Cooling Fabrics Market Size

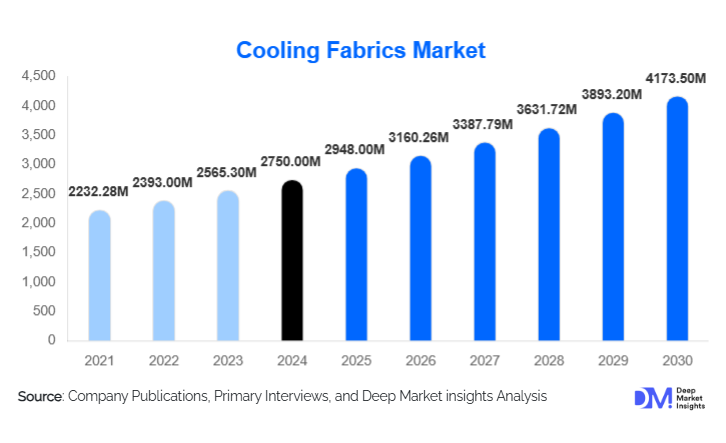

According to Deep Market Insights, the global cooling fabrics market size was valued at USD 2,750 million in 2024 and is projected to grow from USD 2,948 million in 2025 to reach USD 4,173.50 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). Growth in the cooling fabrics industry is primarily driven by rising demand for performance-enhancing apparel, increasing awareness of heat stress and comfort, rapid adoption of activewear, and technological advancements such as phase-change materials (PCMs) and moisture-wicking innovations across sports, lifestyle, and industrial applications.

Key Market Insights

- Synthetic cooling fabrics dominate the market, accounting for nearly 69% of global revenue due to their durability, cost-efficiency, and superior moisture-wicking capabilities.

- Moisture-wicking technology leads the cooling mechanisms segment, supported by high adoption in activewear and everyday apparel.

- Sports & athletic apparel is the largest application segment, representing over 42% of overall demand in 2024.

- North America remains the leading regional market, driven by strong consumer awareness and high penetration of performance apparel brands.

- Asia-Pacific is the fastest-growing region, supported by expanding middle-class demographics, hot climatic conditions, and rising fitness engagement.

- Technological integration, including PCMs, nanotechnology, and smart-textile sensors, is reshaping product innovation and elevating functionality in industrial and protective wear.

What are the latest trends in the cooling fabrics market?

Eco-Friendly and Sustainable Cooling Fabrics Gaining Momentum

The industry is witnessing a rapid shift toward sustainable and recycled cooling textiles driven by rising environmental consciousness among consumers and regulatory pressure for chemical safety in textile finishing. Manufacturers are increasingly adopting natural fibres such as organic cotton, bamboo, and linen augmented with cooling treatments. Recycled polyester blends and water-efficient finishing processes are also gaining prominence. Brands are leveraging sustainability certifications and eco-labels to differentiate their cooling apparel collections. As ESG commitments strengthen globally, sustainable cooling fabrics are evolving from a niche to a core industry requirement.

Smart and Advanced Cooling Technologies

Advanced cooling mechanisms, including phase-change materials (PCMs), nanofiber coatings, graphene-based thermal regulation, and moisture-activated cooling technologies, are transforming product performance. Smart cooling fabrics capable of responding to body temperature and external heat are increasingly used in premium sportswear and industrial protective garments. Integrated sensors for heat mapping and performance monitoring are emerging in professional athletics. These innovations enhance comfort, increase safety in high-heat environments, and offer competitive differentiation for manufacturers leveraging next-generation textile technology.

What are the key drivers in the cooling fabrics market?

Growth of Performance and Activewear Consumption

The global rise of fitness culture, outdoor recreation, and athleisure trends is significantly boosting demand for cooling fabrics. Consumers expect sports apparel to deliver sweat management, breathability, and thermal comfort across diverse activities. Major brands are increasingly integrating cooling technologies into training gear, yoga apparel, running outfits, and team sports uniforms. The fusion of fashion and function in athleisure further expands consumption across daily wear, making this a foundational driver of long-term market growth.

Increasing Heat Stress Awareness and Climate Conditions

Rising global temperatures, longer summers, and growing awareness around heat stress are pushing demand for cooling textiles in everyday wear, workwear, and outdoor apparel. Industrial sectors such as construction, manufacturing, mining, and oil & gas are adopting cooling protective wear to improve worker safety and productivity. Governments and organisations are also emphasising heat-stress prevention, accelerating adoption across occupational safety programs. This broadens the addressable market beyond sports into high-value professional and technical textile applications.

What are the restraints for the global market?

High Production Costs and Technology Expenses

Cooling fabrics often require specialised coatings, embedded PCMs, or high-performance synthetic blends, leading to increased production costs compared to standard textiles. These costs can limit adoption in price-sensitive markets and restrict penetration in the mass apparel segment. Fabric durability and performance testing add to cost barriers, reducing economies of scale for small manufacturers. As a result, premium pricing remains a market constraint for budget-conscious consumers and competing garment producers.

Limited Consumer Awareness and Performance Verification

In some regions, consumer understanding of cooling fabrics and their benefits remains low. Moreover, performance consistency after repeated washing and prolonged use can vary significantly across manufacturers, creating scepticism. Lack of standardised certifications for cooling performance also challenges market credibility, particularly in emerging economies. These factors slow adoption in mainstream apparel segments and hinder broader market expansion.

