Camping Pods Market Size

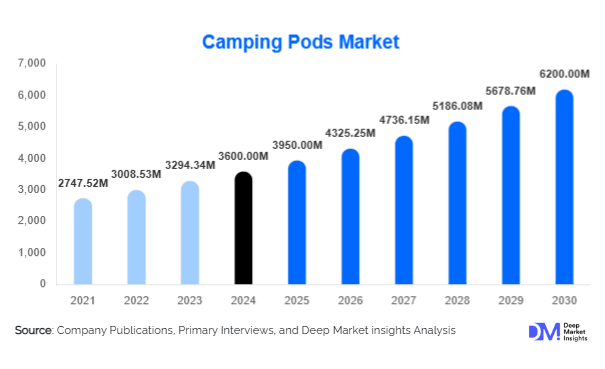

According to Deep Market Insights, the global camping pods market size was valued at USD 3,600 million in 2024 and is projected to grow from USD 3,950 million in 2025 to reach USD 6,200 million by 2030, expanding at a CAGR of 9.5% during the forecast period (2025-2030). The camping pods market growth is primarily driven by the increasing popularity of glamping and experiential tourism, expanding eco-friendly accommodation demand, and government initiatives to boost outdoor recreation infrastructure globally.

Key Market Insights

- Eco-friendly and sustainable tourism is a key demand driver, with camping pods increasingly designed using renewable materials and off-grid technologies.

- Luxury glamping pods are gaining traction, appealing to affluent travelers seeking unique outdoor experiences without compromising comfort.

- Europe and North America dominate the global market in 2024, supported by strong camping cultures and established holiday park infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, tourism investments, and eco-resort development.

- Smart pod innovations, including IoT integration, solar power, and modular interiors, are transforming customer expectations.

- Direct-to-consumer and online retail channels are becoming critical distribution modes, especially for individual buyers and smaller operators.

What are the latest trends in the camping pods market?

Sustainable and Off-Grid Camping Pods

Manufacturers are increasingly focusing on developing pods with low environmental impact. Features such as solar panels, water recycling, and natural insulation are becoming standard in premium offerings. This trend aligns with global sustainability goals and government-backed eco-tourism programs. Operators who offer certified green pods are gaining traction in markets like Europe and Australia, where travelers prioritize eco-conscious accommodations.

Rise of Luxury and Modular Glamping Pods

Luxury camping pods with modular designs, enhanced interiors, and smart amenities are reshaping the glamping segment. These pods cater to high-income travelers seeking a balance between nature immersion and modern convenience. Modular pods also provide flexibility for campgrounds and resorts to expand capacity quickly. This premiumization trend is contributing significantly to revenue growth, with luxury pods accounting for nearly 28% of the market share in 2024.

What are the key drivers in the camping pods market?

Growing Demand for Experiential Tourism

Consumers are increasingly prioritizing unique travel experiences over traditional vacations. Camping pods provide weather-resistant, comfortable alternatives to tents, making them highly attractive for families, adventure tourists, and digital nomads. The rise of glamping—combining glamour with camping—has accelerated adoption, especially among millennials and Gen Z travelers.

Government Support for Outdoor Recreation

Governments worldwide are investing in eco-tourism and national park infrastructure. Initiatives in the U.S., U.K., India, and Australia include subsidies for campsite upgrades and outdoor activity promotions, directly fueling demand for camping pods in both public and private holiday parks.

Affordability and Ease of Installation

Compared to cabins or permanent structures, camping pods are cost-effective and easy to install. Their portability and low maintenance needs make them attractive to seasonal rental operators, community projects, and small-scale entrepreneurs.

What are the restraints for the global market?

High Upfront Cost for Luxury Pods

While entry-level pods are affordable, luxury pods equipped with smart technologies, insulation, and high-end interiors require significant investment. This pricing gap limits adoption among small operators and slows scaling in developing regions.

Seasonality of Camping Demand

In many regions, camping is a seasonal activity, reducing year-round utilization. Limited demand during colder months affects ROI for operators and restrains consistent market growth, particularly in Europe and North America.

What are the key opportunities in the camping pods industry?

