Coding Bootcamp Market Size

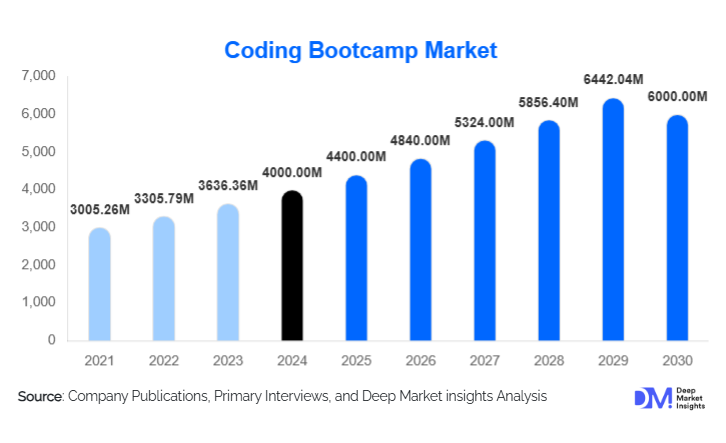

According to Deep Market Insights, the global coding bootcamp market size was valued at USD 4,000 million in 2024 and is projected to grow from USD 4,400 million in 2025 to reach USD 6,000 million by 2030, expanding at a CAGR of 10% during the forecast period (2025–2030). The coding bootcamp market growth is primarily driven by the rising demand for tech talent, increasing adoption of online and hybrid learning models, and growing corporate partnerships for upskilling and reskilling initiatives.

Key Market Insights

- Online and hybrid bootcamps are becoming the preferred mode of learning, offering flexibility, cost efficiency, and accessibility for global learners.

- Full-stack web development remains the dominant subject focus, while specialized courses in AI, data science, cybersecurity, and cloud computing are witnessing rapid growth.

- North America dominates the market, driven by the U.S. and Canada, with high tuition prices, strong employer acceptance, and extensive corporate partnerships.

- Asia-Pacific is the fastest-growing region, led by India, China, and Southeast Asian countries, fueled by digital skilling initiatives and growing tech employment demand.

- Alternative payment models such as Income Share Agreements (ISAs) and deferred tuition are increasing accessibility and attracting a broader learner base globally.

- Technological integration, including AI-based learning platforms, adaptive content, and virtual labs, is enhancing student engagement and learning outcomes.

What are the latest trends in the coding bootcamp market?

Specialization in Emerging Tech Fields

Bootcamps are increasingly focusing on high-demand skills like AI, machine learning, cybersecurity, cloud computing, and DevOps. Providers partner with tech companies to deliver hands-on, industry-relevant curricula, helping graduates secure higher-paying roles. This specialization allows bootcamps to differentiate themselves in a crowded market and command premium pricing while aligning with global workforce demands.

Flexible and Alternative Learning Models

There is a growing preference for online, part-time, and self-paced bootcamps that cater to working professionals and remote learners. Alternative payment methods, including ISAs and deferred tuition, are making bootcamps accessible to students from emerging markets and lower-income backgrounds. This approach reduces financial barriers, increases enrollment, and broadens the market reach globally.

What are the key drivers in the coding bootcamp market?

Global Tech Skills Shortage

The persistent demand for qualified software developers, data scientists, and AI professionals is a primary driver of the coding bootcamp market. Organizations are increasingly partnering with bootcamps for rapid upskilling and reskilling programs, reducing reliance on traditional multi-year degrees. This trend is particularly strong in sectors like finance, healthcare, and IT services, where technological transformation is urgent.

Affordability and Speed of Learning

Coding bootcamps offer accelerated learning experiences compared to traditional academic programs, often in 3–6 months, with lower costs and flexible schedules. This attracts career changers, students, and working professionals who require quick, practical skill acquisition to enter or advance in the tech workforce.

Corporate Adoption and Employer Recognition

Employers are increasingly recognizing bootcamp credentials, integrating graduates into their workforce, and partnering with providers to upskill existing staff. Universities and corporate enterprises are also adopting bootcamp-style micro-credentials, increasing the credibility and demand for bootcamp programs.

What are the restraints for the global market?

Quality and Credibility Concerns

Variation in curriculum quality, lack of uniform accreditation, and inconsistent job placement outcomes can undermine confidence among learners and employers. Providers need to ensure transparency in results and maintain high instructional standards to overcome this challenge.

