Compostable Paper Trays Market Size

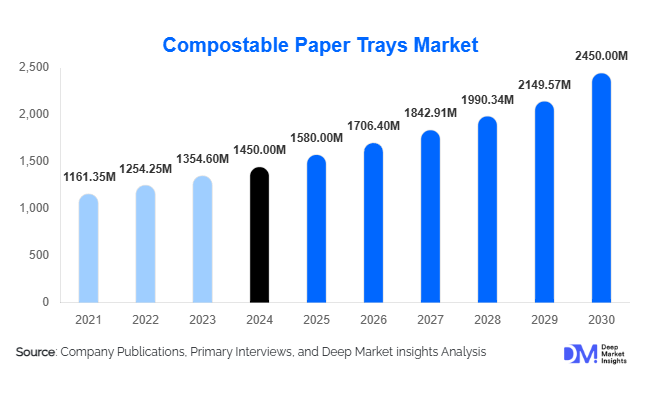

According to Deep Market Insights, the global compostable paper trays market size was valued at USD 1,450 million in 2024 and is projected to reach USD 1,580 million in 2025, before expanding to USD 2,450 million by 2030, at a CAGR of 8.0% during the forecast period (2025–2030). Market growth is driven by regulatory pressure to replace single-use plastics, increasing consumer demand for sustainable packaging, and expanding food delivery and takeaway services worldwide.

Key Market Insights

- Bagasse-based trays lead the material segment, accounting for about 30% of global demand in 2024, thanks to abundant sugarcane residue availability and favorable economics.

- Food-service applications dominate end use, contributing roughly 40% of global market revenue, supported by quick-service restaurant sustainability mandates.

- Asia-Pacific represents the largest and fastest-growing region, with an estimated 30% share in 2024 and a double-digit CAGR driven by rapid food-delivery growth.

- Industrial compostable certified trays are becoming the benchmark, spurred by EPR and compostability legislation in Europe and North America.

- Technological upgrades, such as advanced molding, barrier coatings, and automated inspection, are improving product performance and lowering cost per unit.

- Private-label production for global food brands is increasing, as QSRs and meal-kit firms integrate compostable packaging directly into their procurement networks.

Latest Market Trends

Regulation-Driven Adoption of Compostable Alternatives

Government bans on single-use plastics and the rise of Extended Producer Responsibility (EPR) policies across the EU, Canada, India, and parts of the U.S. are pushing brand owners toward compostable tray solutions. Certification labels such as EN 13432 and ASTM D6400 have become critical purchasing criteria, prompting suppliers to upgrade materials to ensure compliance. This has accelerated the shift from plastic or wax-coated trays to fully compostable paper-based designs.

Innovation in Fiber Materials and Barrier Technologies

Manufacturers are developing new tray compositions using bamboo, wheat straw, and agricultural residues to complement bagasse and recycled fiber. Emerging bio-based coatings are replacing PE-laminated layers, enhancing oil, grease, and moisture resistance while maintaining compostability. These innovations allow compostable trays to serve hot, moist, or greasy foods, broadening applicability across food delivery, retail, and catering segments.

Compostable Paper Trays Market Drivers

Sustainability and Consumer Awareness

Rising consumer concern over plastic waste is reshaping packaging procurement. Retailers and restaurants now prioritize biodegradable solutions aligned with corporate sustainability goals. Compostable trays satisfy this demand while communicating an eco-friendly brand image, enhancing customer loyalty.

Growth in Food Delivery and Ready-to-Eat Retail

Global expansion of food delivery apps, cloud kitchens, and meal-kit subscriptions fuels demand for durable yet compostable trays. These outlets require heat-resistant, stackable, and customizable formats, which compostable paper trays increasingly provide. The segment’s growth of over 9% annually directly feeds tray consumption.

Regulatory Tailwinds and Corporate Commitments

Many countries have introduced deadlines for eliminating single-use plastics and enforcing compostable packaging. Major food chains McDonald’s, Starbucks, and Yum! Brands have adopted compostable trays within sustainability roadmaps. This institutional backing provides long-term demand stability and volume scaling opportunities.

