Cold Press Juicer Market Size

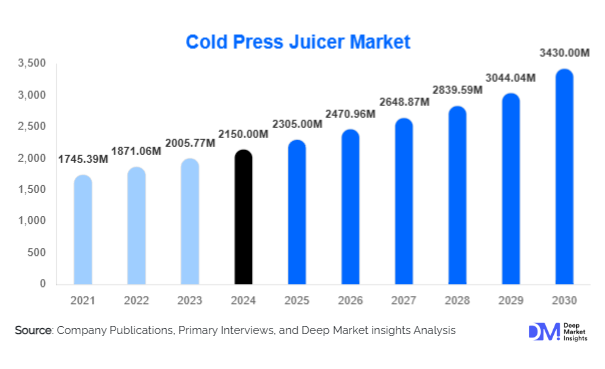

According to Deep Market Insights, the global cold press juicer market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,305 million in 2025 to reach USD 3,430 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing health consciousness, rising demand for nutrient-rich beverages, and the growing preference for cold-pressed juices over traditional centrifugal juicers.

Key Market Insights

- Consumer demand is shifting toward nutrient-preserving and health-focused juicers, as cold press technology retains vitamins, enzymes, and minerals better than traditional juicers.

- Online retail channels are gaining prominence, enabling manufacturers to reach a broader audience and offer convenience-driven direct-to-consumer sales.

- North America dominates the global market, led by the U.S. and Canada, with a strong preference for premium, health-oriented kitchen appliances.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urban wellness trends, and increasing exposure to global health practices in countries like China and India.

- Technological innovation, such as dual-gear and IoT-enabled juicers, is enhancing product differentiation and attracting premium consumer segments.

What are the latest trends in the cold-press juicer market?

Health and Wellness Integration

Increasing consumer focus on health, detoxification, and organic nutrition is driving the adoption of cold-press juicers. These devices preserve nutrients, enzymes, and flavors better than conventional centrifugal juicers. Juice cleanse programs, diet plans, and wellness-focused beverage consumption are contributing to higher demand across households and commercial settings, such as juice bars and wellness centers. Manufacturers are also marketing juicers as lifestyle products, aligning them with broader health and fitness trends.

Technological Advancements and Smart Features

Emerging cold-press juicers are integrating smart technologies, including IoT connectivity, automated nutrient tracking, and app-based control systems. Dual-gear and hybrid juicer models are gaining popularity for their high yield and nutrient retention. Noise reduction technology, energy-efficient motors, and self-cleaning systems are also influencing purchase decisions. These innovations appeal strongly to tech-savvy and premium consumers, expanding market adoption in both household and commercial segments.

What are the key drivers in the cold-press juicer market?

Growing Health Awareness

Rising global awareness of healthy lifestyles, weight management, and chronic disease prevention is a primary driver of the cold-press juicer market. Consumers are seeking nutrient-rich, preservative-free beverages that support wellness, immunity, and detoxification. This trend is particularly strong in urban regions of North America and Europe, where the premium appliance segment has witnessed consistent growth. The home consumption trend is also supported by social media promotion of healthy diets and influencer-led juice-based lifestyles.

Expansion of E-Commerce Channels

Online retail platforms are significantly boosting market growth by enabling manufacturers to reach a wider audience. Convenience, easy comparison, and availability of user reviews are driving online sales. Subscription-based e-commerce models, digital marketing campaigns, and partnerships with health-focused marketplaces are further expanding the market, especially for premium and smart juicer models.

Rising Demand in Commercial and Wellness Segments

Juice bars, cafes, wellness centers, and healthcare facilities are increasingly adopting cold-press juicers for high-quality, nutrient-dense beverages. The commercial segment contributes nearly 25% of the global market revenue, reflecting strong demand from institutional buyers seeking reliable, high-capacity devices. Partnerships with health programs and nutritionists further support market growth in this segment.

What are the restraints for the global market?

High Product Costs

Cold-press juicers are typically priced higher than centrifugal juicers, making affordability a challenge for cost-sensitive consumers. Premium models with dual-gear systems and smart features can be prohibitive for lower-income households. Price sensitivity in emerging markets can limit adoption, requiring manufacturers to explore mid-range product lines.

Complex Maintenance Requirements

Slow extraction mechanisms and intricate components can lead to difficult cleaning and maintenance, particularly for twin-gear and high-end models. Consumers may be deterred by these operational complexities, potentially restricting market growth. Companies are addressing this through self-cleaning designs and educational campaigns, but maintenance remains a key restraint.

