Cordless Appliances Market Size

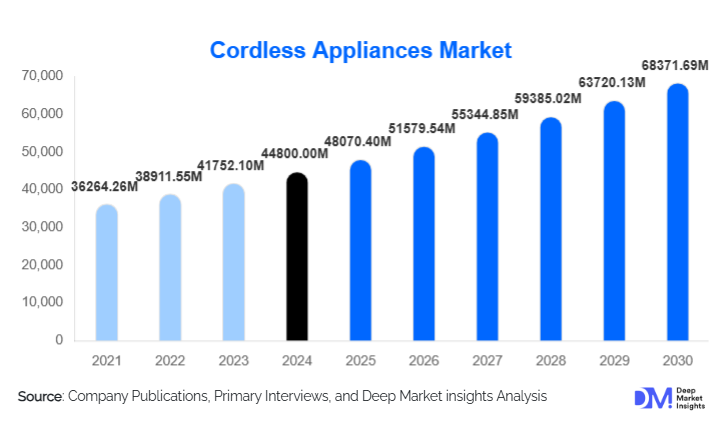

According to Deep Market Insights, the global cordless appliances market size was valued at USD 44,800.00 million in 2024 and is projected to grow from USD 48,070.40 million in 2025 to reach USD 68,371.69 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The cordless appliances market growth is primarily driven by rising consumer demand for portability and convenience, rapid advancements in lithium-ion battery technologies, and the widespread integration of smart-home and IoT functionalities across residential appliances.

Key Market Insights

- Cleaning appliances, especially cordless stick vacuums, dominate global demand, benefiting from strong adoption in both developed and emerging markets.

- Lithium-ion battery-powered devices account for nearly 80–90% of total cordless appliance sales, reflecting the shift toward high-performance, long-runtime products.

- Online distribution channels lead global sales, driven by e-commerce expansion, D2C brand strategies, and increasing consumer preference for online comparison shopping.

- North America is the largest regional market, supported by high disposable incomes and strong penetration of premium cordless appliances.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class populations in China and India and increasing smart home adoption.

- Sustainability-focused innovations, including recyclable battery systems and eco-friendly materials, are increasingly shaping product design and competitive strategies.

What are the latest trends in the cordless appliances market?

Smart-Home Integration and AI-Enabled Functionality

Manufacturers are rapidly integrating AI, sensors, and wireless connectivity into cordless appliances. Smart vacuums now include advanced mapping, dust-detection lasers, and adaptive suction technologies, while kitchen appliances offer app-based control, automated recipes, and voice assistant compatibility. These innovations cater to tech-savvy consumers seeking automation, convenience, and personalized features. IoT ecosystems are emerging as a key differentiator, with brands investing in platforms that allow seamless interaction between multiple cordless devices in a household.

Sustainable Product Design and Battery Circularity

Environmental considerations are becoming central to cordless appliance innovation. Brands are adopting recyclable plastics, modular components, and long-life battery packs to improve sustainability. Circular battery programs, battery return, refurbishment, and recycling, are gaining traction in response to growing regulatory pressure and consumer demand for eco-conscious devices. Manufacturers are also reducing energy consumption through efficient motors and power-management systems, reinforcing the market's shift toward responsible product lifecycles.

What are the key drivers in the cordless appliances market?

Growing Demand for Portability and Convenience

Modern households increasingly value appliances that eliminate the limitations of power cords. Cordless devices offer enhanced mobility, ease of storage, and ergonomic usability, especially important for urban consumers living in smaller spaces. Cleaning, kitchen, and personal-care products benefit significantly from this shift, with cordless vacuums, blenders, and grooming tools becoming mainstream preferences in both residential and commercial environments.

Advancements in Battery Technology

The transition from older battery chemistries to high-density lithium-ion cells has transformed appliance performance. Longer runtime, shorter charging cycles, and higher power output have enabled manufacturers to develop devices that match or exceed corded alternatives. R&D investments are focused on improving energy efficiency, reducing weight, and enabling swappable battery systems, factors that directly support user satisfaction and expand product applications across home, commercial, and industrial settings.

