and Brazil are creating strong demand for cordless garden tools. Smaller garden spaces in urban areas and increasing interest in eco-friendly home landscaping offer a clear growth avenue for new entrants and established manufacturers.

Battery and Smart-Tool Platform Expansion

Manufacturers can tap into modular battery systems, high-voltage cordless platforms, and IoT-enabled tools to differentiate offerings. Fast-charging batteries, interoperable platforms, and smart maintenance features are key opportunities to capture both residential and professional users seeking efficiency, convenience, and sustainable solutions.

Regulatory and Sustainability Tailwinds

Government bans on petrol-powered tools and emission regulations in urban and residential areas create demand for cordless alternatives. Sustainability initiatives and eco-conscious consumer behaviour further reinforce opportunities for market expansion, including new business models such as equipment rental and service fleets.

Product Type Insights

Lawn mowers are the leading product segment, representing approximately 28% of the 2024 market (USD 2.2 billion). Their dominance is due to the universal demand for regular lawn maintenance in residential and commercial settings. Trimmers & edgers, hedge trimmers, and leaf blowers follow, with adoption driven by both DIY homeowners and professional landscapers. The trend towards compact, cordless, and modular tools has accelerated growth across all product types.

Application Insights

Residential landscaping remains the largest application, accounting for 66–67% of the market. Commercial landscaping, municipal maintenance, and institutional green spaces are growing segments, fueled by regulations, sustainability targets, and professional demand for high-voltage, durable cordless equipment. Emerging applications include robotic lawn mowers, subscription-based landscaping services, and greenhouse maintenance.

Distribution Channel Insights

Offline retail channels, including hardware stores, garden centers, and big-box retailers, dominate with a 58% share due to customer preference for tool inspection and demos. Online sales are rapidly growing, driven by e-commerce platforms, brand D2C websites, and digital marketing, particularly in mature markets such as North America and Europe.

End-User Insights

Homeowners dominate adoption (66–67% share) due to ease-of-use and convenience. Professional landscapers and municipalities represent high-value segments adopting high-voltage, professional-grade cordless tools. Emerging rental and subscription services are extending cordless tool adoption in commercial and institutional segments. Residential and commercial demand is also supported by export-driven manufacturing from China and India to North America and Europe.

| By Product Type | By Battery Technology | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market (33–35% share, USD 2.7 billion in 2024), driven by widespread adoption of residential cordless tools, regulatory support, and high DIY landscaping engagement. The U.S. and Canada lead demand, especially for lawn mowers, trimmers, and hedge trimmers.

Europe

Europe accounts for 30% of the market (USD 2.4 billion in 2024). Germany, the U.K., France, and Italy are key markets, with consumers preferring eco-friendly and low-noise tools. Emissions regulations further promote adoption, and growth is steady across both residential and professional segments.

Asia-Pacific

Asia-Pacific, including China and India, is the fastest-growing region, benefiting from suburban expansion, rising middle-class incomes, and government support for green infrastructure. CAGR in APAC is expected to exceed 10%, offering significant growth opportunities.

Latin America

Brazil, Mexico, and Argentina are key markets, representing 5–10% of global demand. Outbound and domestic adoption is growing among affluent consumers, with interest in mid-range and professional tools.

Middle East & Africa

MEA accounts for 5% of the market, with growth driven by urban landscaping initiatives in the UAE, Saudi Arabia, and South Africa. Adoption is currently limited but supported by luxury residential and commercial projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cordless Garden Equipment Market

- Husqvarna Group

- STIHL Group

- Makita Corporation

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- The Toro Company

- Greenworks Tools

- Honda Motor Co., Ltd.

- MTD Products Inc.

- EGO Power+ (Chervon Group)

- Koki Holdings Co., Ltd.

- Ryobi (Techtronic Industries)

- AL-KO GmbH

- John Deere (Deere & Company)

- WORX (Positec)

Recent Developments

- In 2025, Husqvarna launched a new high-voltage cordless mower series for professional landscapers, enhancing runtime and battery interoperability.

- In 2025, STIHL expanded its Li-ion battery platform across hedge trimmers, chainsaws, and trimmers, targeting both residential and commercial markets.

- In 2025, Makita introduced IoT-enabled lawn mowers with app-based monitoring and automated maintenance alerts, catering to tech-savvy homeowners and professional users.