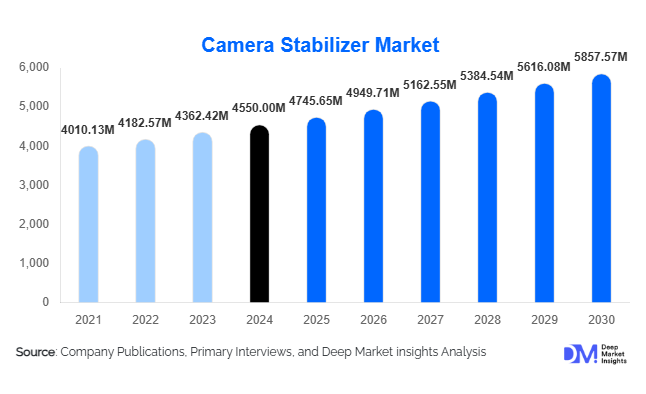

Camera Stabilizer Market Size

According to Deep Market Insights, the global camera stabilizer market size was valued at USD 4,550 million in 2024 and is projected to reach approximately USD 4,745.65 million in 2025, growing steadily to about USD 5,857.57 million by 2030. This represents a CAGR of around 4.3% during the forecast period (2025–2030). This growth is fueled by continued demand from content creators, increased drone adoption, and rapid technological advances in stabilization systems.

Key Market Insights

- Handheld gimbals dominate the market, thanks to their widespread adoption by vloggers, social-media creators, and budding filmmakers.

- 3-axis motorized stabilizers remain the preferred choice for most users, offering full stabilization across pitch, roll, and yaw.

- The content-creator / influencer segment is the largest application, driven by the explosive growth of short-form video platforms.

- Online sales channels account for the majority of stabilizer purchases, given the digital-native customer base and the ease of comparing tech specs.

- Asia-Pacific is one of the fastest-growing regions, powered by strong manufacturing bases and increasing adoption among creators in China and India.

- AI-enabled features (such as object tracking and auto-horizon correction) are reshaping product innovation and customer value proposition.

What are the Latest Trends in the Camera Stabilizer Market?

AI-Enhanced Stabilization and Tracking

Stabilizer manufacturers are increasingly embedding artificial intelligence and machine-learning algorithms into their devices. These include subject-tracking, gesture recognition, predictive motion correction, and auto-reframing. The use of AI helps even solo creators to capture smooth, professional-looking footage without needing a second operator. App integration allows for automatic tuning of motor strength, balancing profiles, and smart scene recognition, improving usability for both beginners and advanced users.

Modular & Multi-Device Stabilizer Kits

A significant trend is the rise of modular stabilizer systems that support multiple payloads, smartphones, mirrorless cameras, action cams, and even drones. These kits enable users to switch devices rapidly, adjust motors, and reconfigure mounts, giving them flexibility without having to invest in separate gimbals. This modularity is particularly appealing to prosumers and professionals who operate across multiple platforms.

Portable & Foldable Designs

As mobile content creation dominates, lightweight and foldable stabilizer designs are gaining traction. Compact gimbals that can be carried in a backpack or even a pocket make them ideal for travel vloggers, solo creators, and anyone working on the go. The shift toward portability does not compromise performance; many newer stabilizers maintain high payload capacity and battery life while being significantly more transportable.

What are the Key Drivers in the Camera Stabilizer Market?

Creator Economy Expansion

The global explosion of content creation, especially via YouTube, TikTok, and other short-form platforms, is a primary engine of growth. As more individuals and small teams produce video content, the demand for stable, high-quality footage surges. Stabilizers are indispensable for creators who want to elevate production value without hiring large crews.

Technological Innovation & Miniaturization

Advances in brushless motor technology, sensor precision, and AI integration have made stabilizers smarter, smaller, and more power-efficient. These innovations reduce the barrier to entry for new users and open up new use cases (e.g., smartphone gimbals, travel rigs) that were previously prohibitive. Lowered power consumption and better battery performance also extend operational time.

Growing Adoption of Drone Videography

Drones are being used more often in commercial applications, real estate, inspections, agriculture, and cinematography. To ensure smooth aerial footage, robust gimbal stabilizers are essential. The increasing deployment of UAVs with integrated gimbal systems is translating into higher demand for both consumer- and enterprise-grade stabilization technology.

What are the Restraints for the Global Market?

Cost Sensitivity in Entry-Level Segments

While demand is strong, many potential users in emerging and price-sensitive markets are hesitant to invest in stabilizers whose prices exceed their budget. Achieving a balance between advanced features, build quality, and affordability remains a challenge for manufacturers targeting consumers in these regions.

Reliability and Power Constraints

Motorized stabilizers depend on batteries and delicate motor systems, which may suffer from wear, reduced lifespan, or performance degradation in harsh environments. Concerns over battery life, motor efficiency, and long-term durability can deter professional or industrial users who need highly reliable equipment.

What are the Key Opportunities in the Camera Stabilizer Market?

Expanding into Emerging Creator Markets

With internet penetration rising rapidly in regions such as India, Southeast Asia, and Latin America, there is a massive opportunity to capture the growing population of content creators. By offering cost-effective, easy-to-use handheld gimbals tailored to local smartphone ecosystems, manufacturers can tap into first-time buyers and micro-influencers. Localizing product offerings, creating region-specific bundles, and leveraging regional e-commerce channels can help players build strong footholds in these markets.

