Contraceptive Sponge Market Size

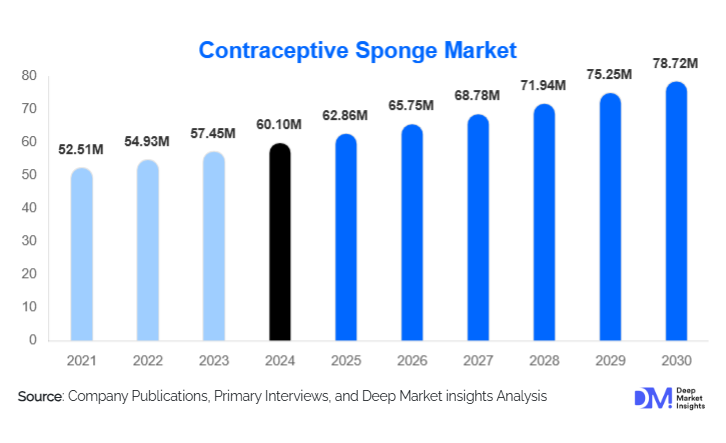

According to Deep Market Insights, the global contraceptive sponge market size was valued at USD 60.1 million in 2024 and is projected to grow from USD 62.86 million in 2025 to reach USD 78.72 million by 2030, expanding at a CAGR of 4.6 during the forecast period (2025–2030). Growth is primarily driven by rising demand for non-hormonal contraceptive options, increased OTC and online availability, growing sexual-health awareness, and public-health initiatives that support accessible, user-controlled contraceptive methods.

Key Market Insights

- Non-hormonal contraception is rapidly gaining mainstream adoption, with contraceptive sponges emerging as a preferred OTC barrier method among women seeking hormone-free alternatives.

- Online pharmacies and e-commerce platforms dominate sales growth, offering discreet purchasing options and expanding product availability across developed and emerging regions.

- North America leads the global market, driven by high awareness, strong OTC access, and favorable regulatory environments.

- Asia-Pacific remains the fastest-growing region, fueled by sexual-health education campaigns, rising disposable incomes, and increased penetration of digital health channels.

- Material and design innovation, including silicone-based sponges, ergonomic shapes, and eco-friendly options, is reshaping consumer preferences.

- Public health and family-planning programs are accelerating adoption in emerging markets through subsidies, community distribution, and awareness initiatives.

What are the latest trends in the contraceptive sponge market?

Shift Toward Non-Hormonal, User-Controlled Contraception

Consumers are increasingly preferring non-hormonal contraceptive methods due to concerns about hormonal side effects, long-term health implications, and prescription requirements. Contraceptive sponges, being hormone-free, discreet, and OTC, are benefiting from this trend. Women seeking autonomy in family planning are driving demand, particularly in markets that emphasize reproductive choice and personal control. Health organizations are also promoting non-hormonal alternatives, encouraging product adoption in clinics and community programs.

Technological and Material Innovation

Manufacturers are introducing advanced materials such as silicone-based and biocompatible polymers that improve comfort, reduce irritation, and enhance durability. Non-spermicidal sponges are also gaining visibility as consumers seek options free from chemical agents like nonoxynol-9. Digital health integration, such as mobile guidance tools, usage reminders, and online education, further enhances correct use and consumer confidence. Product packaging improvements, eco-friendly materials, and ergonomic designs are creating clear differentiation in a traditionally uniform product category.

What are the key drivers in the contraceptive sponge market?

Rising Demand for Hormone-Free Options

Growing concerns about hormonal contraceptives are pushing women toward alternatives that avoid side effects such as mood swings, weight gain, or medical contraindications. Contraceptive sponges provide a convenient barrier solution with minimal systemic impact. This shift is particularly strong among younger demographics, health-conscious consumers, and individuals seeking reversible, non-prescription methods. Increasing online discussions and healthcare guidance are reinforcing this preference.

Increasing Access Through OTC & Online Channels

The widespread availability of contraceptive sponges through pharmacies, e-commerce platforms, and telehealth-linked stores has significantly reduced barriers to purchase. Online channels offer privacy, an important factor in markets where cultural or social stigma restricts in-person contraceptive purchases. Subscription-based ordering, digital product education, and same-day delivery services are reshaping consumer engagement and boosting consistent demand.

What are the restraints for the global market?

Variable Effectiveness & User Dependency

The effectiveness of contraceptive sponges depends heavily on correct insertion, removal timing, and adherence to usage guidelines. High user dependency leads to potential misuse, resulting in higher failure rates compared with long-acting or hormonal contraceptives. Lack of STI protection further limits adoption among certain consumer groups. These factors create hesitancy among new users, restraining overall market expansion.