What are the restraints for the global market?

High Battery and Component Costs

Despite technological improvements, battery packs remain the most expensive component in cordless appliances. High-quality lithium-ion cells, safety circuits, and smart power-management systems increase manufacturing costs, making premium cordless appliances less accessible to budget-conscious consumers. Price sensitivity in emerging markets continues to limit adoption, posing a challenge for brands aiming for mass-market penetration.

Battery Degradation and Replacement Concerns

Rechargeable batteries naturally degrade over time, reducing runtime and performance. Consumers have expressed concerns over expensive battery replacements and the environmental impact of discarded cells. Limited battery lifespan also affects long-term product value, restricting repeat purchases among dissatisfied users. Addressing battery recycling, offering warranty programs, and implementing replaceable battery architecture remain key industry challenges.

What are the key opportunities in the cordless appliances industry?

AI-Enabled, Fully Connected Appliance Ecosystems

There is a major opportunity to create integrated smart-home ecosystems that unify multiple cordless appliances under a single app-based interface. Features such as predictive maintenance alerts, personalized usage recommendations, and cross-device communication can increase brand loyalty and unlock premium pricing. AI-driven appliances can also gather performance data to optimize energy usage and personalize household routines, expanding long-term value for users.

Expansion into Emerging Markets

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and Africa present a significant opportunity for affordable, battery-efficient cordless appliances. Many households in emerging markets value portability due to smaller living spaces and fluctuating power reliability. Brands can capture strong growth by offering region-specific models, localized manufacturing, and robust after-sales services, accelerating cordless adoption across price-sensitive markets.

Product Type Insights

Cordless cleaning appliances, particularly stick vacuums, continue to lead the market due to their ease of use, lightweight and compact design, and ability to replace traditional corded models without compromising performance. The increasing consumer preference for ergonomic and efficient cleaning solutions has made stick vacuums the go-to option in both urban and suburban households, with runtime and suction performance improvements further driving adoption. Kitchen appliances such as cordless blenders, mixers, and kettles are rapidly gaining traction as consumers prioritize flexible, clutter-free countertops, compact storage, and multi-functionality. Personal care appliances, including cordless hair dryers, grooming tools, and electric toothbrushes, are witnessing growth as lifestyles become more mobile, with consumers seeking portability and convenience for both home and travel use. Utility tools such as cordless power drills, screwdrivers, and garden equipment are also seeing increased adoption, driven by improved battery technologies that offer longer runtime and performance comparable to corded alternatives. This segment is particularly supported by the DIY and professional construction sectors, which value cordless tools for efficiency, mobility, and precision in on-site applications.

Application Insights

The residential segment accounts for the largest share of global demand, fueled by growing consumer preference for convenience-oriented appliances suited for daily household tasks. Cordless appliances provide flexibility and save time, making them ideal for urban homes, small apartments, and multi-floor houses. Commercial applications are expanding in hospitality, cleaning services, and facility management sectors, where cordless devices enhance operational efficiency, reduce setup times, and minimize hazards associated with power cords. Industrial users increasingly adopt cordless power tools for construction, maintenance, and repair operations, leveraging lightweight designs and longer runtime for mobile and high-precision tasks. Battery technology improvements, including lithium-ion efficiency and modular swappable packs, are expanding cordless use cases across residential, commercial, and industrial applications, enabling manufacturers to deliver devices with higher performance, reliability, and versatility.

Distribution Channel Insights

Online channels dominate the global cordless appliances market, driven by the rapid expansion of e-commerce, the convenience of direct-to-consumer (D2C) purchasing, competitive pricing, and easy access to a wide range of models. Brands are leveraging online platforms to launch exclusive products, extend warranties, provide subscription-based services, and offer customization options. Offline retail, including electronics stores, hypermarkets, and specialty appliance shops, remains critical for premium products, allowing customers to experience devices first-hand and compare performance, ergonomics, and battery life. The coexistence of online and offline channels supports broad market coverage, with online platforms rapidly gaining share due to consumer preference for convenience, especially in urban regions.

