CBD Skincare Market Size

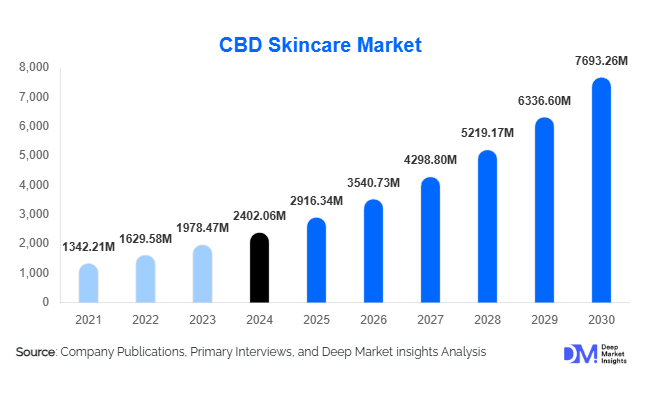

According to Deep Market Insights, the global CBD skincare market size was valued at USD 2,402.06 million in 2024 and is projected to grow from USD 2,916.34 million in 2025 to reach USD 7,693.26 million by 2030, expanding at a CAGR of 21.41% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of clean-beauty active botanicals, increasing regulatory clarity for hemp-derived CBD, and the rapid expansion of e-commerce and direct-to-consumer skincare models.

Key Market Insights

- CBD skincare is increasingly positioned as a dermocosmetic and active-ingredient category, attracting consumers seeking anti-inflammatory, barrier-repair, and natural-botanical alternatives.

- Premium formulations and technology-enabled delivery systems are expanding, with nanoemulsions, liposomal CBD blends, and multi-actives (CBD + peptides/hyaluronic acid) driving higher price points.

- North America dominates the market, with the U.S. leading demand thanks to favorable hemp-derived CBD regulation and strong e-commerce adoption.

- Europe remains an established market with strong uptake of pharmacy/derma channels, while regulatory shifts across the EU are supporting gradual growth.

- Asia-Pacific is emerging as a critical growth region, led by Australia and South Korea (and eventually Japan and India) as middle-class wealth and premium skincare adoption increase.

- Sustainability, traceable hemp sourcing, and supply-chain transparency, together with clinical substantiation, are reshaping consumer trust and brand differentiation.

What are the latest trends in the CBD skincare market?

Clinical & Dermocosmetic Positioning Gaining Traction

Skincare companies are increasingly funding clinical trials and dermatology-led studies to substantiate claims around anti-inflammation, barrier repair, and post-procedure recovery for CBD-infused products. These efforts not only build consumer trust but also facilitate access to pharmacy channels and dermatology clinics. Partnerships with dermatologists and clinical endorsements are becoming more common, positioning CBD skincare beyond “wellness trend” status and toward established dermocosmetic categories.

Technology-Enhanced Formulations & Delivery Systems

Emerging technologies such as nanoemulsion or liposomal encapsulation are being used to increase skin penetration of CBD, improve stability, and deliver enhanced performance. Brands are also integrating smart packaging (QR codes linking to test results), blockchain-backed traceability of hemp sourcing, and digital tools for skin analysis that recommend CBD-based serums or creams. This appeals to tech-savvy consumers who expect measurable performance and transparency in active skincare.

What are the key drivers in the CBD skincare market?

Growing Demand for Clean-Botanical Actives

Consumers are increasingly seeking skincare ingredients that are natural, plant-based, and multifunctional, yet backed by science. CBD fits this demand because of its anti-inflammatory, antioxidant, and barrier-support biology, making it a compelling alternative to synthetic actives. This shift toward clean and effective skincare actives is accelerating the adoption of CBD into mainstream beauty routines.

Legal Clarity and Retail Channel Expansion

As more jurisdictions differentiate hemp-derived CBD from marijuana and set clear THC limits, cosmetic manufacturers and retailers feel confident bringing CBD skincare to market. This regulatory clarification has unlocked shelf space in specialty beauty stores, drugstores, and pharmacy chains, further broadening distribution. The resulting reduction in risk for retailers and brands is a key growth enabler.

Digital-First and D2C Business Models

The rise of direct-to-consumer (D2C) brands and online marketplaces has significantly lowered entry barriers for CBD skincare. Brands can reach niche segments (male grooming, post-procedure care, sensitive skin) directly via e-commerce, consumer education content, and subscription models. This channel helps accelerate trial, repeat purchases, and brand loyalty without heavy reliance on traditional retail.

What are the restraints for the global market?

Regulatory Fragmentation & Advertising Limitations

Although regulatory clarity is improving in some jurisdictions, the rules around CBD in cosmetics remain inconsistent globally. Variation in THC limits, permitted claims, labelling requirements, and advertising restrictions (many ad networks restrict CBD promotion) complicate brand expansion. This fragmentation slows multi-market roll-out and increases compliance costs for new entrants.

Quality/Trust-Gap and Ingredient Cost Volatility

Many consumers remain cautious due to past incidents of inaccurate labelling, incorrect potency, and a lack of third-party testing in CBD products. Brands that fail to invest in transparent supply chains and COAs (Certificates of Analysis) risk losing consumer trust. Additionally, raw-material price volatility (hemp crop yields, extraction capacity) can squeeze margins and hamper smaller players.

