Chargeable Ultrasonic Beauty Instrument Market Size

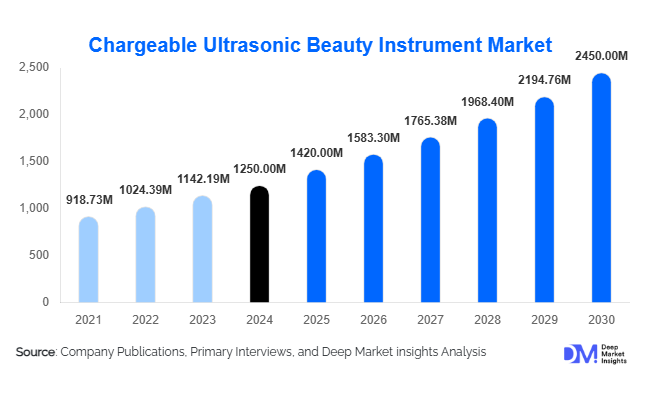

According to Deep Market Insights, the global chargeable ultrasonic beauty instrument market size was valued at USD 1,250 million in 2024 and is projected to grow from USD 1,420 million in 2025 to reach USD 2,450 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of non-invasive beauty treatments, the growing adoption of home-use and professional-grade devices, and innovations in AI- and IoT-enabled beauty instruments offering personalized skincare solutions.

Key Market Insights

- Handheld and portable devices are gaining immense popularity, providing consumers with convenient and cost-effective solutions for daily facial and body care at home.

- Professional-grade ultrasonic devices are increasingly adopted in aesthetic clinics and wellness centers, driven by the demand for anti-aging, skin tightening, and cellulite reduction treatments.

- North America dominates the global market, with the U.S. and Canada leading demand due to high disposable income and advanced adoption of beauty technologies.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, increasing beauty consciousness, and growing e-commerce penetration in countries like China, India, and South Korea.

- Technological innovation, including multi-frequency, AI-powered, and rechargeable devices, is reshaping consumer engagement and creating new opportunities for personalized treatments.

- Online retail channels are rapidly expanding, offering accessibility and convenience, particularly among millennial and Gen Z consumers seeking home-use devices.

Latest Market Trends

Shift Toward Home-Based Skincare Solutions

Consumers are increasingly preferring non-invasive, easy-to-use devices that can be integrated into daily skincare routines. Handheld ultrasonic beauty instruments are replacing corded and professional-only devices due to portability, ease of use, and affordability. The rise of social media influencers, skincare tutorials, and product reviews has further accelerated adoption in the home-use segment. Multi-functional devices that combine ultrasonic therapy with LED light therapy or microcurrent stimulation are particularly popular, reflecting a growing demand for all-in-one solutions.

Integration of AI and IoT in Devices

Technological advancements are driving innovation in the ultrasonic beauty device space. AI-enabled devices provide real-time skin analysis, personalized treatment recommendations, and usage tracking. IoT-enabled devices allow remote monitoring and data collection, connecting users to apps for long-term skincare management. These trends appeal strongly to tech-savvy consumers and professionals, creating differentiation opportunities for manufacturers. Such smart devices are rapidly gaining traction in premium and professional segments.

Chargeable Ultrasonic Beauty Instrument Market Drivers

Rising Consumer Awareness and Self-Care Trends

Consumers are increasingly aware of non-invasive anti-aging, skin tightening, and rejuvenation therapies. Home-based treatments using chargeable ultrasonic devices provide convenience, privacy, and cost-efficiency compared to clinic visits. Social media and influencer campaigns have heightened awareness, further boosting demand among millennials and Gen Z demographics.

Technological Innovations in Beauty Devices

Developments in multi-frequency, high-frequency, and rechargeable ultrasonic devices have significantly expanded their applications. Devices now cater to both facial and body treatments, including wrinkle reduction, cellulite reduction, and hair & scalp therapy. Advanced features like AI diagnostics and app connectivity create personalized experiences, driving consumer adoption in both home and professional segments.

Expansion of E-Commerce Channels

The rise of online sales platforms, including D2C websites and major e-commerce marketplaces, has made these devices more accessible globally. Consumers can compare products, read reviews, and purchase without visiting a store, accelerating market penetration. Online channels also support marketing innovations such as influencer campaigns, targeted ads, and subscription-based skincare models.

Market Restraints

High Initial Costs of Professional Devices

Professional-grade ultrasonic devices are expensive, often exceeding USD 1,500. This restricts adoption in smaller clinics, emerging markets, and among price-sensitive consumers. Without financing options or leasing models, market penetration may be limited in certain regions.

