Cigarette Filters Market Size

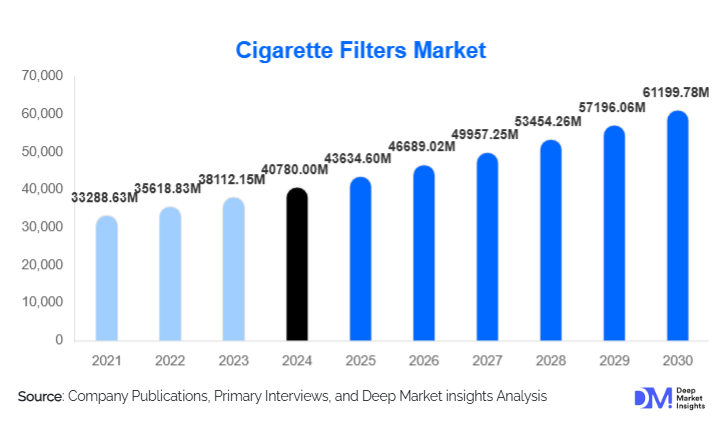

According to Deep Market Insights, the global cigarette filters market size was valued at USD 40,780 million in 2024 and is projected to grow from USD 43,634.6 million in 2025 to reach USD 61,199.78 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). This growth reflects increasing demand for conventional cigarette filters, innovation in filter technology (such as capsule filters and biodegradable materials), and rising regulatory pressure on filter waste management globally.

Key Market Insights

- Cellulose acetate remains the dominant filter material, owing to its cost efficiency, established supply chains, and widespread use in mass-market cigarettes. It currently accounts for the majority of filter volume.

- Sustainability is a growing differentiator, with biodegradable and compostable filters gaining traction due to environmental regulations and consumer pressure to reduce cigarette butt pollution.

- Premium filter variants (e.g., capsule, dual-layer, and activated-carbon filters) are increasingly adopted by tobacco companies to enhance flavor, reduce perceived harm, and differentiate their products.

- Emerging markets in Asia-Pacific, particularly China and India, dominate consumption, driven by high smoking prevalence and large populations.

- Heat-Not-Burn (HNB) products are reshaping filter demand, as they require specialized filter designs and are gaining market share in certain geographies.

- Independent filter converters remain critical suppliers, but integrated chemical companies (two producers) maintain a strong influence through control of raw material production and long-term contracts.

Latest Market Trends

Sustainable and Biodegradable Filter Adoption

One of the most pressing trends shaping the cigarette filters market is the shift toward more eco-conscious materials. With growing regulatory scrutiny on single-use plastics and environmental pollution, filter manufacturers are investing heavily in biodegradable and compostable alternatives. These novel filters, often made with plant-based fibers or water-soluble polymers, appeal to both regulators and consumers. As sustainability becomes a core part of brand strategies, tobacco firms are increasingly collaborating with filter converters and tow producers to develop next-generation “green” filters that can degrade more rapidly in the environment, reducing the burden of cigarette butt waste.

Innovation in Premium Filters

Innovation is accelerating in the filter space, particularly around capsule (flavor) filters, dual-layer configurations, and high-performance activated-carbon filters. These advanced designs allow companies to deliver altered taste profiles, better filtration, and a differentiated user experience. Capsule filters enable smokers to change flavor mid-smoke, while dual-layer filters combine different materials (e.g., acetate plus carbon) for improved filtration. Such enhancements help tobacco companies target premium and reduced-risk product lines, especially in markets where HNB and flavored cigarettes are gaining traction.

Market Drivers

Health Awareness and Demand for Harm Reduction

As consumers and regulators become more health-conscious, there is an increasing demand for filters that reduce tar, nicotine, and other harmful constituents. Tobacco companies are responding by deploying multi-layer filters, charcoal-impregnated designs, and more efficient filter materials, which help improve the perceived safety profile of cigarettes, driving greater acceptance and adoption.

Regulatory Pressure and Environmental Legislation

Governments around the world are tightening laws relating to cigarette waste, microplastics, and single-use products. This regulatory pressure is incentivizing filter manufacturers to innovate with biodegradable materials, water-dispersible fibers, and other environmentally friendly solutions. Compliance with such regulations is becoming a core driver of product development and capital investment in the filter sector.

