Car Leasing Market Size

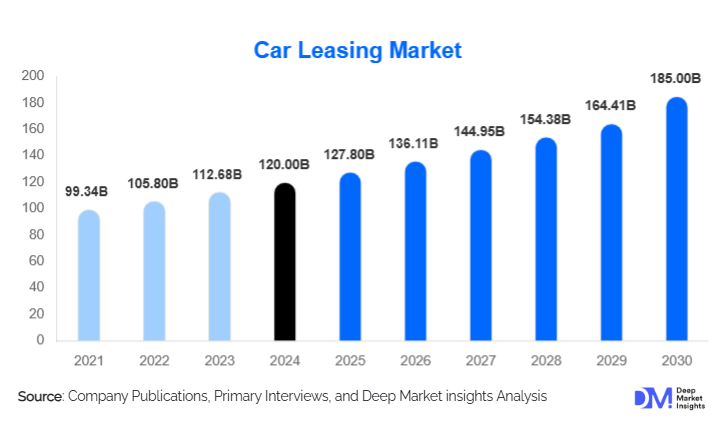

According to Deep Market Insights, the global car leasing market size was valued at USD 120 billion in 2024 and is projected to grow from USD 127.8 billion in 2025 to reach USD 185 billion by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The car leasing market growth is primarily driven by the rising adoption of flexible ownership models, increasing corporate fleet management, and the growing popularity of electric and hybrid vehicles in both mature and emerging markets.

Key Market Insights

- Corporate fleets dominate global demand, driven by cost efficiency, fleet modernization programs, and operational flexibility.

- Europe leads the car leasing market, accounting for around 40% of the total market share in 2024, due to a mature leasing infrastructure and strong consumer awareness.

- APAC is the fastest-growing region, fueled by urbanization, rising disposable incomes, and supportive government policies for electric vehicles.

- Operating leases are gaining traction, especially for short-term mobility solutions, while finance leases remain popular among large enterprises.

- Technology integration, including telematics, AI-powered fleet management, and digital leasing platforms, is reshaping market operations and improving customer experience.

- Electric and hybrid vehicle adoption is creating new leasing opportunities, particularly in regions with stringent emission regulations and government incentives.

What are the latest trends in the car leasing market?

Shift Towards Electric Vehicle Leasing

Leasing companies are increasingly offering dedicated electric vehicle (EV) programs, including battery leasing, charging infrastructure solutions, and maintenance packages. This trend is driven by global initiatives to reduce carbon emissions, rising fuel costs, and government incentives for green mobility. EV leasing is becoming particularly popular in Europe and APAC, enabling consumers and corporate fleets to adopt sustainable transportation while reducing upfront capital expenditure.

Digital Platforms and Telematics Integration

Technology adoption is transforming the car leasing landscape. Companies are implementing telematics and IoT solutions to monitor fleet usage, schedule predictive maintenance, and optimize operations. Digital leasing platforms streamline contract management, billing, and customer onboarding, improving overall efficiency and user experience. AI-based analytics further enable leasing companies to provide personalized pricing, risk assessment, and maintenance services for both corporate and individual clients.

What are the key drivers in the car leasing market?

Rising Corporate Fleet Requirements

Corporations increasingly prefer leasing vehicles to reduce capital investment, manage operational costs, and maintain a modern fleet. SMEs and large enterprises alike are leveraging fleet leasing to optimize mobility while mitigating depreciation risks. The trend is particularly strong in Europe and North America, where tax benefits and accounting incentives favor leased vehicle solutions over outright purchase.

Growing Urbanization and Individual Mobility Demand

Urban consumers are shifting from vehicle ownership to flexible leasing options due to high car prices, limited parking, and congestion charges. Leasing provides a cost-effective alternative with lower maintenance responsibility. The emergence of subscription-based models further enhances appeal, especially among millennials and Gen Z, who value convenience and flexibility over long-term ownership.

Government Policies Supporting Green Mobility

Regulatory frameworks promoting electric vehicles, fuel efficiency, and emission reduction are driving the adoption of EV leases. Incentives such as tax rebates, reduced registration fees, and preferential access to urban zones encourage both individuals and fleets to switch to leased EVs. Countries like Germany, China, and India are spearheading programs that integrate policy support with fleet modernization strategies.

What are the restraints for the global market?

High Initial Costs for EV Leasing

While operational costs for EVs are lower, the higher upfront cost of electric vehicles compared to conventional cars limits adoption in certain regions. Leasing providers must manage risk and price competitively to attract both individual and corporate customers.

