Children Tableware Market Size

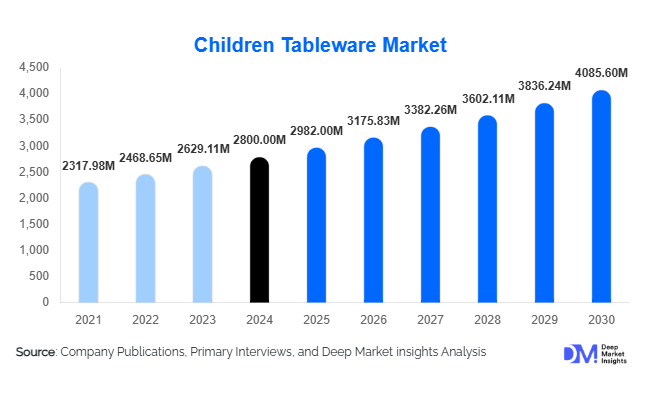

According to Deep Market Insights, the global children tableware market size was valued at USD 2,800 million in 2024 and is projected to grow from USD 2,982 million in 2025 to reach USD 4,085.60 million by 2030, expanding at a CAGR of 6.5% during 2025–2030. This growth is driven by increasing parental awareness of child-safe dining products, expanding demand for eco-friendly materials such as silicone and bamboo, and the rising penetration of online retail channels offering themed and premium children’s tableware worldwide.

Key Market Insights

- Health-conscious and eco-friendly materials are reshaping the market, with BPA-free, food-grade silicone, and bamboo-fiber products gaining strong traction among parents globally.

- Online retail has become a core sales channel, with parents preferring digital platforms for convenience, variety, and easy product comparison.

- Asia-Pacific is the fastest-growing region, driven by expanding middle-class populations in China and India, urbanization, and increasing awareness of child hygiene and nutrition.

- North America remains the largest market by value, supported by high consumer spending and established safety standards for child-feeding products.

- Character-themed, ergonomic, and training-based tableware are creating new revenue streams through personalization and design innovation.

- Eco-safe manufacturing and government incentives for sustainable production (e.g., “Make in India”, “Made in China 2025”) are encouraging capital investment in the sector.

Latest Market Trends

Eco-Friendly & Sustainable Material Adoption

Manufacturers are increasingly shifting toward sustainable materials such as bamboo composites, biodegradable plastics, and food-grade silicone to meet the growing demand for non-toxic, environmentally safe products. Parents are actively avoiding products with BPA, phthalates, and heavy metals, accelerating the market transition away from conventional plastics. This trend is particularly prominent in Europe and North America, where eco-labels and compliance certifications drive purchase decisions. Product innovation now focuses on recyclable packaging, plant-based polymers, and reusable training tableware that align with global sustainability goals.

Digitally-Driven Direct-to-Consumer Sales Growth

Online platforms such as Amazon, Walmart Online, and brand-owned e-commerce portals are becoming the dominant retail channel for children’s tableware. The convenience of home delivery, extensive catalogs, and easy price comparison appeal strongly to young parents. Brands leverage social media, influencer marketing, and subscription models to sustain customer engagement. This channel also supports personalized product offerings such as name-engraved or themed sets, boosting repeat sales and customer loyalty. Digital penetration is expected to surpass 25 % of global sales by 2030, with omnichannel integration (online + offline) becoming the new standard.

Children Tableware Market Drivers

Rising Parental Awareness of Safety and Hygiene

Global parents are increasingly informed about the impact of materials and design on child safety. The surge in BPA-free, phthalate-free, and dishwasher-safe products reflects this trend. Government regulations and health organizations emphasizing safe feeding utensils further reinforce market expansion, particularly in developed economies.

Expanding Middle-Class and Changing Family Dynamics

Emerging markets such as China, India, and Brazil are witnessing rising disposable incomes and smaller family sizes, leading to higher per-child spending. Working parents prioritize convenience and durability, fueling demand for multifunctional and spill-proof designs. This socio-economic shift supports the steady growth of the global children tableware industry.

E-Commerce Penetration and Product Accessibility

The global spread of online retail has democratized access to children’s tableware, connecting niche brands and specialized products to global consumers. Online distribution enables cost efficiencies, transparent reviews, and a platform for eco-friendly and premium brands to reach parents directly, thus driving growth across price segments.

Market Restraints

Raw Material Cost Volatility

The cost of key materials such as silicone, bamboo fiber, and BPA-free plastics fluctuates due to supply-chain constraints and energy-price volatility. Manufacturers face pressure to maintain margins while adhering to strict safety and environmental standards, particularly in cost-sensitive markets.

Market Saturation in Developed Economies

In mature markets like the U.S. and Western Europe, children’s tableware penetration is already high. Intense price competition among private labels and imported low-cost goods restricts further volume growth, compelling established brands to innovate through design and sustainability to sustain profitability.

