Coil Zipper Market Size

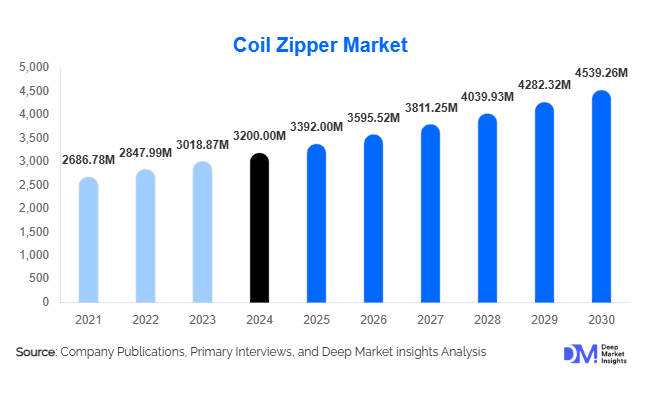

According to Deep Market Insights, the global coil zipper market was valued at USD 3,200 million in 2024 and is projected to grow from USD 3,392 million in 2025 to reach USD 4,539.26 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The coil zipper market growth is driven by the expanding global apparel industry, rising demand for durable and lightweight fasteners in luggage and outdoor gear, and increasing adoption of sustainable and recycled materials by zipper manufacturers.

Key Market Insights

- Asia-Pacific dominates the coil zipper market, accounting for approximately 45% of global revenue in 2024, led by strong manufacturing bases in China, India, and Vietnam.

- Nylon coil zippers hold the largest material share (around 35% in 2024) due to their flexibility, durability, and cost-efficiency in apparel and luggage applications.

- Closed-end coil zippers lead by product type, contributing nearly 40% of market value due to widespread use in garments, pockets, and bags.

- Fashion & lifestyle industries remain the largest end-use segment, representing roughly 38% of total demand in 2024.

- Sustainable materials and eco-friendly zippers are gaining traction, with leading companies investing in recycled polyester and bio-based coil production.

- Technological advancements such as automated coil winding, color customization, and precision molding are improving production efficiency and product quality.

Latest Market Trends

Sustainable Coil Zippers Gaining Momentum

Manufacturers are increasingly adopting sustainable production processes by using recycled nylon and polyester materials for coil zippers. Major global apparel brands are prioritizing eco-certified fasteners, pushing suppliers to align with their sustainability commitments. This trend is also supported by government initiatives promoting circular economy principles and reducing plastic waste. As a result, the adoption of recycled coil zippers is expected to grow significantly through 2030, creating opportunities for both established and new players offering environmentally responsible products.

Automation and Smart Manufacturing

Automation is transforming the coil zipper manufacturing process. Companies are investing in advanced coil winding, laser-cutting, and color-matching machines to reduce labor costs and improve consistency. Automated inspection systems powered by AI ensure higher quality standards and faster throughput. This technological integration not only enhances efficiency but also enables greater customization and responsiveness to changing fashion trends. Manufacturers adopting smart factory models are expected to achieve higher productivity and profitability over the coming decade.

Coil Zipper Market Drivers

Growing Global Apparel and Fashion Industry

The continuous growth of the global apparel industry is the primary driver of the coil zipper market. The demand for versatile, lightweight, and customizable fasteners has increased as fashion trends evolve rapidly. Coil zippers are preferred in garments due to their flexibility, soft texture, and ability to match various fabric types and colors. E-commerce-driven fast fashion and the expansion of premium apparel segments are further accelerating demand for coil zippers in both developed and emerging markets.

Expanding Luggage and Outdoor Gear Demand

The surge in global travel, outdoor recreation, and lifestyle accessories is boosting the need for high-strength, lightweight coil zippers. Luggage, backpacks, and sports bags heavily rely on coil zippers for functionality and aesthetics. Their ability to conform to curved designs and offer smooth operation makes them ideal for performance-oriented gear. This sector is projected to record robust growth through 2030, driven by increasing disposable incomes and a strong preference for stylish, durable travel products.

Rising Adoption in Automotive and Industrial Textiles

Beyond traditional apparel, coil zippers are gaining traction in automotive interiors, seat covers, and industrial textiles. They provide strong fastening solutions in lightweight designs suitable for modular applications. Automotive OEMs are increasingly specifying high-durability zippers for upholstery and storage solutions, creating new industrial demand streams for zipper manufacturers.

Market Restraints

Volatile Raw Material Prices

The coil zipper industry is highly dependent on nylon and polyester, both derived from petrochemical feedstocks. Fluctuating oil prices and supply disruptions can significantly impact production costs and profit margins. Manufacturers face challenges in balancing cost pressures with competitive pricing, particularly in commodity zipper segments.

