Clothing Fibers Market Size

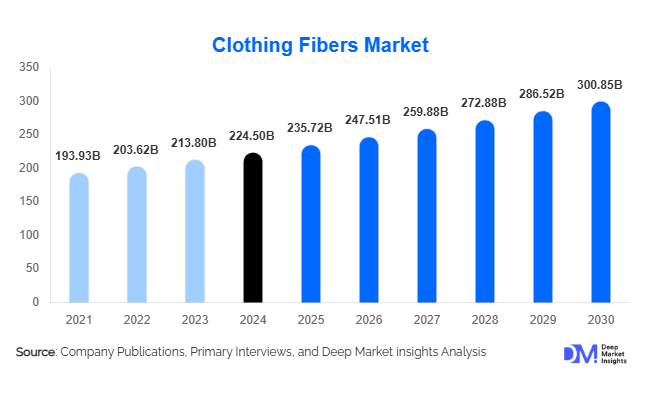

According to Deep Market Insights, the global clothing fibers market size was valued at USD 224.5 billion in 2024 and is projected to grow from USD 235.72 billion in 2025 to reach USD 300.85 billion by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is driven by the rapid expansion of apparel consumption across emerging economies, the rising adoption of sustainable and recycled fibers, and increasing demand for high-performance, comfort-oriented textiles in athleisure and functional apparel.

Key Market Insights

- Synthetic fibers continue to dominate global clothing fiber demand, accounting for nearly 59% of market share in 2024 due to their durability, versatility, and cost advantages.

- Asia-Pacific leads the global clothing fibers market with about 45% share in 2024, driven by large-scale textile manufacturing hubs in China, India, and Southeast Asia.

- Sustainability and circularity are reshaping industry priorities, with recycled polyester (rPET), bio-based nylon, and lyocell emerging as high-growth fiber types.

- Women’s wear is the largest apparel end-use segment, representing around 35% of total fiber consumption value in 2024.

- Rising e-commerce and fast-fashion cycles are accelerating fiber consumption through shorter product lifespans and higher apparel turnover.

- Major fiber producers are investing heavily in recycling technologies, digital traceability, and closed-loop manufacturing to meet tightening sustainability regulations.

What are the latest trends in the clothing fibers market?

Sustainability and Circular Fiber Systems

One of the most significant shifts in the clothing fibers market is the growing transition toward sustainable and circular fiber production. Apparel brands and fiber manufacturers are collaborating to increase the share of recycled and bio-based fibers, driven by consumer demand and regulatory pressures. Recycled polyester (rPET), regenerated cellulose fibers such as lyocell, and bio-nylon are witnessing accelerated adoption. Circular models, where post-consumer textiles are collected and re-spun into new fibers, are gaining traction globally. Fiber producers are introducing traceability platforms using blockchain to verify recycled content and carbon-neutral credentials, while retailers are promoting “fiber-to-fiber” recycling initiatives to meet zero-waste goals.

Performance and Functional Fiber Innovation

The line between fashion and functionality is blurring, with the rise of performance apparel driving fiber innovation. Moisture-wicking, stretchable, anti-odor, UV-resistant, and thermoregulating fibers are in high demand, particularly within athleisure, sportswear, and outdoor segments. This trend is supported by advances in nanotechnology and polymer science, allowing fiber producers to enhance performance without sacrificing comfort or sustainability. Hybrid fiber blends combining natural and synthetic materials are becoming common, creating fabrics that are both breathable and durable, reflecting evolving consumer expectations for everyday wear that supports active lifestyles.

What are the key drivers in the clothing fibers market?

Rising Global Apparel Consumption

Expanding middle-class populations and urbanization in emerging markets such as India, China, Indonesia, and Brazil are driving robust apparel demand, directly translating into higher fiber consumption. Growing disposable income and rapid fashion turnover cycles are pushing overall textile production upward, while consumers in developed markets are diversifying wardrobes with activewear and comfort-wear collections. Together, these dynamics ensure a consistent growth trajectory for fiber demand.

Growth of E-Commerce and Fast Fashion

Digital retailing and fast-fashion models are transforming the apparel value chain. The shift to online shopping has accelerated product variety and shortened design-to-market cycles. Brands such as Zara, H&M, and Shein are producing smaller batches more frequently, increasing total garment output and thereby fiber usage. This demand for agility encourages the use of cost-efficient synthetics and quick-to-manufacture blends, giving fiber producers opportunities to scale production and integrate digital supply-chain solutions.

Shift Toward Sustainable and Premium Fibers

Consumers are increasingly prioritizing eco-friendly and premium materials. Organic cotton, recycled polyester, bamboo viscose, and lyocell are gaining share as buyers favor sustainable, traceable fabrics. Premium animal fibers such as merino wool and cashmere are also seeing steady demand among affluent consumers. This transition toward quality and sustainability is allowing fiber producers to capture higher margins through differentiated products and eco-certifications such as GRS (Global Recycled Standard) and OEKO-TEX.

What are the restraints for the global market?