Financial Barriers in Emerging Markets

Despite being more affordable than traditional degrees, bootcamps still pose a significant financial burden in low- and middle-income countries. Economic fluctuations, opportunity costs, and competition from free online learning platforms create pricing pressures and limit market penetration.

What are the key opportunities in the coding bootcamp industry?

Expansion into Emerging Geographies

Asia-Pacific, Latin America, and the Middle East offer substantial growth potential due to rising demand for digital skills, government skilling initiatives, and increasing internet penetration. Localizing content and partnering with regional enterprises can drive rapid adoption.

Corporate Upskilling and Reskilling Programs

Bootcamps can collaborate with corporations to deliver tailored upskilling programs. Enterprises increasingly prefer bootcamp partnerships over traditional multi-year training, creating a stable, recurring revenue stream for providers.

Technological Enhancements in Learning Delivery

Integration of AI, virtual labs, gamified learning, and VR/AR platforms is improving student engagement and outcomes. Providers adopting these innovations can differentiate themselves and capture a higher market share.

Product Type Insights

Full-time immersive bootcamps dominate the market, offering intensive skill training with high placement rates. Part-time and self-paced programs are growing rapidly, providing flexibility for working professionals. Hybrid models combining online and in-person elements are also gaining traction, especially in emerging markets where physical infrastructure is limited.

Application Insights

Full-stack web development remains the most popular application, followed by data science, AI, cybersecurity, and mobile development. Emerging applications include cloud computing, DevOps, and UX/UI design. Enterprises increasingly use bootcamp graduates for digital transformation, automation, and specialized tech projects.

Distribution Channel Insights

Online channels, including bootcamp websites and digital learning platforms, dominate distribution. Direct marketing to individual learners, partnerships with universities, and corporate contracts also drive enrollment. Social media, influencer marketing, and online communities are increasingly important for student acquisition.

Traveler Type Insights

Individual learners, particularly career changers and students, represent the majority of enrollments. Corporate learners and institutional programs are expanding rapidly, providing high-volume, recurring demand. Online self-paced and hybrid learners are growing faster than full-time immersive participants, reflecting changing learning preferences and workforce demands.

Age Group Insights

The 18–30 age group drives demand for bootcamps as career entry or switchers. The 31–50 age group increasingly seeks part-time or hybrid programs for upskilling. Older professionals (>50) participate mainly in specialized reskilling programs for niche roles in AI, cybersecurity, or cloud computing.

| By Course Type | By Delivery Mode | By End-User | By Pricing / Payment Model |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market, with the U.S. and Canada accounting for nearly 47–50% of global revenue in 2024. High tuition fees, corporate adoption, and strong tech ecosystems drive demand. Online and hybrid bootcamps continue to expand their reach across the continent.

Europe

Europe contributes 20–25% of the global market share, with the UK, Germany, and France as leading countries. Demand is growing steadily, fueled by digital transformation initiatives, corporate adoption, and increasing acceptance of bootcamp certifications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by India, China, Japan, and Southeast Asia. Government skilling initiatives, rising tech employment, and widespread digital penetration are accelerating adoption. CAGR in this region is projected to be significantly higher than the global average.

Latin America

Latin America accounts for 5–10% of the global market, led by Brazil and Mexico. Demand is increasing due to digital upskilling requirements in corporate and individual sectors, with growing interest in online and hybrid bootcamp models.

Middle East & Africa

MEA represents 5–7% of the global market share, with South Africa, the UAE, and Saudi Arabia as key contributors. Growth is driven by government skilling programs, corporate upskilling, and increasing adoption of online and hybrid bootcamps.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Coding Bootcamp Market

- General Assembly

- Springboard

- Flatiron School

- Le Wagon

- Ironhack

- App Academy

- Thinkful

- BrainStation

- Coding Dojo

- Bloom Institute of Technology (BloomTech)

- Hack Reactor

- DigitalCrafts

- CourseCareers

- Makers Academy

- Byte Academy

Recent Developments

- In March 2025, General Assembly launched a new AI & Data Science immersive track across its U.S. and UK campuses, integrating industry mentorship and corporate placement partnerships.

- In February 2025, Springboard expanded its global online offerings, targeting Asia-Pacific learners with localized content and income-share agreements to improve accessibility.

- In January 2025, Le Wagon announced the opening of new hybrid bootcamp campuses in India and Southeast Asia, combining online delivery with hands-on local projects to meet growing regional demand.