Eco-Tourism Integration

Camping pods align with global sustainability goals, offering operators opportunities to integrate renewable materials and energy-efficient designs. Partnerships with eco-resorts and government-supported green tourism projects are expected to unlock new revenue streams.

Expanding Demand in Asia-Pacific and LATAM

Tourism growth in the Asia-Pacific and Latin America presents lucrative opportunities for manufacturers and investors. Countries like India, Thailand, and Brazil are investing heavily in eco-tourism and outdoor leisure, creating a strong pipeline for camping pod adoption.

Smart Pod Technology

IoT-enabled pods with temperature control, modular interiors, and off-grid solutions are emerging as a premium trend. These innovations are expected to capture affluent travelers and tech-savvy consumers, reshaping the market toward high-margin offerings.

Product Type Insights

Wooden camping pods dominate the market, accounting for approximately 42% of the global share in 2024. They are favored for their natural aesthetics, durability, and eco-friendly appeal. Wooden pods are especially popular in Europe and North America, where sustainability certifications strongly influence consumer choices. Meanwhile, luxury glamping pods are growing fastest, driven by high-income travelers seeking premium outdoor experiences.

Capacity Insights

The 3-4 person pods segment leads globally, representing around 37% of the market in 2024. These pods balance affordability with family-friendly functionality, making them the preferred choice for campgrounds, rental operators, and small families. Larger pods (5-6 person capacity) are also gaining ground in group camping and adventure tourism markets.

Application Insights

Leisure and tourism applications dominate, capturing about 46% of global market demand in 2024. Camping pods are widely deployed in holiday parks, adventure resorts, and seasonal rentals, reflecting their growing role in global tourism infrastructure. Adventure sports and Airbnb-style seasonal rentals are expanding sub-segments contributing to steady demand growth.

End-User Insights

Campgrounds and holiday parks represent the largest end-user segment, holding nearly 48% market share in 2024. Growing investments in campsite modernization and eco-resorts are fueling adoption. Hospitality operators such as boutique resorts and glamping destinations are the fastest-growing end-users, leveraging pods to expand accommodation capacity quickly and cost-effectively.

Distribution Channel Insights

Direct sales and online platforms dominate distribution, with direct-to-consumer channels accounting for nearly 44% of sales in 2024. Online platforms are gaining traction, particularly for individual buyers and small-scale entrepreneurs seeking affordable pod solutions.

| By Product Type | By Capacity | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 32% of the global market share in 2024. The U.S. dominates demand due to its strong camping culture, national park infrastructure, and rising interest in glamping. Canada is also witnessing robust growth, supported by eco-tourism policies and high domestic travel rates.

Europe

Europe represents 29% of the global market in 2024. The U.K., Germany, and France lead adoption, driven by cultural affinity for camping and government-backed sustainability initiatives. The region is also home to the fastest-growing luxury glamping segment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expected to expand at a CAGR of over 11% from 2025 to 2030. Rising disposable incomes, government tourism campaigns, and eco-resort development in China, India, Thailand, and Australia are fueling demand.

Latin America

LATAM markets such as Brazil, Chile, and Costa Rica are embracing camping pods as part of eco-tourism expansion. Growth remains at a nascent stage but is expected to accelerate as regional governments promote outdoor leisure activities.

Middle East & Africa

MEA markets are gradually adopting camping pods, particularly in South Africa, the UAE, and Saudi Arabia. Adventure tourism initiatives and desert glamping projects are supporting regional adoption, with the UAE emerging as a key luxury pod market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camping Pods Market

- Arctic Cabins

- Wigwam Cabins

- EcoPod Concepts

- Timber Buildings

- Arch Leisure

- Forest Holidays

- Green Eco Living

- Riverside Pods

- Glampitect

- Camping Cabins Ltd.

- Pod Factory

- Norwegian Log Cabins

- Eco Retreats

- Glamping Pods UK

- GlamXperience

Recent Developments

- In May 2025, EcoPod Concepts launched a new line of solar-powered camping pods targeting eco-resorts across Europe.

- In March 2025, Wigwam Cabins expanded its production facility in the U.K. to meet rising export demand from Asia-Pacific markets.

- In January 2025, Arctic Cabins announced strategic partnerships with U.S.-based holiday park operators to deploy luxury pods across national campgrounds.