Car Roof Box Market Size

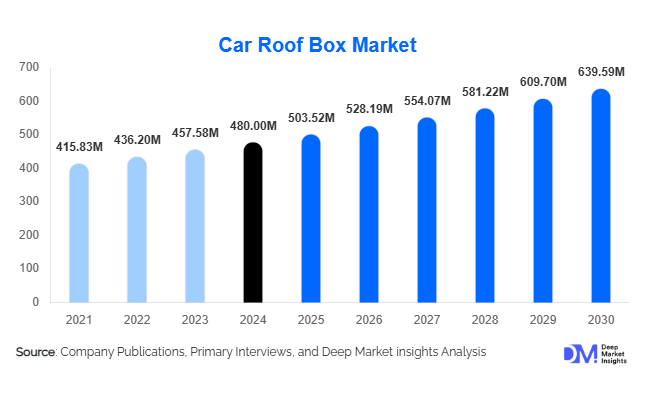

According to Deep Market Insights, the global car roof box market size was valued at USD 480 million in 2024 and is projected to grow from USD 503.52 million in 2025 to reach USD 639.58 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of SUVs and crossovers, the increasing popularity of outdoor recreation and road trips, and the growing availability of lightweight, aerodynamic, and eco-friendly roof storage solutions.

Key Market Insights

- Hard-shell roof boxes dominate the global market, accounting for more than 60% of sales in 2024, due to superior durability and weather resistance.

- Plastic/ABS materials lead by share, representing nearly 45% of global sales, as they balance strength, weight, and cost-effectiveness.

- North America and Europe together hold over 60% market share, supported by a strong outdoor leisure culture and widespread SUV adoption.

- Asia-Pacific is the fastest-growing region, with China and India driving demand through rapid vehicle ownership growth and rising middle-class incomes.

- E-commerce channels are surging, capturing an increasing portion of aftermarket sales as consumers prefer convenient, online purchase options.

- Manufacturers are innovating with aerodynamic designs, smart locking systems, and eco-friendly materials to differentiate in competitive markets.

What are the latest trends in the car roof box market?

Sustainable and Lightweight Materials

Manufacturers are increasingly investing in sustainable production, using recycled plastics, bio-based composites, and hybrid materials to reduce carbon footprints. Lightweight construction helps minimize drag and fuel consumption, an especially critical factor for electric vehicles. Many brands are highlighting eco-certifications to capture environmentally conscious consumers, particularly in Europe and North America.

Integration of Smart Features

Technology is entering the car roof box industry through GPS-enabled anti-theft systems, load sensors, and app-based monitoring. These features offer convenience and peace of mind to consumers, particularly in premium segments. Integration with vehicle infotainment systems is emerging, and some prototypes even include built-in lighting and modular sports gear attachments, signaling the market’s move toward connected, tech-driven solutions.

What are the key drivers in the car roof box market?

Adventure and Outdoor Lifestyle Growth

Global enthusiasm for road trips, camping, skiing, and adventure sports has been a major driver. Car roof boxes provide essential extra capacity for transporting gear, especially as families and young travelers seek flexible, on-the-go storage solutions. Seasonal activities like skiing in Europe or camping in North America reinforce recurring demand.

Rising SUV and Crossover Ownership

The global shift toward SUVs and crossovers, vehicles typically equipped with roof rails, makes roof box installation easier. This trend has been particularly strong in North America, Europe, and emerging Asia-Pacific markets, fueling consistent demand across income segments.

Product Innovation and Premiumization

Advancements in aerodynamic design, lockable features, and durable materials have elevated consumer interest. Premiumization has allowed leading brands to capture higher margins, with customers willing to pay more for better safety, convenience, and efficiency. This has strengthened growth in mature markets where penetration is already high.

What are the restraints for the global market?

High Costs and Price Sensitivity

Premium roof boxes can cost several hundred dollars, excluding installation accessories like roof racks. In emerging markets, this limits adoption, as many consumers choose cheaper alternatives such as soft rooftop bags or skip rooftop storage altogether. Price-sensitive regions remain challenging for premium brands seeking expansion.

