Chair Pressure Cushions Market Size

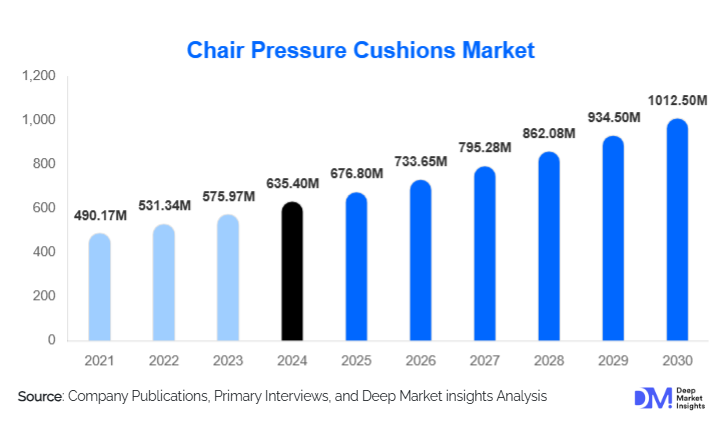

According to Deep Market Insights, the global Chair Pressure Cushions Market was valued at USD 635.4 million in 2024 and is projected to grow from USD 676.8 million in 2025 to reach USD 1,012.5 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The market growth is primarily driven by the rising prevalence of pressure ulcers among elderly and immobile patients, expanding home healthcare adoption, and technological advancements in pressure redistribution materials such as gel, foam, and air cell cushions.

Key Market Insights

- The rising aging population and increased hospitalization rates are significantly driving demand for pressure relief seating solutions.

- Foam-based pressure cushions hold the largest market share due to their affordability, comfort, and widespread use in both medical and residential settings.

- Alternating air cell cushions are emerging as the fastest-growing category, supported by the integration of smart sensors and automatic pressure adjustment technologies.

- Hospitals and rehabilitation centers dominate end-user demand, while home care applications are gaining traction with the expansion of telehealth and home-based therapy models.

- North America leads the global market, followed by Europe, owing to well-established healthcare infrastructure and strong reimbursement policies.

- Asia-Pacific exhibits the highest growth rate, fueled by rapid healthcare modernization, increasing awareness, and government investments in elderly care facilities.

Latest Market Trends

Integration of Smart and IoT-Enabled Cushions

One of the most transformative trends in the chair pressure cushions market is the integration of smart technologies. Manufacturers are developing IoT-enabled cushions embedded with sensors that monitor pressure distribution, temperature, and patient posture in real time. These cushions transmit data to mobile apps or hospital systems, alerting caregivers when repositioning is needed to prevent pressure injuries. Such innovations are revolutionizing patient monitoring in hospitals and long-term care facilities, improving clinical outcomes while reducing caregiver workload.

Eco-Friendly and Sustainable Cushion Materials

Growing environmental consciousness among healthcare providers and consumers is driving demand for eco-friendly pressure cushions. Manufacturers are adopting sustainable materials such as plant-based foams, recyclable covers, and low-emission manufacturing processes. Additionally, cushions with antimicrobial and hypoallergenic coatings are gaining popularity for infection control. This trend aligns with global sustainability goals and hospital procurement guidelines that increasingly favor green-certified medical equipment.

Chair Pressure Cushions Market Drivers

Rising Incidence of Pressure Ulcers

The growing prevalence of pressure ulcers among immobile, geriatric, and post-surgical patients is a major market driver. According to healthcare studies, pressure injuries affect millions of individuals annually, creating a significant burden on healthcare systems. Chair pressure cushions help distribute body weight evenly, reduce tissue compression, and enhance circulationmaking them essential tools in both preventive and therapeutic care. Increased emphasis on pressure ulcer prevention guidelines from healthcare authorities has also accelerated product adoption globally.

Expansion of Home Healthcare Services

The shift toward home-based care, accelerated by cost-efficiency and patient comfort considerations, is fueling demand for portable and easy-to-maintain pressure cushions. The growing availability of advanced home medical equipment, including air and gel-based cushions, supports individuals with mobility impairments, spinal cord injuries, or chronic illnesses. Home caregivers increasingly rely on ergonomic cushions to minimize pressure injuries, supporting long-term patient independence and quality of life.

Market Restraints

High Product Costs for Advanced Models

While basic foam cushions are widely affordable, advanced models featuring air cells, gel layers, or dynamic pressure alternation systems come at a higher cost, which can limit accessibility in low-income regions and smaller healthcare facilities. Furthermore, maintenance requirements, power dependence, and replacement costs for electronic cushions act as deterrents for broader adoption in price-sensitive markets.

Lack of Awareness in Developing Regions

Despite increasing geriatric populations, awareness of pressure ulcer prevention and assistive seating solutions remains limited in emerging economies. Inadequate training among caregivers, insufficient healthcare funding, and a lack of standardized guidelines hinder adoption rates. Educational campaigns and government initiatives promoting pressure relief aids are gradually mitigating this challenge, but continue to be an area of concern for market expansion.