What are the key opportunities in the cooling fabrics industry?

High-Growth Potential in Industrial & Protective Wear

Industrial and occupational sectors offer substantial untapped potential for cooling fabrics. Workers in high-heat environments, such as construction sites, factories, mines, and emergency services, require apparel that mitigates heat stress. Cooling fabrics embedded in uniforms, gloves, liners, and protective suits can enhance safety, reduce fatigue, and support regulatory compliance. Companies developing certified high-performance cooling textiles tailored for industrial use can capture premium, less price-sensitive demand with strong growth outlooks.

Expansion of Cooling Technologies in Home Textiles

Cooling fabrics are increasingly integrated into bedding, mattresses, pillow covers, and upholstery to enhance sleep comfort and indoor thermal regulation. Rising demand for temperature-regulating home products, especially in hot climates and urban markets, creates strong opportunities for textile manufacturers. The convergence of lifestyle upgrades, increased home furnishing expenditure, and heightened sleep-quality awareness is expected to accelerate the next wave of cooling fabric adoption in the home textile sector.

Product Type Insights

Synthetic cooling fabrics dominate the market, capturing the largest share due to their superior flexibility, durability, and compatibility with advanced cooling finishes. Polyester and nylon blends are widely used in activewear and industrial garments thanks to their cost-effectiveness and scalability. Natural cooling fabrics, such as cotton, linen, and bamboo, are gaining traction in eco-conscious consumer segments, particularly in lifestyle apparel and home textiles. Blended cooling fabrics combining synthetic and natural fibers are emerging as a balanced solution offering sustainability, comfort, and performance, expected to expand steadily through 2030.

Application Insights

Sports and athletic apparel are the leading application segments, driven by high adoption of moisture-wicking and breathable fabrics in fitness, outdoor, and performance activities. Lifestyle apparel, including athleisure, is rapidly expanding as consumers demand everyday clothing with enhanced comfort. Protective wear is the fastest-growing application segment as industries increasingly adopt cooling garments for heat-stress mitigation. Home textiles such as cooling bedding and furnishings are emerging as a strong growth niche, supported by rising urban temperatures and health-oriented consumer preferences.

Distribution Channel Insights

Online retail channels dominate the cooling fabrics market, fueled by the rise of D2C apparel brands, e-commerce penetration, and easy access to product comparisons. Sports and performance apparel brands heavily leverage digital platforms for targeted marketing and product education. Specialty stores offering athletic gear and technical textiles contribute significantly to premium cooling apparel sales. B2B distribution channels, including fabric mills, garment manufacturers, and OEM suppliers, remain essential for industrial and protective wear applications, often involving long-term supply partnerships.

End-Use / Consumer Insights

Active lifestyle consumers represent the largest demographic for cooling apparel, driven by fitness participation and outdoor recreational activities. Industrial workers form a key high-value segment, particularly in sectors exposed to heat stress. Household consumers increasingly adopt cooling bedding and home textiles, especially in warm regions. Fashion-conscious consumers are embracing cooling fabrics in casual and athleisure wear, drawn by comfort and performance features.

| By Product Type | By Technology | By application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the leading regional market, driven by high adoption of high-performance textiles, strong presence of major sportswear brands, and advanced R&D ecosystems. The U.S. leads demand across sports apparel, lifestyle wear, and industrial protective applications. Consumer willingness to invest in premium performance apparel solidifies the region’s dominance.

Europe

Europe demonstrates strong growth, particularly in sustainable cooling fabrics, driven by stringent environmental regulations and high consumer preference for eco-friendly materials. Germany, the U.K., and France lead demand, supported by robust outdoor recreation culture and premium sports apparel markets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, expanding activewear markets in China and India, and the region’s hot climatic conditions that increase demand for cooling apparel. Rapid growth in apparel manufacturing hubs across Southeast Asia further accelerates the adoption of cooling textiles.

Latin America

Latin America is experiencing steady growth, driven by increasing interest in performance apparel and expanding athletic participation. Brazil and Mexico lead demand, with rising middle-class spending supporting broader adoption of cooling textiles.

Middle East & Africa

High temperatures and a growing fitness culture in GCC countries are driving demand for cooling fabrics in apparel and home textiles. In Africa, industrial applications and outdoor apparel are expanding, with demand concentrated in South Africa, Nigeria, and Kenya.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cooling Fabrics Market

- Coolcore LLC

- Nan Ya Plastics Corporation

- Ahlstrom-Munksjö

- Asahi Kasei Corporation

- NILIT Ltd

- Polartec

- Formosa Taffeta Co., Ltd.

- Tex-Ray Industrial Co., Ltd.

- HeiQ Materials AG

- Liebaert NV

Recent Developments

- In April 2025, Coolcore LLC unveiled a next-generation moisture-activated cooling fabric designed for high-performance athletic wear and scalable industrial applications.

- In March 2025, HeiQ Materials AG introduced a sustainable cooling technology using bio-based polymers that reduce chemical load while enhancing thermal regulation.

- In January 2025, NILIT Ltd expanded its speciality fibre production in Asia-Pacific to meet rising regional demand for cooling and eco-friendly nylon yarns used in sports and lifestyle apparel.