Raw Material Price Volatility

Petrochemical feedstocks for synthetic fibers and agricultural outputs for natural fibers are prone to price fluctuations caused by crude oil volatility, climate variability, and geopolitical tensions. These fluctuations create uncertainty in production costs and pricing strategies for fiber producers, compressing profit margins and disrupting supply planning for apparel manufacturers.

Regulatory and Environmental Compliance Costs

While sustainability presents long-term opportunity, near-term compliance with emerging regulations, such as microplastic restrictions, extended producer responsibility (EPR), and stricter effluent-treatment norms, raises production costs. Smaller producers struggle to invest in advanced filtration, recycling, and waste-treatment technologies, potentially limiting market participation or slowing expansion.

What are the key opportunities in the clothing fibers industry?

Sustainable and Recycled Fiber Expansion

The global push toward a circular textile economy is creating strong incentives for investment in recycling infrastructure. Fiber producers can benefit by expanding rPET and regenerated fiber capacities, entering partnerships with apparel brands for textile waste collection, and developing advanced mechanical and chemical recycling methods. Government sustainability grants and consumer willingness to pay for eco-fabrics further enhance this opportunity.

Regional Reshoring and Supply Chain Localization

Disruptions in global logistics and trade realignments are encouraging apparel and fiber manufacturers to regionalize production. Countries such as India, Vietnam, and Bangladesh are attracting investment in integrated textile parks, while Eastern Europe is emerging as a near-shoring base for European brands. Fiber producers that establish localized, vertically integrated operations can capitalize on reduced lead times and preferential trade incentives.

High-Performance and Technical Apparel Growth

The surge in sportswear, athleisure, and outdoor adventure apparel has boosted demand for innovative fibers with specific functionalities. Fiber manufacturers offering spandex-integrated synthetics, antimicrobial finishes, and breathable composites can tap into this premium segment. Collaborations between fiber developers and apparel technology companies will define the next generation of smart and performance-driven fabrics.

Product Type Insights

The synthetic fibers segment continues to dominate the global clothing fibers market, accounting for approximately 59% of total market value in 2024, equivalent to nearly USD 139 billion. Polyester remains the most extensively utilized fiber, favored for its affordability, durability, and compatibility with modern textile processing technologies. Its widespread application across fast fashion, activewear, and industrial textiles reinforces its leading position. However, recycled synthetics, particularly recycled polyester (rPET), are registering the fastest growth, fueled by stringent sustainability mandates and major apparel brands’ commitments to achieve 100% sustainable sourcing by 2030. The trend toward circular textile systems and the introduction of bio-based polyester blends are further catalyzing innovation within this segment.

Natural fibers such as cotton, wool, silk, and hemp retain significant market relevance, particularly in premium apparel and casual wear. These fibers appeal to consumers valuing comfort, breathability, and authenticity, with organic and ethically sourced variants showing steady expansion in high-income regions. Meanwhile, regenerated cellulose fibers, including viscose, lyocell, and modal, are emerging as sustainable alternatives to synthetics, offering excellent texture, moisture management, and biodegradability. Technological advancements in closed-loop production and reduced chemical usage are enhancing their environmental credentials, making them a key growth driver in the sustainable fashion ecosystem.

Application Insights

The women’s wear segment represents the largest application area within the clothing fibers market, valued at approximately USD 82 billion in 2024, translating to around 35% of total fiber consumption. High fashion turnover, broad product diversity, and constant trend evolution drive substantial demand across both fast fashion and luxury apparel. Global fashion retailers’ rapid product cycles and the growing influence of digital retailing continue to underpin fiber consumption in this segment.

Sportswear and activewear are the fastest-growing application categories, propelled by evolving consumer lifestyles emphasizing health, fitness, and athleisure. The segment benefits from advancements in performance fibers offering breathability, moisture-wicking, UV resistance, and elasticity. This trend is reinforced by cross-sector innovation where apparel brands partner with fiber producers to co-develop functional textiles for specialized use. Meanwhile, children’s wear and workwear & uniforms form emerging niches supported by higher disposable incomes, school uniform programs, and increased demand for protective and functional clothing in industrial sectors.

Distribution Channel Insights

Branded and private-label apparel retailers remain the largest fiber-consuming distribution channel, as vertically integrated fashion giants such as Inditex, H&M, and Uniqlo rely on large-scale fiber procurement contracts to sustain rapid design-to-market cycles. These players influence global fiber demand through centralized sourcing strategies and sustainability benchmarks. E-commerce platforms continue to revolutionize distribution by promoting agile, trend-responsive production models that shorten supply cycles and amplify fabric innovation visibility. Digital traceability platforms, leveraging blockchain and QR-based systems, are increasingly utilized to authenticate sustainability claims and strengthen consumer trust in fiber provenance. Meanwhile, contract apparel manufacturers serving industrial, hospitality, and uniform markets contribute to a stable, though slower-growing, demand segment focused on consistency and durability over fashion flexibility.

