Canvas Bell Tents Market Size

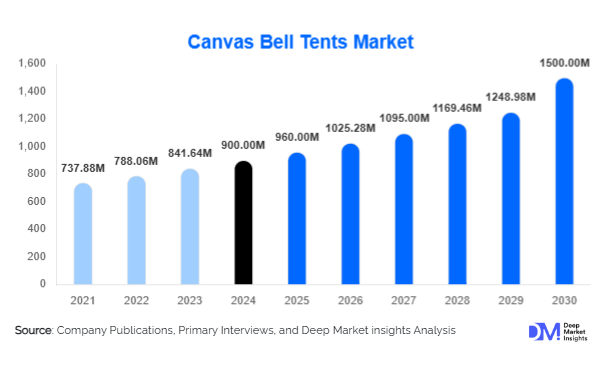

According to Deep Market Insights, the global canvas bell tents market size was valued at USD 900 million in 2024 and is projected to grow from USD 960 million in 2025 to reach USD 1,500 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for glamping and outdoor accommodation, increasing popularity of eco-friendly and sustainable materials, and the growing adoption of technologically enhanced and luxury tent designs for tourism, events, and recreational purposes.

Key Market Insights

- Luxury and premium canvas bell tents are gaining traction, particularly in glamping resorts, outdoor hospitality, and events, offering aesthetic appeal, comfort, and durability.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising disposable income, urban middle-class growth, and increasing domestic and outbound tourism in China, India, and Southeast Asia.

- North America dominates the market, with the U.S. and Canada leading in glamping and outdoor tourism infrastructure, contributing significantly to market revenue.

- Online direct-to-consumer sales are transforming distribution, enabling customization, better margins, and broader customer reach, alongside traditional specialty outdoor retail channels.

- Sustainability and eco-friendly product differentiation are increasingly influencing purchase decisions, with organic, recycled, and treated canvas materials preferred by both consumers and operators.

- Technological integration, including modular designs, waterproof coatings, and solar lighting, is enhancing the product appeal for premium and rental segments.

Latest Market Trends

Growth of Glamping and Outdoor Hospitality

The rising popularity of glamping is driving demand for high-quality canvas bell tents that combine luxury, comfort, and immersive nature experiences. Glamping operators are increasingly investing in semi-permanent and fully furnished bell tents with amenities such as insulated floors, electricity, and heating solutions. This segment appeals to travelers seeking upscale outdoor accommodation and contributes significantly to premium segment revenue. The trend is supported by tourism boards and local governments promoting eco-tourism and experiential travel, especially in Europe, North America, and APAC.

Eco-Friendly and Sustainable Product Adoption

Consumers are gravitating towards tents made from organic or recycled canvas, water-resistant coatings, and eco-certified materials. Manufacturers are responding by introducing sustainable treatments that maintain durability while minimizing environmental impact. Certifications such as OEKO-TEX or other eco-labels provide an added advantage, particularly for exported products. This trend reinforces premium pricing opportunities and strengthens brand positioning, especially among environmentally conscious travelers and glamping operators.

Canvas Bell Tents Market Drivers

Increasing Outdoor Recreation and Nature-Based Tourism

Globally, the shift towards outdoor experiences and socially distanced travel has boosted canvas bell tent demand. Festivals, retreats, adventure tourism, and glamping are key drivers. Medium-capacity tents (5–8 persons) are particularly popular due to their versatility, balancing comfort, transportability, and occupancy for families or small groups.

Rising Disposable Income and Premium Travel Spending

Higher disposable income in both developed and emerging markets is driving luxury and mid-range canvas tent adoption. Consumers are willing to pay premiums for comfort, design, and enhanced features such as integrated floors, heating, and lighting, allowing operators and manufacturers to expand product offerings and maintain higher profit margins.

Technological Enhancements and Product Innovation

Technological innovation in canvas treatments, modular design, quick setup mechanisms, and solar-powered amenities is increasing product appeal. Lightweight yet durable materials, better waterproofing, and convertible tent designs allow manufacturers to differentiate products, meeting diverse consumer needs from private camping to high-end glamping experiences.

Market Restraints

High Cost and Weight Constraints

Canvas bell tents are heavier and more expensive compared to synthetic alternatives. Bulk and transportation costs, coupled with higher material prices, restrict adoption among cost-sensitive consumers and reduce attractiveness for backpacking or casual camping markets.

Seasonality and Maintenance Challenges

Demand for canvas bell tents is seasonal in many regions, and the tents require maintenance to prevent mildew, water damage, and material wear. Harsh weather conditions can limit usability, creating operational challenges for rental businesses and affecting year-round sales consistency.

