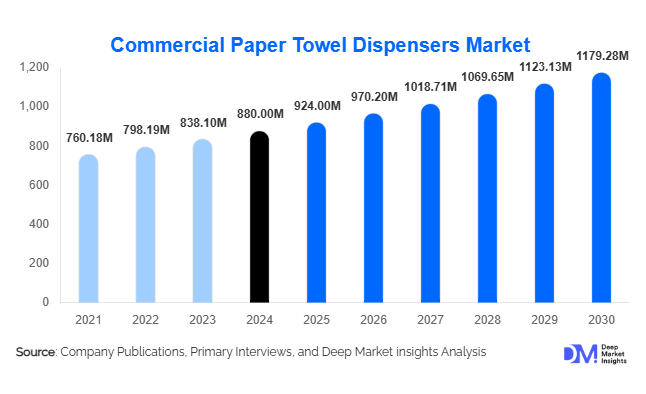

Commercial Paper Towel Dispensers Market Size

According to Deep Market Insights, the global Commercial Paper Towel Dispensers Market was valued at approximately USD 880 million in 2024 and is projected to reach USD 924.00 million in 2025, expanding further to USD 1,179.28 million by 2030, at a compound annual growth rate (CAGR) of around 5.0% during the forecast period (2025–2030). Growth in this market is primarily driven by increasing hygiene awareness across commercial spaces, rising demand for touchless dispensing systems, and infrastructure modernization across emerging economies. The shift toward sustainable and sensor-based restroom solutions continues to define market expansion globally.

Key Market Insights

- Touchless and automatic dispensers dominate due to rising hygiene and health-conscious infrastructure standards in corporate, healthcare, and hospitality facilities.

- Stainless steel dispensers lead material demand, reflecting a preference for durability, aesthetics, and hygienic design in high-traffic environments.

- Europe remains the largest regional market, accounting for around 30% of global revenue in 2024, driven by strong sanitation standards and building refurbishment programs.

- Asia-Pacific is the fastest-growing region, led by large-scale commercial and institutional infrastructure expansion across China, India, and Southeast Asia.

- Digitalization and IoT integration are reshaping the industry, enabling smart dispensers with usage tracking, waste control, and predictive maintenance.

- Sustainability is a key purchasing factor, as organizations seek recyclable materials, waste-minimizing feed systems, and eco-certified manufacturing.

Latest Market Trends

Smart and IoT-Enabled Dispensers

The commercial paper towel dispenser industry is undergoing digital transformation, with connected devices gaining adoption in corporate, airport, and healthcare facilities. Smart dispensers equipped with IoT sensors enable real-time usage tracking, refill alerts, and predictive maintenance scheduling. These systems optimize janitorial operations, minimize paper waste, and reduce downtime. Facility managers benefit from data analytics dashboards that monitor hygiene compliance and maintenance efficiency. The growing use of cloud platforms in facility management systems positions connected dispensers as a key component of “smart restroom” ecosystems.

Eco-Conscious and Low-Waste Dispensing Solutions

Growing sustainability mandates across global markets are driving demand for eco-friendly dispenser systems. Manufacturers are developing controlled-feed and single-sheet dispensing mechanisms to reduce paper consumption and waste generation. The adoption of recyclable and biodegradable materials in dispenser construction is also increasing. Corporate sustainability programs and public sector procurement standards that emphasize green certifications are directly influencing buyer decisions, leading to the emergence of low-carbon, refillable, and modular dispenser designs.

Commercial Paper Towel Dispensers Market Drivers

Heightened Hygiene Awareness

Post-pandemic hygiene priorities have spurred the widespread adoption of touchless restroom technologies. Automatic dispensers minimize surface contact, supporting infection prevention in public and institutional environments. This trend remains a primary driver across sectors such as healthcare, education, and hospitality, where hygiene compliance is a key operational standard.

Expansion of Commercial Infrastructure

Rising investment in commercial real estate—spanning office complexes, airports, retail centers, and hospitals—is generating consistent demand for washroom fixtures. Modern building codes emphasize accessibility and touchless facilities, prompting developers and facility managers to integrate premium dispensers in new projects. Additionally, retrofitting and renovation of existing facilities contribute to stable recurring demand.

Technological Innovation and Product Upgrades

Continuous innovation in dispenser design, materials, and automation technologies has increased product replacement cycles. Manufacturers introducing durable stainless-steel units, vandal-resistant designs, and IoT-compatible models are improving functionality and aesthetics, driving higher average selling prices and sustained revenue growth.

Market Restraints

Cost Sensitivity in Price-Conscious Markets

Premium automatic dispensers are significantly more expensive than manual units, which limits adoption in budget-sensitive markets and institutions. Price constraints are especially pronounced in small enterprises and public-sector facilities in emerging economies, where procurement budgets remain tight.

