Compostable Cold Beverage Cup Market Size

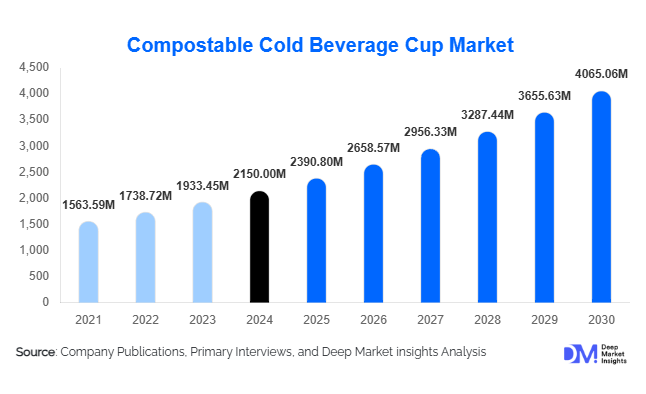

According to Deep Market Insights, the global compostable cold beverage cup market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,390.80 million in 2025 to reach USD 4,065.06 million by 2030, expanding at a CAGR of 11.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing environmental awareness, stringent government regulations on single-use plastics, and rising global demand for cold beverages, particularly in cafes, quick-service restaurants, and retail chains.

Key Market Insights

- Material innovation is shaping market growth, with PLA, bagasse, and bio-coated paperboard cups gaining traction due to their biodegradability and consumer preference for sustainable packaging.

- Medium-sized cups (12–16 oz) dominate the market, aligning with standard cold beverage servings across QSRs, cafes, and convenience stores globally.

- North America leads market adoption, with strict plastic bans and high consumer awareness driving demand, particularly in the US and Canada.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable income, and increasing café culture in China, India, and Japan.

- Food and beverage chains are the largest end-use segment, accounting for nearly 45% of market share in 2024, supported by sustainability-focused procurement.

- Technological integration in cup manufacturing, including advanced PLA and bagasse blends, is improving durability and compostability, helping expand market adoption.

Latest Market Trends

Shift Towards Sustainable Materials

Manufacturers are increasingly adopting biodegradable materials like PLA, bagasse, and PHA to reduce reliance on single-use plastics. Innovations in coating technologies for paperboard cups are improving liquid resistance while maintaining compostability. Retailers and QSRs are actively promoting these eco-friendly options to meet regulatory mandates and growing consumer demand for environmentally responsible packaging.

Rising Adoption in HoReCa and Event-Based Segments

The HoReCa segment remains a key driver for compostable cold beverage cups. Restaurants, cafes, and catering services procure in bulk to comply with regulations and enhance their sustainability credentials. Outdoor events, festivals, and sports venues are also increasingly using compostable cups, creating high-volume, short-duration demand spikes.

Compostable Cold Beverage Cup Market Drivers

Environmental Awareness and Sustainability

Consumers worldwide are seeking alternatives to conventional plastic cups due to environmental concerns. Compostable cups offer a tangible solution for reducing landfill waste and plastic pollution. The growing trend of eco-conscious consumer behavior is pushing both small businesses and global chains to adopt compostable options.

Government Regulations and Policy Support

Regulatory measures, such as bans on single-use plastics in Europe, North America, and parts of APAC, are driving demand. Compliance with environmental standards has become a necessity for restaurants, cafes, and packaged beverage manufacturers, boosting the adoption of compostable cold beverage cups.

Increasing Cold Beverage Consumption

The rapid growth of iced coffees, smoothies, bubble teas, and ready-to-drink beverages is creating strong volume demand. This trend is particularly evident in urban areas and regions with high café culture adoption, supporting market expansion across all cup sizes and material types.

Market Restraints

Higher Cost Compared to Conventional Cups

Compostable cups are generally more expensive than traditional plastic or paper cups, which can limit adoption among small-scale vendors and cost-sensitive consumers. The higher production costs, combined with raw material price fluctuations, create affordability challenges for certain market segments.