Chair Pressure Cushions Market Opportunities

Technological Innovation in Material Design

Advances in material engineering are opening new growth avenues for manufacturers. The development of hybrid cushions combining foam, gel, and air cell structures enables enhanced comfort, breathability, and weight distribution. Integration of phase-change materials (PCMs) for temperature regulation and memory foam for contour adaptation is further enhancing user comfort and therapeutic benefits. These innovations present opportunities for product differentiation and higher-margin growth.

Rising Demand from Long-Term and Geriatric Care Facilities

With the global geriatric population expected to double by 2050, long-term care facilities are expanding rapidly. This growth presents strong opportunities for suppliers of medical seating solutions, including pressure cushions. Nursing homes, assisted living centers, and rehabilitation facilities increasingly require advanced cushions that minimize the risk of skin breakdown and improve patient outcomes, creating a steady demand pipeline for manufacturers worldwide.

Product Type Insights

Foam cushions dominate the market owing to their cost-effectiveness, lightweight design, and easy availability. Gel cushions are gaining momentum in hospitals and rehabilitation settings due to superior comfort and cooling properties that reduce moisture and skin friction. Air cell cushions, particularly alternating pressure models, are the fastest-growing segment, favored for their dynamic support and customizable inflation control. Hybrid cushions integrating multiple materials are also emerging as premium solutions in high-end healthcare and mobility aid applications.

Application Insights

Medical and clinical applications represent the largest market share, driven by use in hospitals, nursing homes, and rehabilitation centers. Home care applications are expanding rapidly with increased adoption of home treatment models for chronic conditions. Additionally, wheelchair usersincluding those with spinal cord injuries and neurological disordersconstitute a critical end-use group, creating ongoing demand for ergonomic and durable cushion designs tailored for mobility equipment.

End-User Insights

Hospitals dominate global demand as they prioritize pressure relief solutions for bedridden and postoperative patients. Rehabilitation centers and elder care facilities follow closely, focusing on long-term patient comfort. The home healthcare segment is anticipated to record the fastest growth rate, supported by the rise of self-managed care, remote patient monitoring, and growing access to affordable pressure management products through online retail channels.

Distribution Channel Insights

Offline medical supply stores remain the primary distribution channel due to strong relationships with healthcare institutions and physiotherapy centers. However, online channels are witnessing robust growth, driven by e-commerce convenience, transparent pricing, and direct-to-consumer marketing by leading brands. Digital marketplaces now play a major role in the home care segment, especially for foam and gel-based cushions, supported by educational content and product comparison tools.

| By Product Type | By Application | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with a dominant share, attributed to high healthcare spending, widespread awareness about pressure ulcer prevention, and the presence of major manufacturers. The U.S. is the largest contributor, supported by Medicare reimbursement policies and the growing use of advanced seating aids in hospitals and long-term care homes.

Europe

Europe remains a key market, driven by aging demographics and strong regulatory frameworks promoting patient safety and medical device quality. Countries such as Germany, the U.K., and France have well-established hospital infrastructure and supportive insurance systems that facilitate cushion adoption across clinical and home settings.

Asia-Pacific

Asia-Pacific is projected to exhibit the fastest growth over the forecast period, supported by expanding healthcare infrastructure, rising income levels, and increasing awareness of pressure ulcer prevention. China, Japan, and India are major growth drivers, with investments in elderly care facilities and assistive technology distribution networks.

Latin America

Latin America is gradually emerging as a potential market with growing healthcare modernization in Brazil, Mexico, and Argentina. The region’s adoption is driven by public hospital upgrades and government initiatives promoting home care equipment access for elderly patients.

Middle East & Africa

The Middle East & Africa market is in an early growth phase, characterized by increasing healthcare investments in GCC countries and gradual adoption in African nations. Rising demand for mobility aids and hospital equipment upgrades is expected to enhance regional market penetration in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chair Pressure Cushions Market

- Invacare Corporation

- Permobil AB

- Sunrise Medical LLC

- ROHO Inc. (Permobil subsidiary)

- Varilite (Cascade Designs, Inc.)

- Comfort Company

- Drive DeVilbiss Healthcare

- Ottobock SE & Co. KGaA

- Supracor Inc.

- Star Cushion Products, Inc.

Recent Developments

- In June 2025, Invacare Corporation launched a new hybrid gel-foam pressure cushion series with enhanced cooling channels and washable covers aimed at hospital and home care users.

- In March 2025, Permobil AB introduced a smart air cushion equipped with real-time pressure mapping and Bluetooth connectivity for continuous monitoring in clinical settings.

- In January 2025, Drive DeVilbiss Healthcare expanded its medical seating product line in Asia-Pacific through new distribution partnerships in India and Malaysia.