End-User Insights

The residential segment continues to drive global demand, fueled by the adoption of cordless cleaning and kitchen appliances for everyday household convenience. Commercial users, such as hotels, offices, and professional cleaning contractors, benefit from cordless devices that enable rapid cleaning cycles, easy transport between locations, and reduced dependency on power outlets. Industrial users increasingly rely on cordless tools for on-site construction, repairs, and maintenance tasks, as lightweight devices with longer runtimes improve operational efficiency. Professional-grade cordless tools have gained significant traction due to improvements in power, reliability, and ergonomics, offering performance comparable to corded alternatives while enhancing mobility and flexibility.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest regional market for cordless appliances, with the U.S. and Canada driving demand for premium devices. Key growth drivers include high disposable incomes, widespread adoption of smart-home technologies, and a preference for convenience-oriented cleaning and kitchen appliances. Urbanization and smaller home layouts further encourage consumers to choose lightweight, portable devices. The robust online retail ecosystem supports D2C and e-commerce sales, allowing brands to target consumers directly with innovative products, subscription services, and extended warranty offerings. In addition, rising awareness of energy-efficient and sustainable products is pushing manufacturers to develop eco-friendly appliances, reinforcing market expansion.

Europe

Europe shows strong demand for sustainability-focused cordless appliances, particularly in Germany, the U.K., France, and the Nordic countries. Stringent environmental regulations, consumer preference for energy-efficient motors, and recyclable battery systems drive innovation in eco-friendly product design. Established appliance brands, coupled with a high penetration of smart-home devices, encourage the adoption of smart cordless vacuums, kitchen appliances, and personal-care devices. Drivers of regional growth include growing disposable income, increasing urbanization, and the trend toward compact, multi-functional devices suitable for small apartments and energy-conscious consumers.

Asia-Pacific

Asia-Pacific is the fastest-growing region for cordless appliances, led by China, India, Japan, South Korea, and Southeast Asia. Rising disposable incomes, expanding middle-class populations, rapid urbanization, and the shift toward modern, space-efficient lifestyles are primary growth drivers. Consumers are adopting cordless devices for both residential convenience and commercial applications, including offices and hospitality services. Japan and South Korea are mature markets with high penetration of smart appliances, while Southeast Asia is emerging with strong demand for affordable, high-performance cleaning and kitchen devices. Increasing e-commerce penetration, government initiatives promoting manufacturing, and rising awareness of battery-efficient devices further accelerate growth.

Latin America

Latin America is witnessing gradual but steady growth, particularly in Brazil, Mexico, and Argentina. Rising urbanization and a growing middle class are increasing the adoption of cordless cleaning and kitchen appliances. Regional consumers show a strong interest in durable, long-runtime products due to intermittent power supply in some areas. Online retail expansion and improved distribution networks enhance accessibility to premium and mid-range products. Growth is supported by awareness campaigns highlighting convenience, energy efficiency, and portability, which appeal to both residential and small commercial users.

Middle East & Africa

MEA markets, including the UAE, Saudi Arabia, South Africa, and Kenya, are experiencing increasing demand for modern, portable home appliances. High-income households in the Gulf region drive the consumption of premium cordless devices, while African markets are adopting cost-efficient models designed for environments with fluctuating power supply. Drivers of growth include government-backed modernization initiatives, expanding retail infrastructure, and rising awareness of energy-efficient appliances. Urbanization, exposure to global lifestyle trends, and growing e-commerce adoption further support expansion in both residential and commercial sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cordless Appliances Market

- Dyson

- SharkNinja

- Bissell

- Electrolux

- Techtronic Industries (TTI)

- Samsung

- LG Electronics

- iRobot

- Hoover

- Miele

Recent Developments

- In February 2025, Dyson introduced its next-generation cordless stick vacuum featuring AI-powered dirt detection and extended battery life.

- In January 2025, Samsung launched a new cordless kitchen appliance line integrating SmartThings connectivity and modular battery systems.

- In late 2024, SharkNinja expanded its European portfolio with lightweight cordless vacuums designed for sustainability and easy-recycle components.