Chunky Sneaker Market Size

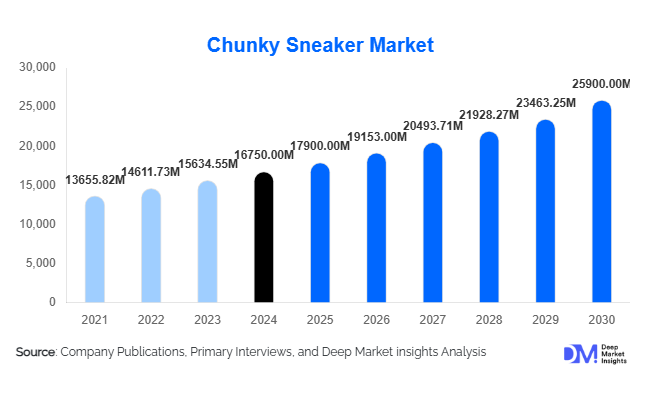

According to Deep Market Insights, the global chunky sneaker market size was valued at USD 16,750 million in 2024 and is projected to grow from USD 17,900 million in 2025 to reach USD 25,900 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The growth of the chunky sneaker market is primarily driven by rising adoption of athleisure fashion, increasing popularity of sustainable and premium footwear, and the expansion of digital and e-commerce channels enabling global accessibility.

Key Market Insights

- Lifestyle and casual wear dominate the chunky sneaker market, driven by urban millennials and Gen Z consumers seeking comfort without compromising style.

- North America holds the largest market share, with strong brand penetration, celebrity endorsements, and high disposable incomes fueling demand.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes, e-commerce adoption, and increasing fashion-conscious urban populations.

- Europe demonstrates steady growth, particularly in Germany, France, and the UK, due to demand for premium and designer sneakers.

- Sustainable and tech-enhanced sneakers are gaining traction, with eco-friendly materials and smart design innovations appealing to environmentally conscious and tech-savvy consumers.

- Online retail and direct-to-consumer channels are reshaping consumer engagement, providing convenience, personalized marketing, and global reach.

Latest Market Trends

Rise of Athleisure and Lifestyle-Driven Demand

The chunky sneaker trend has evolved beyond niche streetwear into mainstream fashion, with consumers embracing sneakers that offer both style and functionality. Lifestyle-focused chunky sneakers, particularly low-top and mid-top designs, are increasingly popular in daily wear, office casuals, and urban environments. Influencer marketing, celebrity endorsements, and social media trends have accelerated the visibility and adoption of these products across global markets. Consumers are prioritizing versatile designs that complement a variety of outfits while providing comfort and durability.

Sustainable and Smart Sneaker Innovations

Brands are integrating sustainable materials such as recycled plastics, organic fabrics, and vegan leather into chunky sneakers, meeting growing environmental and ethical consumer preferences. Additionally, technological innovations such as 3D-printed soles, fitness tracking insoles, and improved cushioning technologies are emerging as differentiators. Companies adopting these eco-friendly and tech-enabled designs are capturing premium buyers, boosting brand reputation, and positioning themselves for long-term growth.

Chunky Sneaker Market Drivers

Celebrity and Pop Culture Influence

High-profile collaborations and celebrity endorsements significantly shape purchase behavior. Social media campaigns on Instagram, TikTok, and YouTube influence trends and brand desirability, particularly among younger demographics. Limited edition releases and designer partnerships are driving hype and creating premium demand segments.

Growth of E-Commerce Channels

The rise of online retail and direct-to-consumer platforms allows consumers to access global brands conveniently. Dynamic pricing, AR try-on experiences, and fast delivery services enhance purchasing experiences. Brands investing in e-commerce strategies are reaching previously untapped regional markets, accelerating adoption and sales growth.

Increasing Urbanization and Lifestyle Changes

Urban populations across Asia-Pacific, North America, and Europe are increasingly seeking comfortable yet stylish footwear for daily activities. Rising disposable incomes, urban mobility, and casual workplace norms contribute to growing demand for lifestyle-oriented chunky sneakers. This urban-driven trend is expected to continue over the forecast period.

Market Restraints

High Competition and Market Saturation

The global chunky sneaker market faces intense competition from both global brands and emerging regional players. High marketing expenses, price wars, and brand imitation can impact profitability and slow growth in saturated urban markets. Differentiation through design, sustainability, and technology remains critical.

Raw Material Price Volatility

Fluctuations in leather, synthetic materials, and rubber prices directly affect production costs. Manufacturers must optimize sourcing strategies to maintain profitability without increasing retail prices, which could negatively impact demand in price-sensitive markets.

