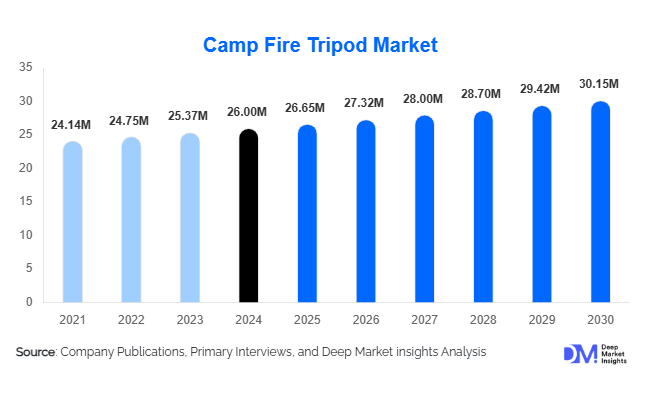

Camp Fire Tripod Market Size

According to Deep Market Insights, the global campfire tripod market size was valued at USD 26 million in 2024 and is projected to grow to USD 26.65 million in 2025 and reach USD 30.15 million by 2030, expanding at a CAGR of 2.5% during the forecast period (2025–2030). Growth in the market is primarily driven by rising outdoor recreation activities, increasing interest in authentic open-fire cooking experiences, and the adoption of lightweight, durable, and multifunctional tripod designs among campers, hikers, and survivalists.

Key Market Insights

- Steel-based tripods dominate the market due to their durability, heat resistance, and suitability for heavy cookware.

- Adjustable-height tripods account for the largest design share, driven by demand for flexible and customizable cooking setups.

- North America leads the global market owing to a strong camping culture and high per-capita spending on outdoor equipment.

- Asia-Pacific is the fastest-growing regional market as camping gains popularity across China, India, and Southeast Asia.

- Online retail channels hold the highest distribution share, supported by specialty platforms and direct-to-consumer brand websites.

- Lightweight materials and multifunctional designs including foldable structures, grill grates, and modular accessories, are shaping product development.

What are the latest trends in the Camp Fire Tripod market?

Premium & Eco-Conscious Tripods Gaining Traction

Manufacturers are increasingly offering premium tripods made from stainless steel, titanium, and sustainable materials to target glamping operators and high-end outdoor consumers. These products focus on durability, aesthetic appeal, and eco-friendly construction, aligning with the growing preference for low-impact and environmentally responsible camping gear. Some brands are introducing recycled metals, wooden elements, and artisanal finishes to appeal to design-conscious buyers seeking unique outdoor experiences.

Modular and Multi-Functional Designs

Innovation is accelerating with modular features such as detachable grill grates, integrated windshields, adjustable chains, rotating arms, and collapsible legs. These enhancements allow users to perform multiple cooking tasks, boiling, simmering, and grilling, within a single setup. Such versatility is particularly appealing to bushcraft practitioners and overland travelers who prioritize compact, multipurpose equipment.

What are the key drivers in the Camp Fire Tripod market?

Increasing Outdoor Recreation Participation

Rising global interest in camping, hiking, and nature-based travel is driving demand for open-fire cooking accessories. Campfire tripods remain essential tools for campers seeking traditional, authentic culinary experiences beyond portable gas stoves. Growth in organized camping, youth outdoor programs, and family recreation activities further strengthens demand.

Growing Preference for Authentic, Off-Grid Cooking Experiences

The resurgence of bushcraft, survivalism, and off-grid living movements has boosted sales of durable and multifunctional tripods. Enthusiasts value the control, stability, and versatility that tripods provide compared to fixed grills or stoves. This trend supports higher demand for rugged steel tripods and advanced designs suited for wilderness conditions.

What are the restraints for the global market?

Competition from Portable Stove Systems

Portable gas and multi-fuel stove systems remain strong substitutes for tripods due to their convenience, speed, and compactness. Backpackers and minimalist travelers often choose lightweight stoves over fire-based cooking, which requires more time and is subject to environmental restrictions. This competitive pressure limits adoption among ultralight users.

