RFID Card Cabinet Locks Market Size

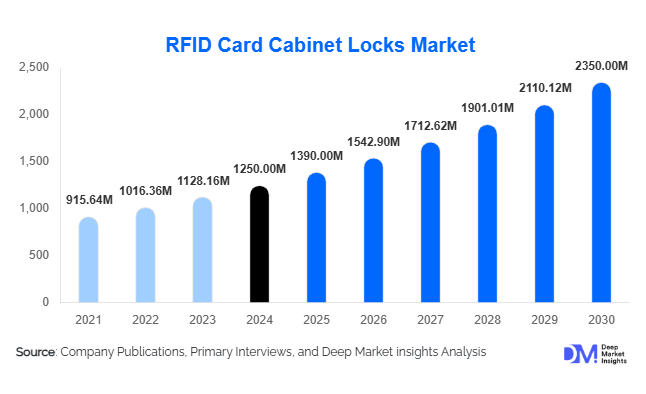

According to Deep Market Insights, the global RFID card cabinet locks market size was valued at USD 1,250 million in 2024 and is projected to grow from USD 1,390 million in 2025 to reach USD 2,350 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The RFID card cabinet locks market growth is primarily driven by rising demand for secure, contactless access control systems, increased adoption of IoT-enabled smart locks, and expanding applications in healthcare, hospitality, and government sectors.

Key Market Insights

- Smart, networked cabinet locks are replacing mechanical models, offering centralized access control, usage logging, and audit trails.

- Healthcare and government institutions lead adoption, driven by regulatory compliance and asset protection needs.

- North America holds the largest market share, supported by early adoption and stringent security regulations.

- Asia-Pacific is the fastest-growing region, driven by new infrastructure projects and rising awareness of access security.

- Integration with IoT and cloud systems is redefining how organizations monitor, manage, and automate cabinet security.

- Competitive pressure from low-cost Asian manufacturers is encouraging innovation and pricing optimization.

Latest Market Trends

Digital & Networked Upgrades

Organizations are increasingly upgrading to digital RFID cabinet locks that enable real-time monitoring, access tracking, and tamper alerts. These smart systems integrate with enterprise security dashboards, allowing remote management and central administration of multiple facilities. Healthcare, research, and government institutions are the primary adopters of these advanced systems.

Integration with Smart Building & IoT Ecosystems

Modern RFID cabinet locks are being connected to building management systems (BMS) and IoT frameworks. This integration supports real-time monitoring, predictive maintenance, and automated access scheduling. As smart city and smart campus projects expand globally, IoT-enabled RFID cabinet locks are becoming standard components of connected infrastructure.

Credential Flexibility & Mobile Access

Emerging RFID cabinet locks now support multi-mode authentication, including RFID cards, NFC, Bluetooth, and mobile credentials. This flexibility enhances user convenience and security, particularly in hybrid workplaces and BYOD environments. It also reduces key management complexity and improves scalability across large facilities.

RFID Card Cabinet Locks Market Drivers

Heightened Security and Compliance Requirements

Industries such as healthcare, pharmaceuticals, and government require strict access control to safeguard sensitive materials and data. RFID cabinet locks provide audit trails, timestamped logs, and identity verification, helping organizations comply with global security and privacy standards.

Growing Demand for Contactless and Hygienic Solutions

Post-pandemic hygiene concerns have accelerated the shift toward touchless access systems. RFID technology allows contactless unlocking, reducing physical touchpoints and minimizing contamination risk in healthcare and laboratory environments.

Cost Reduction and Technological Advancement

Declining prices of RFID chips, sensors, and batteries are making smart locking systems more affordable. Enhanced durability, low power consumption, and cloud compatibility are increasing market penetration among mid-size enterprises and institutions.

Market Restraints

High Upfront and Maintenance Costs

Smart RFID cabinet locks have higher installation and integration costs compared to mechanical locks. Regular maintenance, battery replacements, and firmware updates add to the total cost of ownership, limiting adoption among small and medium-sized enterprises.

Integration and Security Challenges

Interoperability issues with legacy systems and cybersecurity vulnerabilities remain challenges. Ensuring data encryption, credential protection, and secure firmware updates are key priorities for lock manufacturers and system integrators.

Product Type Insights

Passive RFID systems dominate the market with over 60% share in 2024 due to low cost and energy efficiency. Digital smart cabinet locks represent the fastest-growing product type, offering advanced control, real-time tracking, and audit functionalities. Networked or cloud-managed RFID systems account for nearly 48% of installations, primarily in multi-site enterprises.

End-User Insights

Healthcare represents the leading end-user segment, accounting for approximately 28% of total market revenue in 2024. Hospitals and pharmaceutical facilities rely on RFID cabinet locks for medication control, sample storage, and compliance tracking. Hospitality and government institutions follow, driven by rising investments in security automation and digital transformation.

| By Technology Type | By Lock Mechanism | By Key Management System | By End-User Industry | By Region |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds around 38% of the global market share, led by the U.S. due to early adoption of smart locking systems in healthcare and government sectors. Strong presence of leading manufacturers and high regulatory standards contribute to market maturity in the region.

Europe

Europe commands about 26% of the market, supported by security regulations, public infrastructure modernization, and strong adoption of cloud-based management systems. Germany, the U.K., and France are leading contributors.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at over 12% CAGR during 2025–2030. Rising construction activity, government-backed smart city programs, and healthcare investments in China, India, and Japan are key growth drivers.

Latin America

Latin America is emerging as a growing market, led by Brazil and Mexico. Adoption remains moderate due to higher import costs and limited local manufacturing, but is expected to accelerate with infrastructure modernization.

Middle East & Africa

The Middle East and Africa are experiencing strong growth, particularly in the Gulf Cooperation Council (GCC) countries. Investments in hospitals, education, and tourism infrastructure are fueling demand for RFID-based security solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the RFID Card Cabinet Locks Market

- ASSA ABLOY

- Dormakaba Group

- Shenzhen Omni Intelligent Technology

- ShineACS Locks

- PASSTECH Co. Ltd.

- Kerong Industry Co. Ltd.

- Guangzhou Guub Technology Co., Ltd.

Recent Developments

- In June 2025, ASSA ABLOY launched its next-generation RFID smart cabinet lock series featuring Bluetooth mobile access and cloud connectivity.

- In April 2025, Dormakaba introduced an IoT-integrated cabinet lock solution for healthcare facilities in North America and Europe.

- In February 2025, PASSTECH partnered with a major hospitality chain in the UAE to deploy RFID-based access control for staff and guest storage cabinets.