Compatibility and Regulatory Barriers

Not all vehicles are designed for roof box use, and issues such as roof load limits, drag impact, and mounting complexity reduce adoption. Regulatory requirements around safety and secure attachment, especially in Europe, also impose compliance costs for manufacturers. Lack of consumer awareness in developing markets further slows penetration.

What are the key opportunities in the car roof box industry?

Eco-Friendly and Recycled Material Products

Consumers and regulators are pushing for sustainable solutions. Companies offering roof boxes made from recycled ABS plastics or bio-composites can capture new market share. Marketing eco-conscious products in mature, environmentally aware regions such as Scandinavia and Western Europe presents a significant revenue opportunity.

Emerging Regional Demand

Asia-Pacific, Latin America, and the Middle East represent fast-growing markets. Rising middle-class incomes, rapid SUV adoption, and growing domestic tourism create fertile ground for new entrants offering affordable, region-specific designs. Localization of production facilities could further reduce costs and improve competitiveness in these regions.

Smart and EV-Compatible Roof Boxes

Designs optimized for electric vehicles, with minimal drag and smart monitoring systems, will be highly attractive. EV owners are particularly sensitive to range reduction, creating demand for innovative, aerodynamic, and lightweight designs. Manufacturers who integrate connected technology can appeal to the premium consumer base.

Product Type Insights

Hard-shell roof boxes lead the market with over 60% share in 2024. Their durability, weather resistance, and security make them the top choice for consumers. Soft-shell roof boxes, while smaller in market share, are growing at a faster CAGR due to affordability, lightweight construction, and ease of storage when not in use.

Application Insights

Individual and private consumer use dominates the market with around a 65% share in 2024, reflecting demand from families and outdoor travelers. Rental and shared fleet services are an emerging growth area, particularly in tourist-heavy regions where adventure vehicles are increasingly offered with rooftop cargo solutions.

Distribution Channel Insights

Aftermarket sales via specialty retailers and online platforms dominate globally. E-commerce channels are gaining rapid traction as bulky roof boxes are increasingly sold through direct-to-consumer models with home delivery. OEM channels remain significant but are concentrated in developed markets where premium automakers offer roof boxes as optional accessories.

| Mount Type | Capacity/Size | Material & Features |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for around 33% of the global market in 2024, led by the U.S. with its high SUV ownership, extensive road trip culture, and preference for premium automotive accessories. Canada also contributes significantly, with winter sports driving demand for ski-compatible roof boxes.

Europe

Europe holds nearly 28% market share in 2024. Countries such as Germany, France, and the U.K. are leading adopters, while Scandinavian nations like Sweden and Norway have among the highest per-capita usage, fueled by strong outdoor culture and harsh weather conditions demanding durable storage solutions.

Asia-Pacific

Asia-Pacific holds approximately 23% of the market in 2024, but is the fastest-growing region. China and India are key drivers, supported by surging vehicle ownership and rising middle-class incomes. Australia and Japan also represent mature demand bases, particularly for adventure and camping enthusiasts.

Latin America

Latin America accounts for about 6% of the global market, with Brazil and Mexico leading regional demand. Growing domestic tourism and expanding SUV fleets are supporting gradual uptake, though price sensitivity remains a challenge.

Middle East & Africa

This region contributes 6–7% of global sales, with Gulf countries such as Saudi Arabia and the UAE driving premium demand. In Africa, South Africa is a key market due to its outdoor adventure culture, while overall adoption remains limited in lower-income nations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Car Roof Box Market

- Thule Group

- Yakima Products, Inc.

- Rhino-Rack Pty Ltd

- INNO (Japan)

- Hapro

- Cruzber S.A.

- Fabbri

- Menabo

- Mont Blanc Group

- Whispbar

- JAC Products

- Strona

- Smittybilt

- Apex

- SportRack

Recent Developments

- In May 2025, Thule announced the launch of a new line of roof boxes made from 80% recycled ABS plastic, targeting the premium eco-conscious consumer segment.

- In April 2025, Yakima introduced an EV-optimized aerodynamic roof box designed to minimize drag and preserve electric vehicle driving range.

- In February 2025, Rhino-Rack expanded its manufacturing facility in Australia to scale up production for Asia-Pacific demand, focusing on lightweight, affordable roof boxes for emerging markets.