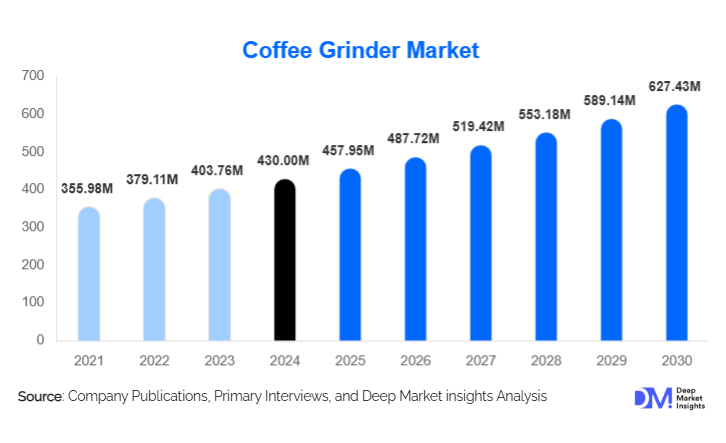

Coffee Grinder Market Size

According to Deep Market Insights, the global coffee grinder market size was valued at USD 430 million in 2024 and is projected to grow from USD 457.95 million in 2025 to reach USD 627.43 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Market growth is primarily driven by the rapid expansion of specialty coffee culture, surging home-brewing adoption, and rising demand for advanced burr and smart-connected grinders among both households and commercial cafés.

Key Market Insights

- Burr grinders dominate the market due to rising consumer preference for consistent grind quality and specialty coffee brewing.

- Electric grinders hold a leading share, driven by demand for convenience, automation, and programmable grind settings.

- North America remains the largest regional market, supported by mature café networks and high home-brewing adoption.

- Asia-Pacific is the fastest-growing region, fueled by booming café chains in China and India and rising middle-class consumption.

- Smart and app-connected grinders are gaining traction as consumers embrace IoT-enabled kitchen appliances.

- Premiumization continues to shape consumer spending, with demand rising for low-retention burr systems, precision micro-adjustment, and professional-grade builds.

What are the latest trends in the coffee grinder market?

Smart-Connected Grinders Transforming User Experience

Manufacturers are increasingly integrating smart technologies such as Bluetooth connectivity, programmable dosing, and app-based grind control. These features allow users to save grind profiles, monitor usage, and achieve café-level consistency at home. Specialty cafés are also adopting connected grinders to standardize operations and reduce training time. This trend is particularly strong among tech-savvy younger consumers, with app integrations offering real-time diagnostics, calibration alerts, and brew-method guidance. As part of the broader connected-kitchen ecosystem, smart grinders are reshaping engagement, convenience, and repeat purchasing behaviors.

Rise of Low-Retention and Precision Burr Technologies

Low-retention burr systems are becoming a defining feature in premium and commercial grinders. These designs reduce ground buildup inside the grinding chamber, ensuring freshness and minimizing waste. Precision-machined flat and conical burrs, stepless micro-adjustment, and enhanced motor efficiency are pushing grinders toward professional-grade performance. Advanced burr coatings, quieter grinding mechanisms, and optimized airflow systems enable improved durability and better extraction consistency. These innovations appeal strongly to specialty cafés, micro-roasteries, and serious home enthusiasts.

What are the key drivers in the coffee grinder market?

Growing Home-Brewing and Specialty Coffee Culture

The surge in home-brewing, fueled by work-from-home lifestyles and rising interest in café-quality beverages, is a major demand driver. Consumers increasingly recognize the importance of fresh grinding and precise particle size for espresso, pour-over, and immersion brewing. Specialty coffee shops and micro-roasteries have played a central role in educating consumers, driving sales of burr grinders across mid-range and premium segments. As home espresso machine ownership grows, the need for compatible high-precision grinders has expanded in parallel.

Expansion of Café Chains and Commercial Coffee Operations

Global café chains, boutique roasteries, and restaurants rely heavily on high-capacity burr grinders to maintain consistency and efficiency. The proliferation of specialty coffee shops across major markets such as the U.S., Europe, China, and India continues to accelerate commercial demand. Operators increasingly favor digitally controlled grinders with precise dosing, temperature control, and endurance-focused motors. As new café formats, drive-thru, micro-cafés, and co-working cafés, emerge, commercial grinder adoption is expected to rise significantly.

What are the restraints for the global market?

High Cost and Maintenance Requirements

Premium burr grinders and connected electric models carry high upfront costs, which limit penetration in price-sensitive regions. Commercial grinders require frequent maintenance, including burr replacement and recalibration, raising the total cost of ownership. These factors deter potential buyers, especially in developing markets. Furthermore, supply chain fluctuations affecting steel and motor components contribute to cost volatility.