Limited Awareness in Emerging Regions

Although sponges are gaining traction, many developing countries experience low awareness of barrier contraceptive options beyond condoms. Cultural norms, stigma surrounding women’s reproductive autonomy, and inadequate sexual-health education reduce adoption. Infrastructural challenges and inconsistent product availability further limit market penetration. Addressing these barriers requires coordinated government and NGO interventions.

What are the key opportunities in the contraceptive sponge industry?

Expansion into Public Health & Family Planning Programs

Government-led family planning initiatives and NGO-supported sexual-health programs offer high-volume opportunities for sponge manufacturers. These programs prioritize low-cost, non-invasive, user-controlled contraceptive methods, making sponges ideal candidates for subsidized distribution. Partnerships with global health organizations can significantly scale product outreach in Africa, Asia, and Latin America, while also improving health outcomes and expanding brand presence.

Innovation with New Materials & Eco-Friendly Designs

There is growing consumer interest in contraceptive products made from sustainable, hypoallergenic, and reusable materials. Silicone-based, biodegradable, and premium comfort-focused sponges present opportunities for segment expansion. Eco-conscious product lines also appeal to developed markets where environmental responsibility influences purchasing decisions. Manufacturers investing in reusable designs or recyclable packaging can create distinct competitive advantages.

Product Type Insights

Sponges with spermicide dominate the market, accounting for over 70% of global revenue. Their dual mechanism, a physical barrier combined with spermicidal action, offers users added confidence in effectiveness. Non-spermicidal and hormone-based sponges, while still emerging, are gaining traction among consumers seeking chemical-free or enhanced-efficacy options. Polyurethane remains the most widely used material due to cost efficiency and regulatory familiarity, though silicone and eco-friendly materials are rising in premium segments.

Application Insights

Self-use contraception remains the largest application segment, as sponges are primarily purchased directly by consumers for personal use. Clinics, hospitals, and community health centers constitute a smaller but fast-growing segment, especially in regions where NGOs fund contraceptive distribution. Bulk procurement for family-planning programs is increasing, driving demand for affordable, standardized sponge variants. Export-driven applications are also expanding as emerging markets rely on imported sponges to meet rising demand.

Distribution Channel Insights

Online pharmacies and e-commerce retailers lead distribution, offering discreet purchasing and broad product access. Retail pharmacies continue to play a significant role, particularly in North America and Europe, where OTC contraceptive availability is well-established. Specialty sexual-health stores contribute to premium product sales, while public-health channels distribute low-cost sponges in underserved regions. Subscription-based delivery models are emerging as a high-potential channel for consistent contraceptive use.

End-User Insights

Women aged 18–40 constitute the primary user base, driven by preferences for reversible, non-hormonal contraception. Younger demographics increasingly adopt sponges due to ease of access and privacy, especially through digital platforms. Healthcare providers and NGOs form institutional end-users, purchasing in bulk for community distribution. Premium sponge variants appeal to health-conscious, urban consumers seeking natural or eco-friendly contraceptive alternatives.

| By Product Type | By Material Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates global demand, with the U.S. contributing the majority share. High awareness of non-hormonal methods, strong OTC access, and widespread e-commerce infrastructure drive market leadership. Reproductive-health education and consumer preference for hormone-free contraception further reinforce the region's position.

Europe

Europe represents a mature but steadily expanding market. Countries such as Germany, the U.K., and France show strong adoption due to progressive health policies, robust pharmacy networks, and consumer preference for safe, reversible contraceptives. Growth is supported by increasing demand for eco-friendly and silicone-based sponge options.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, expanding digital-health ecosystems, and government initiatives promoting reproductive health. Markets like China, India, and Southeast Asia are experiencing rapid adoption as online access improves and sexual-health education becomes more widespread.

Latin America

Latin America is witnessing gradual but steady demand growth. Brazil, Mexico, and Argentina show rising interest in non-hormonal contraception, supported by sexual-health campaigns and improved pharmacy distribution. Cultural openness to OTC barrier methods is increasing, particularly among younger women.

Middle East & Africa

ME&A regions show significant long-term potential driven by NGO-supported family planning programs and increasing retail access. Africa, in particular, benefits from public-health initiatives that promote barrier methods in underserved communities. The Middle East demonstrates moderate growth, driven by rising digital access and private-sector health investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Contraceptive Sponge Market

- Bayer AG

- Tree of Life Pharma

- Mayer Laboratories

- Pharmatex

- CooperSurgical

- Innotech International

- Protectaid

- Pirri Pharma

Recent Developments

- In March 2025, Mayer Laboratories announced a new silicone-based contraceptive sponge designed to enhance comfort and reduce irritation for sensitive users.

- In January 2025, CooperSurgical expanded its OTC contraceptive portfolio by launching a non-spermicidal sponge variant targeting consumers seeking chemical-free alternatives.

- In November 2024, Pharmatex entered new distribution partnerships across Latin America to support public health contraceptive programs in underserved regions.