Raw Material and Supply Chain Volatility

Fluctuations in stainless-steel prices and electronic component costs directly impact production margins. Disruptions in global supply chains, coupled with high transportation costs, can delay installations and raise overall project expenditures for both manufacturers and facility operators.

Commercial Paper Towel Dispensers Market Opportunities

Integration of Smart Facility Technologies

The convergence of hygiene products with digital facility management presents a major opportunity. IoT-based dispensers that track consumption, optimize refill schedules, and transmit maintenance alerts will gain traction across large institutions and airports. Manufacturers developing integrated software ecosystems can secure long-term service contracts and differentiate through value-added offerings.

Emerging Market Infrastructure Boom

Rapid commercial construction across Asia-Pacific, Latin America, and the Middle East is creating new installation opportunities. Public sanitation programs, tourism expansion, and large-scale healthcare projects in countries such as India, Indonesia, and Saudi Arabia are driving demand for modern washroom equipment. Local production capabilities and cost-effective models tailored to regional needs will be key for market penetration.

Sustainability-Driven Innovation

Global ESG initiatives and green procurement policies are encouraging the use of environmentally responsible dispensers. Manufacturers that focus on recyclable materials, energy-efficient automation, and waste-minimizing dispensing systems can capture institutional buyers prioritizing sustainability compliance and LEED certification standards.

Product Type Insights

Automatic/touchless dispensers account for approximately 38% of the global market value (2024) and lead overall demand. The segment’s growth is supported by corporate hygiene policies and public health compliance requirements. Manual dispensers continue to serve cost-sensitive segments but are gradually losing share as organizations modernize restroom infrastructure.

Material Insights

Stainless-steel dispensers dominate with around 40% market share, favored for their durability, easy sanitation, and premium appearance. They are particularly prevalent in airports, hospitals, and luxury hospitality venues. Plastic dispensers maintain relevance for budget projects and high-volume installations where cost efficiency is a priority.

Mounting Type Insights

Wall-mounted dispensers hold a commanding 60% market share due to their versatility, compact design, and ease of integration into diverse washroom layouts. Recessed and countertop models serve specialized or high-end interior applications, particularly in modern commercial buildings.

End-Use Insights

Commercial buildings represent nearly 50% of the total market demand in 2024. Offices, retail malls, and public facilities drive consistent volume, while healthcare and hospitality are the fastest-growing end-use segments, supported by heightened hygiene standards and ongoing facility renovations. Industrial plants, airports, and educational institutions also contribute steadily to demand growth worldwide.

Distribution Channel Insights

Offline sales channels remain dominant, accounting for around 70% of the global market in 2024. Institutional procurement, tender-based sales, and distributor networks handle the majority of commercial installations. However, online channels are rapidly expanding, especially for small-scale replacements and facility management supply orders.

| By Product Type | By Material | By Mounting Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

Representing approximately 26% of the global market in 2024, North America remains a mature but resilient market. The U.S. dominates regional demand, driven by hygiene regulations, high facility standards, and widespread adoption of automatic dispensers in healthcare and hospitality. Growth remains steady, supported by retrofit programs and energy-efficient building upgrades.

Europe

Europe is the largest regional market with around a 30% share in 2024. Strong sanitation laws, public infrastructure renovation, and eco-friendly procurement policies in Germany, the U.K., France, and Italy fuel consistent demand. Market maturity encourages replacement-driven sales and adoption of stainless-steel, sensor-enabled dispensers.

Asia-Pacific

The fastest-growing region, Asia-Pacific, is witnessing robust expansion driven by commercial real estate growth, public hygiene initiatives, and the rise of organized retail and healthcare infrastructure. China, India, Japan, and South Korea lead regional adoption, with developing Southeast Asian economies showing accelerating uptake.

Latin America

Moderate growth is observed across Brazil, Mexico, and Argentina, driven by tourism, retail, and hospital construction. Price-sensitive procurement patterns favor manual dispensers, but gradual migration to automatic systems is expected as hygiene standards improve.

Middle East & Africa

MEA represents a smaller but rapidly growing market. The UAE and Saudi Arabia lead demand, driven by hospitality and airport projects. Africa’s demand is primarily driven by public sanitation programs and commercial property development in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top 15 Key Players

- Essity AB

- Kimberly-Clark Corporation

- Rentokil Initial plc

- Hagleitner Hygiene International GmbH

- Bobrick Washroom Equipment Inc.

- Franke Holding AG

- American Specialties Inc.

- Georgia-Pacific LLC

- CWS-boco International GmbH

- Bradley Corporation

- Dolphin Solutions Ltd.

- Ophardt Hygiene-Technik GmbH & Co. KG

- Palmer Fixture Company

- Jaquar & Company Ltd.

- Mar Plast S.r.l.