Complexity and User Learning Curve

Many consumers find advanced grinders, especially stepless burr models, difficult to operate and calibrate. Achieving the correct grind size for different brewing methods requires knowledge and experimentation, which may discourage beginners. Café operators also face training challenges as staff need to understand grinder settings, retention behavior, and dosing accuracy. This learning curve slows broader adoption of high-end grinders.

What are the key opportunities in the coffee grinder industry?

Premium and Specialty Grinder Expansion

Growing global enthusiasm for specialty coffee presents strong opportunities for premium burr and low-retention grinders. Manufacturers can target connoisseurs, baristas, and micro-roasteries through innovations such as titanium burrs, noise-dampening chambers, and variable torque motors. The premium segment also allows brands to command higher margins, making it a key area for strategic investment. Emerging markets like China, India, and Brazil are showing rising interest in premium home-brewing tools, offering notable growth potential.

Affordable Product Lines for Emerging Markets

As café culture grows rapidly in Asia-Pacific, Latin America, and the Middle East, there is a rising demand for cost-effective grinders tailored to developing markets. Compact electric grinders, upgraded blade models, and durable manual grinders represent attractive entry points. Partnering with local distributors, coffee chains, and appliance retailers can increase penetration while enabling region-specific product design. Local manufacturing incentives in India, China, and parts of Latin America further support this opportunity.

Product Type Insights

Burr grinders dominate the market, driven by their superior consistency and alignment with specialty coffee preferences. Flat and conical burr grinders lead adoption across both household and commercial segments. Electric grinders are the most widely used due to their speed, convenience, and automation, especially in busy café environments. Manual grinders retain a strong niche among travelers, pour-over enthusiasts, and budget-conscious consumers. Blade grinders, while less precise, maintain relevance in entry-level markets due to affordability and wide retail availability.

Application Insights

The commercial segment, including cafés, restaurants, and roasteries, accounts for nearly half of total grinder demand, driven by high throughput and durability requirements. Household usage is the fastest-growing application, fueled by the boom in home espresso and pour-over brewing. Specialty coffee drinkers increasingly invest in premium burr grinders to replicate café-quality beverages at home. Roasteries and coffee production units represent a small but rising segment due to expanding artisanal roasting operations in Latin America, Africa, and Asia.

Distribution Channel Insights

Online platforms dominate sales, with marketplaces and brand websites offering broad product visibility, reviews, and competitive pricing. Direct-to-consumer (D2C) brands are gaining ground through subscription models, grinder + bean bundles, and loyalty programs. Offline channels, including specialty coffee equipment stores and appliance retailers, remain important for high-end grinders that benefit from hands-on demonstrations. Café equipment distributors continue to play a crucial role in the commercial segment.

End-User Insights

Household consumers represent the fastest-growing end-user category, driven by rising adoption of espresso machines and pour-over gear. Cafés and specialty coffee shops remain the core commercial users, requiring precision and durability for high-volume grinding. Roasteries and small-scale producers increasingly require industrial-capacity grinders for packaging and cupping operations.

| By Product Type | By Automation Level | By End Use | By Sales Channel | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for nearly 35% of global demand. High specialty coffee consumption, extensive café networks, and willingness to invest in premium kitchen appliances drive growth. The U.S. leads adoption of smart grinders and commercial burr grinders, while Canada shows strong home-brewing momentum.

Europe

Europe represents a mature and steadily expanding market, driven by strong café culture in Germany, Italy, France, and the Nordic region. The region shows high adoption of premium burr grinders, supported by sustainability-focused consumers who favor durable, long-lasting appliances. Espresso culture further fuels demand for precision grinders.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia. Rising café chains, growing middle-class income, and increasing specialty coffee awareness support rapid market expansion. Chinese consumers show strong interest in smart, design-forward grinders, while India experiences fast growth in mid-tier models for home use.

Latin America

Latin America is emerging as both a consumption and production hub. Café growth in Brazil, Colombia, and Mexico increases demand for commercial grinders, while local roasteries drive adoption of high-capacity burr grinders. Rising domestic specialty coffee consumption is boosting household grinder sales.

Middle East & Africa

The region shows rising demand for high-end grinders driven by premium café culture in the UAE, Saudi Arabia, and Qatar. Africa’s emerging specialty coffee scene, particularly in Kenya, Ethiopia, and South Africa, also boosts grinder demand across cafés and roasteries. Growth is supported by increasing intra-regional tourism and café-chain expansions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Coffee Grinder Market

- Baratza

- Breville Group

- Bodum

- Cuisinart (Conair)

- Mahlkönig

- Hario

- Krups (Groupe SEB)

Recent Developments

- In 2024, Baratza launched an upgraded low-retention burr series aimed at home espresso users and specialty cafés.

- In 2025, Breville introduced a new line of smart-connected grinders with app-based grind profiling and diagnostics.

- In 2025, Mahlkönig expanded its commercial grinder portfolio with enhanced cooling systems and precision titanium burrs for high-volume operations.