Christmas Lights and Christmas Decorations Market Size

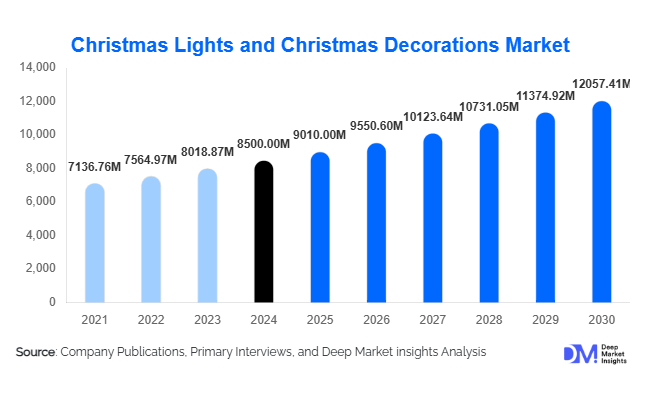

According to Deep Market Insights, the global Christmas Lights and Christmas Decorations market was valued at USD 8,500 million in 2024 and is projected to grow from USD 9,010.00 million in 2025 to reach USD 12,057.41 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer spending on festive décor, the widespread adoption of LED and smart lighting technologies, and the increasing penetration of online retail channels across emerging markets. Furthermore, a strong emphasis on sustainability and the shift toward energy-efficient decorations are reshaping product innovation and consumer preferences worldwide.

Key Market Insights

- Decorative lighting remains the dominant product category, accounting for nearly 44% of global revenue in 2024, supported by rising adoption of LED and smart lighting systems.

- Residential applications lead the market with approximately 65% share in 2024, driven by consumer enthusiasm for home décor and outdoor festive lighting.

- North America represents the largest regional market, contributing nearly 38% of global sales, with the United States leading demand for both residential and commercial installations.

- Asia-Pacific is the fastest-growing region, supported by rapid urbanization, expanding middle-class income, and growing e-commerce participation.

- Smart and connected décor is emerging as a premium segment, featuring IoT integration, app-based control, and voice-activated functionality.

- Sustainability initiatives, including the use of recyclable materials and low-energy LED products, are becoming central to market competitiveness.

Latest Market Trends

Smart and Connected Christmas Decorations

Technological innovation is reshaping the festive décor landscape. Consumers increasingly prefer connected products such as smart string lights, programmable outdoor displays, and app-controlled ornaments that offer customizable lighting effects. Integration with virtual assistants like Alexa or Google Home enhances user convenience and interactivity. Smart décor also allows homeowners to automate lighting schedules and sync displays with music or seasonal themes. Manufacturers are leveraging these trends by introducing IoT-enabled products and energy-efficient solutions, aligning with global sustainability goals while enhancing user experience and personalization.

Eco-Friendly and Sustainable Décor Products

Growing environmental awareness among consumers is driving a shift toward sustainable décor options. Manufacturers are emphasizing eco-friendly materials such as recycled plastics, biodegradable ornaments, and energy-efficient LED lighting. Additionally, artificial Christmas trees made from recycled polymers and solar-powered outdoor displays are gaining traction in Western and Asian markets alike. Retailers are responding with sustainability-certified product lines, while municipalities are adopting solar-powered lighting for large-scale displays. This trend reflects the broader global movement toward green consumerism and circular-economy production models in the home décor industry.

Christmas Lights and Decorations Market Drivers

Rising Household Spending on Festive Décor

Growing disposable income and an expanding middle class across developed and emerging economies have boosted consumer spending on holiday decorations. The emotional and cultural appeal of Christmas festivities drives household purchases of new ornaments, trees, and lighting systems each year. Social media platforms further amplify this demand by encouraging visually appealing home décor trends, resulting in annual product upgrades and higher-value purchases. This rising consumer enthusiasm continues to be a fundamental growth driver of the market.

Advancements in LED and Smart Lighting Technology

The transition from incandescent bulbs to LED-based lighting has revolutionized the décor industry. LED lights offer longer lifespans, lower power consumption, and enhanced color versatility, leading to widespread adoption. The introduction of smart lighting systems—capable of app control, automation, and synchronized color effects—has added a new dimension of personalization to festive displays. Continuous innovation in energy-efficient lighting solutions and smart décor integration is expected to sustain growth over the next decade.

Expansion of E-commerce and Global Retail Networks

Online retail is rapidly transforming the sales landscape for holiday décor. Consumers increasingly prefer e-commerce platforms for convenience, variety, and competitive pricing. The availability of international products through major online marketplaces such as Amazon, Alibaba, and Walmart has expanded global accessibility. Additionally, the rise of direct-to-consumer (D2C) brands enables manufacturers to reach niche markets more effectively, enhancing profitability and brand visibility during peak holiday seasons.

Market Restraints

Seasonal Demand Concentration

One of the primary challenges in this market is its highly seasonal demand cycle. Most purchases occur within the final quarter of the year, limiting revenue consistency and inventory turnover. Manufacturers and retailers must manage production schedules and supply chains effectively to handle this short yet intense sales window, which also impacts cash flow and long-term investment decisions.

