Camping Tents Market Size

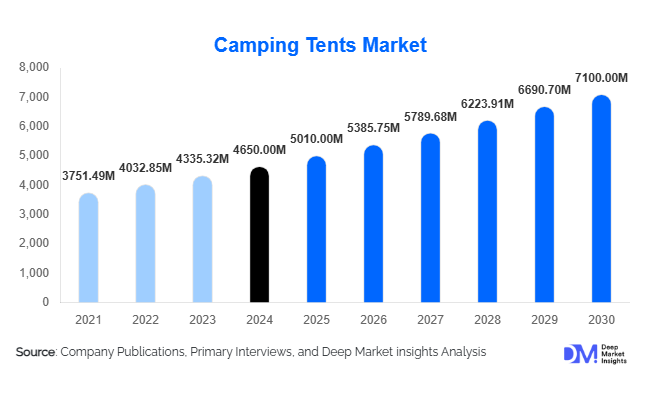

According to Deep Market Insights, the global camping tents market size was valued at USD 4,650 million in 2024 and is projected to grow from USD 5,010 million in 2025 to reach USD 7,100 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of outdoor recreational activities, adventure tourism, and the emergence of glamping and eco-friendly camping experiences across the globe.

Key Market Insights

- Demand for lightweight and durable tents is increasing, as outdoor enthusiasts and adventure travelers seek products that are easy to carry, assemble, and withstand diverse weather conditions.

- Family and group camping is driving the adoption of cabin and multi-person tents, particularly in North America and Europe, where recreational outdoor activities are well-established.

- Asia-Pacific is emerging as the fastest-growing regional market, driven by increasing middle-class incomes, adventure tourism initiatives, and government support for eco-tourism infrastructure.

- Technological innovations, including UV-resistant, waterproof, and modular designs, are shaping consumer preferences and allowing premium pricing in niche segments such as glamping.

- Online retail platforms are increasingly influencing purchasing decisions, offering direct-to-consumer access, product comparisons, and convenient delivery options.

- Sustainability trends, including eco-friendly fabrics and recyclable materials, are becoming critical differentiators for modern camping tents.

Latest Market Trends

Rise of Glamping and Luxury Camping

Glamping, or glamorous camping, is a key growth trend in the global camping tents market. Luxury tents with canvas exteriors, spacious interiors, and integrated amenities such as solar lighting, heating, and modular furniture are increasingly adopted by resorts, tourism operators, and high-income outdoor enthusiasts. This trend is expanding the market beyond traditional camping, attracting consumers who desire outdoor experiences without sacrificing comfort. Glamping tents are also marketed as premium products, driving higher profit margins for manufacturers and opening new avenues for innovation in materials and design.

Technology-Integrated and Advanced Material Tents

Innovations in tent materials and design are shaping market growth. UV-resistant polyester, waterproof coatings, high-tensile nylon, and modular structures enhance durability and user convenience. Some manufacturers are experimenting with smart tents equipped with solar-powered LED lighting, temperature-regulated ventilation, and IoT-enabled features. These technological advancements not only enhance the outdoor experience but also support premium pricing models. Lightweight and quick-setup pop-up tents are gaining popularity among casual campers, while extreme-weather specialty tents appeal to mountaineers and expedition teams, demonstrating the diversity of material and technological integration in the market.

Camping Tents Market Drivers

Growing Popularity of Outdoor and Adventure Tourism

The global rise in adventure tourism and recreational outdoor activities is a major driver for the camping tents market. Increasing disposable incomes, urbanization, and leisure travel trends encourage individuals and families to engage in camping, trekking, and hiking, boosting demand for both standard and specialty tents. Adventure sports enthusiasts are seeking durable, lightweight, and high-performance tents suitable for extreme conditions, further fueling market expansion. Tourism boards promoting national parks, eco-camps, and trekking circuits also indirectly drive market growth by increasing overall camping activity.

Expansion of Online Retail Channels

E-commerce platforms are significantly driving the sales of camping tents by providing convenient access to global consumers. Brands leverage online platforms to showcase product specifications, real-time reviews, and competitive pricing, increasing transparency and consumer confidence. Direct-to-consumer channels allow manufacturers to expand their reach, reduce dependence on traditional retail, and penetrate emerging markets with limited offline infrastructure. Social media marketing and influencer campaigns further amplify visibility and brand engagement, particularly among younger demographics seeking adventure experiences.

Rising Interest in Eco-Friendly and Sustainable Products

Consumers are increasingly prioritizing sustainability in their purchasing decisions, driving demand for tents made from recyclable, biodegradable, or eco-friendly materials. Manufacturers are responding by integrating sustainable fabrics, low-impact production methods, and packaging innovations. Eco-conscious consumers, particularly in Europe and North America, are willing to pay a premium for tents that align with environmental values. This trend also intersects with the glamping segment, where high-end resorts emphasize sustainability as part of their brand experience.

