Clothing Fastener Market Size

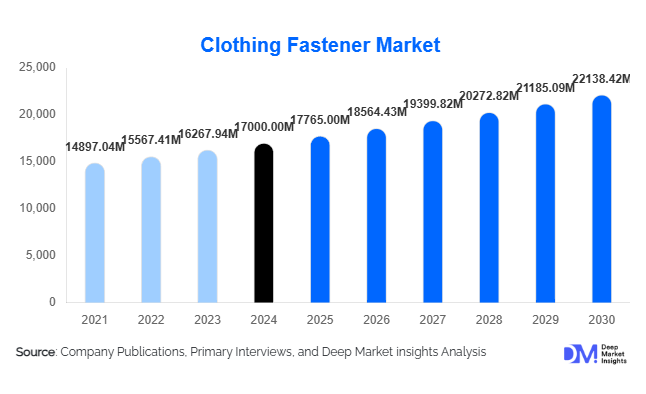

According to Deep Market Insights, the global clothing fastener market size was valued at USD 17,000 million in 2024 and is projected to reach USD 17,765.00 million in 2025, before expanding to USD 22,138.42 million by 2030, growing at a CAGR of 4.5% during 2025–2030. The market growth is primarily driven by rising global apparel production, increased demand for innovative fastening systems, and the proliferation of fashion and sportswear segments worldwide.

Key Market Insights

- Zippers remain the largest product category, accounting for approximately 45% of global revenue in 2024, due to their widespread use in apparel, footwear, and accessories.

- Asia Pacific dominates global fastener manufacturing, with over 45% market share, led by China, India, Bangladesh, and Vietnam.

- Eco-friendly and recyclable materials such as bio-plastics, organic cotton loops, and recycled metal alloys are gaining rapid adoption among top brands.

- Smart and decorative fasteners integrated with RFID tags or brand insignia are creating premium sub-segments in the market.

- Online B2B and B2C platforms are reshaping the distribution landscape, enabling direct procurement from manufacturers and customization at scale.

- Export-driven apparel growth in emerging economies continues to boost fastener demand through 2030.

Latest Market Trends

Sustainable and Eco-Material Fasteners

Growing environmental awareness among consumers and apparel brands is fueling demand for sustainable fasteners made from recycled metal, biodegradable plastic, and bio-composites. Leading manufacturers are introducing certified eco-fastener lines compliant with REACH and OEKO-TEX standards. Fashion houses increasingly prefer suppliers offering full traceability and carbon-neutral operations. Brands are adopting biodegradable zippers and non-toxic dyes for eco-apparel ranges, positioning sustainability as a key differentiator in the fastener industry.

Smart and Customizable Fastening Solutions

Technological innovation is transforming the clothing fastener market. RFID-enabled and QR-coded fasteners now enable supply-chain traceability and anti-counterfeiting. Fashion-tech companies are integrating magnetic and automatic lock systems for ease of use. Custom-branded buttons and laser-engraved zippers are gaining traction in luxury and streetwear segments. 3D printing allows small-batch customized toggles, enabling rapid prototyping for apparel designers and start-ups.

Clothing Fastener Market Drivers

Expanding Global Apparel and Footwear Production

The continuous expansion of global apparel and footwear production is the single largest driver of fastener demand. With apparel exports from the Asia Pacific surging, factories require bulk fastener supplies for jeans, jackets, footwear, and bags. The fashion cycle’s speed, driven by fast fashion and online retail demands consistent fastener innovation and just-in-time supply capabilities.

Material and Design Innovations

New materials such as ultra-light nylon, high-strength polymer composites, and corrosion-resistant metal alloys have improved performance and design versatility. Invisible zippers, waterproof seals, and decorative embellishments appeal to both functional and aesthetic needs, expanding market penetration across premium and sportswear segments.

Regional Manufacturing Shift to Asia and Emerging Markets

Global apparel brands continue relocating production to cost-efficient regions like India, Bangladesh, and Vietnam. The proximity of fastener manufacturing hubs to garment factories reduces logistics costs and accelerates production turnaround times. Government incentives and textile parks in emerging markets further strengthen regional supply ecosystems, making Asia the epicenter of fastener growth.

Market Restraints

Raw Material Price Volatility

Metal and polymer price fluctuations significantly affect production costs. Dependence on commodities such as brass, aluminum, and nylon introduces pricing instability. Volatility constrains smaller manufacturers, who often operate with narrow margins and limited hedging capabilities.

Intense Price Competition and Product Commoditization

Low-end fastener categories are highly commoditized, especially in zippers and plastic buttons. Intense price competition in Asia’s mass-production segment limits profitability and deters innovation. Manufacturers must differentiate through design, sustainability, or technology integration to remain competitive.

Clothing Fastener Market Opportunities

Adoption of Sustainable and Recyclable Materials

The growing emphasis on environmental responsibility opens major opportunities for fastener manufacturers to develop eco-friendly products. The shift toward recyclable and biodegradable materials aligns with brand-level sustainability goals, enabling suppliers to command premium pricing. Government regulations promoting sustainable textiles in Europe and North America further accelerate this opportunity.

