CBD Pet Products Market Size

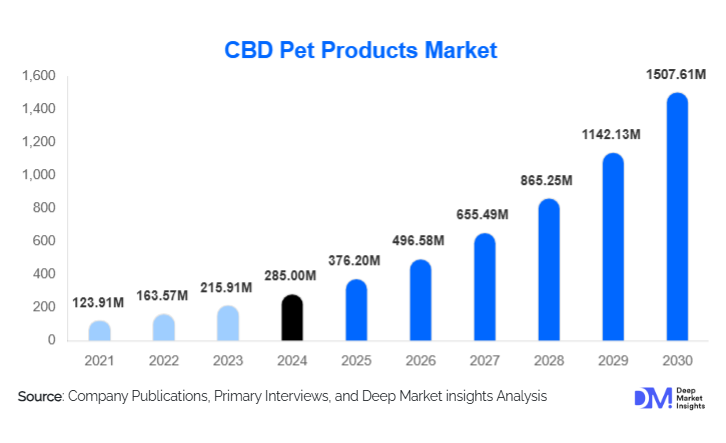

According to Deep Market Insights, the global CBD pet products market was valued at approximately USD 285 million in 2024 and is projected to grow to around USD 376.20 million in 2025 and further reach USD 1,507.61 million by 2030, expanding at a robust CAGR of approximately 32% during the forecast period (2025–2030). This rapid growth reflects rising consumer demand for natural pet wellness solutions, increasing pet humanization, and broader regulatory acceptance of hemp-derived CBD in animal health.

Key Market Insights

- Pet owners are increasingly treating their pets like family, driving demand for natural, holistic wellness products such as CBD oils, treats, and capsules.

- Oils/tinctures remain the dominant product format, due to ease of dosing, flexibility in administration, and high bioavailability.

- Dogs represent the largest animal-type segment, accounting for over half of the total market share, as owners seek CBD for joint pain, stress, and age-related conditions.

- Joint pain/arthritis is the leading indication among pet CBD users, especially in aging dogs, due to CBD’s perceived anti-inflammatory benefits.

- Full-spectrum formulations are preferred by premium buyers for their entourage effect and higher perceived efficacy.

- Online retail (e-commerce) dominates distribution, powered by direct-to-consumer models, subscription options, and ease of access to third-party-tested products.

- North America is the largest regional market, driven by high pet ownership, disposable income, and favorable regulation.

What are the latest trends in the CBD Pet Products Market?

Premiumization & Product Innovation

Recent trends in the CBD pet products market show a strong shift toward premiumization. Brands are launching high-potency, full-spectrum CBD oils, flavored soft chews, and specialized formulations for anxiety, mobility, or sleep. There is also growing interest in subscription-based dosing and personalized wellness regimens for pets, enabling pet owners to tailor CBD use by weight, life stage, and condition. This product diversification is helping brands capture more niche demand and build customer loyalty.

Veterinary Integration and Scientific Validation

Another trend is deeper integration with veterinary medicine. As more veterinarians become aware of CBD’s potential benefits, companies are emphasizing clinical studies, third-party testing, and Certificates of Analysis (COAs) to build trust. Brands are partnering with vet research institutes to run trials on arthritis, anxiety, and seizure management in pets. This scientific backing is crucial to mainstream adoption and aligns the CBD pet market with more credible, evidence-based treatment paradigms.

Cross-Border & E-Commerce Expansion

E-commerce remains central to growth, with pet CBD brands scaling through direct-to-consumer sales. Many companies are also leveraging cross-border platforms to export into Europe, Asia-Pacific, and Latin America. As regulatory frameworks for hemp-derived CBD mature in new geographies, brands are expanding globally. This export-driven model, combined with subscription offerings, helps firms scale quickly and reach health-conscious pet owners in emerging markets.

What are the key drivers in the CBD Pet Products Market?

Humanization of Pets

The deepening emotional bond between pet owners and their pets is a major growth driver. As pets are increasingly seen as family members, owners are more willing to spend on health and wellness solutions that mirror human self-care trends. This drives demand for premium, plant-based remedies like CBD to address anxiety, mobility, sleep, and chronic conditions.

Growing Awareness & Research on CBD Benefits

The proliferation of research, case studies, and anecdotal evidence around CBD’s potential to support joint health, reduce anxiety, and manage seizures is fueling adoption. Transparent lab testing and third-party certification reinforce consumer confidence. As more veterinarians engage with this science, the therapeutic argument for CBD in pets strengthens, propelling market growth.

Direct-to-Consumer & Digital Sales Channels

The rise of e-commerce has made it far easier for brands to reach pet owners directly. D2C models allow for personalized dosing, subscription plans, and education-driven sales strategies. With lower overheads than traditional retail, companies can invest more in product quality, testing, and customer experience, fueling faster adoption and recurring purchases.

What are the restraints for the global CBD Pet Products Market?

Regulatory Uncertainty

The regulatory landscape for CBD in pet products remains fragmented. Legal restrictions vary widely across countries and regions regarding allowable THC levels, labeling, and marketing claims. These inconsistencies create compliance risks, slow international expansion, and discourage some investors and veterinarians from participating fully.

Quality Control & Standardization Challenges

Lack of industry-wide standards around potency, purity, and manufacturing processes undermines trust. Some products may be mislabeled or contaminated if not tested rigorously. Without uniform certification or standardization, lower-quality or unverified products can erode confidence, limiting mass-market adoption.

What are the key opportunities in the CBD Pet Products Market?

Clinical Research & Veterinary Partnerships

There is a meaningful opportunity to deepen scientific validation through veterinary-backed clinical trials. Brands that partner with veterinary colleges, research labs, or pet-health biotech companies can generate robust efficacy and safety data. This not only builds trust but may also allow for the co-development of prescription-grade CBD therapies for pets. Clinically validated products can command premium pricing and encourage veterinarians to recommend CBD more confidently.