Market Restraints

High Production Costs

Compostable trays cost 10–30% more than plastic alternatives due to raw-material costs, certification expenses, and limited economies of scale. Until production volumes rise further, small manufacturers face margin pressure that may hinder market entry.

Limited Composting Infrastructure

While trays are designed for compostability, many regions still lack adequate industrial or municipal composting facilities. This restricts proper end-of-life processing, reducing consumer confidence and limiting sustainability benefits in regions without compost collection systems.

Compostable Paper Trays Market Opportunities

Expansion into Emerging Regions

Asia-Pacific, Latin America, and parts of the Middle East & Africa are poised for rapid adoption as governments enforce sustainable packaging norms. Local manufacturing of bagasse and bamboo trays enables low-cost scaling, presenting a strong opportunity for investors and new entrants.

Strategic Partnerships with Foodservice Giants

Collaborations with multinational QSR and retail chains provide stable long-term supply agreements. Companies offering certified, regionally compliant trays gain access to high-volume contracts, improving production utilization and profit margins.

Material Innovation and Composting Technology Integration

R&D into next-generation bio-resins, natural coatings, and home-compostable formulations opens differentiation opportunities. Digital traceability, such as QR codes verifying compost origin and recyclability, further enhances brand value for eco-conscious consumers.

Product Type Insights

Bagasse-based trays dominate material usage with roughly 30% market share in 2024 due to abundant feedstock, low energy intensity, and biodegradability. Bamboo and recycled fiber trays follow, with growing preference in Asia and Europe, respectively. Innovations enabling dual-compartment or heat-resistant trays expand applications across retail and catering. Rectangular formats lead globally (45% share) because of compatibility with automated filling and stacking equipment.

End-Use Insights

Food service applications hold around 40% of global market revenue in 2024, led by restaurants and cafés transitioning from plastic clamshells to fiber trays. Food delivery and meal-kit packaging segments are growing fastest, with 10%+ annual growth projected through 2030. Non-food uses in cosmetics, medical disposables, and electronics packaging are nascent but expanding as industries pursue sustainable alternatives to thermoformed plastics.

Distribution Channel Insights

Direct supply contracts with large food-service brands account for approximately 35% of the 2024 market value, reflecting vertically integrated procurement by global QSRs. Traditional converters and packaging distributors continue to serve smaller customers, while online channels and e-commerce B2B platforms are gaining ground for SME buyers seeking certified compostable trays in bulk.

| By Material Type | By Product Type | By End-Use Industry | By Compostability Certification | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

Accounting for about 25% of global revenue in 2024, the U.S. and Canada remain leading adopters due to early bans on polystyrene trays and strong sustainability commitments by major food chains. Growth is steady at 6% CAGR, supported by robust composting infrastructure and widespread consumer awareness.

Europe

Europe holds around 20% market share, driven by EPR legislation and advanced waste-segregation networks. Germany, the U.K., and France lead demand, while Southern and Eastern European nations are catching up through EU green-deal funding. Demand centers on industrially compostable, certified trays meeting EN 13432 standards.

Asia-Pacific

The region captures roughly a 30% share and represents the fastest-growing market segment, with an expected CAGR of 10–12%. China’s large pulp capacity, India’s strong food-delivery boom, and Southeast Asia’s sugarcane production base collectively underpin regional leadership. Cost advantages and export capability to Western markets make Asia-Pacific the global growth engine.

Latin America

Holding about a 10% share, Latin America benefits from sugarcane-based feedstock and government incentives for sustainable packaging. Brazil and Mexico lead production and domestic adoption. Regional growth of 8–9% CAGR is projected through 2030.

Middle East & Africa

Combined, these markets account for a roughly 15% share, with GCC countries and South Africa spearheading initiatives to reduce plastic waste. Rising hospitality and catering activities, coupled with government sustainability agendas, drive steady demand expansion from a small base.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

- Pactiv Evergreen

- Huhtamaki

- WestRock

- Stora Enso

- DS Smith

- Cascades

- International Paper

- BioPak

- EcoProducts

- Genpak

- Greenware

- Packnwood

- Green Paper Products

- Sappi Lanaken

- Platinum Package Solutions