Digitalization and E-Commerce Integration

Digital supply-chain management and online sales platforms are redefining procurement models. Fastener companies integrating e-commerce and B2B portals can reach apparel manufacturers directly, offering real-time inventory and custom-order capabilities. This transition also supports small and mid-size garment producers who rely on on-demand sourcing.

Emerging Manufacturing Hubs and Trade Agreements

Rising apparel production in developing economies such as India, Bangladesh, and Vietnam presents expansion opportunities for localized fastener facilities. Regional trade pacts, like RCEP and India’s PLI scheme for textiles, encourage investment in domestic fastener production, reducing import dependency and improving regional supply security.

Product Type Insights

Zippers dominate the market, holding roughly a 45% share in 2024. Their universal application across apparel, footwear, bags, and outerwear ensures continued demand. Advanced sub-types such as waterproof, invisible, and two-way zippers are increasingly preferred by sportswear and premium fashion brands. Buttons represent the second-largest segment, particularly in casual and formal wear, while snaps and Velcro closures continue to grow in children’s clothing and accessories.

Material Insights

Metal fasteners account for over 40% of global revenue, reflecting their durability and aesthetic appeal in denim, jackets, and luxury goods. While plastic fasteners dominate in volume, rising environmental concerns are driving a gradual shift to recyclable metal alloys and bio-composite alternatives. Innovations such as corrosion-resistant coatings and decorative metal plating further reinforce metal’s leadership position.

Application Insights

Outerwear and sportswear applications lead the market, capturing over 50% share of fastener usage in 2024. The segment benefits from growth in performance wear and active lifestyle trends, where technical zippers, snaps, and adjustable buckles enhance garment functionality. Accessories, including bags and footwear, represent fast-growing sub-segments as premium brands invest in design-integrated closures that enhance product differentiation.

Distribution Channel Insights

Offline B2B and wholesale channels dominate, supplying bulk quantities directly to garment factories and brands. However, online distribution is the fastest-growing channel, enabling smaller apparel manufacturers and designers to access customized fasteners globally. Direct-to-manufacturer sales and e-procurement platforms are anticipated to reshape the industry’s supply dynamics by 2030.

End-Use Industry Insights

The apparel industry remains the primary end-use sector, accounting for nearly 70% of total demand. Within this, outerwear, denim, and sportswear drive the majority of fastener consumption. Emerging end-uses include smart garments, medical wear, and protective clothing, where functionality and ease of use are critical. Export-driven apparel production in the Asia Pacific underpins global fastener consumption growth.

| By Product Type | By Material Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia Pacific dominates the clothing fastener market with a 45% global share in 2024. China remains the largest producer and exporter, followed by India, Bangladesh, and Vietnam. Regional growth is supported by large-scale apparel manufacturing, low production costs, and expanding domestic fashion demand. India and Vietnam are the fastest-growing markets, each posting above-average CAGR during 2025–2030.

North America

North America holds approximately 25% of global revenue, driven by demand for premium and sustainable fasteners in the U.S. apparel industry. Major brands prioritize supply-chain transparency, stimulating demand for traceable and eco-certified fasteners. Domestic production remains limited, but imports from Asia support the bulk of supply.

Europe

Europe represents around 20% of the market, underpinned by strong sustainability mandates and premium fashion sectors. Countries such as Germany, Italy, and France lead the adoption of recycled and organic fasteners. EU regulations on circular textiles are prompting large-scale conversion toward environmentally responsible materials.

Latin America

Latin America accounts for about 5% of the market, led by Brazil and Mexico. The region’s apparel and footwear industries are expanding, creating localized demand for zippers, buttons, and buckles. Trade partnerships with Asia are expected to increase import flows of fasteners into the region.

Middle East & Africa

MEA contributes roughly 5% share but shows rising growth. South Africa’s apparel sector and GCC’s luxury fashion markets are emerging demand centers. Industrial diversification in the UAE and Saudi Arabia supports increased imports of high-end fasteners for branded apparel production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clothing Fastener Market

- YKK Corporation

- Coats Group plc

- Prym Group

- IDEAL Fastener Corporation

- RIRI Group

- SBS Zipper

- Weixing Group

- Talon International Inc.

- Duraflex Company Ltd.

- Kamal Group

- Universal Fasteners Ltd.

- M. Cohen & Sons Ltd.

- Bangsberg Manufacturing

- Buttons & Buckles Inc.

- Pulltex Fasteners

Recent Developments

- In April 2025, YKK Corporation introduced a new line of biodegradable zippers targeting sustainable apparel brands in Europe and North America.

- In March 2025, Coats Group announced the expansion of its eco-fastener manufacturing facility in Vietnam under its sustainability investment program.

- In January 2025, Prym Group launched RFID-integrated fasteners for smart-apparel supply-chain tracking, improving brand traceability and anti-counterfeiting measures.