Combi Steamer Market Size

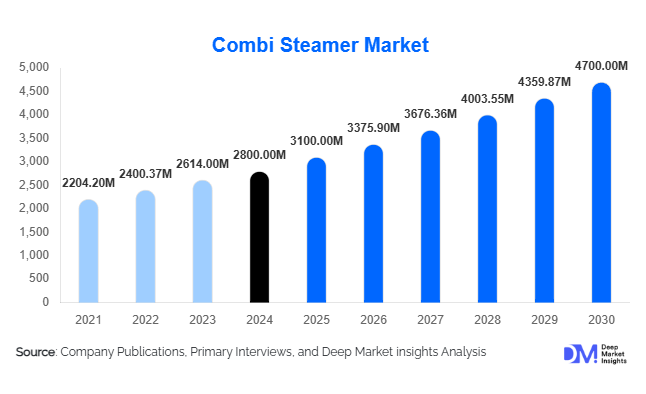

According to Deep Market Insights, the global combi steamer market size was valued at USD 2,800 million in 2024 and is projected to grow from USD 3,100 million in 2025 to reach USD 4,700 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025–2030). The combi steamer market growth is primarily driven by the expansion of the global foodservice industry, rising demand for energy-efficient and multi-functional cooking appliances, and increasing adoption of smart, automated kitchen solutions across restaurants, hotels, and institutional kitchens.

Key Market Insights

- Electric combi steamers lead the market, accounting for more than 50% of the global share in 2024 due to ease of installation, regulatory incentives, and cleaner energy usage.

- Hospitality and restaurant end-users dominate demand, contributing over 55% of the global revenue in 2024, driven by high throughput and diverse menu requirements.

- North America holds the largest share, representing 30–35% of the market in 2024, while Europe follows closely with 25–30%.

- Asia-Pacific is the fastest-growing region, with rising penetration in China, India, and Southeast Asia, supported by tourism expansion and rapid urbanization.

- Medium-capacity units (11–20 trays) dominate globally, accounting for 40% of sales due to an optimal balance between cost, footprint, and output.

- Smart/IoT integration and automated cleaning systems are emerging as critical differentiators for premium models in developed markets.

Latest Market Trends

Smart and Connected Kitchen Solutions

Manufacturers are increasingly integrating IoT-enabled features, automated cleaning systems, and predictive maintenance capabilities into combi steamers. Remote monitoring, cloud-based recipe management, and real-time diagnostics are gaining traction, especially in chain restaurants and institutional kitchens. This technology integration improves energy efficiency, reduces downtime, and enhances food safety compliance, making it one of the most prominent trends shaping the industry.

Shift Toward Energy-Efficient and Sustainable Models

With rising energy costs and stricter global regulations on emissions and efficiency, operators are prioritizing appliances that minimize water and power consumption. Manufacturers are innovating with hybrid fuel models, better insulation, and advanced steam generation technologies. These solutions not only help operators comply with standards but also lower total operating costs over the product lifecycle.

Combi Steamer Market Drivers

Growing Foodservice and Hospitality Sector

The rapid expansion of restaurants, hotels, catering services, and institutional kitchens worldwide has created significant demand for high-performance cooking equipment. Combi steamers, with their ability to replace multiple appliances, are increasingly viewed as essential investments by operators seeking efficiency and versatility.

Regulatory Push for Energy Efficiency

Government standards across Europe, North America, and Asia are encouraging the adoption of energy-efficient kitchen equipment. Incentives for electricity-based appliances and sustainability-focused initiatives are fueling the growth of electric combi steamers while pushing operators toward faster replacement cycles.

Technological Advancements

Innovations such as touch-panel controls, precise humidity and temperature regulation, and smart cooking presets have made combi steamers easier to operate, even for less experienced staff. These features reduce food waste, standardize quality, and lower labor costs, driving adoption across chain restaurants and catering services.

Market Restraints

High Initial Investment and Ownership Costs

Combi steamers are expensive appliances, with additional installation, maintenance, and water treatment requirements. Smaller restaurants and cafes, especially in emerging economies, often find the upfront costs prohibitive, slowing penetration in cost-sensitive markets.