Fire Regulations and Seasonal Limitations

Frequent fire bans, dry-season restrictions, and safety regulations in parks and campgrounds directly affect tripod usage. Many regions limit open-fire cooking during peak summer months, reducing annual utilization. Weather dependency and seasonal demand fluctuations continue to restrain the market’s long-term scalability.

What are the key opportunities in the Camp Fire Tripod industry?

Glamping and Premium Outdoor Hospitality

The rising glamping sector presents significant potential for premium tripod designs. Luxurious open-fire cooking setups, crafted with stainless steel, titanium, or decorative wood elements, appeal to high-end outdoor resorts seeking to elevate guest experiences. Tripods bundled with designer cookware and curated cooking kits offer new revenue streams.

Emerging Markets in Asia-Pacific and Latin America

Rapid growth in domestic tourism, outdoor recreation, and weekend travel across China, India, Brazil, and Mexico is expanding the consumer base for campfire tripods. Affordable steel models and region-specific marketing offer strong entry points for manufacturers targeting these high-growth markets. Online retail expansion further accelerates adoption.

Product Type Insights

Steel tripods lead the market as the most durable and cost-effective option, favored for heavy-duty cooking and long-term use. Aluminum and titanium variants are growing steadily, driven by demand for lightweight and portable designs among backpackers and hikers. Foldable and adjustable-height tripods are increasingly preferred for their versatility and compact storage, making them ideal for multi-day camping and overlanding trips.

Application Insights

Recreational camping represents the largest application segment, with families and weekend explorers driving consistent demand. Hiking and backpacking applications are growing due to increased interest in lightweight tripods designed for mobility. Survival and bushcraft users form a niche but influential segment, prioritizing ruggedness and multi-functionality. Commercial outdoor operators, including glamping resorts and guided camp tours, increasingly integrate high-end tripods into their service offerings.

Distribution Channel Insights

Online retail dominates the distribution landscape, with outdoor equipment platforms and brand-direct websites offering the broadest product variety. Specialty camping stores remain crucial for premium and technical gear, while big-box retailers offer budget-friendly, mass-market tripod options. Direct-to-consumer models are gaining traction as brands leverage social media marketing, influencer campaigns, and community-driven outdoor content to boost engagement.

End-User Insights

Individual outdoor enthusiasts account for over half of total demand, seeking durable and convenient cooking solutions for camping, hiking, and bushcraft. Glamping operators and outdoor lodges represent a fast-growing segment that values premium, aesthetically appealing tripods. Institutional users, such as scouting groups and outdoor education programs, continue to invest in rugged, long-lasting steel tripod systems.

| By Material Type | By Weight Capacity | By Portability Design | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the campfire tripod market, driven by widespread outdoor recreation culture and high consumer spending on camping equipment. The U.S. leads demand, supported by national park visitation and strong interest in bushcraft and survival skills. Premium tripod products perform particularly well in this region.

Europe

Europe represents a mature and environmentally conscious market, with high demand for stainless steel and eco-friendly tripod designs. Germany, France, and the U.K. dominate consumption, with sustainability, compactness, and modularity serving as key purchase drivers. Growing interest in glamping further boosts premium tripod adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by expanding middle-class participation in outdoor recreation and rising domestic travel trends. China and India are major growth engines, with the increasing popularity of camping, overlanding, and nature tourism. Lightweight tripods are particularly favored among new campers and youth demographics.

Latin America

Latin America is emerging as a moderate-growth market, led by Brazil and Mexico. Increasing interest in adventure travel and outdoor cooking supports demand, though price sensitivity influences purchasing patterns. Growth in online retail access is gradually expanding market reach.

Middle East & Africa

This region contributes modestly but steadily, with South Africa serving as the primary market due to an established camping and overlanding culture. Outdoor hospitality developments in the UAE and other Gulf countries are creating niche opportunities for premium tripod products. Intra-regional camping tourism is slowly expanding in adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|