CBD Serums Market Size

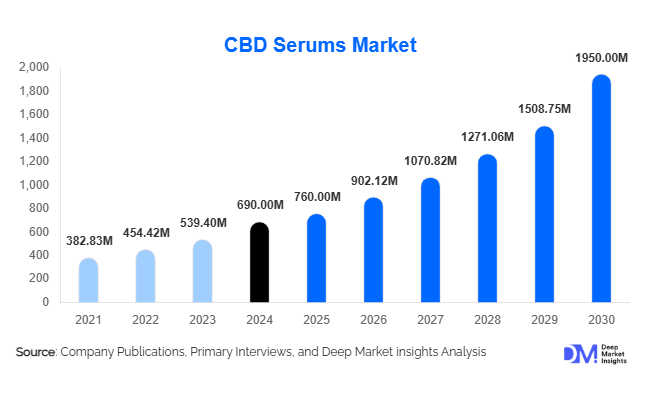

According to Deep Market Insights, the global CBD serums market size was valued at USD 690 million in 2024 and is projected to grow from USD 760 million in 2025 to reach USD 1,950 million by 2030, expanding at a CAGR of 18.7% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer preference for plant-based skincare, rising adoption of CBD in cosmetic formulations, and expanding distribution through e-commerce and wellness channels globally.

Key Market Insights

- Anti-aging CBD serums dominate globally, reflecting the strong demand for multifunctional skincare targeting aging concerns among millennials and Gen X consumers.

- Hemp-derived CBD formulations account for the largest share, due to widespread legalization and regulatory approval in North America, Europe, and parts of the Asia-Pacific.

- Online retail channels lead distribution, providing ease of access, digital marketing opportunities, and global reach for premium and niche CBD serum brands.

- North America is the largest regional market, led by U.S. consumers embracing natural, clean-label, and dermatology-backed skincare solutions.

- Asia-Pacific is the fastest-growing market, driven by rising middle-class wealth, increased skincare awareness, and acceptance of plant-based beauty products in countries like China, South Korea, and Japan.

- Technological integration, including advanced serum formulations, nanotechnology-based delivery systems, and AI-driven personalized skincare solutions, is enhancing consumer adoption.

Latest Market Trends

Premium and Multi-Functional Skincare

Consumers are increasingly seeking CBD serums that combine multiple benefits such as anti-aging, hydration, acne control, and brightening effects. Premiumization trends have led to the development of luxury CBD serums that integrate high-quality ingredients like hyaluronic acid, peptides, and botanical extracts. These products cater to high-income and skincare-conscious consumers who prioritize efficacy, safety, and natural formulations. Multi-functional serums reduce the need for multiple products, making them attractive for both daily routines and targeted skincare regimens.

Integration with Advanced Technologies

Technological advancements are transforming the CBD serums market. Nanotechnology-based delivery systems improve bioavailability, ensuring active ingredients penetrate deeper into the skin. AI-powered skincare platforms allow consumers to customize formulations based on individual skin needs. These innovations, combined with increased e-commerce penetration, enable brands to provide personalized, high-value products. Technology also facilitates quality assurance, regulatory compliance, and traceability from raw hemp to final formulations, enhancing consumer trust and brand credibility.

CBD Serums Market Drivers

Rising Awareness of Plant-Based Skincare

The global shift toward natural and chemical-free cosmetic products is a key driver for CBD serums. Consumers are increasingly aware of the anti-inflammatory, antioxidant, and anti-aging benefits of CBD, leading to higher adoption. Growing health and wellness trends, along with increased media coverage and influencer promotion, have boosted the visibility of CBD skincare solutions.

Expansion of Online and Specialty Retail Channels

Digital retail channels, including direct-to-consumer websites, e-commerce marketplaces, and social media platforms, have improved access to CBD serums worldwide. Specialty wellness and cosmetic stores are also expanding their offerings, creating a diverse retail ecosystem that supports premium and niche products. This omnichannel distribution approach is facilitating market penetration and improving consumer engagement.

R&D and Product Innovation

Continuous investment in research and development has led to innovative CBD serum formulations targeting specific skin concerns. Dermatology-backed products, combination formulations with hyaluronic acid, peptides, or vitamins, and clinically tested efficacy have positioned CBD serums as high-value offerings. This innovation-driven approach encourages repeat purchases and premium pricing strategies.

Market Restraints

Regulatory Challenges

Inconsistent regulations across regions limit the marketing, sale, and formulation of CBD serums. Certain countries impose strict restrictions on hemp-derived products, creating barriers for new entrants and complicating international trade. Regulatory uncertainty increases compliance costs and may slow market expansion in some regions.

