Consumer Drone Market Size

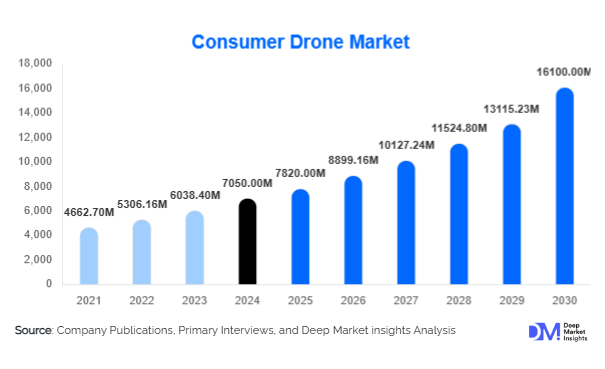

According to Deep Market Insights, the global consumer drone market size was valued at USD 7,050 million in 2024 and is projected to grow from USD 7,820 million in 2025 to reach USD 16,100 million by 2030, expanding at a CAGR of 13.8% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of drones for aerial photography and videography, increasing demand from hobbyists and professionals, and technological advancements such as AI-powered autonomous flight and advanced imaging systems.

Key Market Insights

- Aerial photography and videography applications dominate the market, supported by the booming content creator economy and professional media adoption.

- Multi-rotor drones account for the majority of sales, owing to their affordability, ease of use, and compact designs.

- North America holds the largest market share, with strong consumer spending and favorable regulatory frameworks.

- Asia-Pacific is the fastest-growing region, fueled by large-scale manufacturing in China and rising consumer adoption in India and Southeast Asia.

- Technological integration, such as AI-driven obstacle avoidance, foldable designs, and 4K/8K cameras, is transforming consumer experiences.

- The rising popularity of drone racing and recreational sports is emerging as a new high-growth niche in the market.

What are the latest trends in the consumer drone market?

AI-Powered Autonomous Flight

AI-driven navigation is revolutionizing the consumer drone market. Features such as subject tracking, obstacle detection, and automated flight paths are making drones accessible even for novice users. Autonomous capabilities also improve safety, reduce the risk of crashes, and enable advanced use cases such as cinematic video capture without manual piloting skills. This trend is pushing manufacturers to differentiate by integrating AI-powered chips and cloud-based flight data analytics into consumer-grade drones.

Drone Racing and Recreational Growth

The emergence of FPV (First Person View) drone racing leagues and recreational drone sports is creating a vibrant sub-sector. With younger demographics adopting drones for competitive and social activities, manufacturers are designing high-speed, modular, and customizable drones. Live-streaming integration and esports-style broadcasting are further enhancing global visibility of this trend, making it one of the fastest-growing applications within the consumer drone market.

Integration with Social Media Platforms

Consumer drones are increasingly being marketed as tools for content creators on platforms such as YouTube, Instagram, and TikTok. High-resolution imaging, portability, and real-time sharing features are critical differentiators. Some manufacturers are even embedding direct social media integration, enabling instant uploads and live broadcasts. This synergy between drones and social platforms is amplifying demand across millennials and Gen Z users worldwide.

What are the key drivers in the consumer drone market?

Growing Demand for Aerial Content

The rise of the digital economy has fueled demand for high-quality aerial photography and videography. Content creators, vloggers, journalists, and even amateur hobbyists are increasingly adopting drones to differentiate their content. With platforms prioritizing video-based engagement, drones have become essential creative tools, boosting adoption across both premium and mid-range product categories.

Falling Hardware Costs and Wide Accessibility

Mass production in China and competitive global supply chains have significantly reduced consumer drone costs. Entry-level drones are now available under USD 500, expanding adoption among casual users. As hardware affordability increases, drones are shifting from niche luxury gadgets to mass-market consumer electronics, particularly in developing economies.

Regulatory Clarity and Supportive Policies

Governments are formalizing drone usage guidelines for recreational purposes, creating a stable regulatory environment. For example, the U.S. Federal Aviation Administration (FAA) has streamlined registration processes, while India has introduced “Drone Shakti” initiatives to promote local drone ecosystems. Clearer rules are instilling consumer confidence, supporting wider adoption of drones across demographics.

What are the restraints for the global market?

Regulatory and Privacy Concerns

Despite progress, strict regulations in some countries limit drone usage in urban or sensitive areas. Privacy concerns related to aerial surveillance also restrict broader acceptance. Inconsistent global regulatory frameworks continue to pose challenges for international players, hindering seamless adoption worldwide.

Limited Battery Life and Technical Constraints

Most consumer drones offer a limited flight time of 20–30 minutes per charge, constraining user experience. Dependence on weather conditions, susceptibility to wind, and lack of robust battery technology continue to limit the performance of drones, particularly in professional-grade applications.