Rising Competition from Alternative Fasteners

Alternative fastening systems such as magnetic closures, hook-and-loop fasteners, and molded plastic zippers are increasingly being adopted across fashion and industrial applications. These alternatives pose a threat to conventional coil zippers, compelling manufacturers to innovate and diversify their product offerings to maintain market share.

Coil Zipper Market Opportunities

Sustainable Material Innovation

Eco-conscious production represents one of the strongest opportunities in the coil zipper market. Manufacturers investing in bio-based polymers, recycled yarns, and closed-loop recycling systems are likely to gain a competitive advantage. As global brands commit to sustainability goals, suppliers offering certified eco-zippers will become preferred partners in global apparel and luggage supply chains.

Emerging Regional Manufacturing Hubs

Rising industrialization and low-cost manufacturing in India, Vietnam, and Indonesia present expansion opportunities. Establishing regional production hubs reduces logistics costs and improves responsiveness to local demand. Government initiatives like “Make in India” and “Made in China 2025” are further accelerating investments in textile accessories and component manufacturing, including coil zippers.

Integration into Performance and Smart Textiles

As technical textiles evolve, there is increasing potential for high-performance zippers featuring waterproof coatings, heat resistance, and integrated sensors for smart garments. This represents a lucrative niche for innovation-focused manufacturers targeting premium sportswear and industrial clients.

Product Type Insights

Closed-end coil zippers dominate the market, accounting for approximately 40% of global revenue in 2024. They are widely used in garments, pockets, and handbags, where the zipper does not fully separate. Open-end and two-way zippers, although smaller segments, are gaining traction in jackets, outdoor wear, and performance apparel. Innovations in color-fast tapes and anti-corrosive sliders are enhancing product longevity and aesthetics across all categories.

Application Insights

Apparel and fashion garments represent the largest application segment, contributing nearly 45% of the total market value in 2024. Growth is driven by global apparel production expansion and fast-fashion dynamics. The luggage and outdoor gear segment follows, showing robust momentum due to increasing global travel and recreational activities. Automotive interiors and industrial textiles are emerging as new frontiers, offering diversification opportunities for manufacturers.

End-Use Industry Insights

The fashion and lifestyle industry remains the dominant end-use segment, holding approximately 38% of the global coil zipper market in 2024. Rising disposable incomes and growing apparel exports from Asia-Pacific countries sustain high demand. The automotive and technical textile sectors are expected to register the fastest CAGR (~7%) through 2030, driven by the integration of zippers into vehicle interiors, modular furniture, and protective clothing. Export-oriented garment production in Bangladesh, India, and Vietnam continues to bolster global coil zipper consumption.

| By Material Type | By Functionality | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the coil zipper market with a 45% share in 2024. China, India, and Vietnam are major manufacturing and export hubs for apparel and accessories. India and Southeast Asia are expected to record the fastest growth (CAGR > 7%), supported by government-backed manufacturing initiatives and strong apparel exports. Increasing domestic fashion consumption in China and India is also boosting local demand for coil zippers.

North America

North America accounts for approximately 22% of the global coil zipper market in 2024. The region’s demand is concentrated in premium apparel, outdoor equipment, and automotive interiors. The U.S. is the largest importer, with a strong preference for high-quality, sustainable fasteners. Technological integration and sustainable sourcing are key trends among North American brands.

Europe

Europe holds about 20% of the global market, driven by high-end fashion houses and outdoor gear brands in Germany, Italy, and France. The region is witnessing increasing adoption of recycled zippers and eco-compliant manufacturing, aligned with EU environmental standards. European demand is characterized by higher unit values and a strong preference for quality and design versatility.

Latin America

Latin America represents roughly 7% of the global market. Brazil and Mexico are key contributors, supported by growing apparel manufacturing and trade integration. Although smaller in scale, the region presents potential for local production to cater to domestic brands and export markets.

Middle East & Africa

MEA accounts for around 6% of the market, led by South Africa and GCC nations. Growth is driven by rising consumption of fashion and travel goods. Industrial development in the UAE and Saudi Arabia, coupled with increasing interest in local textile manufacturing, is expected to create new opportunities through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Coil Zipper Market

- YKK Corporation

- RIRI Group

- Coats Group plc

- IDEAL Fastener Corporation

- Weixing Group

- SBS Zipper

- YBS Zipper

- YCC Zippers

- KAO SHING ZIPPER Co., Ltd.

- Lampo S.p.A.

- Salmi Oy

- Max Zipper Co., Ltd.

- HSD Zipper Group

- 3F Industries Ltd.

- Sanli Zipper Co., Ltd.

Recent Developments

- In March 2025, YKK Corporation announced new investments in recycled polyester coil production in Vietnam to strengthen its sustainable zipper portfolio.

- In January 2025, Coats Group launched an eco-friendly zipper range made from 100% post-consumer recycled nylon for the apparel sector.

- In November 2024, RIRI Group expanded its European operations with an advanced automated zipper manufacturing plant in Italy, focusing on premium and performance-grade coil zippers.