AI-First Stabilizers and Smart Ecosystems

There is a white space for stabilizers that prioritize smart features, AI-based subject tracking, predictive stabilization, horizon auto-correction, and app-driven control. By building a seamless ecosystem (hardware + app + firmware), companies can offer more intuitive, “set-it-and-forget-it” stabilizers. This appeals strongly to solo creators, livestreamers, and individuals who demand high-quality video without a learning curve.

Market for Hybrid / Modular Kits

Creators increasingly use multiple devices, smartphones, mirrorless cameras, and drones, often within the same project. Modular stabilizer kits that support quick switching between payloads, motor tuning, and accessory integration offer high value. New entrants and incumbents alike can design such adaptive systems, targeting prosumers and professionals who want flexibility without buying separate stabilizers for each device.

Product Type Insights

Handheld gimbals dominate the camera stabilizer market due to their versatility, portability, and popularity with content creators. These are largely used with smartphones and mirrorless cameras, offering a balance of performance and affordability. Drone-mounted gimbals are critical in aerial videography, especially for commercial inspections and creative filming. Shoulder rigs and Steadicams remain valuable in professional cinematography for their ergonomics and higher payload handling. Wearable stabilizers are increasingly used for action, adventure, or point-of-view shooting, particularly in sports and event videography. Mechanical stabilizers, while more niche, appeal to purists and those who prefer traditional, non-motorized stabilization.

Application Insights

The biggest demand comes from the content-creation sector, vloggers, social media influencers, and YouTube creators. Stabilizers in this space help to deliver smooth, visually engaging footage. Cinematography and film production also use high-end rigs like 3-axis motorized stabilizers and shoulder mounts to support heavier cameras and cinematic workflows. In real estate videography, stabilizers (especially for drones) are critical for producing polished property walk-throughs. Industrial and inspection use-cases are growing, with drones fitted with stabilizers deployed in infrastructure surveillance, energy, and utilities. Event coverage, weddings, and live performances also account for a steady share, where portable stabilizers capture dynamic movement without visible shake.

Distribution Channel Insights

Online channels dominate stabilizer sales, with creators and professionals alike using e-commerce platforms and direct-to-consumer websites to research and purchase. Offline channels (camera specialty stores, pro-AV distributors) remain important for high-end cinema rigs and business buyers who require hands-on evaluation. Many stabilizer manufacturers also run branded showrooms and demo centers to showcase flagship models. In addition, trade shows and professional content-creation events serve as key engagement points for both sales and education.

End-User / Customer Type Insights

The prosumer and enthusiast segment accounts for a large portion of demand, driven by creators who need high-performance stabilizers but are cost-conscious. Professional filmmakers and cinematographers demand premium rigs and shoulder mounts for their payloads and control. Commercial enterprises, such as real estate firms, inspection companies, and event organizers, are buying stabilizers as part of their video-production toolkits. Industrial users (drones, surveillance) represent another important customer base that values reliability and precision. Emerging creators (in developing markets) are a rapidly growing segment, often buying entry-level handheld stabilizers.

| By Product Type | By Camera Type | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a leading region in the camera stabilizer market, with the U.S. contributing a large share thanks to its strong creator community, high disposable income, and demand for both consumer and professional rigs. The region benefits from robust e-commerce infrastructure, sophisticated filmmaking hubs, and established content platforms. Stabilizer adoption in industries such as real estate, videography, and live events also supports growth.

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing region. China and India are major drivers: China is a manufacturing powerhouse and a big exporter, while India’s rapidly growing creator economy is fueling strong domestic demand. Southeast Asian countries, including Indonesia and Vietnam, are also witnessing a surge in content creators adopting gimbals. As manufacturing costs remain favorable in this region, many stabilizer brands originate here, further boosting local availability and innovation.

Europe

European markets (especially the UK, Germany, and France) continue to adopt stabilizers strongly. The demand is driven by both independent creators and commercial production houses. Sustainability-conscious buyers prefer longer-lasting, modular rigs, and there’s increasing uptake of AI-enabled devices. Cross-border trade within the EU facilitates access to a wide variety of stabilizers, and specialized pro-AV distributors support the high-end segment.

Latin America

Latin America is gradually expanding its share in the global stabilizer market. Countries like Brazil and Mexico are seeing growing use in content creation, particularly for social media and real estate marketing. Though import costs can be significant, e-commerce and secondhand sales help drive adoption. Local creators are increasingly investing in mid-tier handheld gimbals to boost production quality.

Middle East & Africa

In the Middle East & Africa region, demand is growing, driven by both creators and professional videographers. The UAE, Saudi Arabia, and South Africa are notable markets where high-income individuals and production companies purchase stabilizers for events, marketing, and film. Meanwhile, intra-regional content creation and cross-border collaborations are fueling the adoption of both consumer and pro-grade stabilization solutions. Additionally, drone usage in infrastructure inspection in parts of Africa is contributing to gimbal demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camera Stabilizer Market

- DJI

- Zhiyun

- FeiyuTech

- Moza

- Tilta

- Manfrotto

- Glidecam

- Gudsen

- Ikan

- Shape

- Hohem

- Edelkrone

- Freefly

- Benro

- Letus

Recent Developments

- In early 2025, DJI launched a foldable 3-axis gimbal designed specifically for smartphones, featuring enhanced AI-driven subject tracking and improved battery efficiency.

- In mid-2025, Zhiyun introduced a modular stabilizer kit that supports fast switching between mirrorless cameras and action cams, targeting prosumer creators.

- In late 2024, Freefly announced a strategic partnership with a major cinema camera manufacturer to co-develop a high-payload stabilizer system for next-generation film production.

- In 2025, Moza rolled out an updated firmware for its flagship gimbal that added gesture control, horizon auto-calibration, and in-app motor tuning.