What are the key opportunities in the consumer drone industry?

Expansion into Emerging Economies

Countries such as India, Brazil, and Indonesia represent untapped opportunities. Rising disposable incomes, supportive government initiatives, and growing access to e-commerce platforms are creating fertile grounds for mass-market adoption. Localized product launches with regional language support and affordable pricing could unlock exponential growth in these markets.

Next-Generation Drone Racing Ecosystem

Drone racing is set to evolve into a mainstream recreational sport with global appeal. Investments in racing leagues, FPV drone technology, and esports broadcasting will enable manufacturers to capture a fast-growing niche. Early movers in this ecosystem can benefit from hardware sales, sponsorships, and recurring revenues from racing kits and accessories.

AI and Immersive Technologies

Integration of AI with immersive tech such as augmented reality (AR) and virtual reality (VR) presents new growth opportunities. AR/VR-enabled drone flying can gamify consumer experiences, while AI enhances real-time analytics and autonomous navigation. These innovations are expected to appeal strongly to younger, tech-savvy demographics.

Product Type Insights

Multi-rotor drones dominate the consumer market, accounting for nearly 68% of global sales in 2024. Their affordability, ease of control, and suitability for photography and hobby flying make them the preferred choice. Fixed-wing and hybrid drones, while more niche, are popular among enthusiasts seeking longer flight ranges. Single-rotor drones occupy a small share due to higher cost and complex handling but remain relevant for specialized applications like racing.

Application Insights

Aerial photography and videography hold the largest application share at 55% in 2024, driven by the rise of content creation. Recreational use, including casual flying and FPV racing, contributes nearly 30% of the market, while education and research applications account for the remaining 15%. The surge in user-generated content and influencer-driven marketing is expected to keep photography as the leading application globally.

Price Range Insights

Mid-range drones (USD 500–1500) lead the market, accounting for 47% share in 2024. This segment balances affordability with advanced features such as 4K video, foldable designs, and obstacle avoidance. Premium drones, representing 28% share, are favored by professionals and enthusiasts. Low-cost drones below USD 500 account for 25% but are growing quickly in emerging markets due to rising affordability and accessibility.

Distribution Channel Insights

Online retail dominates the consumer drone market, contributing over 65% of global sales in 2024. E-commerce platforms like Amazon, Alibaba, and OEM-owned stores drive accessibility and competitive pricing. Offline channels, including electronics stores and hobby shops, maintain relevance for consumers seeking hands-on demonstrations and after-sales support.

End-User Insights

Amateur hobbyists remain the largest end-user group, accounting for 60% of sales in 2024. Professional users, such as vloggers, filmmakers, and journalists, contribute 30% of demand, primarily in the premium drone segment. Institutions, including schools and research organizations, represent a smaller but steadily growing base, supported by the rise of drone-based STEM education programs.

| By Product Type | By Technology | By Application | By Price Range | By Distribution Channel | By End-User Demographics |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America leads the global consumer drone market with a 34% share in 2024. High disposable income, strong content creator ecosystems, and favorable FAA regulations are driving adoption. The U.S. dominates regional demand, particularly in the premium drone segment used by professionals.

Europe

Europe accounts for 27% of the global market, led by demand in Germany, the U.K., and France. The region is witnessing strong adoption of drones for aerial photography, particularly among travel and lifestyle content creators. Regulatory clarity from the European Union Aviation Safety Agency (EASA) is also fostering growth.

Asia-Pacific

Asia-Pacific is the fastest-growing market, expanding at over 16% CAGR during 2025–2030. China leads in both manufacturing and consumer demand, while India is emerging rapidly with government-backed drone initiatives. Japan and South Korea are mature markets driven by tech-savvy consumers and recreational use.

Latin America

Latin America, led by Brazil and Mexico, is showing steady adoption of consumer drones. Social media trends and affordability improvements are key drivers. While the region represents just 8% of the global market in 2024, growth potential is strong with rising interest in mid-range drones.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is witnessing growing consumer adoption of drones for leisure and professional videography. Africa remains nascent but is showing potential, especially in South Africa, where drones are popular for tourism-related videography.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Consumer Drone Market

- DJI

- Parrot SA

- Autel Robotics

- Skydio

- Yuneec International

- Hubsan

- Holy Stone

- Ryze Tech (Tello)

- BetaFPV

- Walkera

- PowerVision

- EXO Drones

- Fimi Technology

- Snaptain

- Potensic

Recent Developments

- In July 2025, DJI launched its new flagship consumer drone with AI-assisted tracking and 8K video capability, expanding its dominance in the premium category.

- In May 2025, Skydio announced expansion into the European consumer market, leveraging its autonomous navigation technology for competitive differentiation.

- In March 2025, Autel Robotics unveiled a foldable drone series targeting mid-range consumers, designed with improved portability and extended battery life.