Camping Heaters Market Size

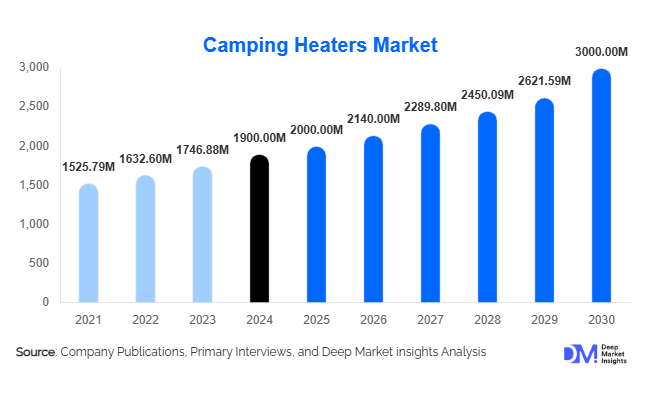

According to Deep Market Insights, the global camping heaters market size was valued at USD 1,900 million in 2024 and is projected to grow from USD 2,000 million in 2025 to reach USD 3,000 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The camping heaters market growth is primarily driven by rising outdoor recreation and glamping trends, increasing adoption of eco-friendly heating solutions, and the expansion of RV and emergency preparedness applications worldwide.

Key Market Insights

- Propane-based and electric camping heaters dominate global sales, offering a balance of portability, efficiency, and user-friendly operation for a range of outdoor activities.

- Technological innovation in safety, hybrid fuel systems, and smart features is reshaping consumer expectations and enabling premium product adoption.

- North America holds the largest market share, driven by the extensive RV and motorhome culture, along with high disposable incomes for outdoor leisure activities.

- Asia-Pacific is the fastest-growing region, fueled by rising domestic tourism, increasing middle-class affluence, and growing outdoor lifestyle culture.

- Europe emphasizes low-emission and electric solutions, spurred by strict environmental regulations and increasing interest in glamping and sustainable camping.

- Export-driven growth is supported by manufacturing hubs in Asia supplying high-quality portable heaters to global markets, particularly in North America and Europe.

Latest Market Trends

Eco-Friendly and Low-Emission Heating Solutions

Manufacturers are increasingly developing propane alternatives, hybrid fuel systems, and electric camping heaters powered by solar or battery technologies. Consumers are actively seeking low-emission, energy-efficient solutions for environmental sustainability, particularly in Europe and North America. This trend aligns with tightening regulations on emissions and safety standards, encouraging innovation in hybrid and renewable-powered heaters. Adoption of catalytic combustion, infrared radiant panels, and multi-fuel designs ensures efficient heating while meeting environmental benchmarks.

Smart and Safety-Enhanced Camping Heaters

Technological integration is becoming a key differentiator in the camping heaters market. Features such as oxygen depletion sensors, tip-over shut-off, remote control, and mobile app connectivity are increasingly adopted. Compact, foldable, and portable designs with multifunction capabilities (heating and cooking) cater to family campers, RV users, and solo adventurers. Consumers also prefer products with enhanced usability and energy efficiency, reflecting a shift towards smarter, safer, and more sustainable camping solutions.

Camping Heaters Market Drivers

Rising Outdoor Recreation and Adventure Tourism

The growing popularity of camping, RV travel, glamping, and outdoor events is a major driver for camping heaters. Longer camping seasons, winter camping, and off-grid adventure tourism increase the demand for portable, reliable heating solutions. Outdoor enthusiasts, families, and festival organizers are seeking heaters that provide safety, comfort, and portability, boosting sales globally.

Technological Advancements and Product Innovation

Advances in heater efficiency, lightweight materials, hybrid fuel compatibility, and smart safety features are driving market growth. Products now offer faster heat-up times, energy efficiency, and multifunctionality. Electric and solar-assisted models appeal to environmentally conscious consumers, creating opportunities for premium and eco-friendly product adoption.

Market Restraints

Regulatory and Safety Compliance Challenges

Strict regulations regarding emissions, fuel storage, and electrical safety can increase production costs and limit market accessibility. Compliance with safety standards, such as CE, UL, and CSA certifications, is mandatory in key markets, potentially delaying product launches and adding operational complexity for manufacturers.

Seasonal Demand and Fuel Availability Constraints

Camping heater demand is heavily influenced by seasonality, limiting sales during warmer months. Additionally, fuel availability (propane, butane, wood, or electric access) can be inconsistent in remote locations. These factors constrain market growth and create logistical challenges for both manufacturers and end-users.