Market Restraints

High Cost of Premium and Specialty Tents

While demand is strong, high prices for technologically advanced or luxury tents can limit adoption among budget-conscious consumers. Specialty tents for extreme weather conditions or high-end glamping experiences often carry premium pricing, restricting accessibility for casual campers or developing markets. Manufacturers must balance performance, durability, and cost to maximize market penetration.

Supply Chain and Raw Material Challenges

Volatility in raw material prices, such as polyester, nylon, and high-quality canvas, impacts manufacturing costs and profitability. Disruptions in supply chains due to global logistics issues or geopolitical factors can also delay production and delivery schedules, potentially affecting brand reliability and market growth.

Camping Tents Market Opportunities

Emerging Markets and Regional Expansion

Asia-Pacific, Latin America, and the Middle East are key regions offering untapped potential. Countries such as India, China, Brazil, and the UAE are experiencing rising disposable incomes, government support for adventure tourism, and increasing interest in outdoor recreational activities. Manufacturers can target these regions with mid-range and specialty tents designed for local climatic conditions, driving both volume and revenue growth.

Smart and Technology-Enhanced Tents

Innovation presents a significant opportunity to differentiate products in the competitive market. Tents with solar-powered lighting, modular designs, temperature control features, or IoT integration appeal to premium customers and adventure enthusiasts. Brands investing in R&D can capture high-margin segments and expand into niche applications such as mountaineering, expedition camping, and glamping resorts.

Government and Public Sector Demand

Government procurement for disaster relief, emergency shelters, and defense operations provides a stable demand base. Public investment in national parks, eco-tourism, and camping infrastructure also indirectly supports market growth. Partnerships with NGOs, defense agencies, and tourism boards offer opportunities for manufacturers to establish recurring revenue streams while strengthening brand presence.

Product Type Insights

Dome tents dominate the market due to their portability, ease of setup, and suitability for a wide range of camping activities, accounting for approximately 35% of the 2024 market. Cabin tents are preferred for family camping, offering comfort and larger capacity, while pop-up and specialty tents cater to niche segments such as adventure sports and extreme-weather expeditions. The trend toward multi-purpose and high-performance tents is driving innovation and adoption across all product types.

Material Type Insights

Polyester tents remain the leading material segment, representing roughly 50% of the 2024 market, due to their lightweight, water-resistant, and cost-effective properties. Nylon tents are gaining traction among trekking and adventure campers, while canvas tents are preferred for glamping and long-term camping applications. Consumer preference for durable and eco-friendly materials continues to influence manufacturing trends.

End-Use Insights

Recreational camping is the largest end-use segment, but adventure and sports camping is growing at the fastest rate due to increased participation in trekking, mountaineering, and expedition activities. Emergency and disaster relief tents also contribute significantly, particularly in regions prone to natural disasters. Commercial camping applications, including festival and resort-based glamping, are emerging as high-margin growth opportunities. Export-driven demand is significant, with North America and Europe being the top importers of premium and specialty tents from Asia-Pacific manufacturers.

| By Product Type | By Material Type | By Capacity | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America held approximately 28% of the global camping tents market in 2024, led by the U.S. and Canada. High disposable income, well-developed outdoor infrastructure, and the popularity of recreational camping drive demand. Specialty tents for adventure sports and family camping are particularly sought after.

Europe

Europe accounts for roughly 25% of the global market, with Germany, the U.K., and France leading demand. Sustainability trends, government support for eco-tourism, and strong adventure travel culture are key growth drivers. The region also shows the fastest growth in premium and glamping tent segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, Japan, and Australia showing rising adoption. Growing middle-class populations, adventure tourism infrastructure, and e-commerce expansion are fueling market growth. Mid-range and specialty tents are experiencing rapid uptake.

Latin America

Latin America shows steady growth, with Brazil, Argentina, and Mexico emerging as key markets. Demand is primarily driven by adventure camping and outbound travel to established camping destinations.

Middle East & Africa

Africa, as a primary production hub for canvas and specialty tents, and the Middle East, led by the UAE and Saudi Arabia, represent important markets. Regional demand is fueled by glamping resorts, recreational tourism, and high-end outdoor experiences. Intra-African tourism is also supporting market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camping Tents Market

- MSR (Mountain Safety Research)

- The North Face

- REI Co-op

- Coleman Company

- Vango

- Decathlon

- Big Agnes

- Hilleberg

- Kelty

- Outwell

- Quechua

- Snow Peak

- Alps Mountaineering

- Black Diamond

- OZtrail

Recent Developments

- In March 2025, MSR launched a series of lightweight, modular tents for extreme-weather trekking, incorporating solar-powered LED systems and high-strength nylon fabrics.

- In January 2025, Decathlon expanded its glamping tent line in Europe, targeting premium outdoor leisure experiences with eco-friendly materials and modular designs.

- In November 2024, The North Face introduced advanced pop-up tents in North America optimized for recreational camping and extreme sports enthusiasts.