What are the key opportunities in the cold-press juicer market?

Expansion in Emerging Economies

Rising disposable incomes, urbanization, and increasing awareness of wellness trends in countries like India, China, and Brazil present significant opportunities. Manufacturers can capture growth by introducing region-specific products, affordable variants, and expanding distribution networks. Emerging markets are expected to contribute a significant share of incremental revenue over the next five years.

Integration with Smart and IoT Technologies

IoT-enabled and app-connected juicers offer features such as nutrient tracking, recipe suggestions, and maintenance alerts. Early adoption of smart technology provides differentiation and allows premium pricing. Integration with health apps and digital wellness programs creates additional engagement opportunities and enhances brand loyalty.

Healthcare and Wellness Collaborations

Juicers are increasingly being adopted in wellness centers, gyms, hospitals, and clinics for dietary and detox programs. Partnerships with nutritionists and wellness programs provide access to institutional buyers and strengthen the cold press juicer’s positioning as a health-centric appliance, driving B2B segment growth.

Product Type Insights

Vertical masticating juicers dominate the market, accounting for approximately 35% of the 2024 market share, due to their compact design, ease of use, and efficiency in extracting juice from a wide variety of fruits and vegetables. Horizontal twin-gear juicers follow, representing 25% of the market, favored for commercial use and high nutrient retention. Hybrid juicers are gaining popularity in the premium segment for their combination of centrifugal and cold press functionality.

Technology Insights

Single auger technology holds the largest share (~40% of the global market in 2024) due to affordability and ease of maintenance. Dual-gear systems, while more expensive, are leading the high-end segment because of superior juice extraction and nutrient retention, particularly in commercial settings. Emerging smart and IoT-integrated juicers are expected to gain traction rapidly, reflecting growing consumer preference for connected appliances.

Distribution Channel Insights

Online retail accounts for 45% of the global cold press juicer sales in 2024, driven by convenience, broad product availability, and attractive pricing. Offline retail, including supermarkets and specialty stores, contributes 40%, mainly in regions with established appliance distribution networks. Direct B2B sales account for the remaining 15%, primarily to juice bars, cafes, and wellness centers.

End-Use Insights

Household users dominate the market with a share of 60% in 2024, driven by health-conscious consumers and urban households. Commercial and wellness segments account for 25%, and food & beverage manufacturing contributes 15%. The fastest-growing segment is wellness centers and healthcare applications, reflecting increased adoption of nutrient-preserving juicers for detox programs and medical dietary plans.

| By Product Type | By Technology | By Distribution Channel | By End-Use Industry | By Region |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, with a 2024 share of 35%, led by the U.S. and Canada. High awareness of health trends, premium appliance adoption, and strong e-commerce penetration are supporting growth. The region favors vertical masticating and smart IoT-enabled juicers.

Europe

Europe accounts for 30% of the market in 2024, with Germany, the U.K., and France being major contributors. The region shows a strong preference for premium twin-gear and eco-friendly juicers. Growing wellness trends and disposable income levels are further boosting adoption.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and Australia. Rapid urbanization, rising disposable incomes, and exposure to Western health trends are fueling demand. Emerging middle-class consumers are increasingly adopting both affordable and premium juicer models.

Latin America

LATAM is witnessing steady growth, with Brazil and Argentina driving demand, particularly in urban centers where lifestyle and wellness trends are emerging.

Middle East & Africa

MEA is experiencing gradual adoption, primarily in high-income markets such as the UAE, Saudi Arabia, and South Africa. Premium and commercial juicer segments are growing fastest due to health-conscious urban consumers and hospitality industry demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cold Press Juicer Market

- Omega Juicers

- Hurom Co., Ltd.

- Tribest Corporation

- Kuvings Co., Ltd.

- Breville Group Ltd.

- Philips

- Panasonic Corporation

- Black+Decker

- Severin Elektrogeräte GmbH

- BioChef

- Jack LaLanne’s Power Juicer

- Cuisinart

- Kenwood Limited

- Russell Hobbs

- Weston Brands

Recent Developments

- In June 2025, Hurom launched an IoT-enabled vertical cold press juicer with automated nutrient tracking in North America.

- In March 2025, Omega introduced a high-capacity twin-gear juicer for commercial juice bars in Europe, emphasizing nutrient retention and efficiency.

- In January 2025, Breville unveiled a hybrid juicer model combining centrifugal and slow juicing mechanisms, targeting the premium household segment globally.