Chunky Sneaker Market Opportunities

Emerging Market Expansion

Emerging economies such as India, Indonesia, Vietnam, and Brazil present significant growth opportunities. Increasing urbanization, rising disposable incomes, and growing awareness of global fashion trends are driving demand. Companies can leverage region-specific marketing, collaborations with local influencers, and affordable product lines to capture market share.

Integration of Sustainable and Tech-Enabled Designs

Eco-friendly sneakers made from recycled materials and smart features such as cushioning technology, enhanced durability, or wearable fitness tracking are gaining consumer interest. Brands prioritizing sustainability and innovation are differentiating themselves in competitive markets and capturing premium segments.

Omnichannel Retail and Digital Engagement

Investment in online platforms, social media marketing, AR try-on experiences, and influencer campaigns provides opportunities to reach global consumers effectively. Direct-to-consumer strategies and interactive digital experiences can improve engagement, conversion, and loyalty, particularly among younger, tech-savvy shoppers.

Product Type Insights

Low-top chunky sneakers lead the global market with a 40% share of total 2024 sales, driven by comfort, versatility, and urban appeal. Mid-range leather and synthetic sneakers contribute 45% of revenue, balancing affordability and durability. High-top and premium designer sneakers account for a smaller, niche market, appealing to fashion-conscious consumers and luxury buyers seeking exclusivity.

Application Insights

Lifestyle and casual wear remain the dominant application with 55% share of the market. Sports and performance applications, while smaller, are growing rapidly due to gym culture and outdoor fitness trends. Emerging hybrid applications include fashion-performance sneakers suitable for office casuals, travel, and streetwear trends.

Distribution Channel Insights

Online retail dominates 30% of the market and is the fastest-growing channel. Offline retail continues to hold a significant share, particularly brand outlets and specialty stores. Direct-to-consumer channels are expanding as brands enhance digital engagement, AR try-on capabilities, and personalized online experiences. E-commerce allows for international reach, faster adoption, and increased sales through promotional campaigns.

Traveler Type Insights

Urban millennials and Gen Z consumers represent the largest demographic for chunky sneakers, prioritizing fashion, comfort, and brand appeal. Middle-aged consumers (31–50 years) drive demand for mid-range sneakers, balancing quality and affordability. High-income adults (>50 years) remain a key segment for luxury and designer sneakers. Children and teens are growing segments for lifestyle-focused, affordable chunky sneakers.

| By Product Type | By Material | By End-Use/Application | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global market share in 2024. The U.S. is the largest contributor, driven by strong brand penetration, pop culture influence, and high disposable income. Canada also contributes significantly, with urban youth adopting global fashion trends. North America remains a high-value market for limited-edition and premium sneakers.

Europe

Europe represents 28% of the global market share, with Germany, France, and the UK as key markets. Consumers in this region prefer premium and designer sneakers, emphasizing sustainability and quality. Spain and Italy are fast-growing markets, particularly among younger demographics adopting online shopping and urban streetwear trends.

Asia-Pacific

The Asia-Pacific region is the fastest-growing, led by China, India, Japan, and Australia. Rising middle-class incomes, urbanization, and e-commerce adoption are driving the adoption of both premium and mid-range sneakers. Social media influence and fashion trends further boost demand in urban centers.

Latin America

Brazil and Mexico lead demand, focusing on mid-range sneakers for lifestyle and casual wear. The growing urban youth population and rising disposable incomes are fueling the adoption of global fashion trends. Outbound trade for premium sneakers is gradually increasing among affluent consumers.

Middle East & Africa

Premium and lifestyle sneakers dominate in high-income markets such as the UAE, Saudi Arabia, and Qatar. Africa’s domestic market is growing slowly, but intra-regional trade is expanding, particularly in South Africa, Nigeria, and Kenya. High-income expatriates and urban youth are primary demand drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chunky Sneaker Market

- Nike

- Adidas

- Puma

- New Balance

- Skechers

- ASICS

- Reebok

- Converse

- Vans

- Fila

- Under Armour

- Balenciaga

- Gucci

- Prada

- Alexander McQueen

Recent Developments

- In March 2025, Adidas launched a sustainable chunky sneaker line using recycled polyester and eco-friendly packaging, targeting environmentally conscious consumers globally.

- In February 2025, Nike introduced smart cushioning technology in select chunky sneaker models, enhancing comfort and performance for casual and athletic users.

- In January 2025, Puma expanded its online direct-to-consumer platform in Asia-Pacific, leveraging AR-based try-on features and influencer-driven campaigns to boost engagement and sales.