High Price Sensitivity

Premium CBD serums face adoption challenges in price-sensitive markets. While affluent consumers drive luxury sales, mid-range and budget-conscious buyers may avoid higher-priced CBD products, limiting penetration. Cost remains a barrier, particularly in emerging markets where disposable income levels are lower.

CBD Serums Market Opportunities

Expansion in Asia-Pacific and Emerging Markets

While North America and Europe remain mature, the Asia-Pacific is emerging as a high-growth region. Increasing disposable income, growing skincare awareness, and acceptance of plant-based beauty products in China, South Korea, India, and Japan create new market opportunities. Companies entering these markets early can establish brand recognition and capture significant market share.

Integration with Advanced Skincare Technologies

Nanotechnology-based delivery systems, AI-driven personalized formulations, and multi-functional serum innovations represent high-value opportunities. Customizable products that address anti-aging, hydration, acne, and skin brightening in a single serum can command premium pricing and enhance consumer loyalty.

Regulatory Standardization and Certification

As governments clarify regulations and implement standards for CBD cosmetics, companies can leverage certifications and compliance as a market differentiator. Early adoption of certified formulations strengthens consumer confidence, opens new markets, and encourages partnerships with dermatologists, wellness clinics, and premium retailers.

Product Type Insights

Anti-aging CBD serums dominate the market with a 38% share in 2024, driven by increasing demand among aging populations and younger consumers adopting preventative skincare. Hydrating and acne-targeting serums are also growing rapidly, reflecting diversification in product offerings and rising consumer awareness of multifunctional skincare. Full-spectrum CBD formulations account for 47% of the market, while hemp-derived products make up 82%, emphasizing regulatory acceptance and global consumer trust.

Distribution Channel Insights

Online retail leads with a 54% share of the 2024 market, propelled by direct-to-consumer websites, e-commerce marketplaces, and social media marketing. Offline channels, including specialty CBD stores, pharmacies, and department stores, complement online sales, catering to consumers seeking personalized consultations and in-store trials. Omnichannel strategies are helping brands expand reach, improve engagement, and maximize market penetration.

End-Use Insights

Individual consumers represent the largest end-use segment, accounting for over 60% of demand. Professional applications, including salons, spas, and dermatology clinics, are the fastest-growing segments, benefiting from CBD serums’ integration into anti-aging treatments, post-procedure care, and premium skincare services. Export-driven demand is expanding from North America and Europe into Asia-Pacific and Latin America, particularly for premium, clinically backed products.

| By Product Type | By CBD Source | By CBD Spectrum | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 42% of the global market in 2024, with the U.S. as the largest contributor. High consumer awareness, widespread legalization of hemp-derived CBD, and strong e-commerce infrastructure drive growth. Premiumization trends and dermatology-backed formulations are especially popular, supporting higher price points and repeat purchases.

Europe

Europe accounts for 29% of the market, led by the U.K., Germany, and France. Regulatory clarity, rising demand for clean-label cosmetics, and eco-conscious consumer behavior support strong growth. Younger consumers increasingly favor multifunctional, natural CBD serums, boosting mid-range and premium segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 22% projected during 2025–2030. China, South Korea, Japan, and India are key markets, driven by growing disposable incomes, beauty-conscious middle-class populations, and expanding e-commerce adoption. Demand for premium and luxury CBD serums is rising, particularly in metropolitan centers.

Latin America

Latin America is developing as a market, with Brazil, Argentina, and Mexico leading demand. Affluent consumers and growing interest in natural cosmetics are driving gradual adoption. Outbound imports of premium CBD serums from North America and Europe are increasing.

Middle East & Africa

While small in volume, MEA is growing steadily. The UAE and South Africa are emerging hubs for luxury CBD skincare products, supported by high-income populations and a rising focus on wellness and beauty tourism. Intra-regional demand is expanding, particularly for premium and clinically tested products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the CBD Serums Market

- Sephora

- Kiehl’s

- Estée Lauder

- Cannuka

- Saint Jane Beauty

- Josie Maran Cosmetics

- Endoca

- Elixinol

- Apothecanna

- Charlotte’s Web Holdings

- Lord Jones

- CBDfx

- Vertly Skincare

- Medterra

- Herbivore Botanicals

Recent Developments

- In March 2025, Estée Lauder launched a new full-spectrum CBD serum line targeting anti-aging and hydration, expanding its presence in North America and Europe.

- In January 2025, Sephora introduced a range of multi-functional CBD serums with nanotechnology delivery systems, emphasizing skin brightening and acne prevention.

- In December 2024, Cannuka expanded its distribution to Asia-Pacific, partnering with e-commerce platforms in China and South Korea to meet growing premium skincare demand.