Technological Advancement & Premiumization

Filter makers are investing in R&D to create value-added products like flavor-capsule filters, dual-material filters, and smart filters. These innovations not only cater to premium and niche segments but also command higher margins. The push for differentiated and next-generation tobacco products (e.g., HNB) further accelerates the adoption of these advanced filters.

Market Restraints

Declining Smoking in Mature Markets

Despite innovation, smoking rates are falling in many developed markets due to public health campaigns, rising taxes, and stricter regulations. This decline limits growth for traditional cigarette filter demand in those geographies, putting pressure on volume-based business models.

High Cost of Sustainable Production

Developing biodegradable or eco-friendly filters is capital-intensive, requiring R&D, new equipment, and novel materials. These costs can be challenging to absorb, particularly for independent filter converters. Ensuring that eco-friendly filters match the performance of traditional acetate filters (in terms of filtration, taste, consistency) is also technically difficult, which may slow the adoption of greener alternatives.

Market Opportunities

Expansion of Biodegradable / Compostable Filters

As environmental regulation tightens globally and consumers demand greener products, there is a significant opportunity for filter manufacturers to differentiate through biodegradable and compostable filter solutions. Investing in plant-based fibers, bio-polymer blends, and water-soluble materials positions companies to lead in a future where disposal and sustainability matter as much as cost.

Growth in Next-Generation Tobacco (HNB and Capsule Cigarettes)

The rise of heat-not-burn products and flavored capsule cigarettes opens a major opportunity for filter innovation. Specialized filters tailored for HNB devices and capsule-enabled taste modulation can help converter companies partner with tobacco firms launching new product lines, thereby capturing premium value.

Emerging Market Volume Play

Emerging regions, especially in the Asia-Pacific, present a strong volume opportunity. By establishing local production in high-consumption markets, filter manufacturers can reduce logistics costs, respond more quickly to regulatory and consumer shifts, and benefit from growing consumption. Additionally, export opportunities to emerging markets make scale-efficient production attractive.

Product-Type Insights

The global cigarette filters market continues to be shaped by evolving consumer behavior, regulatory expectations, and technological advancements. Regular (Monolayer) Filters remain the dominant product type worldwide, largely due to their low production cost, high manufacturing speed, material efficiency, and widespread adoption in low- and mid-tier cigarette brands. Their simplicity and compatibility with existing high-throughput cigarette-making equipment strengthen their leadership position. Meanwhile, Capsule Filters, featuring breakable flavor capsules, are witnessing rapid global adoption. These filters provide enhanced sensory experiences, higher consumer engagement, and allow cigarette brands to differentiate with unique flavor profiles. This segment’s growth is primarily driven by rising demand for flavored cigarettes in Asia-Pacific, Latin America, and parts of Europe.

Dual-Layer Filters, combining cellulose acetate with activated carbon or other specialized materials, are gaining traction among smokers seeking smoother taste and perceived harm reduction. Their ability to trap volatile compounds positions them as a preferred option for premium cigarette lines. Finally, Biodegradable and eco-friendly filters are emerging as a critical growth category in response to increasing global scrutiny on cigarette butt pollution and microplastics. Using plant-based fibers, rapidly degradable cellulose materials, or water-dispersible polymers, these filters align with sustainability commitments adopted by major tobacco firms. Although still a smaller segment, its expansion is fueled by regulatory pressures in Europe and North America and ongoing R&D investments by leading filter manufacturers.

Application Insights

The market remains strongly centered on conventional combustible cigarettes, which dominate application demand due to their global prevalence and the large-scale procurement of filter rods by tobacco manufacturers. This segment continues to account for the bulk of volume despite gradual declines in smoking rates in developed nations. The Heat-Not-Burn (HNB) category is, however, the fastest-growing application. These products require specialized filter-like components engineered for aerosol cooling, flavor enhancement, and controlled particulate delivery. HNB growth is driven by rising consumer interest in reduced-risk products, particularly in Japan, South Korea, Italy, and the U.S.