Children Tableware Market Opportunities

Sustainable Material Innovation

Rising consumer preference for environmentally friendly, chemical-free products creates opportunities for manufacturers to invest in biodegradable materials, compostable plastics, and plant-based composites. Brands emphasizing transparency and sustainability certifications can capture premium market share and foster long-term loyalty.

Emerging Market Expansion

Asia-Pacific, Latin America, and Africa represent under-penetrated markets with rapidly growing populations of young children. Increasing e-commerce access, modernization of retail, and government support for local manufacturing create favorable entry conditions. Regional adaptations such as affordable pricing tiers and culturally relevant designs can unlock substantial growth potential.

Functional and Smart Tableware

Innovation opportunities exist in temperature-sensitive, suction-based, and interactive tableware designed for self-feeding and spill prevention. Integrating smart sensors or educational themes enhances product appeal to modern parents seeking convenience and learning benefits. Premium segments combining function and safety are expected to achieve double-digit growth through 2030.

Product Type Insights

Plates lead the global market, accounting for about 27 % of total revenue in 2024. Their ubiquity in every meal and rapid innovation, such as suction bases and divided compartments, have made them indispensable in both standalone and multi-piece sets. Bowls and cups & mugs follow closely, with increasing demand for ergonomic and spill-proof designs for toddlers and preschoolers. Multi-piece sets combining plates, bowls, and cutlery are emerging as a high-value segment driven by gifting trends.

Material Insights

Plastic remains the dominant material segment with approximately 45 % share in 2024, primarily due to affordability, durability, and lightweight features. However, silicone and bamboo composites are the fastest-growing categories, reflecting consumer preference for sustainable and toxin-free products. Silicone’s flexibility, heat resistance, and soft texture make it particularly suitable for infants and toddlers.

Age Group Insights

The toddler (3–5 years) segment leads with about 33 % of total demand in 2024. This age group represents the transition from assisted feeding to independent dining, spurring purchases of ergonomic, themed, and training tableware. Products for preschoolers (6–8 years) are also expanding as schools adopt reusable, child-safe tableware to replace disposables.

Distribution Channel Insights

Online retail is the fastest-growing distribution channel, accounting for 22 % of total sales in 2024. E-commerce provides global reach, transparency, and personalization, encouraging small and premium brands to compete effectively. Supermarkets & hypermarkets remain dominant in volume terms but face ongoing migration of premium consumers toward online platforms.

End-Use Insights

The household segment dominates, representing nearly 80 % of global consumption in 2024, as parents purchase tableware for home use. The commercial & institutional segment, including schools, day-care centers, and children’s restaurants, is expanding quickly with urbanization. Gift & specialty sets are also rising in popularity, creating new premium niches with customized and character-themed products.

| By Product Type | By Material | By Age Group / User | By Distribution Channel | By End-Use / Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global children tableware market with a 35 % share in 2024. The U.S. drives demand through strong retail infrastructure, parental awareness of safety regulations, and adoption of premium brands. Growth is moderate (4–5 %CAGR), but margins remain high due to premiumization trends.

Asia-Pacific

Asia-Pacific holds 29 % of the global market in 2024 and is the fastest-growing region (7–8 %CAGR). China and India lead, supported by expanding middle-class demographics and online retail growth. Increased child-health awareness and government emphasis on domestic manufacturing (“Made in China 2025”, “Make in India”) bolster regional production and exports.

Europe

Europe accounts for around 22 % of the global market in 2024. Sustainability is a defining factor, with high demand for bamboo, glass, and stainless-steel tableware. Germany, the U.K., and France dominate regional sales, and European brands are global pioneers in eco-friendly innovation.

Latin America

Latin America contributes roughly 6 % to global value. Brazil and Mexico are key markets with growing middle-class spending and rising awareness of child nutrition. Local manufacturing initiatives and import substitution policies are encouraging domestic production of affordable plastic and silicone products.

Middle East & Africa

The region accounts for about 8 % of the global market value. GCC countries such as Saudi Arabia and the UAE are seeing strong premium demand due to high household incomes. African markets show emerging potential with government programs promoting locally produced, reusable tableware to reduce plastic waste.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Children Tableware Market

- Munchkin Inc.

- Nuby USA

- Green Sprouts Inc.

- NUK USA LLC

- Tommee Tippee (Mayborn Group)

- OXO Tot

- Boon Inc.

- Innobaby LLC

- Joovy

- BabyBjörn AB

- Bumkins Finer Baby Products

- Skip Hop Inc.

- EZPZ

- B.Box

- Avanchy LLC

Recent Developments

- In May 2025, Munchkin Inc. announced a new line of biodegradable bamboo tableware designed for toddlers, expanding its sustainability-focused portfolio.

- In March 2025, Nuby USA partnered with major online retailers to launch a direct-to-consumer digital storefront featuring customizable children’s feeding sets.

- In January 2025, Tommee Tippee introduced its SmartEase series with temperature-responsive silicone bowls to enhance feeding safety.