Infrastructure and Service Limitations

Unreliable power supply, limited gas infrastructure, and inadequate after-sales service in certain regions hinder adoption. Inconsistent water quality also affects steam generation, increasing maintenance frequency and operating expenses for end-users.

Combi Steamer Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and growth of tourism-driven hospitality industries in Southeast Asia, Latin America, and the Middle East present significant untapped potential. Players that establish robust distribution and after-sales networks in these markets are likely to capture early-mover advantages.

Development of Compact and Hybrid Models

There is growing demand for compact, affordable combi steamers among small restaurants, cloud kitchens, and catering startups. Similarly, hybrid gas-electric models are gaining traction in regions with variable infrastructure, creating new product opportunities for OEMs.

Integration of IoT and Predictive Maintenance

Smart, connected combi steamers equipped with predictive maintenance features offer significant value to large chains and institutions. These innovations minimize downtime, reduce the total cost of ownership, and ensure compliance with food safety regulations, creating strong growth prospects in the premium segment.

Product Type Insights

Electric combi steamers dominate the market with over 50% share in 2024, supported by regulatory incentives and ease of use. Gas-fired models remain relevant in high-volume kitchens with lower gas prices, while hybrid models are emerging to address infrastructure gaps. Medium-capacity units (11–20 trays) hold the largest market share, appealing to restaurants and hotels seeking scalability without excessive space or installation requirements.

Application Insights

Hospitality and restaurant applications dominate the global combi steamer market, contributing over 55% of total revenue in 2024. Institutional kitchens such as hospitals and schools are steady adopters, while catering services are expanding rapidly. Emerging applications include cloud kitchens and retail food chains, which are increasingly integrating compact units for ready-to-eat offerings.

Distribution Channel Insights

Direct OEM sales and authorized distributors account for the majority of purchases, particularly for large and institutional buyers. However, online and e-commerce platforms are becoming increasingly important for small and mid-sized restaurants purchasing compact electric units. Leasing and rental models are gaining traction among cost-sensitive operators seeking to avoid heavy upfront capital investments.

End-User Insights

Restaurants, hotels, and catering services remain the core end-users of combi steamers. Quick-service restaurants (QSRs) and chain restaurants are among the fastest-growing adopters due to their demand for consistent quality and high throughput. Institutional kitchens are expected to grow steadily, driven by investments in healthcare, education, and defense infrastructure worldwide.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for 30–35% of global revenue in 2024. The U.S. dominates demand, supported by widespread adoption of energy-efficient appliances, high restaurant density, and chain-driven investments in automated cooking solutions.

Europe

Europe holds 25–30% of the global share, with Germany, the U.K., France, and Italy as leading markets. Regulatory pressures for sustainability and energy efficiency are encouraging equipment upgrades. Eastern Europe is witnessing strong percentage growth as foodservice infrastructure develops further.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, holding a 20–25% share in 2024. China, India, Japan, and Southeast Asia are key growth hubs, driven by booming hospitality industries, rising disposable incomes, and rapid urbanization. Government investments in tourism and foodservice infrastructure further support demand.

Latin America

Latin America represents 8–10% of the market in 2024, with Brazil and Mexico as primary contributors. Growth is supported by expanding middle-class dining culture and increasing penetration of QSR chains. Economic volatility and import tariffs remain key challenges.

Middle East & Africa

The region accounts for 5–7% of the market in 2024, with GCC countries such as the UAE and Saudi Arabia driving growth through luxury hospitality projects and tourism investments. South Africa is another notable market, supported by its developed foodservice infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Combi Steamer Market

- Rational AG

- Electrolux Professional

- The Middleby Corporation

- Welbilt, Inc.

- Alto-Shaam, Inc.

- Unox S.p.A.

- Fagor Industrial

- GIORIK S.p.A.

- AccuTemp Products

- AIHO Corporation

- Lainox

- Bosch

- Convotherm (Ali Group)

- Retigo

- Henny Penny Corporation

Recent Developments

- In June 2025, Rational AG launched a new IoT-enabled combi steamer series with integrated predictive maintenance tools, targeting large institutional buyers.

- In May 2025, Middleby Corporation expanded its manufacturing facility in the Asia-Pacific region to reduce costs and improve local distribution efficiency.

- In March 2025, Electrolux Professional introduced energy-efficient hybrid combi steamers designed for markets with variable fuel infrastructure.