Canvas Bell Tents Market Opportunities

Expansion in Glamping and Luxury Outdoor Accommodation

As outdoor tourism expands globally, glamping and luxury camping operators are increasingly seeking high-end, customized canvas bell tents. Partnerships with these operators, offering semi-permanent and furnished tents, can drive revenue growth. The trend also provides opportunities for recurring purchases, maintenance contracts, and premium pricing for value-added features.

Eco-Friendly and Sustainable Product Differentiation

Manufacturers that integrate organic, recycled, and certified eco-friendly materials can tap into the growing sustainability-conscious consumer base. Government incentives and certification programs for sustainable products further enhance market appeal and differentiation.

Technological Integration and Modular Design Innovations

Adopting features such as rapid setup, modular or convertible designs, integrated solar lighting, insulation, and weatherproofing opens opportunities to serve both premium glamping markets and rental companies. Innovative products also allow manufacturers to expand into niche applications, including events, festivals, and emergency shelters.

Product Type Insights

Luxury canvas bell tents dominate the market, offering enhanced durability, aesthetics, and comfort for glamping resorts, events, and premium rentals. Standard and medium-tier tents appeal to smaller operators and individual consumers, balancing affordability with sufficient features. Lightweight or portable tents are gaining traction in recreational camping, but their market value contribution is lower compared to the luxury segments due to pricing differences.

Application Insights

Glamping and outdoor hospitality remain the most lucrative applications, while events, festivals, and weddings are rapidly growing due to temporary accommodation needs. Rental companies and institutional applications, including emergency and disaster relief, are emerging segments contributing to diversified demand. Recreational camping continues to provide volume-based growth, particularly in North America and Europe.

Distribution Channel Insights

Online direct-to-consumer sales are increasingly preferred due to customization options, competitive pricing, and broader geographic reach. Specialty outdoor stores and mass retail still maintain relevance, particularly for mid-tier and entry-level tents. Rental channels are growing as repeat or bulk demand, particularly for glamping resorts and festivals, becomes more prevalent. E-commerce platforms also allow smaller manufacturers to reach international markets effectively.

End-User Insights

Glamping operators and resorts are the highest-value end users, purchasing large numbers of premium tents for long-term installations. Event organizers and festivals drive seasonal demand for luxury and mid-tier tents. Individual consumers show steady adoption of smaller tents for recreational camping. Institutional buyers, including governments and NGOs, represent a smaller but important segment for emergency shelters and temporary housing applications.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 38–40% of the global market in 2024 (USD 350–380 million), led by strong glamping adoption and recreational camping demand. The U.S. and Canada dominate, with high disposable incomes, mature outdoor tourism infrastructure, and a preference for luxury and premium tents. The region exhibits steady growth with increasing direct-to-consumer purchases and higher adoption of technological enhancements in tents.

Europe

Europe represents 28–30% of the global market (USD 250–270 million in 2024), with the U.K., Germany, and France leading demand. The region favors eco-friendly, sustainable tents for both glamping and events. Growth is driven by government support for outdoor tourism and strong consumer preference for experiential and nature-based vacations.

Asia-Pacific

APAC is the fastest-growing region, with increasing adoption in China, India, Japan, and Australia. Rising disposable incomes, urban middle-class growth, and outbound tourism are driving demand. Investments in domestic outdoor tourism and glamping infrastructure are creating new opportunities, particularly in luxury and mid-tier segments.

Latin America

Brazil, Argentina, and Mexico are emerging markets for canvas bell tents, accounting for 5–6% of the global share (USD 50–60 million). Growth is supported by adventure tourism and rising interest in event-based temporary accommodations.

Middle East & Africa

Africa remains the core of natural outdoor experiences, while Middle Eastern countries (UAE, Saudi Arabia, Qatar) are growing markets due to luxury tourism and outdoor recreational investments. Combined market share is 4–5% (USD 35–45 million), with rapid growth potential from high-income consumers seeking unique outdoor experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Canvas Bell Tents Market

- Nordisk

- Robens

- Big Agnes

- Naturehike

- Teton Sports

- CanvasCamp

- Haven Tents

- Outwell

- Bell Tent UK

- Glamping Essentials

- LeisureQuip

- Outdoor Revolution

- Adventure Tents

- Eco Tents

- Expeditions Canvas

Recent Developments

- In May 2025, Nordisk expanded its luxury bell tent range with integrated solar lighting and modular flooring for glamping resorts in Europe.

- In April 2025, Big Agnes launched a line of lightweight, waterproof bell tents for recreational camping and festival use, targeting North American and APAC consumers.

- In February 2025, Naturehike introduced eco-certified canvas tents in India and Southeast Asia, promoting sustainable outdoor experiences and export-driven demand.