Raw Material Supply Constraints

Availability and pricing of PLA, bagasse, and other biopolymers can restrict manufacturing capacity. Supply chain disruptions may impact the consistent availability of raw materials, slowing down production expansion and affecting profit margins.

Compostable Cold Beverage Cup Market Opportunities

Expansion in Emerging Regions

Emerging markets in the Asia-Pacific and Latin America present significant growth potential. Increasing urbanization, café culture expansion, and rising disposable income in countries like China, India, and Brazil are creating demand for compostable cups. Manufacturers can benefit by localizing production or partnering with regional distributors.

Technological Integration in Manufacturing

Advanced biopolymer blends, including PLA, PHA, and bagasse composites, are enhancing durability and liquid resistance. Manufacturers integrating smart packaging, such as QR codes for recycling instructions, can differentiate products, build brand recognition, and appeal to eco-conscious consumers.

Regulatory Incentives and Corporate ESG Programs

Governments are offering subsidies, tax incentives, and support for sustainable packaging initiatives. Large beverage chains and QSRs are integrating compostable cups as part of their ESG and sustainability commitments, creating long-term bulk procurement opportunities.

Product Type Insights

PLA cups dominate the market globally, accounting for around 35% of the 2024 market, due to their transparency, durability, and compostability. Bagasse-based cups and bio-coated paperboard cups are gaining traction as alternatives for premium and sustainable product lines. The demand for medium-sized cups (12–16 oz) remains highest, meeting standard serving requirements in QSRs, cafes, and retail chains.

Application Insights

The food and beverage chain segment is the largest application, representing 45% of market share. High-volume demand comes from cafes, quick-service restaurants, and convenience stores. Events, catering services, and institutional applications are emerging as growth segments, driven by bulk procurement and regulatory compliance. Ready-to-drink beverages and bubble tea outlets are expanding the end-use landscape, particularly in APAC and Latin America.

Distribution Channel Insights

HoReCa dominates the market with a 40% share due to bulk procurement by restaurants, cafes, and catering businesses. Supermarkets and online retail platforms are gaining importance, enabling broader consumer reach. Specialty eco-focused stores and direct-to-consumer online platforms are emerging channels for premium compostable cup offerings, particularly among environmentally conscious buyers.

| By Material Type | By Capacity/Volume | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 38% in 2024, driven by regulatory mandates and strong consumer awareness. The US accounts for USD 800 million of the market, with widespread adoption by QSR chains and cafes emphasizing sustainability. Canada contributes significantly through urban and institutional adoption, with regulatory compliance as a key driver.

Europe

Europe represents 30% of the global market in 2024, led by Germany, the UK, and France. Germany alone contributes USD 250 million, while the UK accounts for USD 200 million. Strong government regulations on single-use plastics and high eco-conscious consumer penetration support continued growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Japan leading demand. Rapid urbanization, café culture adoption, and disposable income growth are fueling the transition to sustainable cups. China is projected to reach USD 400 million by 2030, supported by urban QSR chains and bubble tea outlets.

Latin America

Brazil, Argentina, and Mexico are driving regional growth. Outbound trends and urban QSR chains are increasing demand, with rising awareness about sustainability in the retail and events segments.

Middle East & Africa

South Africa, the UAE, and Saudi Arabia are key markets. Adoption is driven by high-income urban populations and premium cafes. Africa remains central to the global market due to local production and emerging QSR adoption in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Compostable Cold Beverage Cup Market

- Dart Container Corporation

- Huhtamaki Oyj

- Evergreen Packaging

- Genpak, LLC

- Novolex

- Stora Enso

- Berry Global

- Biopak

- Eco-Products

- Pactiv

- WinCup

- Tetra Pak

- Vegware

- Green Pack

- NatureWorks

Recent Developments

- In May 2025, Huhtamaki Oyj expanded its PLA cup production in Europe, integrating advanced bio-coating technology for enhanced liquid resistance.

- In April 2025, Dart Container Corporation launched a new bagasse-based cup line targeting QSR and event-based applications, promoting full compostability in North America.

- In February 2025, Evergreen Packaging invested in machinery upgrades for medium and large cup sizes, improving production efficiency and supporting APAC market expansion.