Volatility in Raw Materials and Shipping Costs

Fluctuations in the prices of key raw materials such as plastics, metals, and electronic components significantly impact production costs. Additionally, global shipping disruptions and rising freight charges have pressured profit margins, particularly for products manufactured in Asia and exported to Western markets. These factors can constrain competitiveness for low-margin players and delay product availability during peak seasons.

Christmas Decorations Market Opportunities

Smart Lighting and IoT Integration

Integration of IoT and smart connectivity in decorative lighting presents one of the most promising opportunities in this market. App-controlled, color-changing lights and voice-activated decorations are appealing to tech-savvy consumers seeking convenience and creativity. As 5G and smart-home adoption accelerate, connected décor solutions will expand rapidly, opening doors for premium product categories and cross-industry collaborations between décor manufacturers and technology firms.

Emerging Markets and Regional Expansion

Emerging economies across Asia-Pacific, Latin America, and the Middle East are witnessing increased adoption of Western-style festive celebrations. Rising disposable income and expanding online retail infrastructure are fueling décor consumption in these regions. Companies investing in localized production, culturally adapted products, and affordable LED-based decorations are well-positioned to capture this untapped demand. India, China, and Brazil are expected to emerge as key growth contributors during the forecast period.

Commercial and Public Display Installations

Beyond residential consumption, large-scale commercial installations in malls, hotels, and city centers represent an expanding revenue stream. Governments and corporations increasingly invest in festive lighting displays to boost tourism and retail activity. This trend supports demand for high-value, energy-efficient lighting systems and customized décor installations. Companies specializing in turnkey solutions and outdoor display technologies stand to benefit from this segment’s rapid growth.

Product Type Insights

Decorative lighting dominates the market, accounting for approximately 44% of the global market in 2024. The popularity of LED string and net lights, projection lighting, and novelty displays drives this segment’s leadership. Their versatility, lower energy use, and long lifespan make them the preferred choice among consumers and municipalities alike. Smart lighting products, in particular, are expanding this segment by merging aesthetics with functionality.

Application Insights

Residential applications hold around 65% of the total market share, driven by strong cultural traditions and increasing consumer interest in home beautification. The growth of outdoor lighting and social media-inspired décor trends further supports this dominance. Meanwhile, commercial and municipal applications are emerging rapidly, as large-scale installations and themed events gain popularity among retail and tourism sectors.

Distribution Channel Insights

Online retail is the fastest-growing distribution channel, representing approximately 30–35% of global sales. E-commerce platforms offer diverse product portfolios, convenience, and international accessibility. The rise of D2C sales and online-exclusive product launches is reshaping the traditional retail landscape. Offline retail remains significant for impulse purchases and experiential in-store displays, but digital channels are clearly gaining traction, especially among younger consumers.

| By Product Type | By Distribution Channel | By End Use | By Technology Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 38% share in 2024. The U.S. dominates due to its deeply ingrained Christmas traditions, widespread adoption of outdoor lighting, and strong purchasing power. Commercial displays in malls and public areas continue to expand, while online retail platforms fuel incremental growth. Canada follows closely, supported by rising demand for sustainable décor options and LED transitions.

Europe

Europe holds roughly 28% of the global market, with Germany, the U.K., and France leading demand. The region is characterized by a preference for premium and eco-friendly decorations. Sustainable LED lighting, handcrafted ornaments, and reusable artificial trees are particularly popular. Eastern European countries are experiencing rising demand as Western décor trends permeate new markets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for nearly 22% of the market in 2024. Rapid urbanization, a growing middle class, and Western cultural influence are driving strong uptake of Christmas decorations. China is both the largest producer and a rapidly expanding consumer market. India, Japan, and Australia also show increasing adoption of festive décor, particularly through online channels. The region’s CAGR is expected to exceed 8% through 2030.

Latin America

Latin America accounts for about 6% of the global market, led by Brazil and Mexico. Rising disposable incomes, expanding retail infrastructure, and growing Western cultural influence support market expansion. Seasonal décor adoption is becoming more widespread, particularly in urban centers and hospitality venues.

Middle East & Africa

The Middle East & Africa region represents nearly 8% of global revenue. Demand is concentrated in GCC nations, including the UAE and Saudi Arabia, where luxury retail developments and tourism initiatives drive festive décor investment. Africa’s growth is centered around South Africa and Nigeria, where urban retail expansion fuels seasonal sales. The region’s future growth will be supported by public display projects and commercial installations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Christmas Lights and Decorations Market

- Balsam Hill

- Amscan (Party City)

- Barcana (The Decor Group)

- Roman, Inc.

- Tree Classics

- Crystal Valley

- Festive Productions Ltd

- Hilltop Decorations

- Kurt S. Adler

- Philips Lighting

- GE Lighting

- Kingtree

- Blachere Illumination

- Holiday Bright Lights

- National Tree Company

Recent Developments

- In December 2024, Philips Lighting launched a new range of app-controlled LED string lights featuring music synchronization and energy-optimized chips.

- In November 2024, Balsam Hill introduced its first line of recyclable artificial Christmas trees designed to reduce environmental impact.

- In October 2024, Blachere Illumination expanded its municipal lighting projects across Europe with solar-powered decorative installations.