The Roll-Your-Own (RYO) segment is also expanding as cost-sensitive consumers increasingly shift toward DIY smoking formats. RYO filters, often sold through retail and online channels, offer opportunities for biodegradable innovations and reusable filter concepts. Lastly, hybrid and vaping-like devices, including capsule-enabled e-cigarettes, form a niche but growing application area. These products cater to consumers searching for novel sensory experiences and hybrid tobacco–vapor solutions.

Distribution Channel Insights

The cigarette filters supply chain is predominantly B2B-driven, with major cigarette manufacturers sourcing filter rods and cellulose acetate tow through long-term procurement agreements. These relationships create stability and ensure uninterrupted mass production.

In contrast, the B2C segment plays a larger role in the RYO filter tips market, where filters are sold through convenience stores, tobacco shops, and expanding e-commerce channels. Online retail is particularly important in markets with high DIY adoption, offering consumers access to premium, flavored, and eco-friendly filter options. At the converter level, OEM-style supply partnerships between filter manufacturers and tobacco companies remain essential. These collaborations enable co-development of advanced filter technologies such as flavored capsules, dual-layer filtration systems, and biodegradable variants.

End-User Type Insights

Global demand is predominantly driven by large tobacco manufacturers, which require high-volume filter rods for standardized production across multiple cigarette categories. Their focus on cost efficiency, operational reliability, and product consistency sustains demand for regular and dual-layer filters. Independent filter converters play a significant role as well, offering customization, rapid innovation cycles, and localized supply in emerging markets. These converters serve both international tobacco giants and regional cigarette brands.

Next-generation tobacco companies, particularly those involved in HNB and novel flavored cigarette formats, represent a fast-growing end-user segment. Their need for engineered filters with precise aerosol, temperature, and flavor performance is reshaping R&D strategies across the industry. Additionally, the consumer segment, composed of RYO users, contributes to demand for standalone filter tips, biodegradable options, and flavored filters. The rising popularity of RYO culture in Europe and Asia-Pacific adds momentum to this category.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific (especially China and India) commands the largest share of the cigarette filters market, estimated at 40% of global demand in 2024. High smoking prevalence, large populations, and strong domestic production drive this dominance. China’s state-owned tobacco industry, coupled with local tow and filter-rod manufacturing, anchors much of the region’s demand. India’s growing middle class, urbanization, and thriving RYO segment also contribute significantly.

North America

In North America (primarily the U.S. and Canada), the market is mature but still significant, representing about 15–20% of global market share in 2024. While conventional smoking is declining, premium filters (capsules, dual-filter) and next-gen tobacco products (HNB) are helping maintain demand. Innovation and sustainability trends are also important as regulatory pressure increases.

Europe

Europe accounts for roughly 10–15% of global filter demand. The region’s stringent environmental regulations are pushing filter makers to develop biodegradable solutions. Consumer awareness of cigarette butt pollution, combined with regulatory initiatives on microplastics and single-use products, is fueling the adoption of greener filter technologies.

Latin America

Latin America (e.g., Brazil, Mexico) contributes approximately 8–12% of the market. Traditional cigarette consumption remains strong, and the RYO segment is relevant. Local filter converters and export-based production support demand. As tobacco consumption remains relatively stable, incremental growth is driven by filter innovation and regional manufacturing investment.

Middle East & Africa

MEA’s share is estimated at 5–10%, though growth is accelerating. Rising youth population, increased urbanization, and demand for flavored and premium cigarettes create opportunities. Additionally, export of filter rods and components from Asia to African markets is an emerging trend. Regulatory pressure on waste and single-use plastic in some countries may further accelerate demand for sustainable filters.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cigarette Filters Market

- Eastman Chemical Company

- Celanese Corporation

- Daicel Corporation

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Toray Industries, Inc.

- Ahlstrom-Munksjö

- Sichuan Push Acetati Co., Ltd.

- Rayonier Advanced Materials

- Cerdia International GmbH

- Nantong Cellulose Fibers Co., Ltd.

- Kunming Cellulose Fibers

- Filtrona / Essentra PLC

- Sappi Limited