End-Use Industry Insights

The clothing fibers market is intrinsically tied to the performance of the global apparel and textile manufacturing industry. Asia dominates the end-use landscape, driven by large-scale export manufacturing bases in China, India, Bangladesh, and Vietnam. Collectively, these nations account for a majority of global apparel exports, ensuring continuous fiber consumption through integrated value chains and cost-efficient production systems. Export-driven demand, particularly from North American and European fashion retailers, underpins long-term stability.

Simultaneously, the rise of smart textiles and technical fibers is introducing high-margin opportunities. Conductive and sensor-embedded fibers are increasingly utilized in wearable technologies, healthcare monitoring, and defense applications. These innovations represent a premium niche that merges apparel functionality with electronics, expanding the boundaries of fiber application into high-value, technology-integrated segments. In parallel, home textiles and industrial fabrics continue to offer steady demand growth, driven by urbanization, rising living standards, and increasing construction activity worldwide.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global clothing fibers market, contributing approximately 45% of total revenue in 2024 (around USD 105 billion). The region’s dominance is rooted in its vertically integrated textile ecosystem, abundant raw materials, and strong manufacturing infrastructure. China remains the largest producer and consumer, benefiting from economies of scale and advanced fiber processing capabilities. India stands out as the fastest-growing market due to rising domestic apparel consumption, expanding export capacity, and government-led initiatives such as Make in India and the Production-Linked Incentive (PLI) scheme for textiles. Vietnam, Indonesia, and Thailand continue to attract global apparel and fiber manufacturers seeking cost-effective production bases and favorable trade agreements. The region’s growth is further accelerated by increasing investments in recycled polyester facilities and sustainable viscose production lines.

North America

North America represents a mature yet resilient market, driven by the strong presence of premium apparel brands, sustainability-focused consumers, and innovation in technical fibers. The United States leads regional consumption, particularly in high-performance fibers used in sportswear, athleisure, and protective workwear. Market expansion is supported by government policies promoting circular textile systems and recycled fiber initiatives. Rising consumer inclination toward locally produced, traceable, and ethically sourced clothing further drives regional fiber demand. Canada’s growing outdoor apparel sector also supports regional growth through increased use of functional and weather-resistant textiles.

Europe

Europe is a key hub for sustainable and circular textile development, ranking among the largest consumers of organic cotton, recycled synthetics, and cellulosic fibers. Nations such as Germany, France, Italy, and the U.K. lead adoption due to advanced fashion industries, environmental regulations, and high consumer awareness. The EU Green Deal and textile waste directives are stimulating investments in closed-loop fiber recycling systems and biodegradable material innovations. Europe’s leadership in sustainable fashion, combined with government-backed R&D programs and eco-labeling standards, ensures steady fiber demand growth aligned with circular economy goals.

Latin America

Latin America is experiencing consistent expansion in the clothing fibers market, led by Brazil and Mexico. Rising disposable incomes, expanding retail infrastructure, and domestic apparel production are key regional growth drivers. Free trade agreements, particularly between Latin American nations and the U.S., are fostering fiber imports, enabling regional textile processing hubs. Brazil’s growing synthetic fiber usage, supported by its large consumer base and fashion retail penetration, underpins market strength. In addition, local investments in polyester and viscose manufacturing are positioning Latin America as an emerging production destination for global brands.

Middle East & Africa

The Middle East & Africa region, while currently accounting for a smaller share of global fiber consumption, is poised for robust long-term growth. In the Gulf Cooperation Council (GCC) nations, economic diversification efforts, particularly in the UAE and Saudi Arabia, are stimulating investment in textile manufacturing clusters and apparel value chains. Simultaneously, sub-Saharan Africa (notably Ethiopia, Kenya, and South Africa) is emerging as a cost-competitive manufacturing hub, supported by trade access to European and North American markets under the African Growth and Opportunity Act (AGOA) and EU partnership programs. Local availability of cotton, improving logistics infrastructure, and increasing FDI inflows into industrial parks are key drivers shaping the region’s fiber demand trajectory.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clothing Fibers Market

- Reliance Industries Ltd.

- Toray Industries Inc.

- Lenzing AG

- Teijin Ltd.

- Invista

- Indorama Ventures Public Co. Ltd.

- Hyosung TNC Corporation

- Asahi Kasei Corporation

- Eastman Chemical Company

- Unifi Inc.

- Far Eastern New Century Corporation

- Zhejiang Hengyi Group Co., Ltd.

- The Bombay Dyeing & Manufacturing Co. Ltd.

- FiberVisions (DAK Americas)

- Zhejiang Huafon Spandex Co., Ltd.

Recent Developments

- In May 2025, Lenzing AG announced the expansion of its TENCEL™ lyocell production facility in Thailand to meet growing sustainable-fiber demand in Asia.

- In April 2025, Reliance Industries Ltd. unveiled a new rPET fiber line in India aimed at processing post-consumer textile waste under its sustainability initiative “EcoNext.”

- In February 2025, Indorama Ventures launched a global partnership with apparel brands to supply certified recycled polyester and develop traceable supply-chain platforms.