Regulatory Compliance and Safety Concerns

Devices must comply with stringent safety and technical standards, including FDA, CE, and ISO certifications. Non-compliance can delay market entry and restrict sales. Consumers may also be concerned about potential skin irritation or misuse, requiring manufacturers to invest in education and robust safety features.

Market Opportunities

Expansion in Emerging Economies

Rising disposable incomes and growing beauty consciousness in countries like India, Brazil, and Southeast Asian nations offer significant market potential. E-commerce penetration and government initiatives promoting local manufacturing enhance access, creating opportunities for both new entrants and established players.

Integration with Professional and Wellness Sectors

Salons, aesthetic clinics, and wellness centers increasingly adopt professional-grade ultrasonic devices for advanced facial, body, and hair treatments. Partnerships with clinics, bulk procurement, and customized professional devices present opportunities for manufacturers to expand revenue streams and strengthen brand presence.

Technological Advancements and Smart Devices

Devices integrated with AI, IoT, and multi-functional capabilities offer personalized skincare solutions, treatment tracking, and app connectivity. Such innovations cater to tech-savvy consumers and differentiate products in a crowded market. Integration with skincare products or tele-dermatology services can generate recurring revenue and enhance market penetration.

Product Type Insights

Handheld ultrasonic devices dominate the market, accounting for 45% of 2024 global sales. Their portability, affordability, and ease of use make them preferred among home consumers. Professional-grade devices and wearable instruments are growing steadily due to demand from clinics and wellness centers. The trend toward multi-functional, rechargeable devices is influencing purchase decisions, especially in premium segments.

Application Insights

Facial treatment remains the largest application, representing 50% of the global market in 2024. Anti-aging, wrinkle reduction, and skin rejuvenation are primary drivers. Body treatment applications, including slimming and cellulite reduction, and hair & scalp therapy, are emerging niches contributing to incremental growth. Consumer awareness and clinical validation have fueled adoption across all applications.

Distribution Channel Insights

Online retail channels hold 40% of the global market share, offering convenience, a wide selection, and price transparency. Offline retail, including beauty stores and pharmacies, remains important for brand visibility. Professional channels serve clinics, spas, and wellness centers, particularly for high-end devices. The increasing influence of digital marketing, social media, and influencer campaigns is strengthening online sales.

End-Use Insights

Household consumers represent 48% of the 2024 market and are the fastest-growing segment, driven by awareness, accessibility, and convenience. Professional salons and clinics generate higher-value sales but are smaller in volume. Spas and wellness centers are gradually adopting devices for specialized treatments. Emerging applications in tele-dermatology, subscription-based skincare services, and wellness integration offer new growth opportunities.

| By Product Type | By Technology | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 32% of the global market in 2024, led by the U.S. and Canada. High disposable income, advanced adoption of beauty devices, and strong e-commerce penetration drive demand. Consumers favor home-use devices, premium professional instruments, and AI-enabled smart devices. Regulatory approvals and awareness campaigns further support growth.

Europe

Europe accounts for 28% of the global market in 2024, led by Germany, France, and the UK. Consumers seek high-quality, non-invasive beauty devices, and professional adoption in aesthetic clinics is high. Growth is driven by disposable income, technological adoption, and trends in wellness and self-care.

Asia-Pacific

APAC is the fastest-growing region, with China, India, South Korea, and Japan leading adoption. Rising middle-class income, increasing beauty awareness, and e-commerce penetration support growth. Multi-functional, AI-enabled, and rechargeable devices are particularly popular in this region.

Latin America

Brazil and Mexico are emerging markets for home-use and professional devices. Growth is supported by rising beauty consciousness, adoption in clinics and wellness centers, and increased online retail penetration.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, shows increasing adoption due to high-income consumers and a preference for premium devices. African markets remain smaller but are growing in clinics and professional wellness centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chargeable Ultrasonic Beauty Instrument Market

- NuFACE

- Foreo

- Rio Beauty

- Braun

- Panasonic

- Gezatone

- ReFa

- Ya-Man

- Lifetrons

- Kingdom Cares

- Beurer

- SkincareRx

- MTG Co., Ltd

- Medisana

- Tripollar

Recent Developments

- In May 2025, Foreo launched a new AI-enabled wearable ultrasonic device for home facial treatments, enhancing personalized skincare tracking.

- In April 2025, NuFACE expanded its professional device portfolio, targeting aesthetic clinics with high-frequency ultrasonic instruments for anti-aging treatments.

- In February 2025, Rio Beauty introduced multi-functional ultrasonic devices integrating LED therapy and skin tightening features, boosting adoption in wellness centers.