What are the key opportunities in the CBD skincare industry?

Dermatology & Professional Channel Expansion

As clinical evidence grows, CBD skincare can transition from wellness-beauty to clinically positioned dermocosmetic. This opens access to dermatologists, aesthetic clinics, and pharmacy channels that command higher price points and repeat purchase behaviour. Entry into professional channels offers significant upside for brands investing in clinical studies, quality manufacturing, and regulatory compliance.

Emerging Markets & Export-Driven Growth

New regional demand is building in Asia-Pacific, Latin America, and the Middle-East/Africa as premium skincare adoption and disposable incomes rise. Brands headquartered in regulation-friendly jurisdictions can scale via export or white-label manufacturing to these regions. Building compliant cross-border supply chains (traceability, GMP extraction) offers a strong growth path for both existing participants and new entrants.

Technology & Sustainability Integration

Brands that integrate advanced delivery systems (nanoencapsulation, smart packaging) plus sustainable hemp sourcing and circular packaging will differentiate in a crowded market. Consumers increasingly reward traceable, low-carbon supply chains and performance-backed formulations. This convergence of tech, sustainability, and botanical actives is a major growth lever for firms that invest accordingly.

Product Type Insights

Within the CBD skincare category, creams and moisturizers dominate the market, typically capturing around 28% of the 2024 spend (≈ USD 420 million) thanks to their daily-use frequency and broad appeal across face & body applications. Serums and concentrates are also growing fast, especially in the premium tier. Masks, peels, and body-specific formulations (e.g., post-procedure balms) are smaller but showing high growth momentum as consumers trade up for performance and multi-benefit skincare.

Formulation Insights

Broad-spectrum CBD formulations emerged as the preferred choice across regions, commanding approximately 45% of the 2024 market (≈ USD 675 million). These formulations offer the benefit of multiple cannabinoids without THC, addressing regulatory concerns while delivering enhanced consumer perception of the “entourage” effect. They are increasingly used by mainstream brands seeking wider distribution and lower compliance risk, which is driving their leadership in the category.

Distribution Channel Insights

E-commerce (direct-to-consumer and online marketplaces) leads the distribution mix, capturing around 38% of the market (≈ USD 570 million) in 2024. This dominance is driven by the ability for brands to reach niche segments, deploy subscription models, and use social/influencer marketing with fewer advertising restrictions than traditional retail. Specialty beauty stores, pharmacies, and spas continue to grow, especially for premium or clinically positioned CBD skincare.

End-Use Segment Insights

The largest end-use remains consumer retail skincare (mass and premium). However, the fastest-growing segments are dermatology/clinical channels and professional spa/post-procedure care, where CBD-based products are being adopted for inflammation control, barrier repair, and recovery from dermatological treatments. Export-driven demand is also notable, as manufacturing hubs supply finished goods and ingredients to regions with nascent domestic production, enabling growth across end-use industries such as med-aesthetics and sports therapy.

| By Product Type | By Formulation | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest region in the CBD skincare market, accounting for about 33% of global spend in 2024 (USD 495 million). U.S. consumers’ high disposable income, advanced e-commerce infrastructure, and regulatory clarity around hemp-derived CBD contribute to strong demand. The retail environment (drugstores, beauty specialists) and digital platforms are highly developed, enabling fast product launch and scalability.

Europe

Europe holds about 28% of the global market (USD 420 million in 2024). Key countries such as the UK, Germany, and France lead due to mature skincare markets, regulatory frameworks that support dermocosmetics, and a strong premium beauty culture. Growth is being driven by clinical products and sustainability-led formulations more than pure novelty.

Asia-Pacific

Asia-Pacific accounts for roughly 18% (USD 270 million) but is the fastest-growing region in percentage terms. Australia and South Korea are early adopters of premium CBD skincare; India, Japan, and parts of SEA represent high-potential markets as regulatory reform, middle-class wealth, and premium skincare adoption increase. Growth in APAC could outpace other regions over the forecast period.

Latin America

Latin America’s share is about 12% (USD 180 million), with Brazil and Mexico as the leading markets. While relative spend is lower, rising urbanisation, growing beauty awareness, and increasing exports of CBD ingredients are boosting local demand.

Middle East & Africa

The Middle East & Africa account for roughly 9% (USD 135 million) of the global market. Growth is slower due to stricter regulations in many countries, but pockets such as the UAE, South Africa, and the GCC show premium demand for luxury skincare and have active import markets and expatriate consumer bases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the CBD Skincare Market

- L’Oréal

- Charlotte’s Web Holdings, Inc.

- Elixinol Global

- Endoca BV

- Isodiol International Inc.

- Cannuka LLC

- Leef Organics

- Vertly LLC

- Herbivore Botanicals

- Josie Maran Cosmetics

Recent Developments

- In 2025, several skincare brands announced the launch of CBD-infused post-procedure recovery creams designed for dermatology clinics, reinforcing the clinical channel push.

- Also in 2025, multiple extraction/ingredient companies expanded GMP extraction capacity and announced traceability programmes for hemp farms, signalling vertical integration and supply-chain strengthening.

- In early 2025, e-commerce D2C CBD skincare brands increasingly adopted subscription models, skin-analysis apps, and smart packaging (QR-linked COAs) to enhance consumer engagement and trust.