Regulatory and Operational Challenges

Complex leasing regulations, taxation differences across regions, and limited EV charging infrastructure in some markets pose challenges. Companies must navigate these barriers to scale operations effectively, particularly in emerging economies.

What are the key opportunities in the car leasing industry?

Expansion in Emerging Markets

Countries such as India, Brazil, and South Africa present untapped potential for car leasing. Rising urbanization, growing middle-class income, and increasing awareness of leasing benefits create significant growth opportunities. Partnerships with local dealerships and banks can help foreign and domestic players capture market share.

Technology-Driven Fleet Solutions

Integration of AI, telematics, and mobile platforms offers leasing companies the opportunity to provide value-added services such as predictive maintenance, real-time monitoring, and customized leasing plans. This strengthens customer retention and operational efficiency.

Flexible Leasing Models

Short-term leases, subscriptions, and hybrid models that combine ownership and usage flexibility are becoming increasingly popular. These models appeal to younger, urban consumers and small businesses seeking cost-effective mobility solutions without long-term commitment.

Product Type Insights

Passenger cars dominate the global market, with sedans and SUVs accounting for the majority of leased vehicles. Commercial vehicles, including LCVs and HCVs, are also significant, particularly in fleet leasing for logistics and service industries. Operating leases are the preferred type for corporate clients, while finance leases are often utilized by large enterprises seeking ownership transfer at lease end. Electric and hybrid vehicle leasing is expanding rapidly due to government incentives and sustainability goals.

Application Insights

Corporate fleet leasing is the largest application segment, driven by SMEs, large enterprises, and government organizations. Individual leasing is growing steadily in urban areas, especially among younger professionals. Emerging applications include EV-specific leases and subscription models targeting urban mobility solutions.

Distribution Channel Insights

Leasing services are increasingly distributed through digital platforms, direct dealership partnerships, and financial institutions offering captive leasing solutions. Online platforms simplify booking, contract management, and payments, while traditional dealership networks provide in-person support, servicing, and maintenance. Emerging subscription-based models offer recurring revenue opportunities and improved customer retention.

End-User Insights

Corporate clients hold the largest market share due to extensive fleet requirements for operations, logistics, and employee mobility. Individual consumers are adopting leasing solutions for cost efficiency and flexibility. Fleet modernization, particularly with EVs, is a key driver in both segments. Emerging industries such as technology, e-commerce, and last-mile delivery are driving incremental demand for commercial vehicle leasing.

| By Vehicle Type | By Leasing Type | By End-User | By Lease Duration | By Fuel Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for around 25% of the global market in 2024, with the U.S. dominating due to strong corporate fleet adoption and urban mobility solutions. Leasing penetration is high in major metropolitan areas, supported by tax benefits, favorable accounting standards, and a preference for operating leases.

Europe

Europe leads with 40% market share in 2024, driven by mature corporate leasing frameworks, high vehicle ownership costs, and sustainability initiatives. Germany, the UK, and France are major contributors, with strong demand for EV leasing and digital fleet management solutions. The region continues to innovate with subscription models and flexible lease durations.

Asia-Pacific

APAC is the fastest-growing region, particularly in China, India, Japan, and Australia. Urbanization, rising incomes, and government incentives for EV adoption are fueling market expansion. China leads the region in EV leasing, while India shows strong growth potential in fleet modernization programs.

Middle East & Africa

Key countries such as the UAE, Saudi Arabia, and South Africa are investing in corporate and individual leasing solutions. High-income populations and government-backed fleet initiatives support growth. Intra-African leasing demand is rising for both commercial and passenger vehicles.

Latin America

Brazil and Argentina are emerging markets for car leasing, driven by rising urbanization and corporate fleet requirements. Growth is slower compared to other regions, but it presents long-term potential with the increasing adoption of flexible leasing solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Car Leasing Market

- ALD Automotive

- LeasePlan Corporation

- Arval

- Geely Auto Leasing

- Enterprise Holdings

- Sixt Leasing

- Hitachi Capital Mobility

- Volkswagen Financial Services

- BMW Financial Services

- Mercedes-Benz Leasing

- Sumitomo Mitsui Finance

- Element Fleet Management

- Orix Corporation

- Wheels Inc.

- Hertz Fleet Leasing

Recent Developments

- In June 2025, LeasePlan launched a dedicated electric vehicle leasing platform in Europe, targeting corporate fleets with integrated charging solutions and predictive maintenance.

- In May 2025, ALD Automotive expanded operations in India, partnering with local banks to provide flexible leasing options for SMEs and urban consumers.

- In March 2025, Enterprise Holdings announced a new digital fleet management system integrating AI and telematics for corporate clients across North America.