Emerging Regional Markets & Exports

Emerging geographies such as Asia-Pacific, Latin America, and parts of Europe present high-growth potential. As regulations become more favorable, companies can leverage cross-border e-commerce and local distribution partnerships to reach a growing middle class of pet owners. Exporting from established CBD hubs (like North America) to these markets offers a scalable route for expansion, while localized manufacturing could reduce costs and improve margins.

Product Personalization & Subscription Models

Another key opportunity lies in personalization. Brands can offer tailored CBD formulations based on pet weight, age, species (dog, cat, horse), and health indication (joint pain, stress, sleep). By combining these personalized products with subscription-based delivery, companies can increase customer lifetime value, reduce churn, and deepen user engagement. Innovative packaging (like pre-measured droppers or chew packs) can support this tailored, repeat-use model.

Product Type Insights

Among product types, oils and tinctures dominate due to their precise dosing, flexibility, and bioavailability. These formats allow pet owners to easily adjust dosage by weight or condition. Treats and soft chews are gaining rapid traction for their palatability and ease of use, especially for anxiety or stress relief. Capsules/tablets appeal to owners seeking convenience and taste-neutral options, while topicals (balms or sprays) are emerging for localized issues such as skin irritations or joint inflammation. As the market matures, brands are likely to expand into hybrid products combining formats (for example, chewables infused with oil), catering to different use cases and customer preferences.

Application (Indication) Insights

The leading application for CBD pet products is joint pain/arthritis, especially in aging dogs, because of CBD’s anti-inflammatory and analgesic properties. Anxiety and stress management is another major use case, with pet owners increasingly using CBD to help pets cope with separation, loud noises, or travel. Sleep and restlessness interventions are also growing, often via calming oils or chews. In addition, emerging uses include seizure control for epileptic pets and digestive health, with targeted formulations helping with gastrointestinal discomfort.

Distribution Channel Insights

The online retail channel leads in distribution, driven by direct-to-consumer (D2C) business models, subscription services, and e-commerce education. Pet specialty stores (both brick-and-mortar and online) also play a key role, especially for consumers who want to interact with sales staff or inspect product labels. Veterinary clinics are emerging as important channels as more vets become comfortable recommending CBD. There is also a growing presence in supermarkets and hypermarkets in regions where CBD regulations permit. Additionally, CBD specialty stores provide highly focused environments for pet CBD buyers seeking third-party testing and quality assurance.

Animal Type Insights

Dogs are the largest animal segment in the CBD pet products market, accounting for the majority of sales, as pet owners address arthritis, anxiety, and age-related health problems. Cats represent a smaller but growing share, with more cat owners recognizing the benefit of CBD for stress, hyperactivity, and digestive issues. Horses and other performance animals (such as sport or working horses) are emerging applications, especially for inflammation and recovery, while small mammals and birds remain niche but promising segments as the market broadens.

| By Product Type | By Pet Type | By Source Type | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the dominant region in the CBD pet products market, accounting for around 40 % of the 2024 global market (approximately USD 110–120 million). The United States, in particular, leads due to high pet ownership, strong consumer spending on pet wellness, and relatively mature hemp-derived CBD regulation. E-commerce penetration, subscription-based models, and veterinary acceptance are driving continued growth.

Europe

Europe, especially countries like the United Kingdom, Germany, and France, accounts for about 20–25 % of the global market (roughly USD 55–70 million in 2024). Demand is rising as pet humanization increases and pet owners in Europe seek natural wellness solutions. Regulatory harmonization across European countries and growing acceptance of CBD in pet wellness are key factors contributing to growth.

Asia-Pacific

Asia-Pacific is one of the fastest-growing regions, representing about 15–20 % of the 2024 market (USD 45–57 million). Countries such as China, India, and Australia are driving demand growth due to rising pet adoption, growing middle-class disposable income, and increasing awareness of natural therapies. As regulatory systems for hemp-derived CBD mature, this region offers significant long-term potential.

Latin America

Latin America (e.g., Brazil, Mexico) currently holds a more modest share (8–10 %, or USD 23–29 million) of the global market, but demand is expected to climb as regulations evolve and import channels improve. The growing trend of pet wellness in middle- and upper-income segments is creating new opportunities.

Middle East & Africa

The Middle East & Africa region contributes around 5–8 % of the global market (USD 14–23 million in 2024), with Gulf countries like the UAE, Saudi Arabia, and Qatar driving demand. Rising pet ownership, high disposable incomes, and increasing acceptance of wellness products support growth. As regulatory clarity improves, regional sales and investments are likely to increase significantly.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the CBD Pet Products Market

- Canna-Pet

- Honest Paws

- HolistaPet

- Pet Releaf

- HempMy Pet

- Charlotte’s Web

- CBDfx

- Joy Organics

- Green Roads

- FOMO Bones

- Veritas Farms

- King Kanine

- NuLeaf Naturals

- Endoca

- PureKana

Recent Developments

- In 2025, several leading CBD pet brands announced partnerships with veterinary research institutions to conduct controlled trials on joint health and anxiety in dogs.

- In early 2025, a top D2C pet-CBD company launched a global subscription service, enabling international shipping to emerging markets in Europe and Asia-Pacific.

- Also in 2025, one major player introduced a new full-spectrum, flavored soft chew designed specifically for aging dogs with mobility issues, reinforcing the trend toward product personalization.

- Regulatory progress: Several countries in Europe and Latin America have announced clearer hemp-derived CBD policies for pet products, encouraging local production and import.