Camping Heaters Market Opportunities

Hybrid and Renewable Energy Integration

There is a growing opportunity to develop hybrid camping heaters that combine propane, electric, and solar technologies. Environmentally conscious consumers increasingly seek low-emission, energy-efficient solutions. Incorporating renewable energy options not only reduces carbon footprint but also enhances portability and off-grid usability, creating a competitive advantage for early adopters.

Expansion in Emerging Outdoor Lifestyle Markets

Regions such as India, China, and Southeast Asia are witnessing growth in adventure tourism, glamping, and RV travel. Rising disposable incomes and growing interest in outdoor recreation present opportunities for market expansion. Companies entering these regions can leverage localized products and competitive pricing to capture new consumer segments.

Product Type Insights

Propane-based portable heaters dominate the market, accounting for roughly 40–45% of global sales, driven by high portability, reliability, and broad fuel availability. Electric heaters are gaining traction, particularly in Europe, due to low emissions and safety features, representing approximately 25–30% of the market. Infrared and catalytic heaters appeal to premium segments, offering efficient radiant heating suitable for RVs, cabins, and glamping setups.

Application Insights

RVs, motorhomes, and family camping are the largest applications, representing 25–30% of market demand. Emergency preparedness and outdoor events are growing niches, requiring portable and rugged heating solutions. Glamping resorts and adventure tourism operators increasingly invest in high-quality, multifunctional heaters, driving premium product adoption and expanding overall market demand.

Distribution Channel Insights

Online retail and e-commerce account for 30–35% of global sales, providing consumers with convenience, competitive pricing, and wide product selection. Specialty outdoor retailers remain important for high-output and premium models, while direct-to-consumer channels and rental models are emerging trends. Manufacturers increasingly leverage digital marketing, subscription-based models, and influencer campaigns to engage consumers and drive sales.

End-User Insights

Family campers and RV enthusiasts dominate the market, reflecting demand for mid-range and premium portable heaters. Solo travelers and adventure tourists favor compact, lightweight, and multifunctional models. Emergency preparedness agencies represent a niche but rapidly growing segment, particularly in regions prone to natural disasters or cold-weather events. The combination of recreational and emergency applications broadens market potential and drives adoption across diverse user groups.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. and Canada collectively accounting for 40–45% of global demand. Extensive RV and motorhome culture, high disposable income, and a strong outdoor recreation trend drive adoption. Premium and hybrid models are particularly popular, supported by strict safety standards and environmental awareness.

Europe

Europe represents 25–30% of the market, with Germany, the U.K., France, and Nordic countries leading demand. Environmental regulations and a strong glamping culture fuel the adoption of electric and low-emission heaters. Alpine and Nordic regions are the fastest-growing due to cold climate conditions and high outdoor tourism activity.

Asia-Pacific

Asia-Pacific is the fastest-growing region in percentage terms, driven by India, China, Japan, and Australia. Rising middle-class incomes, growing adventure tourism, and expanding domestic camping infrastructure are supporting market growth. Electric and hybrid heaters are particularly attractive for urban consumers, while propane and portable gas models dominate rural and remote areas.

Latin America

Brazil, Argentina, and Mexico are key markets, with growth driven by adventure tourism and emerging glamping facilities. Imported premium heaters from North America and Europe are increasingly adopted for high-end camping experiences.

Middle East & Africa

South Africa and North African countries represent the primary demand base, supplemented by GCC nations such as the UAE and Saudi Arabia. Demand is concentrated in colder regions or high-altitude tourist sites. Intra-regional tourism also contributes to growth, particularly for rugged, multi-fuel heaters suited to desert and mountain environments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camping Heaters Market

- Mr. Heater

- Coleman Company, Inc.

- Texsport

- Gasmate

- Outland Living

- Mr. Buddy

- Lasko Products

- Camco

- Primus

- Kovea

- Honeywell

- Sunforce

- Napoleon

- Enders

- Zodi

Recent Developments

- In March 2025, Mr. Heater launched a new solar-assisted hybrid camping heater targeting eco-conscious consumers in Europe and North America.

- In January 2025, Coleman introduced a compact, foldable electric heater for RV and backpacking applications, featuring smart safety sensors and multi-fuel compatibility.

- In February 2025, Outland Living expanded its propane-based heater lineup to include high-output infrared models suitable for glamping resorts and emergency preparedness kits.